Chapter 1 Tools & Techniques of Investment Planning

advertisement

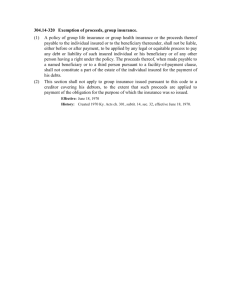

CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning The rule defined In the case of transfer for valuable consideration by assignment or otherwise, of a life insurance contract or any interest therein the amount excluded from gross income shall not exceed an amount equal to the sum of the actual value of such consideration and the premiums and other amounts subsequently paid by the transferee Taxable at ordinary income tax rates on receipt of proceeds less the sum of Amounts paid to acquire the policy Later premiums Other amounts Questions that a planner must ask Is there a transfer? Will the transferee pay any type of consideration for that transfer? 22 - 1 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning The rule defined (cont'd) Points to consider It does not matter whether the policy is term or permanent insurance Rule applies to every type of life insurance contract (group and individual) Method by which policy is transferred is irrelevant for purposes of this rule Transfer for value rules will apply even if ownership has not been transferred For the rule to apply, there must be A transfer of a policy or interest in the policy Valuable consideration paid for the transfer 22 - 2 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning The requirements of transfer Includes the creation for value of an enforceable right to receive all or part of the proceeds of a policy Excludes any pledge or mere assignment of a policy as collateral security Transfer for valuable consideration Encompasses any absolute transfer-for-value of a right to receive any or all part of a life insurance policy Any shifting of a beneficial interest in a policy is sufficient to trigger the transfer for value rule No physical transfer of the policy or policy ownership is necessary 22 - 3 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning The requirements of consideration Transfer for value will occur even if There is no assignment of the policy The policy has no cash surrender value The policy is term insurance so that there never will be cash value Cash need not change hands Any consideration sufficient to support an enforceable right will be sufficient Quid-pro-quo is consideration 22 - 4 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Exceptions to the rule (safe harbors) Transferor’s basis Transfer for value rule does not apply if the transferee's basis for determining gain or loss is determined “in whole or in part” by reference to the transferor’s basis Example 1 – an outright gift Example 2 – Policy transferred from one business to another in a tax free corporate reorganization Potential trap – Where the transferee is considered to pay not only what he actually paid, but also any amount the transferee is deemed to pay by relieving the transferor of the obligation to pay a policy loan Where the policy loan is greater than the transferor’s basis IRC 1041 treats interspousal transfers as nontaxable events 22 - 5 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Exceptions to the rule (safe harbors) transfers to the insured transfer for value rule does not apply to transfer: To the insured To a partner of the insured To a partnership in which the insured is a partner To a corporation in which the insured is a shareholder or officer Transfers to a partner of the insured Transferee partner must own a legitimate share of an operating or investment partnership transfers to a partnership in which the insured is a partner IRS has approved a transfer to a partnership established specifically to receive and hold policies insuring the lives of its partners 22 - 6 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Exceptions to the rule (safe harbors) (cont'd) Transfer to a corporation in which the insured is a shareholder or officer This safe harbor does not apply to Co-shareholders of the insured Key employees (no matter how important) Directors who are neither shareholders nor officers Typical personal life insurance planning problems Where the amount of a policy loan exceeds the transferor’s basis To the extent the loan exceed the transferor’s net cost, ordinary income is realized just as if the policy is sold to the transferee for a payment in the amount of the loan The transferee’s basis is determined by the “sales” price 22 - 7 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in buy-sell planning The uninsurable shareholder trap The uninsurable shareholder sells her individually owned insurance to a co-shareholder to help fund a cross purchase agreement The switch from stock redemption to cross purchase trap A corporation sells to a co-shareholder of the insured because the corporation wants to switch from a stock redemption plan to a cross purchase plan The gift policies by corporation double trouble trap Two shareholders want to change an insured stock redemption to a cross purchase plan Instead of selling the polices, they intend merely to have the corporation give each shareholder the policy on the life of the insured IRS will likely challenge the distribution from the corporation as a dividend 22 - 8 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in buy-sell planning The purchase by insured followed by gift trap Two shareholders want to change from a stock redemption to a cross purchase plan Each insured purchases the policy from the corporation and then gift the policies to each other IRS will argue that this double transfer is really one directly from the corporation The sale by the estate trap The estate of the deceased shareholder sells the policies on the surviving uninsured shareholders Example – Three shareholders X, Y and Z. Shareholder X dies. The policy X owned on Z is sold by X’s estate to Y. 22 - 9 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in buy-sell planning The sale by the estate trap (cont'd) Solution Both policies can be sold to the corporation. The corporation can then establish a stock redemption plan. Decedent's estate can surrender the policies, or keep them in force, or place the policies on extended term or reduced paid-up insurance. The survivors can purchase the policies own their own lives and continue them as personal insurance. The sale by trust trap A trust’s sale of an interest in a life insurance policy to the trust’s beneficiaries 22 - 10 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in buy-sell planning The policy savings trust trap Cross purchase buy-sell agreement established Trust is created to facilitate transaction and assure an orderly transfer of corporate stock A corporate owned policy on each shareholders life is transferred to the trust Insured’s co-shareholders pay premiums on the policies Trustee collects proceeds and in exchange for the stock pay the estate the appropriate of amount of cash There is a transfer – but what is the consideration? One court has held that relieving the business of the burden of making the premium payments and buying the insured’s stock with the proceeds was sufficient valuable consideration (i.e., it was a transfer for value) 22 - 11 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in buy-sell planning The policy savings trust trap (cont'd) Six shareholders form a trust, contribute cash to pay premiums, and have the trust buy one policy on each shareholder When a shareholder dies, his interest in the policy on the lives of the surviving shareholders disappears (per the contract) The group funded cross purchase trap Unrelated shareholders are insured under a corporate owned group term policy and name each other as beneficiary in order to fund the buy sell agreement with tax deductible (from the corporate perspective) dollars There is a transfer in the interest of each policy and although there is no cash consideration, there is reciprocity, considered to be valuable consideration 22 - 12 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in buy-sell planning The endorsement type split dollar trap Shareholders want cross purchase agreement but have no funds to pay premiums Corporation sets up a split dollar arrangement to assist them in paying for the coverage At death of one of the shareholders, corporation will recover it’s outlay first, then excess will be payable to the insured’s co-shareholder In reality, the corporation shifts the beneficial right of the death proceeds to the insured co-shareholder in consideration for their continuing service as an employee Solution – use a collateral assignment split dollar agreement 22 - 13 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in buy-sell planning The perhaps not so safe gift trap Father gives son policy on father’s life and pays the gift tax Father and son enter onto a cross purchase agreement for the purchase of the father’s stock in a corporation at the fathers death Father dies and son uses proceeds to purchase the stock Considerations Do the transfer of the policy and the execution of the agreement occur contemporaneously? How far apart do the two transaction occur? Is there further evidence that establishes an intent to make the transfer a gift rather than part of a business transaction? Is there an explicit agreement that the son will use the proceeds to buy the fathers stock at his death? 22 - 14 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Transfer for value problems in employee benefit planning Transfer of policies to the trustee of a qualified retirement plan Transfer may take place as part of the corporate employers contribution to the plan on behalf of or as part of a participants voluntary contribution to the plan Transaction will succeed of it is properly structured and no significant change of ownership rationale is followed Summary Suspect a transfer for value problem in every transfer of an existing policy or any shift of an interest in a policy Whenever possible – make the transfer only to protected parties (those exempted by the rule Do not transfer a policy with a loan in excess of the policyowners basis Eliminate prior tainted transfers by making a further transfer to a protected party 22 - 15 CashTransfer The and Cash ForEquivalents Value Rule Chapter Chapter221 ToolsTools & Techniques & Techniques of Life of Investment Insurance Planning Summary Suspect a transfer for value problem in every transfer of an existing policy 22 - 16