Assignment 13

advertisement

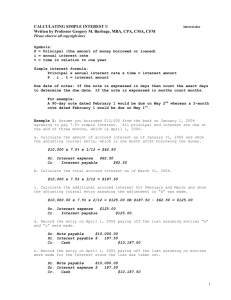

Secured Transactions Assignment 13 Default, Acceleration and Cure Under State Law 1 The Big Picture Chapters 1 and 2. Creditors’ Remedies Chapter 3. Creation of Security Interests Chapter 4. Default: The Gateway to Remedies 2 The Big Picture Chapters 1 and 2. Creditors’ Remedies Chapter 3. Creation of Security Interests Chapter 4. Default: The Gateway to Remedies Assignment 13. Default, acceleration and cure under state law. Assignment 14. Default, acceleration and cure under bankruptcy law. 3 Basic Concepts Installment loan. A loan repayable in more than one payment Line of credit. An arrangement in which the creditor agrees to lend and receive payment at times elected by the debtor, up to the line amount and until the contracted due date of the line How does this “line” differ from your Visa or Mastercard “line?” Payable on demand. Immediately payable when the creditor requests payment 4 Basic Concepts Default. Breach of the loan agreement (contract principles) Acceleration (of installment payments). Rendering a debt previously payable at some future time due and payable now. Cure (of default). Reversing a default by tendering performance Tender. “An unconditional offer of money or performance to satisfy a debt or obligation.” Black’s Law Dictionary The relationship between acceleration and cure: Old Republic Insurance v. Lee. “[A] mortgagor, prior to election of . . . accelerat[ion] . . . may tender the arrears due and thereby prevent [acceleration].” Default triggers a race: If acceleration is first, default can’t be cured If cure is first, obligation can’t be accelerated. 5 When does acceleration occur? Generally: When the contract says it occurs But: In re Crystal Properties, Ltd., 268 F.3d 743 (9th Cir. 2001) “[A] creditor must take affirmative action to put the debtor on notice that it intends to exercise its option to accelerate. “Both state and federal courts have made clear the unquestionable principle that, even when the terms of a note do not require notice or demand as a prerequisite to accelerating a note, the holder must take affirmative action to notify the debtor that it intends to accelerate.” 6 Problem 13.1, page 234 Truck loan made 7 Problem 13.1, page 234 Truck loan made Pat misses two payments Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” 8 Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” 9 Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” 10 Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? 11 Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? Not if she cured before acceleration. 12 Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? Not if she cured before acceleration. When did Pat cure? 13 Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? Not if she cured before acceleration. When did Pat cure? 14 Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? Not if she cured before acceleration. When did Pat cure? At “tender,” p.223; §1-202(f). At option exercise. Which happened first? b. What effect if Bank accelerated before receiving check, then kept the check, and continued to claim acceleration? 15 Waiver? No. Waiver by estoppel? No reliance. Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? Not if she cured before acceleration. When did Pat cure? At “tender,” p.223; §1-202(f). When did Bank accelerate? At option exercise. Which happened first? b. What effect if Bank accelerated before receiving check, then kept the check, and continued to claim acceleration? 16 Waiver? No. Waiver by estoppel? No reliance. Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? Not if she cured before acceleration. When did Pat cure? At “tender,” p.223; §1-202(f). When did Bank accelerate? At option exercise, notice effort Which happened first? b. What effect if Bank accelerated before receiving check, then kept the check, and continued to claim acceleration? 17 Waiver? No. Waiver by estoppel? No reliance. Problem 13.1, page 234 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? b. Not if she cured before acceleration. When did Pat cure? At “tender,” p.223; §1-202(f). When did Bank accelerate? At option exercise, notice effort Which happened first? What effect if Bank accelerated before receiving check, then kept the check, and continued to claim acceleration? 18 Waiver? No. Waiver by estoppel? No reliance. Problem 13.2, page 235 One payment due Now Oct 1 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” 19 Problem 13.2, page 235 One payment due Now Oct 1 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” 20 Problem 13.2, page 235 One payment due Now Oct 1 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” Is Art in default? 21 Problem 13.2, page 235 One payment due Now Oct 1 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” Is Art in default? No. Just late. 22 Problem 13.2, page 235 One payment due Now Oct 1 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” Is Art in default? No. Just late. a. When will Art be in default? 23 Problem 13.2, page 235 One payTen days More than Ten days ment due Now after one pymt due after Oct 1 Oct 11 Nov 1 Nov 11 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” a. Is Art in default? No. Just late. b. When will Art be in default? 24 Problem 13.2, page 235 One payTen days More than Ten days ment due Now after one pymt due after Oct 1 Oct 11 Nov 1 Nov 11 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” a. Is Art in default? No. Just late. b. When will Art be in default? Nov 12. 25 Problem 13.2, page 235 One payTen days More than Ten days ment due Now after one pymt due after Oct 1 Oct 11 Nov 1 Nov 11 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” a. Is Art in default? No. Just late. b. When will Art be in default? Nov 12. c. What happens if he doesn’t pay? 26 Problem 13.2, page 235 One payTen days More than Ten days Accel- Forc ment due Now after one pymt due after eration begins Oct 1 Oct 11 Nov 1 Nov 11 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” a. Is Art in default? No. Just late. b. When will Art be in default? Nov 12. c. What happens if he doesn’t pay? 27 Problem 13.2, page 235 One payTen days More than Ten days Accel- Forc ment due Now after one pymt due after eration begins Oct 1 Oct 11 Nov 1 Nov 11 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” a. Is Art in default? No. Just late. b. When will Art be in default? Nov 12. c. What happens if he doesn’t pay? 28 When is Art’s last chance to pay without serious repercussions? Problem 13.2, page 235 One payTen days More than Ten days Accel- Forc ment due Now after one pymt due after eration begins Oct 1 Oct 11 Nov 1 Nov 11 Contract: “Upon the occurrence of any of the following events of default . . . (1) the Debtor shall have outstanding an amount exceeding one full payment which has remained unpaid for more than 10 days after the due dates . . . mortgagee shall have . . . the right to declare the entire outstanding balance immediately due and payable.” a. Is Art in default? No. Just late. b. When will Art be in default? Nov 12. c. What happens if he doesn’t pay? d. Different under the Illinois reinstatement statute? 29 When is Art’s last chance to pay without serious repercussions? Problem 13.3, page 235 We represent Second National. We plan to pull the plug on Walt Rebel. 30 Problem 13.3, page 235 We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? 31 Problem 13.3, page 235 We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? 32 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Equipment $80k Lease $40-80k Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? 33 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Lease $40-80k Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? 34 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Lease $40-80k Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? 35 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? 36 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? 37 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Default Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? 38 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Default Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? What should we do? 39 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Default Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? What should we do? Replevin 40 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Default Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? What should we do? Replevin With or without notice to Walt? 41 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Default Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? What should we do? Replevin With or without notice to Walt? Notice creates the 30-day risk! 42 Problem 13.3, page 235 Liquidation 30-day risk? Inventory $240k Sale and diversion Equipment $80k Destruction Lease $40-80k Default Total $360-400k We represent Second National. We plan to pull the plug on Walt Rebel. Loan officer (Art) wants to give Walt 30 days advance notice. Is that OK? If we do, what is the worst that could happen? What should we do? Replevin With or without notice to Walt? Notice creates the 30-day risk! 43 JR Hale Contracting, page 225. Basic Concepts Waiver. The voluntary relinquishment of a known right Waiver by estoppel. Misleading a debtor into the honest and reasonable belief that the creditor intended a waiver Good faith. Honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-201(b)(20); 9102(a)(43). Insecurity clause. A provision that the loan is in default if the secured party “deems itself insecure” or the like. §1-309. A creditor can exercise an insecurity clause only if the creditor in good faith believes the prospect for payment impaired. Comment 1. “This section has no application to demand instruments . . . .” 44 Problem 13.4, page 236 Truck loan made Pat misses two payments Pat sends check Bank rejects payment Contract: Missing two payments is a default and “upon default at the secured party’s option, the entire balance of the loan shall become due and payable.” Pat: can they get away with this? Not if she cured before acceleration. When did Pat cure? At “tender,” p.223. §9-623 comment. When did Bank accelerate? At option exercise, notice effort Which happened first? What effect if Bank accelerated before receiving check, then kept the check, and continued to claim acceleration? Waiver? 45 Waiver by estoppel? Basic Concepts, Good Faith §1-201(b)(20). “‘Good faith’ means honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-304. Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement. §1-309: “A term providing that one party . . . may accelerate payment . . . ‘at will’ or ‘when he deems himself insecure’ or in words of similar import shall be construed to mean that he shall have the power to do so only if he is in good faith . . . .” 46 Basic Concepts, Good Faith §1-201(b)(20). “‘Good faith’ means honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-304. Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement. Comment to 1-304. This section does not support an independent cause of action for failure to perform or enforce in good faith. 47 Basic Concepts, Good Faith §1-201(b)(20). “‘Good faith’ means honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-304. Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement. Comment to 1-304. This section does not support an independent cause of action for failure to perform or enforce in good faith. ■ Rather, this section means that a failure to perform or enforce, in good faith, a specific duty or obligation under the contract, constitutes a breach of that contract or makes unavailable, under the particular circumstances, a remedial right or power. 48 Basic Concepts, Good Faith §1-201(b)(20). “‘Good faith’ means honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-304. Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement. Comment to 1-304. This section does not support an independent cause of action for failure to perform or enforce in good faith. ■ Rather, this section means that a failure to perform or enforce, in good faith, a specific duty or obligation under the contract, constitutes a breach of that contract or makes unavailable, under the particular circumstances, a remedial right or power. ■ This distinction makes it clear that the doctrine of good faith merely directs a court towards interpreting contracts within the commercial context in which they are created, performed, and enforced . . . 49 Basic Concepts, Good Faith §1-201(b)(20). “‘Good faith’ means honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-304. Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement. Comment to 1-304. This section does not support an independent cause of action for failure to perform or enforce in good faith. ■ Rather, this section means that a failure to perform or enforce, in good faith, a specific duty or obligation under the contract, constitutes a breach of that contract or makes unavailable, under the particular circumstances, a remedial right or power. ■ This distinction makes it clear that the doctrine of good faith merely directs a court towards interpreting contracts within the commercial context in which they are created, performed, and enforced, and does not create a separate duty of fairness 50 Basic Concepts, Good Faith §1-201(b)(20). “‘Good faith’ means honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-304. Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement. Comment to 1-304. This section does not support an independent cause of action for failure to perform or enforce in good faith. ■ Rather, this section means that a failure to perform or enforce, in good faith, a specific duty or obligation under the contract, constitutes a breach of that contract or makes unavailable, under the particular circumstances, a remedial right or power. ■ This distinction makes it clear that the doctrine of good faith merely directs a court towards interpreting contracts within the commercial context in which they are created, performed, and enforced, and does not create a separate duty of fairness and reasonableness which51 can be independently breached. Basic Concepts, Good Faith §1-201(b)(20). “‘Good faith’ means honesty in fact and the observance of reasonable commercial standards of fair dealing. §1-304. Every contract or duty within this Act imposes an obligation of good faith in its performance or enforcement. Comment to 1-304. This section does not support an independent cause of action for failure to perform or enforce in good faith. ■ Rather, this section means that a failure to perform or enforce, in good faith, a specific duty or obligation under the contract, constitutes a breach of that contract or makes unavailable, under the particular circumstances, a remedial right or power. ■ This distinction makes it clear that the doctrine of good faith merely directs a court towards interpreting contracts within the commercial context in which they are created, performed, and enforced, and does not create a separate duty of fairness and reasonableness which53 can be independently breached. Problem 13.6, page 236 Macklin Mortgage needs money. Wants to call Lance’s loan. a. Does Macklin have right to call it for: 1. Failure to furnish proof of insurance last year? No. Probably waived 2. Failure to furnish proof of insurance 23 days ago? Yes? Too soon to imply waiver (J.R. Hale case) b. Lance: “Macklin waived this year’s proof by estoppel when it failed to require last year’s proof.” Good argument? Contract ¶13 negates that implication c. Is Harvey risking a damage judgment by calling the loan? d. Are you willing to continue representing Macklin? e. If you had to continue, what would you advise? 54 Problem 13.6, page 236 Comment to 1-304. This section does not support an independent cause of action for failure to perform or enforce in good faith. Rather, this section means that a failure to perform or enforce, in good faith, a specific duty or obligation under the contract, constitutes a breach of that contract or makes unavailable, under the particular circumstances, a remedial right or power. This distinction makes it clear that the doctrine of good faith merely directs a court towards interpreting contracts within the commercial context in which they are created, performed, and enforced, and does not create a separate duty of fairness and reasonableness which can be independently breached. 55