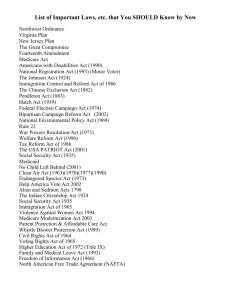

Social Security Reform - Kenston Local Schools

advertisement

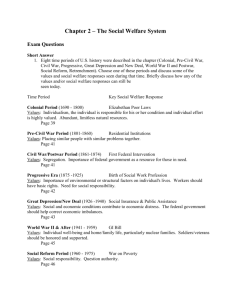

Chapter 19 DOMESTIC POLICY 2 Providing Affordable Health Care for All Health care a central theme of Barack Obama's presidential campaign About 16 percent of U.S. 2007 GDP spent on health care Over 60 percent of all personal bankruptcies in 2007 due to medical costs About 16 percent of population uninsured during a portion of 2007 and 2008 Many denied due to arbitrary definition of preexisting condition 3 Domestic Policy Making More than half of government expenditures made on Social Security, health care, education, and immigration Many designed to address economic inequality To evaluate, must address questions involving conflicts between freedom and order and freedom and equality State and local governments must also have capacity to carry out national programs 4 The Development of the American Welfare State Most controversial purpose of government promotion of social and economic equality Conflict between freedom and equality Most modern nations welfare states Social welfare policy based on concept governments should provide for basic needs of members 5 A Human Tragedy 6 The Great Depression Initiatives related to the New Deal and the Great Society dominated national policy until reforms in 1980s and 1990s Extended protective role of government The Great Depression longest and deepest setback of U.S. economy in history Began with stock market crash Oct. 24th, 1929 and ended with start of WWII One in four workers unemployed; more underemployed 7 The New Deal Franklin Delano Roosevelt, accepting nomination at Democratic Presidential Convention: “I pledge you, I pledge myself to a new deal for the American people.” Were programs imaginative public policy or source of massive government growth without matching benefits? 8 The New Deal’s Two Phases First phase aimed at boosting prices and lowering unemployment Civilian Conservation Corps (CCC) Second phase aimed at aiding “forgotten people” Social Security program Despite programs, poverty and unemployment persisted until WWII 9 The Great Society President Lyndon B. Johnson re-elected in 1964 with landslide Used support to promote Great Society programs to combat political, social, and economic inequalities Vital element was War on Poverty Economic Opportunity Act (1964) designed to end poverty in 10 years A hand up, not a handout 10 Retrenchment and Reform Despite Great Society’s programs, poverty declined but did not disappear Ronald Reagan used presidency in early to mid 1980s to re-examine social welfare policy Shifted focus from economic equality to economic freedom Questioned whether government alone should look after less fortunate 11 Retrenchment and Reform Reagan’s policies abolished some programs and redirected others Felt state and local governments could provide social services more efficiently than national government Congress blocked some cutbacks, but overall spending on social welfare programs fell to mid-1970s levels George H.W. Bush’s presidency continued President Reagan’s approach 12 Retrenchment and Reform President Bill Clinton’s proposals aimed at reforming system while protecting basic fabric of safety net President George W. Bush’s administration greatly expanded welfare benefits for seniors with Medicare drug program 13 Social Security Government social insurance programs protect individuals from various kinds of loss, regardless of need First example was workers’ compensation Social security and Medicare also social insurance programs These programs examples of entitlements 14 Origins of Social Security Social insurance programs began in Europe as early as 1883 In U.S., needs of elderly and unemployed left to private organizations and individuals until Great Depression In 1935, President Roosevelt signed Social Security Act 15 Social Security Act Act had three approaches: Social insurance for elderly and disabled, and unemployment benefits Grants-in-aid to the states to help destitute Federal aid to the states to provide health and welfare services 16 How Social Security Works Most people think of retirement benefits when thinking of Social Security Program provides other services Contributions not set aside for individuals but used to fund “pay as you go” system Program began with more paying into fund than taking out (nine workers to one beneficiary) Today’s program closer to three workers for each beneficiary 17 Will Social Security Remain Solvent? Baby boomers begin to retire in 2010 Current projections show fund exhausted by 2037 Politicians face dilemma: lower benefits or raise taxes to fund program? Current workers’ benefits will be paid by future participants Solvency depends on growth of base What happens when birthrate falls, unemployment rises, mortality declines, and/or economy falters? 18 Figure 19.1 Day of Reckoning 19 Who Pays? Who Benefits? Congress established automatic cost-ofliving adjustments (COLAs) for Social Security in 1972 Changes in payments and wages subject to tax tied to Consumer Price Index (CPI) Stagflation in 1970s jeopardized fund solvency President Reagan and Congress agreed to painful solution in 1983: increased taxes and reduced benefits 20 Social Security Reform Changes in 1983 protected Social Security but future still a concern Majority of adults (61%) in 2009 poll believe program will not have enough funds to pay for benefits throughout their retirement In 2000 and 2004, both Republicans and Democrats proposed reforms that involved private investment of payroll taxes President Obama opposes privatization 21 Public Assistance Public aid to individuals with demonstrated need Some refer to programs as welfare Not all are programs for the poor Social Security Act has categorical assistance programs Old age assistance for needy elderly Aid to the needy blind Aid to needy families with dependent children Aid to the totally and permanently disabled These programs have become entitlements administered by the states 22 Poverty in the United States Since 1960s, poverty level calculated as three times cost of minimally nutritious diet for given number of people in a family for a set time Critics believe calculation not accurate because changes in other costs have lowered proportion of income used for food Measuring poverty one way to measure public policies’ effectiveness in promoting equality 23 Census Estimates in 2008 39.8 million, or 13.2 percent, of Americans live in poverty 19.0 percent of persons under 18 live in poverty 9.7 percent of people over 65 live in poverty One in two poor Americans live in a family with a woman head of household 24 Figure 19.2 The Feminization of Poverty 25 The Poverty Level Poverty threshold determines number of people who live below threshold amount Poverty guideline income level at which a family is eligible for government help Some believe factors other than income should be used to determine poverty Use of poverty as indicator reflects ambiguities in notion of equality 26 Welfare Reform Original poverty programs lacked work incentives A 1994 poll showed 59 percent of Americans believed welfare recipients taking advantage of system Personal Responsibility and Opportunity to Work Act reforms enacted in 1996 Designed to “end welfare as we know it” Abolished Aid to Families with Dependent Children (AFDC) Replaced AFDC with Temporary Assistance to Needy Families (TANF) 27 Features of TANF Adult recipients must be employed within two years States have burden of job creation Families can receive no more than five years’ benefits in a lifetime Control of welfare program design and implementation devolved to states Federal support via block grants totaling $16.5 billion a year Economic stimulus plan added $5 billion 28 Figure 19.3 Families on Welfare, 1955-2008 29 Status of TANF Reauthorized in 2006 and being reexamined in 2010 Questions remain about program How did system fare in 2008 recession? To what extent should states be able to consider job training and education as work? 30 How Have Recipients Fared? The number of families on welfare has declined Large numbers of those formerly on welfare have found work Many jobs do not have good benefits and involve long commutes Many families still living below or close to poverty level 31 Recession Raises Questions To what extent do recipients maintain eligibility for other programs? What happens to TANF benefits if recipient loses their job? What happens to program as states shift money from job training to benefits as more need arises? 32 Health Care U.S. only major industrialized nation without universal health care Many programs exist, providing a patchwork quilt of care Medicare Medicaid Children’s Health Insurance Program (SCHIP) And now, President Obama’s health care bill 33 Cost and Access Most agree U.S. health care system needs fixing Two main issues: cost and access Access issues include: Nearly 47 million people (16 percent) had no health insurance in 2008 Many more under-insured Numbers vary by age, race, and income Supply of physicians does not meet demand 34 Figure 19.4 Poverty in the States 35 Cost and Access Health care sector significant part of U.S. economy In 2008, $2.4 trillion spent on health care, more than 16 percent of GDP Fastest growing sector: prescription drugs As proportion of GDP, U.S. spends more on health care than other nations with more comprehensive care 36 Dealing with Cost and Access Any reforms must democratize health care and control ballooning costs Dilemma of balancing greater equality of coverage with a loss of freedom of choice in markets for health care and doctors Private sector already addresses this balance in many ways, but also seeks to limit risk 37 Medicare Social Security Act amended in 1965 to include Medicare for those over 65 National health insurance first proposed by President Truman in 1945 Medicare program had two components: Part A for hospitalization Part B for physician’s fees Program has expanded over years to cover other services 38 Medicare Compulsory insurance funded by payroll tax and premiums deducted from Social Security Participants can also purchase private sector Medigap plans Medicare Prescription Drug, Improvement, and Modernization Act passed in 2003 Private sector companies provide competing plans for seniors to choose from Cost of program continues to increase faster than rate of inflation 39 What are the differences between Medicare Parts A, B, C and D? Medicare Part A, Hospital Insurance; Medicare Part B, Medical Insurance; Medicare Part C (Medicare Advantage), which was formerly known as Medicare + Choice; and Medicare Part D, prescription drug coverage. Generally, people who are over age 65 and getting Social Security automatically qualify for Medicare Parts A and B. So do people who have been getting disability benefits for two years, people who have amyotrophic lateral sclerosis (Lou Gehrig's disease) and receive disability benefits, and people who have permanent kidney failure and receive maintenance dialysis or a kidney transplant. Part A is paid for by a portion of Social Security tax. It helps pay for inpatient hospital care, skilled nursing care, hospice care and other services. Part B is paid for by the monthly premiums of people enrolled and by general funds from the U.S. Treasury. It helps pay for doctors' fees, outpatient hospital visits, and other medical services and supplies that are not covered by Part A. Part C (Medicare Advantage) plans allow you to choose to receive all of your health care services through a provider organization. These plans may help lower your costs of receiving medical services, or you may get extra benefits for an additional monthly fee. You must have both Parts A and B to enroll in Part C. Part D (prescription drug coverage) is voluntary and the costs are paid for by the monthly premiums of enrollees and Medicare. Unlike Part B in which you are automatically enrolled and must opt out if you do not want it, with Part D you have to opt in by filling out a form and enrolling in an approved plan. Medicaid Main program to provide health care to Americans with low incomes Since 1965, costs have risen from $0.4 billion to $336 billion Single largest public program in nation Program run and financed jointly with states Eligibility and services vary widely by state 42 Medicaid Participants fall into four groups: Children under age 21 (29.8 million, or 48 percent in 2008) Adults (5 million) Blind and disabled (6 million) Aged who are also poor (6.1 million) Last two categories account for over half of Medicaid expenditures 43 Health Care Reform President Obama signed Patient Protection and Affordable Care Act March 23, 2010 Compromises required to balance goal of equality of access with desire for freedom from government intervention Notable provisions in bill include protections for coverage despite pre-existing conditions and mandatory participation Bill includes subsidies and tax credits to help individuals and small businesses pay for coverage 44 Health Care Reform Critics of bill concerned about cost – an estimated $940 billion over 10 years Some, including Congressional Budget Office, believe bill will pay for itself Those wary of “big government” troubled by additional regulations and bureaucracy Is mandating individual coverage Constitutional? Others anxious about effect of reforms on Medicare 45 Elementary and Secondary Education Historically, state and local governments have primary responsibility for schooling in U.S. Today, federal government contributes around 8 percent of expenses Most significant federal involvement has come in recent years 46 Concerns Motivating Change: Equity Most Americans believe social and economic equity can be found through equality of educational opportunity Brown v. Board of Education (1954) Elementary and Secondary Education Act of 1965 (ESEA) Individuals with Disabilities Education Act (IDEA) 47 Concerns Motivating Change: Equity Programs have decreased, but not eliminated, differences in student achievement Significant gaps in math, reading, and overall graduation rates between advantaged and disadvantaged groups 48 Concerns Motivating Change: National Security and Prosperity To remain competitive globally, U.S. must have highly educated and skilled workers First federal program the National Defense Education Act of 1958 (NDEA) Studies relating education to economic competitiveness began in 1970s A Nation at Risk released in 1983 49 Values and Reform At center of current debate is dilemma of freedom versus equality Equality of opportunity to get good education Freedom to choose where to live and what your children will be taught Charter schools and school vouchers two proposals designed to address problems 50 The No Child Left Behind Act of 2001 George W. Bush’s 2000 presidential campaign focused on education Act designed to reform the Elementary and Secondary Education Act Most significant component requires states to guarantee proficiency in reading and math by 2014 Along the way, must make Adequate Yearly Progress in all student groups 51 Implementing NCLB NCLB initially praised for highlighting educational inequalities and need for qualified teachers for all Critics now charge its requirements mean teachers “teach to the test” Other critics charge federal government did not allocate enough funding to address existing inequities Some question if low-performing students “pushed out” to increase scores NCLB not reauthorized in 2007 52 Immigration One of most important problems facing America Immigrants make up around 13 percent of population; of those, 30 percent here illegally Twenty-three percent of noncitizens live below poverty line Americans have mixed feelings about how to approach illegal immigration 53 Immigration Foreign workers should apply for and receive a permanent resident card (“green card”) May eventually apply for citizenship Federal policy limits total number of people receiving green card each year 54 Permanent Resident Status Priority given to Reuniting families Workers in occupations needed in U.S. Refugees who face persecution in home countries Mix of persons from a diverse set of countries Welfare reforms in 1996 prohibits legal immigrants from participating in safety net programs for five years 55 Illegal Immigration Illegal immigrants get most attention in policy debates If caught, penalties range from being asked to leave country to imprisonment Most come from Mexico and other Latin American countries Geographically concentrated in western states and large urban areas Provide cheap labor in agriculture and manufacturing 56 Illegal Immigration Never eligible for safety net programs American-born children are Can enroll in public schools and get treated in hospital emergency rooms Policy debates focus on better border security with Mexico and sanctions on businesses that hire illegal immigrants 57 Undocumented Santa 58 Immigration Reform Unsuccessful bill proposed in 2007 would have allowed illegal immigrants to stay if they met certain conditions Citizenship possibility led conservative critics to accuse supporters of “offering amnesty” Immigrant groups did not like provisions addressing temporary workers and change in focus from reuniting families to needed workforce Union workers feared immigrants would drive down wages and take jobs away from Americans Liberals did not like E-Verify program requirement 59 Immigration Reform Polls show many Americans support some sort of “path to citizenship” Obama administration supports major provisions of bill and plans to attempt similar immigration reforms Given recent battles in Congress, success unlikely 60 Benefits and Fairness Two kinds of benefits provided by national government: Means-tested benefits Non-means-tested benefits Some question fairness of non-means- tested benefits Reform debates may center around making more affluent pay for programs 61