INTERMEDIATE ACCOUNTING

TENTH CANADIAN EDITION

Kieso • Weygandt • Warfield • Young • Wiecek • McConomy

CHAPTER 7

Appendix 7A

Cash Controls

PREPARED BY:

Dragan Stojanovic, CA

Rotman School of Management,

University of Toronto

1

Using Bank Accounts

• Using different bank accounts for different

purposes

– General chequing account

• Used for day-to-day activities

– Imprest bank accounts

• Used for specific purposes

– Lockbox accounts

• Used for collections in subsidiary locations

• Arrangements made with a local bank to pick-up

and deposit funds received

• Allows for quicker collection and availability of cash

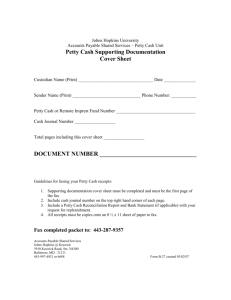

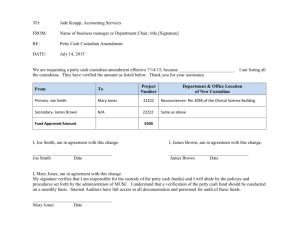

Imprest Petty Cash System

• Designed for disbursements where payment by

cheque is impractical

• Control processes/procedures include the

following:

– Designate a petty cash custodian

– Custodian is responsible for getting a receipt

for each authorized disbursement

– Custodian prepares a summary of petty cash

receipts and disbursements each time the

fund requires reimbursement

– Cheque is prepared and transactions recorded

by someone other than the custodian

Copyright © John Wiley & Sons Canada, Ltd.

3

Imprest Petty Cash System

•

•

Cash Over and Short account used when the

cash in the fund plus dollar amount of receipts

does not equal the balance of the petty cash

fund

Additional control procedures include:

• Unscheduled fund counts to ensure fund

balance is maintained

• Receipts are marked (after being

submitted for reimbursement) in some

way to ensure they cannot be used again

Copyright © John Wiley & Sons Canada, Ltd.

4

Imprest Petty Cash System:

Example

A petty cash fund is established for $300. A

cheque is issued (for cash), with the following

entry made:

Petty Cash

Cash (Bank)

300

300

No entries are required when petty cash

disbursements are made

Copyright © John Wiley & Sons Canada, Ltd.

5

Imprest Petty Cash System:

Example

Petty cash is reconciled and replenished when the fund is

low enough to warrant a cheque being issued or at the

end of an accounting period

The following disbursements were made:

Office Supplies

$ 42

Postage

53

Entertainment

76

Total

$171

The custodian counts the cash and finds there is $127 cash.

The fund is $2 short ($300 – $171 = $129).

Once the custodian has ensured that all receipts and cash have

been accounted for, the $2 difference is considered Cash

Over and Short.

Copyright © John Wiley & Sons Canada, Ltd.

6

Imprest Petty Cash System:

Example

A cheque is written for the required amount of $173

($171 + $2). The entry to record the cheque is:

Office Supplies Expense

Postage Expense

Entertainment Expense

Cash Over and Short

Cash (Bank)

173

42

53

76

2

What would the entry have been if it was decided to

decrease the fund to $250?

Copyright © John Wiley & Sons Canada, Ltd.

7

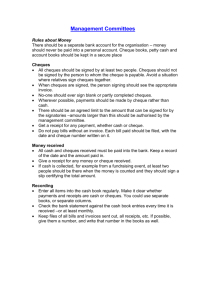

Reconciliation of Bank Balances

• Ensures there are no errors

• Ensures no omissions have occurred during

the month

• Ensures unusual transactions are properly

recorded

• Should not be completed by the same person

who writes cheques or completes the

deposits

Copyright © John Wiley & Sons Canada, Ltd.

8

Bank Reconciliation:

Reconciling Items

1.Deposits in Transit: deposits that have been recorded

in the books of account, but not yet by the bank

2.Outstanding Cheques: cheques that have been

recorded in the books of account, but have not yet

cleared the bank

3.Bank Charges: service, and other charges, made by

the bank, but not yet recorded in the books of account

4.Bank Credits: collections or deposits made by the

bank, but not yet recorded in the books of account

5.Bank or Depositor Errors: any unrecorded errors by

either the bank or the company

Copyright © John Wiley & Sons Canada, Ltd.

9

Bank Reconciliation:

Form and Content

Balance per bank statement (end of period)

$$$

Add:

Deposits in transit

Undeposited receipts

Bank errors

$$

$$

$$

$$

$$$

$$

Deduct: Outstanding cheques

Bank errors

$$

Correct cash balance

$$$

Balance per depositor’s books

$$$

Add:

Unrecorded bank credits

$$

Book errors Copyright © John Wiley & Sons Canada, Ltd.

$$

$$

10

COPYRIGHT

Copyright © 2013 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of

this work beyond that permitted by Access Copyright

(The Canadian Copyright Licensing Agency) is

unlawful. Requests for further information should be

addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may make

back-up copies for his or her own use only and not

for distribution or resale. The author and the

publisher assume no responsibility for errors,

omissions, or damages caused by the use of these

programs or from the use of the information

contained herein.

11