Strategic Pricing Techniques

advertisement

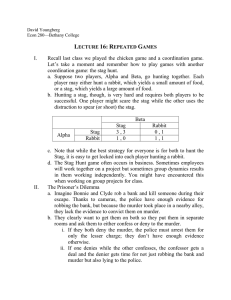

Economics of the Firm Strategic Pricing Techniques Recall that there is an entire spectrum of market structures Market Structures Perfect Competition Many firms, each with zero market share P = MC Profits = 0 (Firm’s earn a reasonable rate of return on invested capital) NO STRATEGIC INTERACTION! Monopoly One firm, with 100% market share P > MC (Positive Markup) Profits > 0 (Firm’s earn excessive rates of return on invested capital) NO STRATEGIC INTERACTION! Most industries, however, don’t fit the assumptions of either perfect competition or monopoly. We call these industries oligopolies Oligopoly Relatively few firms, each with significant market share STRATEGIES MATTER!!! Mobile Phones (2011) Nokia: 22.8% Samsung: 16.3% LG: 5.7% Apple: 4.6% ZTE:3.0% Others: 47.6% US Beer (2010) Anheuser-Busch: 49% Miller/Coors: 29% Crown Imports: 5% Heineken USA: 4% Pabst: 3% Music Recording (2005) Universal/Polygram: 31% Sony: 26% Warner: 15% Warner: 10% Independent Labels: 18% The key difference in oligopoly markets is that price/sales decisions can’t be made independently of your competitor’s decisions Monopoly Q QP Your Price (-) Oligopoly Q QP, P1 ,...PN Your N Competitors Prices (+) Oligopoly markets rely crucially on the interactions between firms which is why we need game theory to analyze them! Strategy Matters!!!!! Prisoner’s Dilemma…A Classic! Two prisoners (Jake & Clyde) have been arrested. The DA has enough evidence to convict them both for 1 year, but would like to convict them of a more serious crime. Jake Clyde The DA puts Jake & Clyde in separate rooms and makes each the following offer: Keep your mouth shut and you both get one year in jail If you rat on your partner, you get off free while your partner does 8 years If you both rat, you each get 4 years. Jake is choosing rows Clyde is choosing columns Clyde Jake Confess Don’t Confess Confess -4 -4 0 -8 Don’t Confess -8 0 -1 -1 Suppose that Jake believes that Clyde will confess. What is Jake’s best response? If Clyde confesses, then Jake’s best strategy is also to confess Jake Clyde Confess Don’t Confess Confess -4 -4 0 -8 Don’t Confess -8 0 -1 -1 Suppose that Jake believes that Clyde will not confess. What is Jake’s best response? If Clyde doesn’t confesses, then Jake’s best strategy is still to confess Jake Clyde Confess Don’t Confess Confess -4 -4 0 -8 Don’t Confess -8 0 -1 -1 Dominant Strategies Jake’s optimal strategy REGARDLESS OF CLYDE’S DECISION is to confess. Therefore, confess is a dominant strategy for Jake Clyde Jake Note that Clyde’s dominant strategy is also to confess Confess Don’t Confess Confess -4 -4 0 -8 Don’t Confess -8 0 -1 -1 Nash Equilibrium The Nash equilibrium is the outcome (or set of outcomes) where each player is following his/her best response to their opponent’s moves Jake Here, the Nash equilibrium is both Jake and Clyde confessing Clyde Confess Don’t Confess Confess -4 -4 0 -8 Don’t Confess -8 0 -1 -1 “Winston tastes good like a cigarette should!” “Us Tareyton smokers would rather fight than switch!” Advertise Don’t Advertise Advertise 10 10 30 Don’t Advertise 5 20 20 30 5 Price Fixing and Collusion Prior to 1993, the record fine in the United States for price fixing was $2M. Recently, that record has been shattered! Defendant Product Year Fine F. Hoffman-Laroche Vitamins 1999 $500M BASF Vitamins 1999 $225M SGL Carbon Graphite Electrodes 1999 $135M UCAR International Graphite Electrodes 1998 $110M Archer Daniels Midland Lysine & Citric Acid 1997 $100M Haarman & Reimer Citric Acid 1997 $50M HeereMac Marine Construction 1998 $49M In other words…Cartels happen! Cartels - The Prisoner’s Dilemma The problem facing the cartel members is a perfect example of the prisoner’s dilemma ! Clyde Cooperate Jake Cheat Cooperate $20 $20 $10 $40 Cheat $40 $15 $15 $10 Cartel Formation While it is clearly in each firm’s best interest to join the cartel, there are a couple problems: With the high monopoly markup, each firm has the incentive to cheat and overproduce. If every firm cheats, the price falls and the cartel breaks down Cartels are generally illegal which makes enforcement difficult! Note that as the number of cartel members increases the benefits increase, but more members makes enforcement even more difficult! Perhaps cartels can be maintained because the members are interacting over time – this brings is a possible punishment for cheating. Clyde Cooperate Cheat Cooperate $20 $20 $10 $40 Cheat $40 $15 $15 Jake Jake “I plan on cooperating…if you cooperate today, I will cooperate tomorrow, but if you cheat today, I will cheat forever!” 0 1 Make Strategic Decision Make Strategic Decision Time $10 2 Make Strategic Decision 3 Make Strategic Decision 4 Make Strategic Decision 5 Make Strategic Decision Cooperate “I plan on cooperating…if you cooperate today, I will cooperate tomorrow, but if you cheat today, I will cheat forever!” Jake Cooperate: $20 Cheat Cooperate $20 $20 $10 $40 Cheat $40 $15 $15 $10 $20 $20 $20 $20 $20 0 1 2 3 4 5 Make Strategic Decision Make Strategic Decision Clyde Time Cheat: $40 Cooperate: $120 Cheat: $115 $15 Make Strategic Decision $15 Make Strategic Decision $15 Make Strategic Decision Make Strategic Decision $15 $15 Clyde should cooperate, right? We need to use backward induction to solve this. 0 1 Make Strategic Decision Make Strategic Decision Time Jake 2 Make Strategic Decision 3 Make Strategic Decision Clyde 4 5 Make Strategic Decision Make Strategic Decision Cooperate Regardless of what took place the first four time periods, what will happen in period 5? Cheat Cooperate $20 $20 $10 $40 Cheat $40 $15 $15 $10 What should Clyde do here? We need to use backward induction to solve this. 0 1 Make Strategic Decision Make Strategic Decision Time Jake 2 3 Make Strategic Decision 4 Make Strategic Decision Clyde 5 Make Strategic Decision Make Strategic Decision Cheat Cooperate Given what happens in period 5, what should happen in period 4? Cheat Cooperate $20 $20 $10 $40 Cheat $40 $15 $15 $10 What should Clyde do here? We need to use backward induction to solve this. 0 1 Make Strategic Decision Make Strategic Decision Time 2 Cheat Cooperate Make Strategic Decision Cheat 3 Make Strategic Decision Cheat Cheat Cooperate $20 $20 $10 $40 Cheat $40 $15 $15 $10 Jake Knowing the future prevents credible promises/threats! 4 Make Strategic Decision Cheat Clyde 5 Make Strategic Decision Cheat Where is collusion most likely to occur? High profit potential Inelastic Demand (Few close substitutes, Necessities) Cartel members control most of the market Entry Restrictions (Natural or Artificial) Low cooperation/monitoring costs Small Number of Firms with a high degree of market concentration Similar production costs Little product differentiation The Stag Hunt: Two individuals are out on a hunt. Each must make a decision on what to hunt without knowledge of the other individual’s choice Only one hunter is required to catch a rabbit – a small, sure reward Two hunters are required to take down a stag – a bigger but riskier reward Stag What’s the equilibrium here? Rabbit Stag 4 4 0 1 Rabbit 1 0 1 1 The Stag Hunt: Two individuals are out on a hunt. Each must make a decision on what to hunt without knowledge of the other individual’s choice If both hunt the stag, neither has an incentive to deviate – an equilibrium! Stag Rabbit Stag 4 4 0 1 Rabbit 1 0 1 1 If both hunt the rabbit, neither has an incentive to deviate – an equilibrium! A quick detour: Expected Value Suppose that I offer you a lottery ticket: This ticket has a 2/3 chance of winning $100 and a 1/3 chance of losing $100. How much is this ticket worth to you? Suppose you played this ticket 6 times: Attempt Outcome 1 $100 2 $100 3 -$100 4 $100 5 -$100 6 $100 Total Winnings: $200 Attempts: 6 Average Winnings: $200/6 = $33.33 A quick detour: Expected Value Given a set of probabilities, Expected Value measures the average outcome Expected Value = A weighted average of the possible outcomes where the weights are the probabilities assigned to each outcome Suppose that I offer you a lottery ticket: This ticket has a 2/3 chance of winning $100 and a 1/3 chance of losing $100. How much is this ticket worth to you? 2 1 EV $100 $100 $33.33 3 3 Suppose that you believed that your fellow hunter was equally likely to hunt the stag or the rabbit what would you do? 50% 50% Stag Rabbit Stag 4 4 0 1 Rabbit 1 0 1 1 If you hunt the rabbit: You are guaranteed a reward of 1 with certainty If you hunt the stag: 50% of the time you get 4, 50% of the time you get 0 EV .504 .500 2 In this example, hunting the stag is reward dominant (better average payout), while hunting the rabbit is risk dominant (lower risk) What if we change the odds…? 10% 90% Stag Rabbit Stag 4 4 0 1 Rabbit 1 0 1 1 If you hunt the rabbit: You are guaranteed a reward of 1 with certainty If you hunt the stag: 10% of the time you get 2, 90% of the time you get 0 EV .104 .900 .4 Now, hunting the rabbit is both reward dominant and risk dominant!! Choosing the stag would never be a good idea here. Let’s find the odds that make the stag and rabbit equally attractive on average… X% Y% Stag Rabbit Stag 4 4 0 1 Rabbit 1 0 1 1 If you hunt the rabbit: You are guaranteed a reward of 1 with certainty If you hunt the stag: EV X 4 Y 0 For them to be equal on average: X 4 Y 0 1 4X 1 X .25 X = 25%, Y = 75% Therefore, in this example, you will only hunt the stag if your fellow hunter hunts the stag at least 25% of the time. Similarly, your fellow hunter will only hunt the stag if you hunt the stag at least 25% of the time. 25% 75% Stag 25% Stag 4 6.25% Rabbit 75% 4 Rabbit 1 0 18.75% 0 1 18.75% 1 1 56.25% Therefore, in this case, the stag hunt has three possible equilibria: 50% 50% Stag Rabbit Stag 4 4 0 1 Rabbit 1 0 1 1 Equilibrium #1: Both players always hunt the stag Equilibrium #2: Both players sometimes hunt the stag (each player must hunt the stag at least 25% of the time) Equilibrium #3: Both players never hunt the stag Example: The Airline Price Wars Suppose that American and Delta face the given demand for flights to NYC and that the unit cost for the trip is $200. If they charge the same fare, they split the market p $500 $220 American 180 What will the equilibrium be? Q P = $500 P = $220 P = $500 $9,000 $9,000 $3,600 $0 P = $220 $0 $3,600 $1,800 $1,800 Delta 60 The Airline Price Wars If American follows a strategy of charging $500 all the time, Delta’s best response is to also charge $500 all the time If American follows a strategy of charging $220 all the time, Delta’s best response is to also charge $220 all the time American P = $220 P = $500 $9,000 $9,000 $3,600 $0 P = $220 $0 $3,600 $1,800 $1,800 Delta This game is just like the stag hunt – it has multiple equilibria and the result depends critically on each company’s beliefs about the other company’s strategy P = $500 The Airline Price Wars: A Stag Hunt! Suppose American charges $500 with probability pH Charges $220 with probability pL Charge $500: EV pH 9000 pL 0 Charge $220:EV pH 3600 PL 1800 American P = $500 P = $220 $9,000 $9,000 $3,600 $0 9000 pH 3600 pH 1800 pL Delta P = $500 pL 3 pH (6%) P = $220 $0 $3,600 (19%) pL 3 (75%) 4 pH 1 (25%) 4 (19%) $1,800 $1,800 (56%) Lets take the game we started out with…what are the strategies? Player 1 Player 2 Rock Paper Scissors Rock 0 0 -1 1 1 -1 Paper 1 -1 0 0 -1 1 Scissors -1 1 1 -1 0 0 Ever Cheat on your taxes? In this game you get to decide whether or not to cheat on your taxes while the IRS decides whether or not to audit you Cheat Don’t Cheat What is the equilibrium to this game? Don’t Audit Audit 5 -5 -25 5 0 0 -1 -1 If the IRS never audited, your best strategy is to cheat (this would only make sense for the IRS if you never cheated) If the IRS always audited, your best strategy is to never cheat (this would only make sense for the IRS if you always cheated) There is no pure strategy equilibrium (i.e. there are no certain strategies)! Cheat Don’t Cheat Don’t Audit Audit 5 -5 -25 5 0 0 -1 -1 Cheating on your taxes! Suppose that the IRS Audits 25% of all returns. What should you do? Cheat: EV .755 .25 25 2.5 Don’t Cheat: EV .750 .251 .25 If the IRS audits 25% of all returns, you are better off not cheating. But if you never cheat, they will never audit, … Cheat Don’t Cheat Don’t Audit Audit 5 -5 -25 5 0 0 -1 -1 The only way this game can work is for you to cheat sometime, but not all the time. That can only happen if you are indifferent between the two! Suppose the government audits with probability p A Doesn’t audit with probability pDA Cheat: EV pDA 5 pA 25 Don’t Cheat: EV pDA 0 PA 1 If you are indifferent… 5 pDA 25 p A p A 5 pDA 24 p A 5 pA pDA 24 p A pDA 1 Don’t Audit Audit Cheat 5 -5 -25 Don’t Cheat 0 0 -1 5 pDA pDA 1 24 29 pDA 1 24 24 pDA (83%) 29 pA 5 -1 5 (17%) 29 We also need for the government to audit sometime, but not all the time. For this to be the case, they have to be indifferent! Suppose you cheat with probability pC Don’t cheat with probability Audit: pDC EV pDC 1 pC 5 Don’t Audit: EV pDC 0 PC 5 If they are indifferent… 5 pC pDC 5 pC 10 pC pDC 1 pC pDC 10 pC pDC 1 Don’t Audit Audit Cheat 5 -5 -25 Don’t Cheat 0 0 -1 pA 1 (9%) 11 1 p DC p DC 1 10 11 p DC 1 10 10 p DC (91%) 11 5 -1 Now we have an equilibrium for this game that is sustainable! The government audits with probability p 17% A Doesn’t audit with probability p 83% DA Suppose you cheat with probability pC 9% Don’t cheat with probability pDC 91% Don’t Audit Cheat 5 -5 (7.5%) We can find the odds of any particular event happening…. You Cheat and get audited: pC p A .09.17 .0153 Don’t Cheat 0 0 (75%) (1.5%) Audit -25 5 (1.5%) -1 -1 (15%) In the Movie Air Force One, Terrorists hijack Air Force One and take the president hostage. Can we write this as a game? (Terrorists payouts on left) Terrorists President (1, -.5) (0, 1) In the third stage, the best response is to kill the hostages Terrorists Given the terrorist response, it is optimal for the president to negotiate in stage 2 (-.5, -1) (-1, 1) Given Stage two, it is optimal for the terrorists to take hostages Terrorists The equilibrium is always (Take Hostages/Negotiate). How could we change this outcome? President (1, -.5) (0, 1) Suppose that a constitutional amendment is passed ruling out hostage negotiation (a commitment device) Terrorists Without the possibility of negotiation, the new equilibrium becomes (No Hostages) (-.5, -1) (-1, 1) A bargaining example…How do you divide $20? Player A Offer Player B Accept Day 1 Reject Player B Two players have $20 to divide up between them. On day one, Player A makes an offer, on day two player B makes a counteroffer, and on day three player A gets to make a final offer. If no agreement has been made after three days, both players get $0. Offer Player A Accept Day 2 Reject Player A Offer Player B Accept Day 3 Reject (0,0) Player A Offer Player B Accept Reject Player A knows Day 1 what happens in day 2 and wants to avoid that! Player A: $19.99 Player B: $.01 Player B knows what happens in Day 2 day 3 and wants to avoid that! Player A: $19.99 Player B: $.01 Player B Offer Player A Accept Reject Player A Offer Player B Accept Reject (0,0) If day 3 arrives, Day 3 player B should accept any offer – a rejection pays out $0! Player A: $19.99 Player B: $.01 Player A Lets consider a variation… Offer Player B The Shrinking Pie Game: Negotiations are costly. After each round, the pot gets reduced by 50%: Accept Day 1 $20 Reject Player B Offer Player A Accept Day 2 $10 Reject Player A Offer Player B Accept Day 3 Reject (0,0) $5 Player A If player B rejects, she gets $5 Day 1 tomorrow. She will accept anything $20 better than $5 Offer Player B Accept Reject Player A: $5.01 Player B: $14.99 Player B Offer Player A Accept Day 2 Reject $10 If player A rejects, she gets $4.99 in one year. She will accept anything better than $4.99 Player A: $5.00 Player B: $5.00 Player A Offer Player B Accept Reject (0,0) If day 3 arrives, Day 3 player B should accept any offer – a rejection pays $5 out $0! Player A: $4.99 Player B: $.01 Did someone say Batman? Back to pricing… Consider the following example. We have two competing firms in the marketplace. These two firms are selling identical products. Each firm has constant marginal costs of production. What are these firms using as their strategic choice variable? Price or quantity? Consider the following scenario…We call this Cournot competition Two manufacturers choose a production target Two manufacturers earn profits based off the market price P Q1 S P* Profit = P*Q1 - TC D Q Q1 + Q2 Q2 A centralized market determines the market price based on available supply and current demand Profit = P*Q2 - TC For example…suppose both firms have a constant marginal cost of $20 Two manufacturers choose a production target P 120 20Q P Q1 = 1 Two manufacturers earn profits based off the market price S $60 Profit = 60*1 – 20 = $40 D Q 3 Q2 = 2 A centralized market determines the market price based on available supply and current demand Profit = 60*2 – 40 = $80 P 120 20Q Let’s figure out the strategies… TR Q1 Suppose that you are firm 1. You know that firm #2 has set a production level of 1 Q2 Q1 Q P TR MR 1 0 1 100 0 1 .25 1.25 95 23.75 95 1 .5 1.5 90 45 85 1 .75 1.75 85 63.75 75 1 1 2 80 80 65 1 1.25 2.25 75 93.75 55 1 1.5 2.5 70 105 45 1 1.75 2.75 65 113.75 35 1 2.00 3 60 120 25 1 2.25 3.25 55 123.75 15 P 120 201 Q1 Recall, firm 2 has set its production at 1 P 100 20Q1 P $100 $20 MC D MR 2 Q1 P 120 20Q Let’s figure out the strategies… TR Q1 Now, Suppose that you are firm 1. You know that firm #2 has set a production level of 2 Q2 Q1 Q P TR MR 2 0 2 80 0 2 .25 2.25 75 18.75 75 2 .5 2.5 70 35 65 2 .75 2.75 65 48.75 55 2 1 2 60 60 45 2 1.25 2.25 55 68.75 35 2 1.5 2.5 50 75 25 2 1.75 2.75 45 78.75 15 2 2.00 2 40 75 5 2 2.25 2.25 35 68.75 -5 An increase in production by firm 1 shifts the demand curve faced by firm #1 down which causes production by firm 1 to drop P 120 202 Q1 P 80 20Q1 P $100 $80 $20 MC D MR 1.5 2 Q1 Whenever firm #2 increases its production, firm 1’s best response is to reduce its production In Game Theory Lingo, this is Firm One’s Best Response Function To Firm 2 q2 q2 5 q1 0 Firm 2 chooses 1.5 0 Firm 1 chooses 1.75 q2 0 q1 2.5 Q2 Q1 0 2.5 .25 2.375 .50 2.25 .75 2.125 1 2 1.25 1.875 1.5 1.75 1.75 1.625 2 1.5 2.25 2.375 2.5 1.25 q1 The game is symmetric with respect to Firm two… Q1 Q2 0 2.5 .25 2.375 .50 2.25 .75 2.125 1 2 1.25 1.875 q1 0 1.5 1.75 q2 2.5 1.75 1.625 2 1.5 2.25 2.375 2.5 1.25 q2 Firm 2 responds with a production target of 1.675 q1 5 q2 0 Firm 1 chooses a production target of 1.75 q1 Eventually, these two firms converge on production levels such that neither firm has an incentive to change q1* q2* 1.67M q2 P 120 20(3.33) $53.33 Firm 1 1 53.331.67 201.67 $55.66 2 53.331.67 201.67 $55.66 HHI 50 2 50 2 5000 q 1.67 * 2 Firm 2 q1* 1.67 q1 P 120 20Q MC $20 Monopoly Q* 2.5M P $70 LI .71 HHI 10,000 2 Firms Q 3.33M q 1.67 P $53 LI .62 HHI 5,000 Perfect Competition Q* 5M P $20 LI 0 HHI 0 Suppose Firm 2’s marginal costs increase to $30 P $20 MC D MR 1.67 Firm 2’s production drops… Q1 Firm 2’s production drops… P $100 $80 $20 MC D MR 1.67 Q1 Firm 1’s best response is to increase it’s production Firm #2 loses market share to Firm #1 q2 Q 1.33 1.83 3.16 P 120 203.16 $56.8 1 56.81.83 201.83 67.34 Firm 1 2 56.81.33 301.33 35.64 HHI 42 2 582 5128 LI .64 q2 1.33 42% Firm 2 q 1.83 * 1 q1 58% Firm 2’s market share drops Now, consider another example. Both firms have a constant marginal cost of $20 Two manufacturers choose a Price P1 Q 6 .05 P Potential customers observe the prices offered and choose how much/from whom to buy Two manufacturers earn profits based off the market price Profit = ?? Profit = ?? P2 With Identical products, consumers choose the cheapest! Firm level demand curves look very different when we are competing in price. Firm Level Demand Industry Demand Q 6 .5 P p p1 p2 D q1 If you are underpriced, you lose the whole market At equal prices, you split the market q D q0 6 .05 P 2 q1 If you are the low price you capture the whole q 6 .05P market Firm One’s Best Response Function Case #1: Firm 2 sets a price above the pure monopoly price: p2 pm p1 pm Case #2: Firm 2 sets a price between the monopoly price and marginal cost pm p2 20 p1 p2 Case #3: Firm 2 sets a price below marginal cost 20 p2 p1 p2 Case #4: Firm 2 sets a price equal to marginal cost c p2 p1 p2 c What’s the Nash equilibrium of this game? Monopoly Q* 2.5M P $70 LI 2.5 HHI 10,000 2 Firms Q 5M q 2.5 P $20 LI 0 HHI 5,000 Perfect Competition Q* 5M P $20 LI 0 HHI 0 However, the Bertrand equilibrium makes some very restricting assumptions… Firms are producing identical products (i.e. perfect substitutes) Firms are not capacity constrained An example…capacity constraints Consider two theatres located side by side. Each theatre’s marginal cost is constant at $10. Both face an aggregate demand for movies equal to Q 6,000 60 P Each theatre has the capacity to handle 2,000 customers per day. What will the equilibrium be in this case? Q 6,000 60 P If both firms set a price equal to $10 (Marginal cost), then market demand is 5,400 (well above total capacity = 2,000) Note: The Bertrand Equilibrium (P = MC) relies on each firm having the ability to make a credible threat: “If you set a price above marginal cost, I will undercut you and steal all your customers!” 4,000 6,000 60P P $33.33 At a price of $33, market demand is 4,000 and both firms operate at capacity. Now, how do we choose capacity?