Game Theory and Behavioral Economics

advertisement

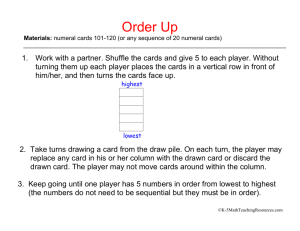

Game Theory and Behavioral Economics An Illustration: The 21 Coins Game Rules: In this two person game, the first mover can remove 1, 2, or 3 coins from the initial 21 coins. Then, the other player can remove 1, 2, or 3 coins from those remaining. The players continue to alternate with the same opportunity (remove 1, 2, or 3 coins). The winner of the game is the one to remove the last coin. Questions: • Do you notice that experience, in the form of playing this game repeatedly, is a good teacher? • Do you see how an optimal way to play can be discovered by “backward induction?” Theory • Cooperative Game versus Noncooperative Game: Binding commitments versus nonbinding commitments • Extensive Form versus Normal Form of a Game • Pure strategy versus mixed strategy • Nash Equilibrium: A set of strategies such that no player has an incentive to deviate from his or her chosen strategies, given the strategies of others. • Unique equilibrium versus multiple equilibria • Roll back equilibrium Theory • • • • • • • • • • • Focal point: A psychological reason to choose one equilibrium over another Information Set: Perfect Information versus Imperfect Information Subgame Perfect Equilibrium: Folk Theorem: State of the World: Complete Information Dominated Strategy Evolutionary Game Theory Payoff Dominance Risk dominance Nash Equilibrium Examples • Cournot Duopoly: Firm 1 chooses optimal production quantity, given the quantity chosen by Firm 2 • Bertrand Duopoly: Firm 1 chooses optimal product price, given the price chosen by Firm 2 • Stackleberg Leader-Follower Duopoly: Leader chooses optimal production quantity, understanding Firm 2 will choose an optimal production quantity based upon the quantity chosen by firm 1. Coordination Game Player 2 Opera Player 1 Boxing Opera (X,X) (0,0) Boxing (0,0) (X,X) Two people prefer to go to the same event together. Because X>0 is assumed, both players prefer coordinating to not coordinating. A larger value for X indicates more is at stake. There are two Nash Equilibria for this game, the two situations where the players coordinate their actions Which side of the road should we drive on? In England, they coordinate on the left. In America, we coordinate on the right. Battle of the Sexes Game Player 2 Opera Player 1 Boxing Opera (2X,X) (0,0) Boxing (0,0) (X,2X) Two people prefer to go to the same event together. However, in this sexist interpretation of this game as originally presented, the woman (Player 1) will be better off if the two coordinate on Opera, while the man (Player 2) will be better off it the two coordinate on boxing. An alternative context for this game could be an employee (player 1) employer (player 2) labor market interaction. If employer and employee do not coordinate, so there is no labor contract, both are worse off. If the two reach a low wage agreement, the coordination benefits the employer more. If the two reach a high wage agreement, the coordination benefits the employee more. Stag Hunt Game Player 2 (Minimum Effort of Others) High Effort Player 1 (Own Effort) Low Effort High Effort (2X,2X) (0,X) Low Effort (X,0) (X,X) The Stag Hunt game is a coordination game. However, the two are each better off if they coordinate on one of the options than the other. There are still two Nash Equilibria for this game, the two where coordination occurs. The high effort equilibrium is payoff dominant, meaning it yields a higher payoff to each player than the low payoff equilibrium. The low effort equilibrium is risk dominant, meaning each player risks less. In the low effort equilibrium, a switch in behavior of the other player results in no loss. However, in the high effort equilibrium, a switch in the behavior of the other player results in a significant loss. Prisoner’s Dilemma Game Player 2 Cooperate Player 1 Cooperate Defect Defect (4X,4X) (0,6X) (6X,0) (X,X) Each player (e.g. each prisoner) is better off if they each cooperate (and do not provide police with information that incriminates the other), compared to if they each defect (and provide the information). However, cooperation is risky, and there is an incentive to defect. Given each possible strategy of the other, the best decision is to defect. Thus, the unique Nash Equilibrium is to defect, implying self interest with complete knowledge generates inefficiency. Chicken Game Player 2 Dare Player 1 Dare Chicken Chicken (-2X,-2X) (2X,0) (0,2X) (X,X) Each player (e.g. each nation) hopes to benefit by challenging the other so that the other “chickens out.” However, if both choose to challenge the other, then both are the worst off compared to if they both chicken out. Centipede Game Player 1 and player 2 alternate decisions as long as the game continues. To continue the game, player 1 must accept risk, but player 1 has an incentive to continue the game because player 1 benefits from continuing as long as player 2 chooses to continue the game. Similarly, player 2 must risk 1 to continue the game, but player 2 similarly has an incentive to continue the game because player 2 benefits from continuing as long as player 1 choses to continue. Using backward induction, one can deduce that the subgame perfect equilibrium for this game is for player 1 to end the game on the first move, which is interesting because player 1 would be better off by ending it at any later date. P-Beauty Contest Game Rules: A group of players are asked to simultaneously pick a number between zero and 100. The winner is the player who chooses the number closest to P times the average of the numbers chosen. (Typically P is set to equal ½ or 2/3) Why is the game of interest? • It provides a measure of the player’s depth of thinking • It demonstrates people will learn when play is repeated • It demonstrates the idea of deriving a Nash equilibrium by eliminating dominated strategies. • It demonstrates the idea that, if other people do not think deeply enough to play the Nash equilibrium, then it may not best for you to play the Nash equilibrium Ultimatum Bargaining Game Rules: A gain Y is to be split between two players, proposer and responder. The proposer acts first and proposes how to split the gain, offering X to the responder. The proposer keeps Y-X. The responder then decides to either accept or reject the proposal. If the proposal is accepted the proposal is implemented. If the proposal is rejected, both proposer and responder receive zero (no deal). Results: Proposers typically offer more than the minimum, which is the Nash Equilibrium. Responders will typically reject offers that approach the minimum, which is also not the Nash Prediction. Importance: People have objectives not entirely captured by the direct incentives in the game. Dictator Game Rules: A gain Y is to be split between two people, a dictator and a receiver. The dictator is the only one of the two that makes a choice. The dictator dictates how the gain is to be split, offering X to the receiver and keeping Y-X. Results: Dictators do not typically offer the minimum, which is what self interest predicts, indicating a preference for “fairness.” However, dictators do not offer as much as proposers in the ultimatum bargaining game, an indication that a portion of the offer in the ultimatum bargaining game is motivated by “gamesmanship,” rather than being entirely motivated by fairness. Importance: People seem to have a “social preference,” in addition to a preference for self. Investment (Trust) Game Rules: In a two person game, a first mover decides how much to trust a second mover by choosing the fraction of an endowment to give to the second mover. The amount the second mover receives is triple the amount sent by the first mover, (implying there is a return to investing in trust). The second mover then has the opportunity to demonstrate trustworthiness by deciding what fraction of the amount received to send back to the first mover. Results: The first movers exhibit trust, even though the Nash equilibrium is to exhibit no trust. The second movers exhibit trustworthiness, even though the Nash equilibrium behavior is to exhibit no trustworthiness. Importance: People seem to be will to accept the risk associated with using trust to elicit trustworthiness and thereby capture gains that may be available. This appears to be become people reciprocate trust with trustworthiness. Applications P-Beauty Contest Game • It captures Keynes view of what is required to predict the stock market • You do not need to know the market fundamentals, so much as you need to know what people think is true (on average) about the market fundamentals • You need to think more deeply than the other thinkers, but not too deeply. Ultimatum Bargaining and Dictator Games • While mutually beneficial trade generates a surplus that can be split between buyer and seller, the trade will be threatened when either party seeks to capture too large a share of the surplus. • People will sacrifice self to help enforce “fairness,” roughly defined as being a “reasonable” split of a gain (where what is reasonable may depend upon context). Investment (Trust) Game • Gift Exchange/Efficiency Wage: Employees and employers that can exhibit trust and reciprocate with trustworthiness may outperform those who do not. References Berg, Joyce, Dickout, John, and McCabe, Kevin (1995). Trust, Reciprocity, and Social History. Games and Economic Behavior 10, 122-142. Dixit, Avinash (Summer, 2005). Restoring Fun to Game Theory, Journal of Economic Education, 205-219. Forsyth, Robert, Horowitz, Joel, Savin, N.E., and Sefton, Martin (1994). Fairness in Simple Bargaining Experiments. Games and Economic Behavior 6, 347-369. Guth, Werner, Schmittberger, Rolf, and Schartz, Bernd (1982). An Experimental Analysis of Ultimatum Bargaining. Journal of Economic Behavior and Organization 3, 367-388. Mailath, George (September, 1998). Do People Play Nash Equilibrium? Lessons from Evolutionary Game Theory. Journal of Economic Literature 36, 1347-1374. Rabin, Matthew (1993). Incorporating Fairness into Game Theory and Economics, American Economic Review 83, 1281–1302. Sexton, Richard (April, 1994). A Survey of Noncooperative Game Theory: Part 1 Theoretical Concepts . Review of Marketing and Agricultural Economics 62(1), 11-28.