Market Premia for BRIC Countries: Local Models vs. Global Models

advertisement

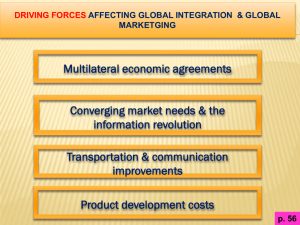

Market Premia for BRIC Countries: Local Models vs. Global Models Antonio Fasano1 (speaker) – University of Rome LUISS Claudio Boido2 – University of Siena A recent branch of the literature on asset pricing focuses on integrated international asset pricing, trying to assess whether standard models can perform better in a country specific or in an aggregate context. To offer new evidences on this research subject we analyse the return dynamic of BRIC countries. Our objective is twofold: first, to test the explanatory power of local model using local explanatory variables; second, to measure the relative premium attainable by an investor selecting a security portfolio based on BRIC countries. As for the first part, an influential work by Karolyi and Stulz3 analyses the local and global factor affecting equity prices. To this end they revise the standard CAPM model and – by contrasting a “domestic” and a “global” CAPM – try to measure and give explanations to phenomenons such as the “home bias”, that is the underweighting of foreign stocks in portfolios. Despite their relevant seminal intuitions, they conclude their understanding of the return mechanics is “quite incomplete”. In more recent times Fama and French4 have proposed a revised version of their own well-known three-factor model describing stock returns (in term of size, value and growth). They compare a model built with global factors with a version of the same model based on local factors, with respect to 23 countries and with a focus on small size companies, and particularly microcaps. Refocusing the analysis on small stocks, they find a statistically significant premium offered by value stocks and show that global models fail to explain regional returns. 1 afasano@luiss.it , http://docenti.luiss.it/fasano - Corresponding author boido@unisi.it 3 Karolyi, G. A., Stulz, R. M., 2003. Are assets priced globally or locally? In: Constantinides, G.M., Harris, M., Stulz, R. (Eds.) Handbook of the Economics of Finance (chapter 16). Elsevier Science, North Holland, 2551–2595. 4 Fama, Eugene F., and Kenneth R. French. “Size, value, and momentum in international stock returns.” Journal of Financial Economics 105.3 (2012): 457–472. 2 Despite the interest of the academia for this subject, most of the prominent literature does not develop those comparisons taking into proper account the impact of exchange rates. For example, Fama and French assume, among the other things, that there is a “complete purchasing power parity [i.e.] relative prices of goods are the same everywhere and an exchange rate is just the ratio of the nominal prices of any good in two countries”. This is clearly not consistent with the dynamic of modern economies. To overcome this limitations in our analysis, we compute returns using a numeraire currency and we add the relative exchange rate as an explicative factor. A further point where we try differentiating is the risk analysis. To this end we adopt the point of view of a foreigner investor willing to invest in a BRIC country. Thereafter, we test if there is a relative premium for the invested assets: that is if, considering the exchange rate effects, there is an excess return moving from a standard equity investment to a BRIC investment. On a second step, we compare the absolute performance with a measure of risk adjusted performance. To this end we propose a Sortino like measure, where the expected excess return of the BRIC investment (relative to a non-BRIC one) is scaled with a shortfall measure (semivariance). Finally it bears mentioning that, to the best of our knowledge, there are no articles on the subject matter explicitly focusing on the BRIC area. Our preliminary results show5 that one size does not fit all and local models can perform in many instances better than a single integrates one. The relative movement of currencies involved can affect the result obtained and permit to improve models. One point to be emphasized is that, despite we tend to bring together under a common name the BRICs, the returns’ dynamic of the BRIC countries is not at all the same, but presents quite distinctive features. While there are today no means to accept or refuse the well-known Goldman Sachs speculation6, we believe that, beyond theoretical insights, analysing the economies of such a broad area is by all means of paramount importance for both scholars and practitioners. 5 The data set used is based on Bloomberg and Datastream service. Models were built and tested in R language http://www.r-project.org. The code used is available to the readers with the paper. Results may vary in the final version. 6 Goldman Sachs is credited for coining the “BRIC” term. Its 2003 report, suggesting to collectively address the economies of Brazil, Russia, India and China, saw as a prominent common trait their joint uprising status, predicting them to overtake the major western economies by 2050. Though such a long term prediction should be taken as an analyst opinion rather than as a scientific claim, no significant events can belie it.