Class 3 Lecture notes (to be posted after class)

advertisement

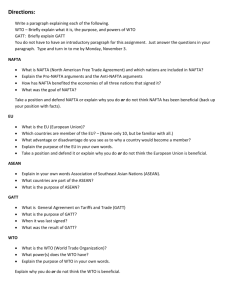

The World Trade Organization READING ASSIGNMENT: Oatley – Chapter 2 Suggested (not required) further reading: Busch, Marc. Overlapping Institutions, Forum Shopping, and Dispute Settlement in International Trade. International Organization 61(4): 735-761. 1 Today’s Plan • History of the WTO • What it does • Relation to regional trade organizations 2 All markets rest on political structures Trade? GATT/WTO 3 History Immanuel Kant David Ricardo 1724-1804 1772-1823 4 GATT/WTO • Initial idea: International Trade Organization – discussed at Bretton Woods • But the ITO failed – Charter drafted 1948 – United States Congress failed to approve it • Meantime, GATT had been initially formed with 15 countries – grew from there. • On 1 January, 1948 the GATT was signed by 23 countries • GATT: 1947-1994 • General Agreement on Tariffs and Trade became: – The World Trade Organization in 1995 5 WTO • 160 members as of 2014 – http://www.wto.org/english/theWTO_e/whatis_e/tif_e/org6_e.htm • Staff of only 635 – IMF: ~2000 – World Bank: >10,000 • 2013 Budget: About CHF 200,000,000 – http://www.wto.org/english/thewto_e/secre_e/budget11_e.htm – http://www.wto.org/english/thewto_e/secre_e/budget_e.htm – World Bank operating budget ~ $1 billion – Total IMF resources approaching 1 trillion… 6 Initial GATT members (1/1/1948) • • • • • • • • • • • Australia Belgium Brazil Burma Canada Ceylon Chile China Cuba Czechoslovak Republic France • • • • • • • • • • • • India Lebanon Luxembourg Netherlands New Zealand Norway Pakistan Southern Rhodesia Syria South Africa United Kingdom United States 7 The WTO 8 What does the WTO do? • Provides a forum for negotiations • Administers trade agreements • Provides a dispute settlement mechanism 9 3 components 1. A set of principles and rules 2. An intergovernmental bargaining process 3. A dispute settlement mechanism 10 (1) Principles & Rules 1. Market liberalism • • In the aggregate gains from trade outweigh losses Winners could compensate losers 2. Nondiscrimination • Most Favored Nation (MFN): Treat all countries as well as its favorite trading partner • National treatment: prohibits the use of taxes, regulations, other domestic policies to advantage domestic over foreign firms 11 Article I: Most Favored Nation Article I (MFN) General Most-Favoured Nation Treatment 1. With respect to customs duties and charges of any kind imposed on or in connection with importation or exportation or imposed on the international transfer of payments for imports or exports, and with respect to the method of levying such duties and charges, and with respect to all rules and formalities in connection with importation and exportation, and with respect to all matters referred to in paragraphs 2 and 4 of Article III,* any advantage, favour, privilege or immunity granted by any contracting party to any product originating in or destined for any other country shall be accorded immediately and unconditionally to the like product originating in or destined for the territories of all other contracting parties. 12 Source: World Trade Organization, Legal Texts Article III* National Treatment on Internal Taxation and Regulation Article III: National Treatment 1. The contracting parties recognize that internal taxes and other internal charges, and laws, regulations and requirements affecting the internal sale, offering for sale, purchase, transportation, distribution or use of products, and internal quantitative regulations requiring the mixture, processing or use of products in specified amounts or proportions, should not be applied to imported or domestic products so as to afford protection to domestic production.* 2. The products of the territory of any contracting party imported into the territory of any other contracting party shall not be subject, directly or indirectly, to internal taxes or other internal charges of any kind in excess of those applied, directly or indirectly, to like domestic products. Moreover, no contracting party shall otherwise apply internal taxes or other internal charges to imported or domestic products in a manner contrary to the principles set forth in paragraph 1.* 13 Source: World Trade Organization, Legal Texts MFN exceptions • Regional trade arrangements – Free-Trade Area (e.g., NAFTA) – or Customs Union (e.g., EU) • Generalized System of Preferences (from 1960s): – Developed countries can apply lower tariffs for developing countries than for their peers 14 (2) Intergovernmental Bargaining Process • Bargain over what? • Tariffs and nontariff barriers – Nontariff barriers? Health & safety regulations, standards (environmental), government purchasing practices, quotas, bans, rules of origin, packaging/labeling conditions, complex regulatory environment, licensing • Antidumping • Intellectual property rights • Textiles, agriculture, services, government procurement, e-commerce… 15 9 Bargaining Rounds • 1947 Geneva • 1949 Annecy • 1951 Torquay • 1956 Geneva • 1960-61 Dillon Round • 1964-67 Kennedy Round Take-away? The rounds are getting longer because remaining issues are more difficult. • 1973–79 Tokyo Round • 1986-93 Uruguay Round • 2002-??? The Doha Round 16 (3) Dispute Settlement Mechanism • “The dispute settlement mechanism ensures compliance by helping governments resolve disputes and by authorizing punishment in the event of noncompliance.” (Oatley txtbook, p28) • How do you tie your hands without a rope? – (commitment/enforcement questions) – COSTS OF ESCALATION 17 Dispute Settlement: GATT vs. WTO •Under GATT, a defendant could block actions. •Under the WTO, this cannot happen GATT WTO Requestforfor Request Consultations Consultation Request for Request for Panel Panel Compliance Retaliation Panel Panel Ruling Appellate Body Panel Ruling Arbitration Panel 18 Retaliation can be clever 19 Sometimes the WTO… lets you lose! Governments can use the WTO as an excuse to protectionist lobbies for opening up to free trade. 20 Regional trade agreements 21 RTAs • Free Trade Area (e.g., NAFTA) – Eliminate tariffs amongst members – Members maintain independent trade policies with non-members • Customs union (e.g., EU) – Eliminate tariffs amongst members – Common tariff policy with non-members • Discriminatory? – Allowed under GATT Article XXIV – as long as tariffs are no higher than the level applied by (ALL***) countries prior to the arrangement – (MERCOSUR led Argentina to raise tariffs on non-members – but not above the level of the highest MERCOSUR member) • Currently 190-250 RTAs in operation (up to 400 on the horizon for 2010) • More than half are bilateral (e.g., KORUS) • Most are free trade agreements 22 Customs Unions • Central American Common Market (CACM) • Andean Community (CAN) • Caribbean Community (CARICOM) • Economic and Monetary Community of Central Africa (CEMAC) • East African Community (EAC) • Eurasian Economic Community (EAEC) • European Economic Area (EEA) (plus EC – Andorra, EC – Turkey) • Gulf Cooperation Council (GCC) • Southern Common Market (MERCOSUR) • Southern African Customs Union (SACU) • West African Economic and Monetary Union (WAEMU) 23 24 Why RTAs not the WTO? • Sign with particularly important markets • New “forums” Forum shopping! (Busch) 25 Why would you go to NAFTA? 26 Why would you go to NAFTA? 27 Choose the forum that best suits you! • NB: – In the absence of the regional option, you may prefer no litigation at all! • By moving a li’l bit toward free trade under NAFTA – Anti-trade interest groups may weaken – Eventually get to WTO position? – (Richardson Hypothesis) 28 Take-home points • WTO is a small international organization • Purposes: Provide a negotiation forum, administer trade agreements, provide a dispute settlement mechanism • Chief principles: MFN, Nondiscrimination • Major negotiation issues: tariffs, nontariff barriers, antidumping, intellectual property rights, textiles, agriculture, services • Regarding disputes - most are settled before full escalation • So the WTO does not cast many rulings - but it still may have a big effect as a deterrent • Regional trade agreements - FTAs and Customs Unions – Why? Forum shopping 29 Thank you WE ARE GLOBAL GEORGETOWN! 30 Concessions and Legal Escalation 80 Probability Defendant Concedes 70 60 50 80 61% of all instances of full concessions under WTO occur prior to ruling 70 Panel Established, No Ruling 30 50 Ruling for Complainant 40 60 Consultations 40 30 20 20 10 Ruling for Defendant 0 10 0 Stage Dispute Reaches 31 Source: Busch and Reinhardt 2000 Full Concessions Under GATT/WTO Busch & Reinhardt. Developing Countries and GATT/WTO Dispute Settlement.” Journal of World Trade 37 (4) 2003: 719-735. 100 90 .63-.78 Prob (Full Concessions) 80 WTO Developed 70 .41-.64 60 WTO Developing 50 40 GATT Developed GATT Developing 30 20 .27-.49 .33-.48 10 0 Complainant Status by Period NOTE: Displays predicted probabilities from Model 1, holding all other variables at their sample means, moving WTO 32 from 0 to 1 and Complainant's Per Capita Income from its 10th percentile value ($2,152) to its 90th ($29,251), with 90 percent confidence intervals The WTO Effect • While the rich are doing better than the poor going from GATT to WTO (as complainants) • This is NOT because the rich win more often or get more compliance ex post. • Rather, it is because rich countries settle more in advance of a ruling. • Remember, the DV is concessions, not wins • The effect of the WTO is through deterrence 33 What is Doha Trying to Get Done? • Getting a deal done: agriculture for nonagricultural market access (NAMA) • Rich countries are increasingly voicing demand for services, as per Singapore agenda • http://www.youtube.com/watch?v=03GU14 F2Zb0 (10 minutes) 34 WTO • Derives most of its income from contributions by its members – according to a formula based on share of international trade – http://www.wto.org/english/thewto_e/secre_e/contrib07_e.htm – (Detail: share of international trade (%), based on trade in goods, services and intellectual property rights for the last five years for which data are available. There is a minimum contribution of 0.015%) 35