View/Open

advertisement

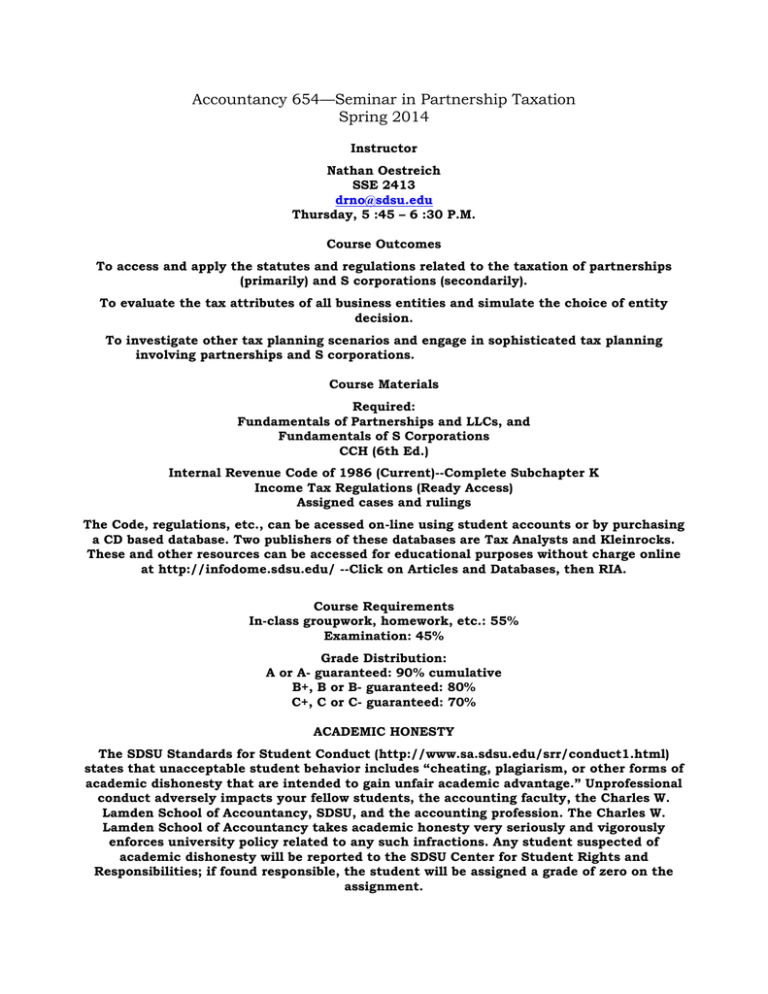

Accountancy 654—Seminar in Partnership Taxation Spring 2014 Instructor Nathan Oestreich SSE 2413 drno@sdsu.edu Thursday, 5 :45 – 6 :30 P.M. Course Outcomes To access and apply the statutes and regulations related to the taxation of partnerships (primarily) and S corporations (secondarily). To evaluate the tax attributes of all business entities and simulate the choice of entity decision. To investigate other tax planning scenarios and engage in sophisticated tax planning involving partnerships and S corporations. Course Materials Required: Fundamentals of Partnerships and LLCs, and Fundamentals of S Corporations CCH (6th Ed.) Internal Revenue Code of 1986 (Current)--Complete Subchapter K Income Tax Regulations (Ready Access) Assigned cases and rulings The Code, regulations, etc., can be acessed on-line using student accounts or by purchasing a CD based database. Two publishers of these databases are Tax Analysts and Kleinrocks. These and other resources can be accessed for educational purposes without charge online at http://infodome.sdsu.edu/ --Click on Articles and Databases, then RIA. Course Requirements In-class groupwork, homework, etc.: 55% Examination: 45% Grade Distribution: A or A- guaranteed: 90% cumulative B+, B or B- guaranteed: 80% C+, C or C- guaranteed: 70% ACADEMIC HONESTY The SDSU Standards for Student Conduct (http://www.sa.sdsu.edu/srr/conduct1.html) states that unacceptable student behavior includes “cheating, plagiarism, or other forms of academic dishonesty that are intended to gain unfair academic advantage.” Unprofessional conduct adversely impacts your fellow students, the accounting faculty, the Charles W. Lamden School of Accountancy, SDSU, and the accounting profession. The Charles W. Lamden School of Accountancy takes academic honesty very seriously and vigorously enforces university policy related to any such infractions. Any student suspected of academic dishonesty will be reported to the SDSU Center for Student Rights and Responsibilities; if found responsible, the student will be assigned a grade of zero on the assignment. TENTATIVE COURSE OUTLINE Beginning Topic January 23 Course overview; Overview of Subchapters K and S and other entity related provisions. January 30 Partner’s Basis in a Partnership Interest IRC § 705 Effect of Partnership Liabilities on Basis IRC § 752 Allocation of Partnership Liabilities Reg. §§ 1.752-1 to 1.752-5 (1991) February 6 Receipt of Partnership Interests for Property IRC § 721-725 Receipt of Partnership Interests for Services Rev. Proc. 93-27 Sol Diamond, 56 TC 530 (1971), aff’d 492 F2d 286 (CA-7, 1974)+ Campbell, 59 TCM 236 (1990), rev’d 943 F2d 815 (CA-8, 1991)+ February 13 Partnership Operations--Tax Accounting IRC §§ 701, 702, 703, 704(d), 706, and 709 Limitations on Tax Shelter Activities—At-risk, Passive Activity Loss Limitations, Etc. IRC §§ 465 and 469 Orrisch, 55 TC 395 (1974) + February 20 Partnership Allocations [Tentatively Distance] IRC § 704 Reg. §§ 1.704-1 (1994), 1.704-2 (1992), 1.704-3 (1994), 1.704-4 (1995) Allocations Related to Ownership Shifts IRC §§ 706 (c) & (d) and 708 Richardson, 76 TC 512 (1981) Partnership Terminations IRC § 708 February 27 More on Special Allocations March 6 Partner-Partnership Transactions IRC § 707; Reg. §§ 1.707-0 to 1.707-9 Family Partnerships IRC § 704(e) Dispositions of Partnership Interests IRC §§ 741 - 742 Dispositions of Collapsible Partnerships IRC § 751(a), (c), (d), and (e); Reg. § 751-1, except (b) Basis Adjustments on Transfers IRC §§ 743(b), and 754; Reg. § 743-1 March 13 Distributions in General [Tentatively Distance] IRC §§ 731 - 733 Post-Distribution Effects to Partner IRC § 735 March 20 Exam ; After-exam exercises March 27 Disproportionate Distributions of §751 Property IRC § 751(b); Reg. § 751-1(b) April 3 Spring break April 10 Basis Adjustments on Certain Distributions IRC § 734(b) Mandatory Adjustments--Transferee Partners IRC § 732(d) Retirement Distributions IRC § 736; Reg. § 736-1 Subchapter K Anti-Abuse Rules Reg. § 701-2 (1995) Check-the-Box Regulations Death of a Partner April 17 Introduction to S corporations April 24 May 8 Subchapter S Corporations Selected specific provisions Catch-up, review, additional topics Comprehensive Case Exam 2 + Examination Landmark cases cited for historical v