Integrated Cost Estimating

advertisement

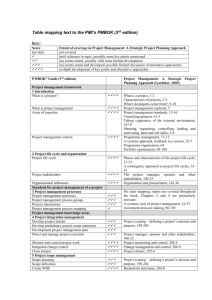

Capital Cost Estimating @ Fluor June 2006 Arjen Blok Chief estimator Haarlem Fluor Overview Publicly owned engineering, procurement, construction and maintenance company – 2005 revenues of $13.2 billion – 2005 new awards: $12.5 billion – 2005 backlog: $14.9 billion 37,000 employees worldwide Offices in more than 25 countries Major European offices: – – – – Haarlem, the Netherlands; Madrid, Spain; Camberley,UK; and Gliwice, Poland. Consistently one of the world’s safest contractors 2 Presentation purpose EPC contractors current outlook EPC contractors view on Estimating Integration of Estimating tools in engineering environment Aspen Kbase solution 3 EAME Market Summary Strong Upstream Oil and gas markets – – – – – Refining upgrades/capacity expansions, new plants in Middle East – – – – Drivers: high prices, reserve replacement, energy supply security, product demand Thriving LNG and gas processing sector Complex projects drive increased client capex spending Up to $50 billion in new contracts expected in ME alone in 2006 National oil companies less reliant on international oil majors Fluor is pursuing about $20bn in regional prospects Market focus shifts from clean fuels to conversion Gas-to-Liquids, Integrated Gasification Combined Cycle Regulatory environment drives European Union biofuels projects New Petrochems/Chemicals complexes, primarily in Middle East – – Chemical/plastics opportunities developing Chemical markets may be peaking, downturn expected 2009 - 2011 4 EAME Market Summary Power Generators focus on capacity shortages / fuel supply – – – Market risks – – – – Carbon Agenda drives environmental upgrades, emissions trading European Union market deregulation, M&A activity Nuclear new-build debate Shortage of skilled personnel Geopolitics / political instability Feedstock / material costs Regulatory / environmental issues Contractor Issues – – – – Record backlog levels resulting in very selective bidding More lump sum conversion contracts Pressure on staffing, use of full service low cost engineering centres Supply chain management, global procurement to contain equipment/ material costs 5 Impact on Operations Selectivity – Business risk assessment – Early indication of cost for investment and pursuit decisions Lump sum conversion contracts – – – – Transparency and accuracy of estimates Joint development High focus on contingencies and allowances Estimate centric execution / Change management Pressure on staffing dispersed execution interfaces – Growth of GEC component, multiple offices – Partnering – National companies Supply chain management, global procurement for equip. & materials – Price instability & risk – Out of sequence engineering – Increased focus on quantities Quality – Increased audits, inspection – Reliability is key 6 EPC contractor view on Estimating Why preparing estimates – Bidding work • EPCm Services • EPC – Service in project development • Support investment decisions • Project execution basis Capex Cost only – Engineering – Procurement equipment & materials – Prefabrication – Erection (up to Mechanical Completion) 7 EPC contractor view on Cap Cost Estimating Fluor follows AACE classification rules 18R-97 8 EPC contractor view on Cap Cost Estimating Estimating tool = AspenTech Kbase – Design estimating tool, provided with • Scope & Construction models, Design rules & Engineering rules of thumb => Quantities • Pricing & labour basis – Estimating scope defined by available engineering data • Equipment data, Flow sheets , Plot Plan, etc – The earlier the estimate, the more use of Kbase technology • Class 4 & 3 – Class 2 • Replace Kbase models by BE info & execution plan 9 Integrated Design Build SM (IDB) Data Ownership Data Release Data Status Single Data Entry Change Notification History Trail 10 Estimating data flow General specifications Equipment data P&ID information Area Information Kbase Utility Systems Plot plan information 11 Connection IDB -> Kbase AspenTech solution: API – Application Programming Interfaces Allows automated data sharing in a controlled manner Considerations – Quality of data – Ownership of data – Timing / availability of data – Status of data – Revision of data – Timing of activities for engineering disciplines is influenced by estimating 12 Fluor’s API’s Area Manager Aspen Zyqad Equipment API Electronic Equipment List Kbase Utility Systems API MHCD Bulk API 3D Model Piping Manual MTO INTOOLS Instrument Manual MTO 13 Equipment API Obtain Equipment data from Kbase to Excel Import data from Excel file back to Kbase Advantages – More simple input of equipment data – Link from Kbase to any obtained excel equipment list – Possibility to make use of applicable data from other electronic sources such as Aspen Zyqad Aspen Zyqad Kbas e Equipment API Electronic Equipment List MHCD 14 Conclusion Market demands us to do it better, cheaper, faster => Automation Estimating has great desire to connect to Engineering – ! Controlled manner, considering status of project definition Engineering should have desire to connect to Estimating – Estimate is Base Line Document Kbase API’s provide great capabilities ? Can ISO 15926-4 help further developments, considering : – Estimating (in)dependency – Accuracy of an estimate is not driven by details 15 Capital Cost Estimating @ Fluor June 2006 Arjen Blok Thank you for you attention Chief estimator Haarlem