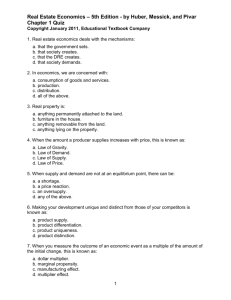

contents of the introductory real estate principles textbook

advertisement