Chapter 25

25

Performance Management and Evaluation

Performance Measurement

OBJECTIVE 1: Define a performance management and evaluation system, and describe how the balanced scorecard aligns performance with organizational goals.

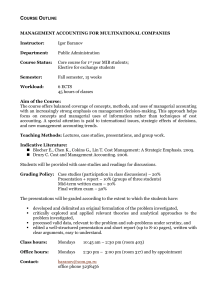

Figure 1: Sample Balanced Scorecard of

Linked Objectives, Measures, and Targets

Performance Measurement

•

What to measure, how to measure

– Performance measurement is the use of quantitative tools to gauge performance in relation to a specific goal or expected outcome.

Performance Measurement

•

What to measure, how to measure (cont.)

– Managers develop a group of measures that identify changes in performance quality so that employees can determine what needs to be done to improve performance.

Performance Measurement

•

Other measurement issues

– In developing performance measures that are appropriate to the needs of their organizations, managers must consider not only the basic questions of what to measure and how to measure, but a variety of other issues as well.

Performance Measurement

•

The balanced scorecard and the management process

– Planning: The balanced scorecard provides a framework that enables managers to translate their organization’s vision and strategy into operational terms.

Performance Measurement

•

The balanced scorecard and the management process (cont.)

– Performing:

• Managers use the organization’s strategic objectives as the basis for decision making.

• Managers verify and track causal relationships to improve performance.

Performance Measurement

•

The balanced scorecard and the management process (cont.)

– Evaluating

• Managers compare financial and nonfinancial results with performance targets.

• Managers analyze results and recommend changes.

– Communicating: Managers prepare reports for various stakeholder groups.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Responsibility Accounting

OBJECTIVE 2: Define responsibility accounting, and describe the role that responsibility centers play in performance management and evaluation.

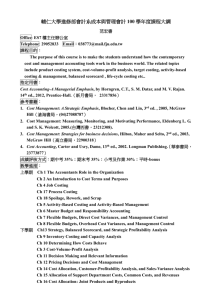

Table 1: Types of Responsibility Centers

Table 1: Types of Responsibility Centers

Figure 2: Partial Organization Chart of a

Restaurant Division

Responsibility Accounting

•

Responsibility accounting classifies data according to areas of responsibility and reports each area’s activities.

– Includes only the revenue, cost, and resource categories that the assigned manager can control.

Responsibility Accounting

•

Responsibility accounting classifies data according to areas of responsibility and reports each area’s activities. (cont.)

– A responsibility center is an organizational unit whose manager has been assigned the responsibility of managing a portion of the organization’s resources.

Responsibility Accounting

•

Responsibility accounting classifies data according to areas of responsibility and reports each area’s activities. (cont.)

– Such costs and revenues are called controllable costs and revenues because they are the result of a manager’s actions, influence, or decisions.

Responsibility Accounting

•

Types of responsibility centers

– Cost center: Manager is accountable only for controllable costs that have well-defined relationships between resources and products or services.

– Discretionary cost center: Manager is accountable for costs only; the relationship between resources and products or services produced is not well defined.

Responsibility Accounting

•

Types of responsibility centers (cont.)

– Revenue center: Manager is accountable primarily for revenue; his or her success is based on the center’s ability to generate revenue.

– Profit center: Manager is accountable for both revenue and costs and the resulting operating income.

Responsibility Accounting

•

Types of responsibility centers (cont.)

– Investment center: Manager is accountable for profit generation and can also make decisions about the resources the center uses.

Responsibility Accounting

•

Organizational structure and performance management

– A company’s organizational structure formalizes its lines of managerial authority and control.

– An organizational chart is a visual representation of a company’s hierarchy of responsibility.

Responsibility Accounting

•

Organizational structure and performance management (cont.)

– Performance reporting by responsibility center enables an organization to trace the source of a cost, revenue, or resource to the manager who controls it and to evaluate the manager’s performance accordingly.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Performance Evaluation of Cost Centers and Profit Centers

OBJECTIVE 3: Prepare performance reports for cost centers using flexible budgets and for profit centers using variable costing.

Exhibit 1: Central Kitchen’s Performance

Report on House Dressing

Exhibit 2: Variable Costing Income Statement

Versus Traditional Income Statement for Trenton

Restaurant

Exhibit 3: Performance Report Based on Variable

Costing and Flexible Budgeting for Trenton

Restaurant

Performance Evaluation of Cost Centers and Profit Centers

•

A performance report should contain information only about the costs, revenues, and resources that a manager can control.

– Performance reports allow comparisons between actual performance and budget expectations.

Performance Evaluation of Cost Centers and Profit Centers

•

A performance report should contain information only about the costs, revenues, and resources that a manager can control.

(cont.)

– The content and format of a performance report depend on the nature of the responsibility center.

Performance Evaluation of Cost Centers and Profit Centers

• A cost center’s performance can be evaluated by comparing its actual costs with the corresponding amounts in the flexible and master budgets.

– The resulting variances between actual costs and the flexible budget can be further examined by using standard costing to compute specific variances for direct materials, direct labor, and overhead.

Performance Evaluation of Cost Centers and Profit Centers

• A profit center’s performance is usually evaluated by comparing its actual income statement results with its budgeted income statement.

– Variable costing is a method of preparing profit center performance reports that classifies a manager’s controllable costs as variable or fixed.

Performance Evaluation of Cost Centers and Profit Centers

• A profit center’s performance is usually evaluated by comparing its actual income statement results with its budgeted income statement. (cont.)

– Variable costing produces a variable costing income statement that has the format of the contribution income statement used in costvolume-profit analysis.

Performance Evaluation of Cost Centers and Profit Centers

• A profit center’s performance is usually evaluated by comparing its actual income statement results with its budgeted income statement. (cont.)

– Performance reports may also use flexible budgeting and variable costing to measure and evaluate nonfinancial information.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Performance Evaluation of Investment

Centers

OBJECTIVE 4: Prepare performance reports for investment centers using the traditional measures of return on investment and residual income and the newer measure of economic value added.

Exhibit 4: Performance Report Based on Return on Investment for the Restaurant Division

Figure 3: Factors Affecting the

Computation of Return on Investment

Exhibit 5: Performance Report Based on Residual

Income for the Restaurant Division

Exhibit 6: Performance Report Based on

Economic Value Added for the Restaurant

Division

Figure 4: Factors Affecting the

Computation of Economic Value Added

Performance Evaluation of Investment

Centers

• The evaluation of an investment center’s performance requires additional performance measures that evaluate the manager’s control over revenues, costs, and capital investments.

Performance Evaluation of Investment

Centers

•

Return on investment is the most common performance measure.

– Takes into account both operating income and the assets invested to earn that income, which is computed by dividing operating income by the assets invested.

Performance Evaluation of Investment

Centers

•

Return on investment is the most common performance measure. (cont.)

– Another approach to the ROI computation is to multiply profit margin (the ratio of operating income to sales) by asset turnover (the ratio of sales to average assets invested).

Performance Evaluation of Investment

Centers

•

Residual income is the operating income an investment center earns above a minimum desired return on invested assets.

– Residual income is a dollar amount, not a ratio like return on investment.

Performance Evaluation of Investment

Centers

•

Economic value added measures the shareholder wealth created by an investment center.

– Although EVA can be quite complex, the basic formula is EVA = After-Tax Operating Income

– Cost of Capital in Dollars.

– Cost of capital is defined as the cost of capital multiplied by the difference between total assets and current liabilities.

Performance Evaluation of Investment

Centers

•

To be effective, a performance management system must consider both operating results and multiple performance measures.

– Comparison of actual results with budgeted figures adds meaning to the evaluation.

– Analysis of nonfinancial performance measures ensures a more balanced view of a business and how to improve it.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Performance Incentives and Goals

OBJECTIVE 5: Explain how properly linked performance incentives and measures add value for all stakeholders in performance management and evaluation.

Performance Incentives and Goals

•

Performance incentives

– The links between goals and performance objectives, measures, and targets must be logical and apparent.

– Performance-based pay ties compensation incentives to targets to foster their achievement.

Performance Incentives and Goals

•

The coordination of goals

– The circumstances of each organization determine which mix of compensation incentives and measures will work best for it.

– The effectiveness of a performance management and evaluation system relies on the coordination of responsibility center, managerial, and company goals.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.