Initial File Review Checklist - Institute of Certified Bookkeepers

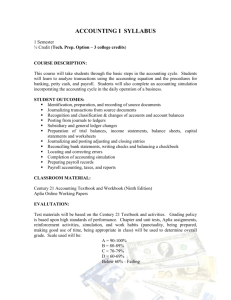

advertisement

Initial File Review Checklist Review File Maintenance Questions and Details Software Review Software, Licensing, Billing and Product Support Product/Version:_________________________________________ Serial # ________________________________________________ Registered Owner of Product_______________________________ Owner of Subscription_____________________________________ Subscription Billing_______________________________________ Software Support_________________________________________ User Access How many users have access? (Online/Remote/Internal) _______________________________________________________ (Ensure owner has Full or Read Only Access for all areas of file) Who has administrator/advisor access? (Password?) Who has access to payroll? Create specific user for Bookkeeper Computers Type of Network (Stand Alone, Peer to Peer, Server, Cloud) Location of File:___________________________________ Backup Regime: Device and Frequency: Weekly/Monthly/Quarterly/Annual File Auditor Run File Auditor for information (If applicable) Check Location of File (local)______________________________ Check Company File Year/Locked Periods___________________ Check Last Date Backup file_____________________________ Linked Accounts Check Accounts used for linked accounts for: Banks – Electronic Clearing and Undeposited Funds Sales - Customer Deposit, Receivables, Discount, Freight Purchases – Supplier Deposit, Payables, Discount, Freight Payroll - Wages, Superannuation, Cash and Electronic Payment Preferences Check Preferences System – Links to other programs, Jobs/Categories assigned, Payroll defaults Reporting – Ageing and Default Forms Sales – Default Layout options, Credit Limit, Default Terms Purchases – Default Layout Options, Default Terms Inventory – Yes or No Security - Audit Trail, Locked Periods GST Status – Cash or Accrual PAYGW Registration – Monthly/Quarterly TPAR – Yes or No ________________________________________________________________________________ YBB-Initial File Review Checklist (Nov 2015) © The Institute of Certified Bookkeepers Page 1 Recurring / Memorised / Rules Transactions Check Recurring/Memorised/Bank Feed Rules Transactions Review List Direct Debits, Bank Loans and Financed Loans Review Frequency, Alerts and Transaction ID General Journals Check if General Journals are used If yes Check the type of journals used IF no suggest use for private % split monthly (if applicable) Card Maintenance Cards Review Check for duplicate cards. Review client’s use of Customer, Supplier and Employee Card/Contact fields Review Customer selling details (sale layout, income account, and receipt memo, sales person, shipping method, credit limit and hold). Review Supplier buying details (purchase layout, expense account, purchase comment, shipping method) Check Supplier payment details (random check against supplier invoices) Check for split bank accounts for both Suppliers and Employees Terms Review Customer terms used and ensure default is correct (Discuss with client of their terms for customers) Review Supplier terms used and ensure default is correct (Check Terms with Supplier Statements) Account Maintenance Chart CHECK comparison of Chart to Accountants Financials CHECK Chart for obsolete accounts CHECK Headings and Subtotals Tax Codes Assigned CHECK Tax Codes assigned to accounts CHECK Tax Codes are linked to correct BAS Fields Account Balances CHECK Balances are same for last tax return lodged from Accountant CHECK Bank Feeds transactions are clear or assigned CHECK Bank Accounts – Last Date Reconciled (Incl. Bank Loans) CHECK Bank Accounts – Unreconciled Transactions CHECK PayPal, EFTPOS, AMEX Accounts Values CHECK Electronic Clearing Accounts – Zero Balance or valid amount CHECK Trade Debtors = Receivables Summary Report CHECK Trade Creditors = Payables Summary Report CHECK Stock on Hand = Inventory Summary Report CHECK Credit cards – last reconciled Loans CHECK Finance Loans e.g. Hire Purchase on Cars REVIEW Finance documents and Check GST CHECK Other Loans – Directors Loans with private expenses used by owner and check NO GST used on personal expenses ________________________________________________________________________________ YBB-Initial File Review Checklist (Nov 2015) © The Institute of Certified Bookkeepers Page 2 Banking Authority Online Banking CHECK who is authorised to transfer money/pay bills CHECK who is authorised to pay employees CHECK security process for Online Payments e.g. Token, SMS used CHECK internet banking access and all users have separate login Authority Signing Cheques CHECK process for Cheque Payments e.g. Two signatories required CHECK records e.g. Cheque Butts filled in correctly Cash REVIEW process of End of Day Till Reconciliation CHECK who has access to petty cash/till CHECK who banks cash CHECK bank deposit records Sales Receivables CHECK Outstanding Debtors DISPLAY Receivables Summary report and review 60-90 days outstanding invoices. REVIEW any old/bad debts, check whether write-offs required REVIEW Credits - should credits be applied to current sales or cleared as they are incorrect? Sales Orders / Layby And Gift Voucher Payments CHECK Outstanding Sales Orders Ensure they are current If old orders with balances, move to an invoice at current date (Discuss with client) Check PAID orders – Customer Deposits Liability Balance match outstanding Customer Orders payments CHECK Laybys and Gift Vouchers Payments Ensure they are current Ensure they marry to register or report of POS system Customer Statements CHECK frequency of producing statement CHECK layout of statement and form of delivery (email, post, fax) Purchases Payables CHECK Outstanding Creditors DISPLAY Payables Summary report and review 60-90 days outstanding invoices. REVIEW any old amounts; check whether any outstanding amounts should be credited. REVIEW Returns and Debits - should credits be applied to current sales or cleared as they are incorrect? CHECK process for review supplier statements REVIEW Clients’ Credit Application Process (If applicable) Purchase Orders CHECK Outstanding Purchase Orders Ensure they are current If old orders with balances, move to an invoice at current date (Discuss with client) Check PAID orders against Supplier Deposit Asset balance ________________________________________________________________________________ YBB-Initial File Review Checklist (Nov 2015) © The Institute of Certified Bookkeepers Page 3 Capital Acquisitions REVIEW various expense accounts that the client may have used for capital purchases and capital acquisition threshold used Inventory Stock Setup CHECK which stock system is used - Perpetual or Physical Stock System? Stock Balances CHECK Stock Value and Average/Fixed/FIFO on Stock Items CHECK Stock items Structure/Reporting CHECK Receipts of stock without a bill against relevant liability Stock Maintenance CHECK operation of maintaining stock levels and distribution CHECK frequency of stock take Payroll Employees Setup CHECK Employee Cards REVIEW Employee Details, Start Date and Notes REVIEW Standard pay, Timesheets or status REVIEW Employee rate of pay against Award/Contract REVIEW Employees Tax scales and TFN Declaration Form ENSURE Tax File Numbers are entered, addresses and termination dates (if applicable) REVIEW Employees payment method and cycle REVIEW Employees hard copy documents Payroll Setup CHECK General Payroll Information Confirm the current payroll year, normal hours worked per week, Tax Table revision date, rounding cents and Superannuation Fund Default CHECK Payroll Categories Display the Payroll Summary Report to determine what payroll categories the client uses. Check and review the setup of each. Pay special attention to post and pre-tax treatment. CHECK Deductions used and ensure correct tax treatment CHECK Salary Sacrifice if used and review liability accounts CHECK Payroll Tax threshold if not registered Entitlements CHECK calculating correctly: Holiday leave entitlement should be linked to holiday pay Personal leave entitlement should be linked to sick pay CHECK setup to ensure hours are correctly accrued in line with employee’s Award/Contract REVIEW lifetime balances report and note any leave balances that look unusual. For example: negative balances Superannuation CHECK Employer Super Default Fund REVIEW Employee Super Choice Form CHECK SGC category (Superannuation Guarantee Expenses) Ensure % rate is correct REVIEW Payroll Categories exempt from SGC REVIEW pay transactions to ensure super is calculating correctly REVIEW whether client pays superannuation monthly or quarterly ________________________________________________________________________________ YBB-Initial File Review Checklist (Nov 2015) © The Institute of Certified Bookkeepers Page 4 CHECK if Salary Sacrifice Superannuation is used Check setup of salary sacrifice and under Superannuation Tab Ensure PAYG is exempt Check SGC% calculation on Salary Sacrifice CHECK Unpaid Superannuation Check business owner’s knowledge of unpaid superannuation Check if a SGC Charge Statement has been or to be lodged Reconciliations PRINT Payroll Summary to date to: CHECK Payroll Gross Wages = Wages and Salaries Expense CHECK PAYG Withholding Liability ensuring IAS/BAS payment cleared liability CHECK Superannuation Liability ensuring last payment cleared Liability GST BAS Setup CHECK setup for GST Cash or Accrual and Frequency (Monthly/Quarterly/Annual) PAYGI % PAYGW (Monthly/Quarterly) Fuel Tax WET Fringe Benefits Review BAS Lodged CHECK BAS lodged for current year against GST Summary Payroll Summary Profit and Loss Income against T1 CHECK BAS payments have been entered correctly GST payment to GST Collected and Paid PAYGW to PAYG Withholding Liability PAYGI to Provision for Income Tax Fuel Tax/WET/FBT to relevant accounts Reconcile GST and PAYGW Accounts CHECK Rounding Account Used Reporting/Forms Standard Reports CHECK Custom/Standard Reports Setup Reports required each Month What format – emailed or printed CHECK Custom Forms used ________________________________________________________________________________ YBB-Initial File Review Checklist (Nov 2015) © The Institute of Certified Bookkeepers Page 5