File

advertisement

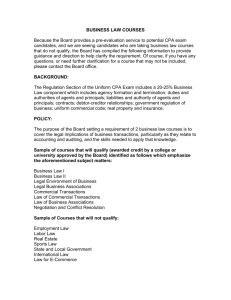

Kelly 1 Savannah Kelly Professor Wolcott ENC 1102 16 July 2014 Annotated Bibliography There are two kinds of people there on the ones that like school and those that do not. There are people who like taking test and those who find test difficult and upsetting. Once you graduate high school you think that you are finished with those standardized test you have been accepted to a you will never have to worry if a test will predict your future. Well that is not true per say, many careers have a test at the end of your education to make sure you qualify for their profession This research shows if it was helpful or not in there passing rates. The Uniform CPA Examination is the examination that individuals must pass in order to qualify for licensure as Certified Public Accountants in any of the 55 U.S. jurisdictions. The CPA Exam is one of the "Three Es" - Education, Examination, and Experience - that are required for licensure as a CPA. Consequently, passing the Exam is not, in itself, sufficient to meet requirements for license. According to the CPA Mission Statement, the purpose of the Exam is to admit individuals into the accounting profession only after they have demonstrated the entry-level knowledge and skills necessary. The CPA Exam is provided on behalf of the Boards of Accountancy who have the ultimate licensing authority. The test is offered jointly by three organizations: NASBA (The National Association of State Boards of Accountancy), the AICPA (American Institute of Kelly 2 Certified Public Accountants), and Prometric. The AICPA is responsible for developing and scoring the test, NASBA for the National Candidate Database, and Prometric for delivery at authorized test centers. The four parts of the test include Auditing and Attestation (AUD). This section covers knowledge of auditing procedures, generally accepted auditing standards and other standards related to attest engagements, ethics, and the skills needed to apply that knowledge. Business Environment and Concepts (BEC). This section covers knowledge of general business environment and business concepts that candidates need to know in order to understand the underlying business reasons for and accounting implications of business transactions, and the skills needed to apply that knowledge. Financial Accounting and Reporting (FAR). This section covers knowledge of generally accepted accounting principles for business enterprises, not-for-profit organizations, and governmental entities, and the skills needed to apply that knowledge. Regulation (REG). This section covers knowledge of federal taxation, ethics in tax practice, professional and legal responsibilities, and business law, and the skills needed to apply that knowledge. There are a number of reasons why a traditional four-year undergraduate program is no longer adequate for obtaining the requisite knowledge and skills to become a CPA. Significant increases in official accounting and auditing pronouncements and the increase of new tax laws have expanded the knowledge base that professional practice in accounting requires. Business methods have become increasingly complex. The production of regulations from federal, state, and local governments requires welleducated individuals to ensure fulfillment. Also, improvements in technology have had a major effect on information systems design, internal control procedures, and auditing Kelly 3 methods. The staffing needs of accounting firms and other employers of CPAs are changing rapidly. With more sophisticated approaches to auditing now in use, and with the increase in business demands for a variety of highly technical accounting services and greater audit efficiency, the requirements for effective professional practice have increased sharply. The demand for a large quantity of people to perform many routine auditing tasks is rapidly diminishing. A certified public accountant (CPA) in today's environment must not only have a high level of technical competence and a sense of commitment to service, but must also have good communications and analytical skills, and the ability to work well with people. Employers are looking for individuals who have the ability to analyze and evaluate complex business problems and the interpersonal skills and maturity to make decisions in a client- and customer-service environment. To obtain the required body of knowledge and to develop the skills and abilities needed to be successful CPAs, students should complete 150 semester hours of education. Many states/jurisdictions now require or will require 150 semester hours of education for obtaining the CPA certification. Kelly 4 Allen, Arthur, and Angela M. Woodland. "The 150-Hour Requirement and the Number of CPA Exam Candidates, Pass Rates, and the Number Passing." Issues in Accounting Education 21.3 (2006): 173-93. ProQuest. Web. 14 July 2014. Author Allen Associate Professor of Accountancy at the University of Nebraska and Angela M. Woodland professor at Montana Sate University College of Business state that The requirement of 150 credit hours prepare student for the four part CPA exam and a accounting career. Others argue that it becomes an expensive entry to public accounting. The research shows that “ A large drop 36 percent in the number of candidate actually go and take the exam.” Although there is such a large drop of candidates taking the test the amount of pass rates increase for first time test takers, and a large drop of almost 32 percent in the number passing the CPA exam after taking 150- hours of school. The objective of the 150-hour requirement was to ensure higher quality audits by producing better auditors. The research between these professors that this new requirement found a decline in the amount of accounting graduates. Bierstaker, James Lloyd, Martha A. Howe, and Inshik Seol. "The Effects Of The 150Credit-Hour Requirement For The Certified Public Accountant (CPA) Exam On The Career Intentions Of Women And Minorities." Journal Of Education For Business 81.2 (2005): 99-104. Business Source Premier. Web. 9 July 2014. The effects of 150 credit hour requirement for the CPA exam on the career intention of women and minorities by James Bierstaker professor at Villanova University, Martha Howe at Bentley college, and Inshik Seol from Clark University The CPA exam now requires you to have 150 semester hours of college education. The student must complete a fifth year of college to be eligible to sit for the exam. This requirement makes for a better-rounded education, and a higher passing rates on the CPA exam. The 150-hour requirement may have a disproportionate effect on minorities and women, whose commitment to public accounting as a long –term career has been somewhat tenuous. Forty-five states now have adopted the 150- credit-hour rule. With Florida be the first in 1983. The percent age of women CPAs have increased significantly over time. The percentage has increased 33% Research regarding wage rates in accounting has shown that women accountants generally earn less then equally qualified men. One of the major reasons for the lower earnings of women is labor market discrimination against women. Similar to minorities, women who encounter barriers in the public accounting sector. The results of this research, using data collected from approximately 600 accounting students that the new 150 credit hour requirement will not deter the minorities, however we found female students are less likely to pursue the CPA, and be more interested in the CMA. Kelly 5 Briggs, Gary P., and Lerong He. "The 150 Credit-Hour Requirement And CPA Examination Pass Rates—A Four Year Study." Accounting Education 21.1 (2012): 97-108. Business Source Premier. Web. 14 July 2014. Debate concerning the minimum educational requirements of certified public accountant candidates in the USA has been taking place for decades. This academic article written by Gary P. Briggs and Lerong He from The College at Brockport, State University of New York compares the sectional pass rates of CPA candidates from jurisdictions requiring 150 credit hours of college study with the pass rates of candidates from jurisdictions not requiring 150 credit hours for the years 2004 to 2007. The paper finds that jurisdictions with a 150 credithour requirement have materially higher pass rates in areas of Auditing and Regulation, but not in the areas of Financial Accounting and Reporting or Business Environment and Concepts. The paper also finds that, on average, increasing a CPA candidate’s formal education requirement results in improved candidate performance, but that some jurisdictions without the 150 credit-hour requirement consistently have sectional pass rates above the national average. Evidence on whether the 150-hour requirement improves candidates’ performance on the CPA exam is mixed. In earlier research examining first-time candidates in Florida, Cumming and Rankin found only 15.9% of first-time candidates passed the each part of the CPA exam, in the year before Florida enacted the 150-hour requirement. That pass rate nearly doubled to 31.5%, the year after the implementation of the 150-hour requirement. Exam pass rates at the national level found that first-time candidates with at least 150 hours of college education were also more likely to pass the CPA exam than candidates not having 150 hours of education. Booker, Quinton1, Bobbie W.2 Daniels, and Yvonne3 Ellis. "Education And Experience Requirements To Become A CPA." CPA Journal 83.8 (2013): 61-66. Business Abstracts with Full Text (H.W. Wilson). Web. 15 July 2014. Quinton Booker Bank Plus Professor and chairman, department of accounting, Jackson State University, Bobbie Daniels, Associate Professor of accounting, Jackson State University and Yvonne Ellis Assistant professor of accounting, Columbus State University, article tackles the research findings about professors' views on the education requirement to sit for the exam and the experience requirement for licensure. The study was motivated by the trend by accountancy boards to allow individuals to sit for certified public accountant exam with minimum of a 120- hour baccalaureate degree in accounting and with 150 hours for licensure. The results show that professors strongly desire uniform education and experience requirements across jurisdiction. Because a graduate degree in accounting is not required, individuals have many options when it comes to obtaining the additional hours (e.g., an undergraduate minor, double major, MBA, a variety of hours). Accordingly, much research has addressed the contents of an appropriate 150-hour program and provided varying perceptions of the requirement. The authors’ research is motivated primarily by the recent trend by accountancy boards to allow individuals to sit for the CPA exam with minimum Kelly 6 of a 120-hour baccalaureate degree in accounting. The AICPA indicated that only 16 of 55 jurisdictions (29.1%) require 150 hours to sit for the exam and 150 hours for licensure Buchholz, Alexander K.1, and Frimette1 Kass. "A Study Of Undergraduate Accounting Students' Graduation Trends Resulting From Changes In Requirements For Certified Public Accountant (CPA) Licensure In New York State." Journal Of Higher Education Theory & Practice 12.1 (2012): 96-107. Education Full Text (H.W. Wilson). Web. 15 July 2014. Alexander K. Buchholz Brooklyn College of the City University of New York and Frimette Kass Brooklyn College of the City University of New York research how students want to obtain the 150- hour requirement to become a CPA. Their research show that some students, will choose to simply get a second bachelor's degree or possibly take some additional undergraduate courses. This may be a solution as graduate school can be expensive. While a literature course on Shakespeare may be interesting to take, it will not necessarily provide a further understanding of the accounting profession, so students should try and to stick with classes that will be useful. One advantage of obtaining the advanced degree is that firms have started to show a strong trend in hiring those students possessing an advanced master's degree Another aspect of the 150-hour education requirement relates to experience requirements. "Acceptable experience can now be earned through providing accounting services or advice involving the use of accounting, attest, compilation, management advisory, financial advisory, tax or consulting skills under the supervision of a certified public accountant This study revealed that most students plan to go to graduate school to obtain the additional credits beyond the 120 required for a bachelor's degree. However, Buchholz and Kass research showed that enrollments into the graduate program for accounting are down at Brooklyn College of the City University of New York. Carpenter Charles G. and E. Frank Stephenson. "The 150-Hour Rule As A Barrier To Entering Public Accountancy." Journal Of Labor Research 27.1 (2006): 115-126. Business Source Premier. Web. 14 July 2014. Charles G. Carpenter from Francis Marion University and Frank E. Stephenson Professor at Berry College researched how 150- hours could be a barrier for people trying to become a public accountant. In many states, CPA licensure now requires 150 credit- hours of college coursework thereby adding an extra semester or year of schooling beyond typical undergraduate degree requirements. Examination of candidates' pass rates on the exam also finds behavior consistent with the hypothesis that the 150-hour rule is a barrier to entry. In 1983, Florida became the first state requiring 150 hours of college education as a condition for CPA licensure and, consequently, a career in public accountancy. The adoption of the new rule was relatively slow; a decade passed before another state, Tennessee, adopted the higher educational requirement. Between 1994 and 2002, however, another 35 states and the District of Kelly 7 Columbia imposed the requirement as a condition of licensure. Long term the people taking the test should do better with there extra 20 to 30 hours of schooling. The 150-hour requirement seems to reduce the number of candidates, and with the extra time in school makes it costly. With no guarantee of knowing if you will pass the CPA exam. Donelan, Joseph G. “Meeting the 150-hour requirement: the impact of curriculum choice on satisfaction” Journal of Accounting Education Volume 20, Issue 2, Spring 2002, Pages 105–121. Web. 16 July 2014 Joseph G. Donelan professor at the University of West Florida wrote reports on a study that examined the impact of type of curriculum on CPA exam candidates' satisfaction with their college preparation in four areas: general skills, accounting skills, general business skills, and information technology skills. CPA candidate respondents were classified into one of four groups depending on the curriculum choice they made in order to meet the 150-hour requirement: first those who completed a master's level accountancy degree program, second those who completed an MBA with an accounting concentration, third those who completed other graduate degrees, and fourth those who completed additional undergraduate credits. Respondents who completed a master's level accountancy degree program were consistently more satisfied than the other three groups with respect to general, accounting, and information technology skills. Respondents who met the 150-hour requirement by taking additional undergraduate credits were consistently less satisfied than the other three groups with respect to general, accounting, and information technology skills. For business skills, there was little evidence of any significant difference in satisfaction between the four groups. Implications for accounting education and the accounting profession are discussed. Elam, Rick. "Is The 150-Hour Requirement Really Progress?." Issues In Accounting Education 11.1 (1996): 205-206. Business Source Premier. Web. 15 July 2014. Rick Elam Vice President-Education, American Institute of Certified Public Accountants argues in favor of the 150 semester-hour requirement of college education designed to prepare future certified public accountants. For the first time, education will be equally as important as passing the CPA Examination for membership. The 150-hour requirement for new CPAs is mandatory continuing education and a mandatory quality review for CPA firms, a response to demands to protect the public by improving the quality of the work of CPAs. Like most professions, accounting has evolved from one which required only apprenticeship to one requiring university education, passing a national examination and, in some states, experience. By the late 1980s, the AICPA had identified the 150-hour requirement as the best approach to increasing and making uniform from state to state the education requirement for future CPAs. The 150-hour requirement represents progress for the accounting profession because it will ensure future CPAs are better educated than current CPAs. Progress toward implementing the requirement is good, as evidenced by the AiCPA membership requirement, state legislation for new CPAs, and expansion of accounting degree programs. Kelly 8 Gramling, Lawrence J., and Andrew J. Rosman. "The Ongoing Debate About The Impact Of The 150-Hour Education Requirement On The Supply Of Certified Public Accountants." Issues In Accounting Education 24.4 (2009): 465-479. Business Source Premier. Web. 15 July 2014. Various studies have observed a decline in CPA exam candidacy and have proposed that the results from the additional education requirement associated with the 150-hour rule. Several states have reacted by allowing candidates to take the CPA exam with 120 hours of education rather than 150 hours in order to increase supply. Following this line of reasoning, Lawrence J. Gramling professor at the University of Connecticut and Andrew J. Rosman Dean of the College of Management and Professor of Accountancy at the College of Liberal Arts and Sciences. They observe declines in candidacy and graduation rates only in states that have adopted the 150-hour requirement, but not in states that retained the 120-hour requirement. The 150-hour education requirement continues to be controversial. Many believe that the existence of the additional education requirement is the reason for the decline in the supply of accountants. For instance, some claim that the requirement discourages entrants to the accounting profession because of the additional costs, both in terms of the outlay of resources for the education and the opportunity cost of postponing work until the education is completed. They then surveyed 156 students taking a one-credit junior-level accounting course on the accounting profession and asked these students a series of questions to determine how well informed they are about the additional education requirements for entry to the profession and whether these requirements were a factor in their decision to choose accounting. The conclusion is supported by the response to the survey question, ‘‘did you consider the cost of the additional education needed to achieve 150 hours when deciding to become an accounting.” Only 34 percent said ‘‘yes’’ and yet they still became accounting majors. King, Teresa T., H. Wayne Cecil, and Christine P. Andrews. "Upcoming changes to the CPA exam." The CPA Journal 2009: 58. Academic OneFile. Web. 9 July 2014 In this academic article by Teresa king from Georgia College & State University, H. Wayne Cecil, and Christine Andrews, both professors of accounting at Florida Golf Coast University discuss the upcoming changes to the CPA exam. The CPA exam was reorganized into four different sections into 2002. Auditing and attestation, Financial accounting and reporting, Regulation, and Environment and concepts. The most important changes involve the content specification and skill specification. The computerized exam allows the inclusion of skills testing in the exam. The current test focuses on five types of skills they are communication, research, analysis, judgment, and understanding. Assessment of knowledge and understanding will be completed using multiple- choice questions. Candidates will have access to Kelly 9 authoritative literature, spreadsheet software and other resources to demonstrate proficiency in applying their knowledge. In 2002, exam coverage changed from “auditing “ to “auditing and attestation.” This test requires candidates will be required to perform the following tasks on the CPA exam to demonstrate knowledge of financial reporting. Prepare source documents and enter data into general and subsidiary ledgers. Calculate amounts for finical statement components. Reconcile the general ledger with the subsidiary ledgers. Prepare account reconciliation and related schedules. Prepare consolidating and eliminate journal entries. Identity financial accounting and their reporting methods. Prepare consolidate financial statements. Analyze financial statements including account and trend analysis. Apply accounting principles to evaluate assumptions underlying fair value calculations. Produce required financial statements to meet regulatory reporting requirements, and determine appropriate treatment for new or unusual transaction. Kranacher, Mary-Jo. "CPA Preparation and Eligibility." CPA Journal Aug. 2008: 80. Business Source Premier. Web. 14 July 2014. Mary- Jo Kranacher MBA, CPA, CFE, Editor-in-Chief of the Business Source Premier states that the state boards decide the education and experience requirements to both sit for the CPA exam and to attain licensure. Over the years the new requirement has called for lots of debate if it really helping or just making a barriers for economically disadvantage individuals. Kranacher states that additional hours of school outweighs the potential cost. Recently the new debate has shifted to weather CPA candidates should be allowed to sit for the exam after the have completed the first 120 academic credits. Although most professionals agree that a four-year program is not long enough to provide the breadth of knowledge and skills needed for an entry-level CPA, the additional credits should intentionally be unspecified to provide flexibility within the accounting curriculum. Perhaps it is time for better communication between regulators, and educators, Teaching and testing the knowledge and skills necessary to prepare students to use their professional judgment and succeed in their chosen career would provide a stronger link between academe, practice, and the CPA exam. One of the many reasons proponents of the 120/150 model cite for allowing candidates to take the exam after 120 credits is that the current CPA exam content can be covered within the undergraduate curriculum. Perhaps it's time to reconsider the CPA exam content in light of the extra credits the additional credit hours, along with appropriate revisions to an exam that provides entry to this profession, could better prepare CPAs and ultimately protect the public. Kelly 10 Kranacher, Mary-Jo. "Regulating The Accounting Profession." CPA Journal 76.4 (2006): 80. Business Abstracts with Full Text (H.W. Wilson). Web. 13 July 2014. Mary- Jo Kranacher MBA, CPA, CFE, Editor-in-Chief wrote Regulating the Accounting Profession Ask someone on the street what CPAs do and he will probably tell you that they prepare income tax returns, assist with financial planning, and keep financial records for businesses. there is no difference between a CPA and an accountant. The public looks to accountants for various types of financial services: tax preparation and planning, financial planning, business management consulting, financial statement preparation, and attestation services. Yet the only function that differentiates a CPA from any other accountant is that only a CPA can sign off on an audit report for a public company. CPAs have worked hard to earn the level of recognition that other professions, such as medicine and law, have achieved. However, the accounting profession's luster and prestige, not to mention compensation, still lag considerably behind. The CPA license should be the basic "general practice" requirement for entry into the accounting profession. Areas of specialization could subsequently be recognized as a result of further education or experience, with a relevant testing instrument in a specific field. Advanced proficiency would be validated by additional certifications and designations, such as certified information systems auditor, certified fraud examiner, and personal financial specialist. Koumbiadis, Nicholas, and Ganesh M. Pandit. "Has the AICPA Changed the Accounting Profession for Better Or Worse?" Journal of Accounting & Organizational Change 10.2 (2014): 190-215. ProQuest. Web. 14 July 2014. Nicholas Koumbiadis, Department of Accounting and Law, Robert B. Willumstad School of Business, Adelphi University and Ganesh M. Pandit, Department of Accounting and Law, Robert B. Willumstad School of Business, Adelphi University, author of this academic article Has the AICPA changed the accounting profession for better or worse? : The case of educational change conducted this study is to examine students who have recently graduated from the standard 120 credit accountancy program and compare and contrast their ethical perceptions with students who have recently graduated from the AICPAmandated 150 credit accountancy program which includes 30 extra credits with a focus on ethics. Recent graduated accounting students from selected Association to Advance Collegiate Schools of Business were asked to fill out a cross-sectional survey based on Victor and Cullen's Ethical Climate Questionnaire to determine whether a difference exists between the two groups' ethical perceptions. The nine hypotheses derived from the ECQ were tested using an independent sample t-test and Levene's test for the homogeneity of the variances between the two groups. The research found that compared with graduates of the 120 credit program, 150 credit program graduates scored significantly higher in ethical perceptions on five domains: Company Profit, Friendship, Team Interest, Personal Morality, and Rules, when testing at a confidence level of 95 percent. The two groups were not significantly different in the domains of Self-Interest, Efficiency, Social Responsibility, or Laws. The article includes implications for the need to Kelly 11 encourage ethical intervention through education in the accounting curriculum. This study is part of a growing body of research for teaching ethics within the accounting profession. This paper fulfills an identified need to study business ethics. Corporate scandals in the late 1990s and early this century led to a decline in the public's trust of the accounting profession. Since that time, the government, companies, and universities have attempted to rebuild that trust through a number of methods, such as passing laws requiring better regulation and more disclosure as well as requiring improved ethics education for future accountants. Read, William J. Raghunandan K, and Brown, Clifford. “150-Hour Preparation Improves CPA Exam Performance” The CPA Journal, Vol. 71, No. 3. Web 16 July 2104 The 150-hour education requirement for CPA licensure has generated enormous debate within the profession. Few recall that the vote to change the AICPA bylaws to require 150 hours of college education for membership was overwhelmingly favorable. Now, some believe that an increased education requirement deters some students from entering accounting programs-and they point to the decline in accounting program enrollments as proof. Others believe that 150 hours are necessary for CPAs to keep abreast of not only the developments in accounting, auditing, and tax but also the increased sophistication in business relationships and the complexity of transactions. This article analyses the passage rates from three years of the CPA exam and finds that candidates with a 150-hour background show higher performance. At the national level, nearly 116,000 candidates took the CPA exam for the first time during a three-year period. Exhibit 1 shows that 33% of first-time candidates possessed more than 150 hours of college credit, whereas 67% had less than 150 hours. About 27% of those candidates not satisfying the 150-hour rule reported credit hours significantly in excess of the threshold generally identified with the baccalaureate degree. Collectively, this information suggests that first-time candidates are embracing the new educational requirements and that accountants would generally benefit from additional coursework. Exhibit 2 indicates that only 13% of the candidates with less than 150 semester hours passed the CPA exam on their first attempt. Vigilante, Barbara. "Women At Full Throttle." Journal Of Accountancy 200.4 (2005): 76-77. Business Source Premier. Web. 13 July 2014. Barbara Vigilante wrote Women at full throttle an academic journal and is manager of work/life and women's initiatives at the AICPA. Ms. Vigilante is an employee of the AICPA Today, women constitute 30% of the AICPA's membership, or about 108,000 members, and that percentage will continue to increase as their presence in accounting education programs rises. Women now make up 57% of accounting graduates and 54% of new hires in public accounting firms. In 1905, when the profession balked at the very idea of female CPAs, the story was much different. The first female to pass the CPA examination was Christine Ross, who sat for the exam in New York in June 1898. Kelly 12 The New York board of regents debated for 18 months whether to award Ross a CPA certificate. Colleges and universities created one hurdle by not accepting women into their accounting programs. Linda Bergen, vice-president of corporate accounting policy at Citigroup in New York, reports that her college was not supportive of her decision to enter the program in 1976. "When I was in graduate school for an MBA in accounting at New York University, I was told by the placement director that I would never get a job with any of the Big 8 accounting firms because I was a woman, older and had children. I decided that could not be correct and that if I worked hard and did well, I would get job offers. In fact, I finished first in my class in accounting and got job offers from all of the Big 8. Bergen's on-the-job experiences also were discouraging. "I worked for partners who would repeatedly ask me why I did not get a 'normal' job, so I could be home with my family more. My response to these and other barriers was always to do excellent work. I thought that excellence would win over the doubters." She was right; before long she headed the public and regulatory reporting departments at J.P. Morgan & Co., where she was responsible for SEC and Federal Reserve filings, as well as risk-based capital and analysis of consolidated financial results. She subsequently led the accounting policies department at J.P. Morgan for eight years, following an 11-year career at Coopers & Lybrand, specializing in financial institutions. If a female CPA has talent and works hard, the pathways to success are many. You can have the kind of career you wish. You can equip yourself to pursue the job you want. Don't be shy about asking for opportunities and experiences. Kelly 13 Works Cited Allen, Arthur, and Angela M. Woodland. "The 150-Hour Requirement and the Number of CPA Exam Candidates, Pass Rates, and the Number Passing." Issues in Accounting Education 21.3 (2006): 173-93. ProQuest. Web. 14 July 2014. Bierstaker, James Lloyd, Martha A. Howe, and Inshik Seol. "The Effects Of The 150Credit-Hour Requirement For The Certified Public Accountant (CPA) Exam On The Career Intentions Of Women And Minorities." Journal Of Education For Business 81.2 (2005): 99-104. Business Source Premier. Web. 9 July 2014. Briggs, Gary P., and Lerong He. "The 150 Credit-Hour Requirement And CPA Examination Pass Rates—A Four Year Study." Accounting Education 21.1 (2012): 97108. Business Source Premier. Web. 14 July 2014. Booker, Quinton1, Bobbie W.2 Daniels, and Yvonne3 Ellis. "Education And Experience Requirements To Become A CPA." CPA Journal 83.8 (2013): 61-66. Business Abstracts with Full Text (H.W. Wilson). Web. 15 July 2014. Buchholz, Alexander K.1, and Frimette1 Kass. "A Study Of Undergraduate Accounting Students' Graduation Trends Resulting From Changes In Requirements For Certified Public Accountant (CPA) Licensure In New York State." Journal Of Higher Education Theory & Practice 12.1 (2012): 96-107. Education Full Text (H.W. Wilson). Web. 15 July 2014. Carpenter Charles G. and E. Frank Stephenson. "The 150-Hour Rule As A Barrier To Entering Public Accountancy." Journal Of Labor Research 27.1 (2006): 115-126. Business Source Premier. Web. 14 July 2014. Donelan, Joseph G. “Meeting the 150-hour requirement: the impact of curriculum choice on satisfaction” Journal of Accounting Education Volume 20, Issue 2, Spring 2002, Pages 105–121. Web. 16 July 2014 Elam, Rick. "Is The 150-Hour Requirement Really Progress?." Issues In Accounting Education 11.1 (1996): 205-206. Business Source Premier. Web. 15 July 2014. Gramling, Lawrence J., and Andrew J. Rosman. "The Ongoing Debate About The Impact Of The 150-Hour Education Requirement On The Supply Of Certified Public Accountants." Issues In Accounting Education 24.4 (2009): 465-479. Business Source Premier. Web. 15 July 2014. King, Teresa T., H. Wayne Cecil, and Christine P. Andrews. "Upcoming changes to the CPA exam." The CPA Journal 2009: 58. Academic OneFile. Web. 9 July 2014 Kranacher, Mary-Jo. "CPA Preparation and Eligibility." CPA Journal Aug. 2008: 80. Business Source Premier. Web. 14 July 2014. Kranacher, Mary-Jo. "Regulating The Accounting Profession." CPA Journal 76.4 (2006): 80. Business Abstracts with Full Text (H.W. Wilson). Web. 13 July 2014. Kelly 14 Koumbiadis, Nicholas, and Ganesh M. Pandit. "Has the AICPA Changed the Accounting Profession for Better Or Worse?" Journal of Accounting & Organizational Change 10.2 (2014): 190-215. ProQuest. Web. 14 July 2014. Read, William J. Raghunandan K, and Brown, Clifford. “150-Hour Preparation Improves CPA Exam Performance” The CPA Journal, Vol. 71, No. 3. Web 16 July 2104 Vigilante, Barbara. "Women At Full Throttle." Journal Of Accountancy 200.4 (2005): 76-77. Business Source Premier. Web. 13 July 2014.