Corporations and Their Structure (cont.)

advertisement

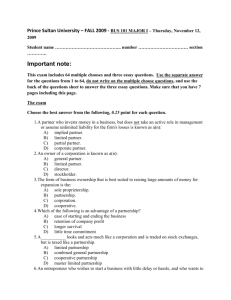

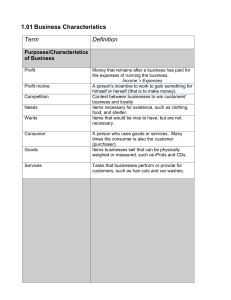

Imagine that you want to start a business. You will need to decide what your business will do, how you would like it to be structured, and whether you would like to work alone or with a partner. In this chapter, read to learn about the different ways that businesses are organized and what it takes to start a business. Getting Started Businesses are started by entrepreneurs who are willing to take risks. Getting Started (cont.) • A person who starts his or her own business is called an entrepreneur. SECTION 1 Getting Started (cont.) • An entrepreneur must: – Gather the relevant factors of production to produce their good or service. – Decide on the form of business organization that best suits their purposes. – Learn about the laws, regulations, and tax codes that will apply to their business. – Investigate their competition. SECTION 1 Getting Started (cont.) • The federal government’s Small Business Administration, as well as other government agencies, often help finance startups. • A small-business incubator and the Internet also provide a wide array of information on how to start a business. SECTION 1 Elements of Business Operation There are four basic elements of business operation: expenses, advertising, record keeping, and risk. FIGURE 1 There are four main elements of business operation: expenses, advertising, record keeping, and risk. INCOME revenue brought in when selling product or service SECTION 1 Elements of Business Operation (cont.) • Every business must consider four basic elements: – Expenses: • Inventory and equipment • Wages • Taxes • Insurance • Utilities • In order to find out if you will make a profit, all expenses must be subtracted from your receipts. SECTION 1 Elements of Business Operation (cont.) – Advertising: notifying potential customers you are open for business. – Record keeping: you will need a system to track your expenses and income. • There are programs on the Internet or software that can help with this. • Net worth—the difference between what you own and what you owe. • You also need to file your receipts properly for tax purposes. PROFIT revenue minus expenses SECTION 1 Elements of Business Operation (cont.) – Risks: you must balance the risks against the advantages of being in business for yourself. SECTION 2 Sole Proprietorship A sole proprietorship is a business owned and operated by one person. SECTION 2 Sole Proprietorship (cont.) • The most common form of business organization is the sole proprietorship. • The owner of a business is called the proprietor. SECTION 2 Sole Proprietorship (cont.) • Advantages: – Satisfaction from being the boss and making the decisions. – Receives all profits – Low taxes SECTION 2 Sole Proprietorship (cont.) • Disadvantages: – It can be demanding and time consuming. – You have unlimited liability – Personal assets may be seized to pay off debt. VS 2 Sole proprietorships and partnerships are two common ways that businesses are organized. SECTION 2 Partnerships A partnership is a business owned and operated by two or more individuals. SECTION 2 Partnerships (cont.) • Businesses are also operated by partnerships. In a partnership, the partners sign a legally binding document describing how they will operate the business. SECTION 2 Partnerships (cont.) • Advantages: – Each partner can work in his or her area of expertise. – Partners may have additional funds to use in business. – Taxes tend to be low. – The borrowing potential is high. SECTION 2 Partnerships (cont.) • Disadvantages: – Decision making can be slower. – Disagreements can lead to problems. – You must share the profits. SECTION 2 Partnerships (cont.) • Some partnerships are specialized: – Limited partnership – Limited liability company – Joint venture limited partnership: special form of partnership in which one or more partners have limited liability but no voice in management SECTION 3 Corporations and Their Structure Stock represents ownership rights to a certain portion of a corporation’s profits and assets. SECTION 3 Corporations and Their Structure (cont.) • A corporation is a business organization owned by many people but treated by law as though it were a person; it can own property, pay taxes, make contracts, and so on. • Stock represents ownership rights in a corporation that entitles the buyer to a certain part of the future profits and assets of the corporation. CORPORATIONS Articles of incorporation-documents that list basic information, filed with state corporate charter-license to operate a business to a corporation by a state common stock-ownership in a corp + voting rights-not guaranteed profits dividend-money return on the money invested in a company’s stock, based on profits preferred stock-no voting rights, but guaranteed a certain divident Board of Directors-supervises and controls corporation, not day-day operations but overall The majority of business revenues in the United States are brought in by corporations, which are owned by many people but treated by law as if they were individuals. SECTION 3 Corporations and Their Structure (cont.) • In order to form a corporation, its founders must do three things: • Register their company with the government of the state in which it will be headquartered. – You will have to file the articles of incorporation with the state where the corporation will be headquartered. SECTION 3 Corporations and Their Structure (cont.) • These articles include: • Name, address, and purpose of the corporation. • Names and addresses of the initial board of directors. • Number of shares of stock to be issued. • Amount of money capital to be raised through issuing stock. – If approved, the state grants you a corporate charter or license to operate in that state. SECTION 3 Corporations and Their Structure (cont.) • Sell stock. – Common stock is issued to raise funds. Stockholders are granted voting rights. • Common stock does not, however, guarantee a dividend. – Preferred stock can be issued to raise funds. Holders have no voting rights. • Preferred stock guarantees a dividend each year and has first claim if corp goes out of business. SECTION 3 Corporations and Their Structure (cont.) • Along with the other shareholders, they must elect a board of directors. – The partners select the first board of directors, and stockholders elect the next board. The bylaws of the corporation govern this election. – The board is responsible for supervising and controlling the corporation. • They hire officers to run the business on a day to day basis. SECTION 3 Franchises A franchise is an arrangement in which a person or group obtains the right to use the name and sell the products of another business. SECTION 3 Franchises (cont.) • Many fast-food chains, gas stations and hotels operate as a franchise. The parent company (the franchisor) sells to another business (the franchisee) the right to use the franchisor’s name and sell its products. – The franchisee pays a fee that may include a percentage of all revenues taken in. – In return, the franchisor will help the franchisee set up their business. SECTION 3 Franchises (cont.) • Advantages: – Name recognition – A proven way of doing business – Advertising dollars largely paid by franchisor SECTION 3 Franchises (cont.) • Disadvantages: – Loss of control in running the business the way you might like. – Sometimes legal trouble if one of the parties fails to hold up its side of the agreement. VOCAB1 entrepreneur: person who organizes, manages, and assumes the risks of a business in order to gain profits VOCAB2 startup: a beginning business enterprise VOCAB3 small-business incubator: private or government-funded agency that assists new businesses by providing advice or low-rent buildings and supplies VOCAB4 inventory: extra supply of the items used in a business, such as raw materials or goods for sale VOCAB5 receipts: income received from the sale of goods and/or services; also, slips of paper documenting a purchase VOCAB6 sole proprietorship: business owned and operated by one person VOCAB7 proprietor: owner of a business VOCAB8 unlimited liability: requirement that an owner is personally and fully responsible for all losses and debts of a business VOCAB9 assets: all items to which a business or household holds legal claim VOCAB10 partnership: business that two or more individuals own and operate VOCAB11 limited partnership: special form of partnership in which one or more partners have limited liability but no voice in management VOCAB12 limited liability company: type of business enterprise that protects members against losing all of their personal wealth; members are taxed as if they were in a partnership VOCAB13 joint venture: partnership set up for a specific purpose for a short period of time VOCAB14 corporation: type of business organization owned by many people but treated by law as though it were a person; it can own property, pay taxes, make contracts, and so on VOCAB15 stock: share of ownership in a corporation that entitles the buyer to a certain part of the future profits and assets of the corporation VOCAB16 limited liability: requirement in which an owner’s responsibility for a company’s debts is limited to the size of the owner’s investment in the firm VOCAB17 articles of incorporation: document listing basic information about a corporation that is filed with the state where the corporation will be headquartered VOCAB18 corporate charter: license to operate granted to a corporation by the state where it is established VOCAB19 common stock: shares of ownership in a corporation that give stockholders voting rights and a portion of future profits (after holders of preferred stock are paid) VOCAB20 dividend: portion of a corporation’s profits paid to its stockholders VOCAB21 preferred stock: shares of ownership in a corporation that give stockholders a portion of future profits (before any profits go to holders of common stock), but no voting rights VOCAB22 bylaws: a set of rules describing how stock will be sold and dividends paid VOCAB23 franchise: contract in which one business (the franchisor) sells to another business (the franchisee) the right to use the franchisor’s name and sell its products