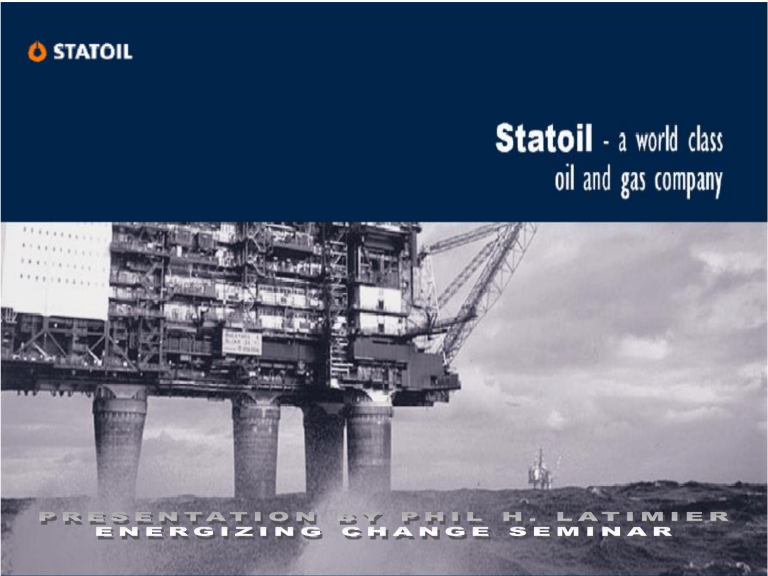

Statoil

advertisement

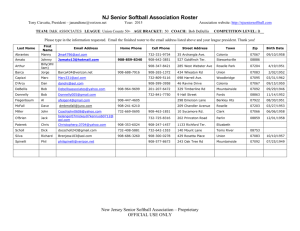

PHLatimer@aol.com 1 Agenda • • • • • • About Statoil Shareholding Entry Barriers Remaining Multinational Risks Emerging Markets Investment Research – Venezuela – Russia • Financing Investment Activities • W.A.C.C and W.M.C.C Calculations PHLatimer@aol.com 2 About Statoil • Statoil, an integrated oil and gas company. • One of the major suppliers of natural gas to the European market • One of the world's biggest sellers of crude oil. PHLatimer@aol.com 3 About Statoil • Founded 1972 • Listed 2001 • Total Turnover 2003 listed NOK 249 billion • 24000 Employees 300 250 200 Total revenues 150 Net income 100 50 0 2003 PHLatimer@aol.com 2002 2001 2000 1999 4 About Statoil • 50% of employees work outside Norway • Operator of 20 oil and gas fields • Represented in 28 countries • 2003 imp. Int. operations – Gas fields Algeria – New producing Angola Source: www.statoil.com/statoils_world PHLatimer@aol.com 5 Shareholding • Listed June 2001; Oslo and New York stock exchanges • One-third of the company’s value was permitted to to be sold • Main objective - to strengthen the company’s competitive position and the group with a broader ownership base Share price Oslo Stock Exchange 2001-2004 PHLatimer@aol.com 6 Shareholding • Government holds 76,3 % of the shares • State ownership in Statoil still important - ensuring that company retains a Norwegian base. • State guidelines from the Norwegian Ministry of Petroleum and Energy. • Statoil’s Board of directors – responsible for development Top 10 Shareholders Sept. 2004 Rank Percent Name 1 76.33 The Norwegian State 2 2.28 State Street Bank and Trust Co. 3 1.44 JP Morgan Chase Bank 4 1.07 Bank of New York 5 0.86 Mellon Bank AS Agent 6 0.71 The Northern Trust Co. 7 0.49 JP Morgan Chase Bank 8 0.47 Folketrygtfondet 9 0.43 Investors Bank and Trust 10 0.42 Deutsche Bank AG PHLatimer@aol.com 7 Entry Barriers -Oil & Gas Market • Government restrictions on entry. Major development projects or issues of principle must be considered and approved by the Storting. The oil and gas market is highly regulated. Statoil has competitive advantage as a state owned company. • Economies of scale. Benefit from producing on a large scale, which means that the average cost of one barrel is lower. Statoil is actively involved in the direct trade sector, delivering large quantities. PHLatimer@aol.com 8 Entry Barriers -Oil & Gas Market • Research and Development Expenditure Heavy spending on research and development can act as a strong deterrent to potential entrants to the industry. Statoil’s research expenditure were NOK 1,004 million 2003, NOK 736 million 2002 and NOK 633 million in 2001. PHLatimer@aol.com 9 International Strategy • Health, safety and the environment • Zero harm • Cut its share of greenhouse gas by 1.5 million tonnes of carbon dioxide • Close cooperation between government, industry, and a select few environmental NGOs • Zero accept in corrupt activities in any country – Statoil belongs to the anti-corruption sub-committee • Staff training. PHLatimer@aol.com 10 Corporate Risk Management • “Top-down” approach • Corporate Risk Committee; responsible for reviewing, defining and developing the company´s strategic market risk policies. • The main goals; ensure Statoil’s long term strategic development and to reach targets through protecting financial flexibility, i.e. avoiding different categories of financial distress, down-rating and protecting cash flows. PHLatimer@aol.com 11 Foreign Exchange & Interest Rate Risks • Forward foreign exchange – Receivables and payables – Borrowing in foreign currencies PHLatimer@aol.com 12 Venezuela Emerging Markets Investment Research Russia PHLatimer@aol.com 13 Statoil in Venezuela • Largest oil reserves in the western hemisphere • 21,000 barrels of oil per day from the LL 652 and Sincor fields,2003. • Committed 2004 to drill three exploration wells in the Plataforma Deltana area Statoil's share 30,00% 25,00% 20,00% 15,00% Statoil's share 10,00% 5,00% 0,00% Sincor PHLatimer@aol.com LL652 14 Economic Fundamentals – Country Investment Risk Venezuela May 26th 2004 From the Economist Intelligence Unit Source: Country data 2000 2001 2002 2003 GDP (% real change pa) 3.24 2.79 -8.88 -9.20 Government consumption (% of GDP) 7.23 8.59 8.06 8.90 Budget balance (% of GDP) -1.65 -4.41 -4.80 -5.80 Public debt (% of GDP)* 27.01 30.41 38.35 38.60 3.22 3.44 2.45 2.11 Recorded unemployment (%)** 13.90 13.30 15.90 21.00 Foreign-exchange reserves (mUS$) 13,09 9,239 8,49 16 Labour costs per hour (USD) PHLatimer@aol.com 15 Economic Fundamentals – Country Investment Risk Venezuela • Geopolitical, political and social risks are expected to remain reasonably low until early 2005. • Increasing risk factors: – Bush’s re-election – Regional impact of the war on terrorism – Regional and Venezuela-specific US government policy goals – Hugo Chavez’s government – Displaced from its position as the OPEC´s third largest oil producer, due United Arab Emirates PHLatimer@aol.com 16 Economic Fundamentals – Country Investment Risk Venezuela • Oil sector: 25% of GDP, 80% of Venezuela's total exports and 50% of the government income. • Production decline; GDP fell 8.9% in 2002 and 9.2% in 2003 • Unemployment 21% and inflation 27.1% in 2003 PHLatimer@aol.com 17 Economic Fundamentals – Country Investment Risk Venezuela • Economic growth, fiscal and balance of payments risks – remain reasonably low through 2005 • GDP slightly above average, though distribution very uneven • Exportation of commodities: oil, gas and aluminium • Rapid increases in public revenues PHLatimer@aol.com 18 Economic Fundamentals – Country Investment Risk Venezuela • So, Investment risk is expected to remain reasonably low through early 2005. • Low investment risk: – has been discounted in equities, leaped almost 250 % higher in 2003 – cheap international bonds // Latin America // other other oil producing emerging markets. PHLatimer@aol.com 19 Financial Sector • Chavez survived the referendum with 58% of the votes – fiscal profligacy will keep the public finances in deficit, despite firm oil prices – continue attract FDI with the aim of boosting fiscal oil revenue – non-oil FDI put off by uncertain legal and regulatory regime – domestic investment and profitability will remain crippled by price and exchange controls. PHLatimer@aol.com 20 Policy Issues • Petroleum,mainstay of the economy since the 1920s • 80% of export revenue • 25% of GDP • largely uncompetitive manufacturing industries PHLatimer@aol.com 21 Legal System • Republic and a federal state • The President of the Republic, same as Head of State and Head of issues for example regulations for the execution of laws • Legal rules:national, state and municipal. PHLatimer@aol.com 22 Regulatory Framework • System to prevent and prosecute corruption • Fines and/or prison sentences • Technical Judicial Police - open cases – private bankers for the 1994-95 financial crisis PHLatimer@aol.com 23 Banking System • • • • Commercial banks Government-owned banks Foreign-owned banks Commercial banks comprise the largest group – accept demand deposits (checking accounts) without paying interest • Savings accounts and time deposits are freely negotiated on a minimum 30 days term • Lending is almost all short term, not exceed three years. PHLatimer@aol.com 24 Banking System • Central bank is legally an independent entity • Operates under the control of the Ministry of Finance • Responsible; government monetary, tax and foreign exchange policies PHLatimer@aol.com 25 Capital & Credit Markets • Foreign debt credit rating raised from Caa1 to B2 (2004, Moody’s) • Fitch Ratings upped the country's credit rating to "BB-" from "B+" with a stable outlook 2004. • keep up payments of foreign debt after oil prices rose to record highs • CSE (Bolsa de Valores de Caracas)is the only Stock Exchange – common/ ordinary shares and preferred shares – owned by brokers the National Securities Commission (CNV) PHLatimer@aol.com 26 Capital & Credit Markets • Second highest growth in the world in 2003 • 2004, the Caracas bourse is leading the ranking • To obtain dollars; buy shares in CANTV exchange them for US deposit receipts listed on the New York Stock Exchange • The telephone company, 40% of trading volume, the only stock in demand by foreign investors PHLatimer@aol.com 27 Statoil in Russia • Representation office in Moscow since August 1991. • Cooperation with Lukoil, Gazprom and Rosneft • Cooperated in 1995-2000 with Russia’s OAO Gazprom Five service stations in the Murmansk region of north-western Russia. PHLatimer@aol.com 28 Economic Fundamentals – Country Investment Risk Russia May 26th 2004 From the Economist Intelligence Unit Source: www.eonomist.com 2000 2001 2002 2003 GDP (% real change pa) 10.05 5.09 4.66 7.33 Government consumption (% of GDP) 15.09 16.44 17.69 16.89 2.37 3.08 1.65 1.63 62.15 49.35 42.01 34.80 Labour costs per hour (USD) 0.44 0.63 0.78 1.00 Recorded unemployment (%) 10.49 9.03 8.00 8.47 24,3 32,54 44,1 73,174 Budget balance (% of GDP)* Public debt (% of GDP) Foreign-exchange reserves (mUS$) PHLatimer@aol.com 29 Economic Fundamentals – Country Investment Risk Russia • Oil and gas; 20 percent of Russia's economy, 55 percent of export earnings, 40 percent of total tax revenues. • The world's second largest oil exporter • Its subsoil contains 33 percent of the world's gas reserves • Supplies 30 percent of Europe's gas needs. PHLatimer@aol.com 30 Economic Fundamentals – Country Investment Risk Russia • High oil prices and strong global demand for oil acceleration of growth in the country from the beginning of 2004. • Forecast; GDP should grow by close to 7 per cent in 2004, slowdown to 5.7 per cent expected for 2005. • Oil generates export revenues and taxes for the state, but it creates few jobs. • Financial crash 1998 PHLatimer@aol.com 31 Economic Fundamentals – Country Investment Risk Russia • Trend towards real exchange rate appreciation. • Investment risk expected to remain low over the short and medium-terms. • In the long-term, investment risk is expected to increase. • Political risk is expected to remain low over all investment horizons. PHLatimer@aol.com 32 Financial Sector 1) Policy, legal and regulatory framework 2) Bank Restructuring 3) Tax Reform in the oil-sector of Russia PHLatimer@aol.com 33 1) Policy, legal and regulatory framework • • • • 2000-2004, important structural reforms; Package of laws to reduce bureaucratic interference in businesses’ activities Adoption of new codes of procedure for the various courts Weakness, inefficiency and, in many cases, corruption of the state administration, the judiciary and the lawenforcement agencies Arbitrary exercise of state power PHLatimer@aol.com 34 2) Bank Restructuring • Financial crisis of 1998 lead to reform of the system of banking regulation. • Since 2002; deposit insurance legislation, reform of the framework for prudential supervision, steps to increase transparency in the sector, measures to facilitate the development of specific banking activities. • Emphasis on transparency will facilitate better monitoring of banks by private-sector agents. • Russia’s largest banks continue to be controlled by the state. PHLatimer@aol.com 35 3)Tax reform in the oil-sector of Russia • Russian tax reform implemented in 2002. • Changes in all three principle group of taxes imposed on oil producers; – Export duty scale became ‘steeper’ and export duties, increased more rapidly. – Three resource payments: royalty, the tax for mineral resources reproduction and the excise tax on oil were replaced by a single extraction tax (ET). – Oil extracting enterprises enjoyed profit tax rate reduction (from 35% to 24%) PHLatimer@aol.com 36 W.A.C.C & W.M.C.C Calculations PHLatimer@aol.com 37 Statoil Capital Cost Kd= Weighted Average Interest Rate= 4.06 % Ki= Kd x (1 - T)= 3.87 x (1 - 0.4)= 2.44% Ks= D1/P0 + g= 2.95/ 96 + 0.017= 4.80% Kn= D1/Nn + g= 2.95/ 77 + 0.017= 5.60% PHLatimer@aol.com 38 Statoil TCS TARGET CAPITAL STRUCTURE Long Term Debt = 64% Common Stock Equity = 36% PHLatimer@aol.com 39 Statoil Breaking Points Assumtion of Ki up to 70% of total balance sheet gives an Afi of 130 184 250 NOK BPLTD = 130 184 250 / 0.64= 203 412 891 NOK BPCSE = 46 758 000 / 0.36= 129 883 333 NOK PHLatimer@aol.com 40 Statoil W.A.C.C Calculations PHLatimer@aol.com 41 IOS Schedule 12% 10% 8% 6% 4% 2% 100 120 140 160 180 200 220 PHLatimer@aol.com 240 260 280 300 320 42 Thank you for your attention ! QUESTIONS? PHLatimer@aol.com 43