module specification template

advertisement

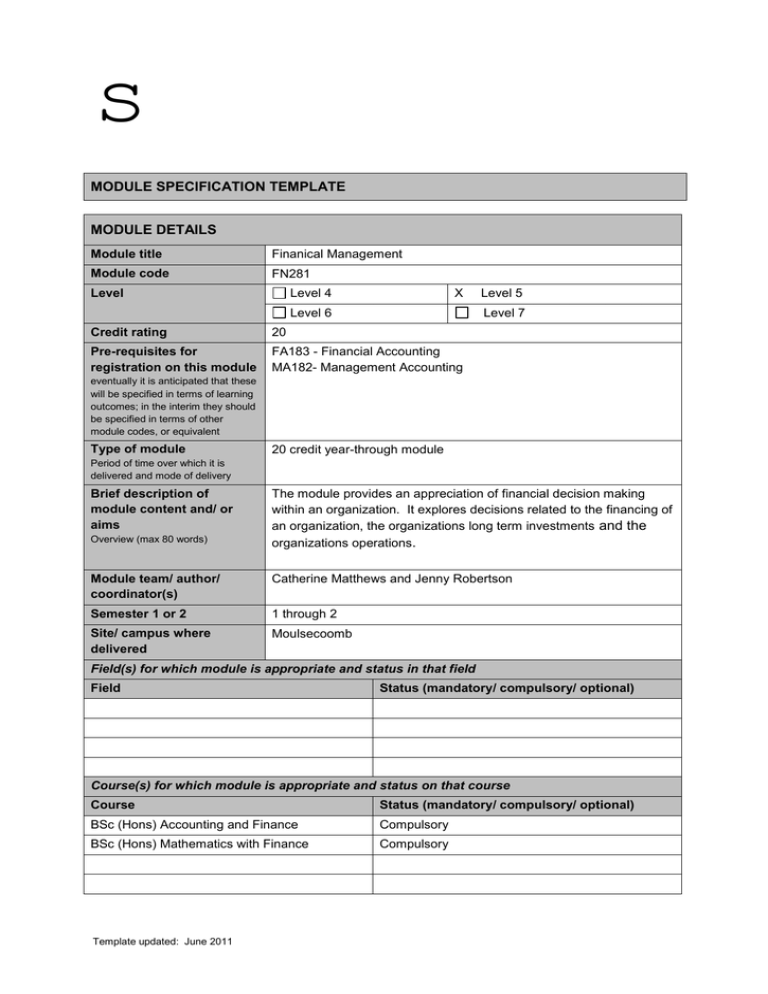

s MODULE SPECIFICATION TEMPLATE MODULE DETAILS Module title Finanical Management Module code FN281 Level Level 4 X Level 6 Level 5 Level 7 Credit rating 20 Pre-requisites for registration on this module FA183 - Financial Accounting MA182- Management Accounting eventually it is anticipated that these will be specified in terms of learning outcomes; in the interim they should be specified in terms of other module codes, or equivalent Type of module 20 credit year-through module Period of time over which it is delivered and mode of delivery Brief description of module content and/ or aims Overview (max 80 words) The module provides an appreciation of financial decision making within an organization. It explores decisions related to the financing of an organization, the organizations long term investments and the organizations operations. Module team/ author/ coordinator(s) Catherine Matthews and Jenny Robertson Semester 1 or 2 1 through 2 Site/ campus where delivered Moulsecoomb Field(s) for which module is appropriate and status in that field Field Status (mandatory/ compulsory/ optional) Course(s) for which module is appropriate and status on that course Course Status (mandatory/ compulsory/ optional) BSc (Hons) Accounting and Finance Compulsory BSc (Hons) Mathematics with Finance Compulsory Template updated: June 2011 MODULE AIMS, ASSESSMENT AND SUPPORT Aims To introduce the financial environments in which financial decision making takes place and to explore the ideas and practices of finance and financial management To understand the workings of the financial system and evaluate alternative sources of finance and assess investment possibilities To develop the knowledge and skills expected of a finance manager in relation to the investment and financing decisions. Learning outcomes/ objectives On completion of this module students should be able to: Subject specific: Demonstrate an understanding of the sources of finance available to an organization and the relationships of the organization with the capital markets and the providers of funds. Identify the relationship between risk and return and how the level of risk can be affected by financing and investment decisions. Demonstrate an understanding of the financial decision making processes and their applications in organisations and to appreciate their practicality, strengths and shortcomings; Demonstrate competence in the analysis and selection of financial data and in its use to generate decision making information. Demonstrate an understanding of risk management techniques and their application to business Demonstrate understanding of and application of the principles of business and assets valuations. Cognitive: Content Template updated: June 2011 Demonstrate numeracy skills, including the ability to manipulate financial and other numerical data and appreciate the statistical concepts at an appropriate level. Demonstrate skills in the use of communications. The role of financial markets and institutions The Stock Market and market efficiency Sources of finance – equity and debt Cost of capital and gearing Traditional analysis of risk Portfolio theory and the capital asset pricing model Dividend decision Investment appraisal, to take account of inflation, taxation, capital rationing and risk. Introduction to financial derivatives and managing exchange rate risk Working capital management Teaching and learning strategy Allocation of study hours to activities (including pre-module activities, contact time, private study time and assessment) The module will use a mix of teaching and learning processes including those detailed below. Students will be given questions to prepare for seminars that will consolidate their understanding of the topics introduced during lectures. Lectures: Seminars: Workshops: 20 20 0 Open Learning: Self Study: Total: Learning support Including indicative reading, computer packages, field trips etc 0 160 200 Indicative reading: The latest editions of: Arnold, G., Corporate Financial Management, Pearson Atrill, P., Financial Management for Non-specialists, Pearson Higson, C.J., Business Finance, Butterworths Lumby, S. & Jones, C., Corporate Finance: Theory and Practice, Cengage McLaney, E. J., Business Finance: Theory and Practice, Pearson Pike, R. & Neale, B., Corporate Finance and Investment, Pearson Watson, D. & Head, A., Corporate Finance: Principles and Practice, Pearson Assessment tasks Including weighting of individual tasks Coursework (30%): The coursework will be designed to assess the application of decision-making using appropriate in-class assessments. Examination (70%): An unseen three hour closed book exam designed to test subject specific knowledge and understanding, and ability to choose and use relevant techniques to formulate appropriate responses to complex problems EXAMINATION INFORMATION Area examination board Finance External examiners Name Date appointed Dr Bode Akinwande QUALITY ASSURANCE Date of first approval May 2007 Only complete where this is not the first version Date of last revision May 2010 Only complete where this is not the first version Date of approval for this version March 2012 Version number 5 Modules replaced None Specify codes of modules for which this is a replacement Template updated: June 2011 Template updated: June 2011