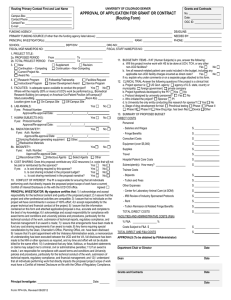

of UCD|AMC - University of Colorado Denver

advertisement

Part I Research Administration Start to Finish (GC1000) Part I Research Administration Start to Finish (GC1000) Research Administration Start to Finish Part I Overview of the Proposal Submission Process Proposal Submission Award Negotiation and Approval Award Receipt and Account Set-Up Overview (Module 1.00) In this Module Introduction Goals of this Course University of Colorado Structure Summary of Office of Grants and Contracts Introduction Purpose of Course • To receive comprehensive, interdisciplinary, mandatory core orientation and education as described in the CU Sponsored Research Audit (1999). • To learn about existing and emerging issues and regulations regarding the administration of sponsored projects and programs. • To receive information on how to work more efficiently and effectively within the guidelines of sponsored programs administration. Maneuvering Through the Course Links Numerous links are available directing you to useful documents or web sites. Underlined words in dark blue generally indicate that you can link to additional information. Modules After you have completed each section of a module, close the browser window (File Menu, Close) to return to SkillSoft. You will be given the option to either continue viewing remaining sections of the module or to close the module and return to the main menu. Maneuvering Through • Supplemental Materials - Throughout this tutorial many terms will be used. To help you better understand what is being referred to, a Definition List and a List of Acronyms have been provided for reference. • Assessments - At the end of each module, an assessment must be completed before moving onto the next module. Each assessment will cover materials in the proceeding module. Broad concepts covered in earlier modules of the tutorial may need to be applied in later assessments. For example: – UCD administrative units and faculty who have received funding from a sponsor are responsible for following and complying with certain policies and procedures. Responsibility for compliance occurs before a sponsored award is made (Pre-Award) and after a sponsored award is received and accepted by UCD (Post-Award). – Any penalties, disallowance or losses of funding caused by non-compliance with UCD policy will be assessed against the faculty and administrative unit in violation of the policy. Goals of this Course 1. To provide a framework of knowledge on sponsored research. 2. To step through the process of applying, receiving, and administering sponsored funding. 3. To provide information on the roles and responsibilities of faculty, administrators, the Office of Grants and Contracts (OGC), and UCD|AMC when applying for and receiving sponsored funding. University of Colorado Structure • The University of Colorado Denver | Anschutz (UCD|AMC) is one campus of a three-campus University of Colorado system governed by the Regents of the University of Colorado. • A State of Colorado educational institution. • UCD|AMC works closely with many affiliated hospitals: – – – – – University of Colorado Hospital (UCH) Children's Hospital Colorado National Jewish Health Veterans Affairs Medical Center Denver Health Medical Center • These affiliated hospitals are separate legal entities from UCD|AMC • Often have requirements and approval processes independent of UCD|AMC. UCD Mission • The mission statement of UCD|AMC reflects its main purpose: – Education of health professionals. – Delivery of both health care and community service. – Advancement of knowledge through research in the health sciences. Read more about the Mission, Vision and Values of UCD|AMC. UCD Support Systems In support of this mission, UCD|AMC has numerous support systems in place to support faculty (and staff) with their research endeavors. For research related activities, the support systems can be broken down into two categories: Administrative Support Systems Technical Support Systems • • • • • • • Institutional Animal Care & Use Committee (IACUC) • Human Subjects - Colorado Multiple Institutional Review Board (COMIRB) • Technology Transfer (TTO) • Environmental Health and Safety (EHS) Grants and Contracts (OGC) Payroll & Benefits Services (PBS) Human Resources Procurement Services Center (PSC) Risk Management (URM) Financial Compliance & Accounting Office of Grants and Contracts • OGC is responsible for sponsored funding coming into UCD|AMC. OGC works with faculty and departments to help foster continued growth of the research effort at UCD|AMC. • The mission of OGC is to provide service to faculty and administrators, for the purpose of obtaining and administering extramural funds in compliance with UCD|AMC and sponsor guidelines. • OGC is the coordinating office for externally funded activities at UCD|AMC. • OGC serves UCD|AMC faculty and staff by supporting: – The Review and execution of proposals. – Negotiation and execution of mutually binding agreements. – Accounting and administration of UCD|AMC's externally funded projects and programs. OGC Website Resources and Information: • Important updates • Funding information • Tools • Proposal, grant and contract forms • Contracts, sub-recipient agreements • Policies and procedures • Accounting & award administration Visit the OGC Website: www.ucdenver.edu/ogc OGC Office Structure PreAward: Provides assistance in developing and reviewing proposals and negotiating acceptable grant award terms. Contracts: Provides assistance in developing and reviewing contract and sub-recipient agreements and negotiating acceptable award terms. PostAward: Deals primarily with financial administration of sponsored activity once awarded. Accounting: Provides standard invoicing, cash management, acting as liaison for audits of sponsored activity, and maintenance of various systems required by the federal government. ERA: Configures and Implements the InfoEd eRA Grants Submission System Summary This module covered a number of topics that concern the use of this tutorial and the structure of UCD|AMC. • We covered the purpose of this tutorial. • The goals for the course to ensure we are all starting with the same understanding of UCD|AMC. • The main support systems for carrying out the research mission at UCDHSC with special emphasis on G&C's role. Proposal submission process (Module 2.00) In this Module Proposals Funding Opportunities Principal Investigator(s) Grants, Contracts, and Gifts Before Getting the Award Proposals • Understanding that there are processes that must be followed prior to submitting a proposal to a sponsor will facilitate proposal writing success. • A proposal is a grant application request for funding submitted by a faculty member to an outside sponsor or contract proposal that may directly lead to an award. • A proposal can also be a set of documents containing a descriptive narrative of an idea and a budget to be submitted to a sponsor for support. Proposals • A sponsor is an external funding agency that enters into an agreement with UCD|AMC institution to support research, instruction, public service or other sponsored activities. • • • • Private Businesses Corporations Foundations Other Universities • Other not-for-profit organizations • Federal, State and local governments. • Some sponsors require that proposals are submitted on preprinted forms while others have no specific format. • Faculty and administrators should take time early in the process to develop fully a well thought out proposal. A well thought out proposal can save considerable time later when there are numerous time constraints on the completion of work. Proposals All formal proposals require an institutional authorized signature to show the institution's acceptance of the proposal. • An authorized signature is the signature of an institutional official who is designated to give assurances, make commitments, and execute documents on behalf of UCD|AMC as may be required by sponsors and/or UCD|AMC for the provision of financial assistance to UCD|AMC. • The signature of an authorized institutional official certifies that commitments made on proposals, applications and agreements can be honored; and ensures that all extramural support conform to Federal regulations, sponsor guidelines, and applicable institutional policies. • Click here for information on OGC signature authority. Funding Opportunities Identification of external funding sources is the first step in the process of obtaining funding from a sponsor. Faculty members are urged to contact – Their Dean's Office – OGC funding opportunities web page – The Office of Research and Development (ORDE) for information about potential sources of funding. Keep At It! • • • • • Do not give up in the pursuit of external funding if a proposal is not funded. Many proposals are not funded the first time the proposal is submitted. Consider resubmitting a proposal after careful evaluation of reviewers’ comments. Just because one sponsor did not fund the proposal does not mean the proposal will never be funded. Be sure to also look to other sponsors for potential funding opportunities. Principal Investigators A Principal Investigator (PI) on a proposal is typically a faculty member who has been qualified and accepted by a sponsor to lead the proposed work. The PI is responsible for technical compliance, completion of programmatic work, and fiscal stewardship of sponsor funded projects (see Fiscal Policy 4-13, Roles and Responsibilities for Grant and Contract Administration). To Be a PI… • Faculty must have certain ranks to be eligible as a PI as determined by the faculty's School. Click here for PI eligibility. Exceptions to school requirements will require written approval by the applicable Department Chairman and Dean of the School. • The sponsor may also limit who can apply for funding. Roles and Responsibilities • Throughout this tutorial the responsibilities of the PI, administrative staff, and OGC will be described. Grants, Contracts and Gifts What’s the difference? Grant applications • Typically result in a grant award that is directed at satisfying specific sponsor requirements • Grant awards tend to be less restrictive, with the primary benefit of the work going to the awardee. • The majority of awards made to UCD|AMC are grants. Grants, Contracts and Gifts Grants involve one or more of the following characteristics: • An award that is directed at satisfying specific sponsor requirements. A proposal or award letter may contain terms specifying the scope of work or line of inquiry, performance targets, timeframe, level of personnel, etc. • A line item budget detailing expenditures by activity, function, and time period that must be adhered to as a condition of funding. • Deviations from the approved budget may require written sponsor approval. • The award involves issues requiring institution review including the use of human subjects or laboratory animals, assignment of patents or copyrights, ownership of data or equipment, allocation of institution space, or research involving recombinant DNA, radioactive or biohazard materials. • A specific period of performance prescribed to the sponsor. • Provisions for audits by or on behalf of the sponsor. • The sponsor requires a detailed financial report and/or technical report at intervals during the period of performance or upon completion of the grant. Grants come in many forms. Two examples of grants received at UCD|AMC are: • Federal Grants • Federally Sponsored Cooperative Agreements Clarification on Grants, Contracts and Gifts Contract proposals • Typically result in a contract award with established deliverables. • Contract awards are designed to acquire services from UCD|AMC that many times will primarily benefit the sponsor. Subrecipient agreement (also termed a subaward or subcontract) differs from a contract. • A subrecipient agreement is designed to procure services from another entity. • The subrecipient in this case is the legal entity that a subcontract is made to and which is accountable to the UCD|AMC for the use of the funds provided. Subrecipient agreements will be covered in greater detail later in this tutorial. Clarification on Grants, Contracts and Gifts For the documentation leading to an award and the award itself to be considered a contract, it normally must contain all of the following elements: • The parties to the agreement must be clearly identified. • Detailed financial and legal requirements must be included with a specific Statement of Work (SOW). • A specific set of deliverables and/or reports to the sponsor are defined. • Legally binding contract clauses are included (period of the contract, termination terms, etc.). • Authorized signatures by all parties to the contract are required. Clarification on Grants, Contracts and Gifts Contracts come in many forms. Examples of contracts received by UCD|AMC include: • • • • Federal Contracts Federally Sponsored Agreements Interagency Agreements Clinical Trial Agreements Clarification on Grants, Contracts and Gifts Distinctions Gifts are cash or non-cash items bestowed voluntarily to the UCD|AMC without any expectation of a tangible good or service being provided in return. • There is no expectation of economic benefit on the part of the donor. • Gifts are charitable contributions for use by UCD|AMC exclusively to fulfill its tax-exempt purpose(s). Why Make a Distinction? The distinction between a grant, a contract and a gift will often determine who in OGC will assist faculty and administrators prior to having a final award and may alter what approvals will be required by OGC. Throughout this tutorial, the different requirements will be outlined to help you better understand what to expect when working with OGC. Before Receiving an Award Awards are the funds provided from a sponsor, in writing, for support of a sponsored project or program at UCD|AMC. This term is used for the original award, and subsequent supplements or modifications; it can mean monies or equipment and could also be referred to as an agreement. Before Receiving an Award The PI normally will: • Be required by the sponsor to develop and submit a grant application or contract proposal.* • Be required to review and acknowledge acceptance of a grant application or contract proposal. • Be provided with written documentation that a gift is being given by a donor. *When the term "proposal" is mentioned, it is referring to both grant applications and contract proposals. Before Receiving an Award • To apply for a grant or contract award, a grant application or a contract proposal is submitted by a PI through OGC to an outside sponsor and may directly lead to an award. • Contracts that arrive in draft form never having required a formal proposal to be submitted are still considered a contract proposal. • Gifts are to be made in writing and may vary in the documentation used, from a letter to a formal agreement. To handle a gift award, contact the CU Foundation the office responsible for accepting gifts at UCD|AMC. Overview of the Proposal Submission Process (Module 3.00) In this Module Development of Proposals Budget Development Budgets and Federal Sponsors Compliance Direct Costs versus F&A Costs Development of Proposals • For the purpose of this tutorial, a Grant Application (or Application Package) is a completed application for funding (scientific presentation, budget, and any necessary administrative paperwork) plus all necessary internal approval forms (i.e., Grants & Contracts Routing Form, COMIRB, IACUC, etc.). Before You Get Started: – Obtain the funding announcement. – Review the criteria and restrictions related to applying – particularly watch eligibility and be aware when limited submission applies (e.g. only one application per campus or institution). – Research historical funding activities of the sponsor. – Analyze and then plan a development timeline Development of Proposals Obtaining Grant Application Instructions and Forms at UCD|AMC • OGC interprets and disseminates the major sponsor policies and forms. • The major sponsors include: – – – – Department of Health and Human Services, National Institutes of Health Health Resources and Services Administration. Visit OGC’s website for sponsor forms or resources. • The PI or the PI’s administrative unit should contact the potential sponsor for appropriate application instructions and forms. Grant Application Preparation • The PI must prepare the grant application (including the preparation of the budget and technical portions) according to the sponsor’s instructions and UCD|AMC’s policies and procedures. Completing the application (before arrival in OGC) Before the application arrives in OGC: • Follow the sponsor directions! – Simple things like the font size, page limitations, and form completion matter. UCD|AMC and other institutions have had grant applications rejected by the National Institutes of Health (NIH) because the font was too small. • Written content must be readable, understandable and well organized. • Check grammar and spelling. • OGC provides pre-submission assistance and review of applications to ensure that all institutional issues have been addressed and that all potential financial and administrative sponsor rules and regulations have been observed. There are a number of checklists that can be used to ensure that everything is being compiled as necessary for OGC eventual review and approval. Review the various checklists. • Training grants can be very complex - Contact OGC for assistance! Signing the Grant Application The PI cannot sign grant applications on UCD|AMC's behalf. • A PI is not an authorized institutional official of UCD|AMC and therefore is not authorized to legally bind UCD|AMC to any legal obligations. • Authorized Institutional Official(s) are individual(s) authorized by the Board of Regents of the University of Colorado to sign grant applications, contract proposals and/or subrecipient agreements on behalf of UCD|AMC. • A PI can only bind his or her own self. Approvals for Proposals The PI must Obtain all institutional, affiliated hospital, regulatory and safety approvals for all proposal arrangements. • Approvals may need to be obtained from the affiliated hospital where work (such as patient care) will be performed. These are separate from the approvals required by UCD|AMC. i.e. University of Colorado Hospital (UCH) is a separate entity with an independent approval process for patient care activities. Contract Proposals • Contracts are usually issued by the sponsor to the PI requiring approval by UCD|AMC. • Occasionally, the sponsor requests UCD|AMC to develop a contract for a project. Requests to develop a contract should be directed to the OGC Contract Specialist(s) for input and assistance. • All contract proposals are subject to review and negotiation as necessary to ensure compliance with UCD|AMC, State and Federal rules and regulations governing sponsored projects. • Contract proposals often have more restrictive and problematic terms and conditions, which make it more likely that it will take more time to negotiate and approve than a typical grant application. Expect inherent delays. Contract Proposals The PI cannot sign contract proposals on UCD|AMC’s behalf. • The PI is not an authorized institutional official of UCD|AMC and has no authority to legally bind UCD|AMC to any legal obligations. • Authorized Institutional Official(s) are individual(s) authorized by the Board of Regents of the University of Colorado to sign grant applications, contract proposals and/or subrecipient agreements on behalf of UCD|AMC. • A PI can only bind his or her own self. All institutional, affiliated hospital, regulatory and safety approvals need to be obtained by the PI for all proposal arrangements. • These approvals may need to be obtained from the affiliated hospital where patient care will be performed, separate from approvals required by UCD|AMC. (i.e. University of Colorado Hospital (UCH) is a separate entity with an independent approval process for patient care activities.) Budget Development Technically A grant application or contract proposal must be put together by the PI. Administratively A proposal must be put together by the PI or administrative unit. (Drafting the scope of the work and the expected outcome of the project) (Budget development, budget justification and a description of how the project will be carried out) Budget Development • The budget is the numerical way of representing the work to be completed in the proposed project, whether a grant application or a contract proposal. • A budget is an itemized summary of anticipated expenditure activity for a given period and activity with an identified (proposed) means for financing. • In some cases a budget is the dollar amount awarded by a sponsor that the institution has a legal claim to collect. • The budget must be realistic and reasonable. It should not be higher or lower than what it would reasonably cost to perform the work. • UCD|AMC is a non-profit organization, not expecting profits. Budget Development Standards • • • No set guidelines that would be applicable to all budgets in all situations. Generally, budget structures differ among federal, state, local government, non-profit and private sponsoring agencies. There are also differences in budget formats on research agreements, clinical trial agreements, contractual service arrangements and budgets for training. Budgets are typically broken into categories: – Include detail by type of expenditure such as personnel, travel, equipment, etc. – Despite the differences among agreements, the major budget categories will be similar in grant applications and contract proposals regardless of the type of sponsor or the type of award mechanism. – Budget categories are standardized to ensure that financial reporting is reasonable. – The greatest amount of variance in budget development will most likely be found in the amount of information required by the sponsor and UCD|AMC, and what budget items can be requested for each category of the budget. Budget Development Standards • The best source for information on how much detail to include in the proposal budget will be the guidelines supplied by the sponsor. • The minimum budget requirements of UCD|AMC must also be followed, even if it means providing a more detailed budget for OGC's internal use (e.g. NIH modular grant applications). • The sponsoring agency will determine the specific requirements of budget development. It is here that a primary distinction between federally funded and non-federally funded budgets will be made. Budgets and Federal Sponsors • Proposal budgets to federal sponsors must adhere to the federal cost principles found in Office of Management and Budget (OMB) Circular A-21. – This includes proposals being submitted to federal sponsors through another institution or agency Read about the Cost Principles “Cost Principles for Educational Institutions” OMB Circular A-21 OMB Circular A-21, “Cost Principals for Educational Institutions”, establishes principals for determining costs applicable to grants, contracts and other agreements with educational institutions. The principals are designed to ensure that the federal government bears its fair share of total costs. The significant principles of A-21 include: • • • • Cost Accounting Standards Allocable Costs Direct Costs vs. Facilities and Administrative (F&A) Costs Allowable and unallowable costs Cost Principals The four tests of allowability: • • • • Reasonableness (including necessity) Allocability Consistency Conformance with the terms and conditions of the award Cost Accounting Standards Allowable Costs • Budgets should only include the estimated costs that would be acceptable to be charged to the sponsored agreement. • For more information on allowable costs see UCD|AMC Fiscal Policy, Direct Charges to Federally Sponsored Projects, 4-7. Cost Accounting Standards Reasonableness (including necessity) • A cost that is necessary to and supports the specific performance of the sponsored project. • A cost is reasonable if a prudent person would purchase a given item for the same purchase price. • Failure to adequately document a cost could result in the disallowance of a legitimate charge. Cost Accounting Standards Allocability • Budgets should include only the estimated costs that can be assigned to the project, in reasonable and realistic proportion to the benefit provided. • At the time of commitment or expense, it should be relatively easy to assign the costs with a high degree of accuracy, in reasonable and realistic proportion to the benefit provided. Cost Accounting Standards Consistency • When setting up a budget, ensure that budgeted costs will be charged consistently for the same purpose in like circumstances, either as direct costs or F&A costs. • Plan the budget knowing that if there are costs incurred that benefit more than one sponsored project, the costs can be allocated to each project or program in proportion to the benefits received, using a reasonable basis for reflecting the use or level of service. • Plan the budget knowing that costs may not be shifted to other sponsored projects due to cost overruns, avoidance of restrictions imposed by law, or for convenience. Cost Accounting Standards Compliance • Requirements start with budget preparation and determining what costs are considered direct costs as opposed to F&A. • When preparing proposal budgets, it is the PI’s and department’s responsibility to ensure compliance with Fiscal Policy 4-7, “Direct Charges to Federally Sponsored Projects”. • OGC assists in this process by: – Ensuring that proposals are managed by consistent treatment of allowable costs. – Responsible for preparing, publishing, and maintaining a manual of administrative and costing information necessary for the proper preparation of a proposal for extramural funding, and as a result may be able to help when PIs and departments have questions or concerns. Direct Costs versus F&A Costs Budgets are to be broken into two broad categories: • Direct Costs • Facilities and Administrative (F&A) costs – Also referred to as “indirect costs” or “overhead” Direct Costs Costs that can be identified specifically with a particular sponsored project relatively easily and with a high degree of accuracy. Direct Costs include many budget items. Examples: Personnel costs • PI, Co-PI, technical staff, and collaborators relative to the level of effort expended on the project Laboratory supplies Long-distance telephone tollcharges Animal and animal care costs Scientific Equipment Travel costs Specialized shop costs F&A Costs The costs incurred by UCD|AMC for common or joint objectives and therefore cannot be identified readily and specifically with a particular sponsored project. Examples: Administrative/Clerical Personnel Costs Routine departmental administrative and accounting costs Membership dues/fees for technical and/or professional organizations Office supplies Ordinary and routine postage Costs associated with preparing proposals, including typing, copying and mailing costs Telephone hook-up fees and local service charges Computer hook-up fees Utilities Public Safety Building and equipment use and maintenance Federal Sponsors Administrative and Clerical Expenses normally treated as F&A: • Office supplies • Postage • Local telephone costs • Memberships • Salaries of administrative and clerical staff However, direct charging of these costs may be appropriate where a major project or activity explicitly budgets for administrative or clerical services and individuals involved can be specifically identified with the project or activity. • . Federal Sponsors Caution • When direct charges for administrative and clerical salaries/supplies are made, care must be exercised to assure that costs incurred for the same purpose in like circumstances are consistently treated as direct costs. • In general, those costs related to the general operation of an administrative unit, division, or lab should not be charged as a direct cost to a federally sponsored project. • PI must complete a “Proposal Checklist for Direct Charging of F&A Costs” form Fiscal Policy 4-7, Exhibit B-2 when a project is anticipated to require Federal funding as direct costs. • Fiscal Policy 4-7, Direct Charges to Federally Sponsored Projects provides more information and guidance on the treatment of costs as either direct costs or F&A costs and when it may be appropriate to directly charge federally sponsored programs for Administrative and Clerical Expenses. Questions about UCD|AMC direct charging of administrative unit salaries/supplies should be referred to the OGC PostAward section. Proposal Submission Process (Module 4.00) In this Module Budget Preparation Contract Budgets Direct Cost Categories Facilities & Administrative Costs Cost Sharing Budget Preparation General rules that should be applicable to any good proposal budget preparation. Proposals that will result in: • • • • Federally Sponsored Agreements Contracts where the Federal Government is the prime sponsor Cost reimbursement agreements Agreements requiring detailed budgets Budget Preparation Prior to developing the budget for a proposal: • Review the sponsor guidelines. • Identify planned purchases by category in the proposal budget. • Describe the purchases in the budget justification as appropriate. • Included purchases in the final agreement if the proposal is awarded. Future Year & Multi-Year Budgets • For budgets proposed to begin in the future, it is appropriate to calculate a 3% increase to the current salary to compensate for cost-of-living increases. Additional increases of 3% per employment year are also appropriate for the same reason. Currently, NIH only permits a 3% factor for inflation. • Any increase(s) should be detailed in the budget justification with a statement such as: “Each category has been increased by ___% per year to account for anticipated inflationary cost increases.” Other Types of Budgets Clinical Trial Agreements • Another type of proposal budgeting arises with proposals where no specified budget is required and/or no financial reporting of expenditure activities are mandated by the sponsor. • These types of proposals are normally non-federally sponsored. (Agreements funded by private sponsors and Fixed-Price Agreements) Note: The Budget Development Standards section previously covered in this tutorial is also applicable to the budgeting practices for contract proposals that are non-federally sponsored. Contract Budgets Remember to consider the following: • There are no set guidelines that would be applicable to all budgets in all situations. Generally, budget structures differ among federal, state, local government, non-profit, and private sponsoring agencies. • There are also differences in budget formats on research agreements, clinical trial agreements, contractual service arrangements, and budgets for training. • Despite the differences, the major budget categories to work toward will be the same when considering proposals regardless of the type of sponsor or the type of award mechanism. (continued) Contract Budgets Remember to Consider the following (continued): • The greatest amount of variance in budget development will most likely be found in the amount of information required by the sponsor and UCD|AMC for each category of the budget. • The best source for information on how much detail to include in the proposal budget will be the guidelines supplied by the sponsor. The minimum budget requirements of UCD|AMC must also be followed, even if it means providing a more detailed budget for OGC's internal use (e.g. NIH modular grant applications). The same direct cost budget categories covered in the Proposal Budgeting section earlier (section 3.07) should be used when developing a budget for proposals that are normally non-federally sponsored and typically result in contracts such as Clinical Trial Agreements, agreements funded by private sponsors and Fixed-Price Agreements. Contract Budgets Additional considerations to think about: • Funding Level - Review budgets offered by sponsors to ensure that the funding level is appropriate for the work that will be performed. All activities and resources used or purchased in order to perform a protocol or statement of work should be covered by the funding provided in the agreement. • Patient Care - Agreements where patient care is conducted at one or more UCD|AMC affiliated hospitals must include the appropriate rate per activity charged at the given affiliated hospital (e.g. University of Colorado Hospital reviews and approve clinical budgets via the Hospital Research Review Committee (HRRC). Check with the hospital conducting any patient care to obtain correct budget information related to planned activities. Clinical Trial Budgets Clinical Trials are expected to be funded on a cash-basis, which means the project is expected to be in a positive cash position throughout the term of the award. See Fiscal Policy 4-1, Clinical Trials. • Pay close attention to the payment schedule in a clinical trial. Make sure that payment will be received in a timely manner to allow the project to maintain a positive cash balance and function smoothly. • Billing Requirements - Generally, on clinical trials the PI is responsible for getting required information to sponsors in order to receive payment. • Incentive payments to individuals from sponsors are not allowed in accordance with UCD|AMC policy. F&A will be assessed on all contracts. Consult OGC Webpages for the appropriate F&A rate. Most sponsored clinical trials are assessed by the off-campus F&A cost rate (26%) because a majority of the activity is generally conducted off-campus, (i.e., at one of the hospitals affiliated with the UCD|AMC). See Fiscal Policy 4-1, Clinical Trials for more information. Payments All payments are to be made payable to the University of Colorado Denver and sent to the OGC Lock Box. • The lock box address is: University of Colorado Denver Department 238 # [proposal number – PI's initials] Denver CO 80291-0238 Note: Additional information will be provided on alternative types of proposal budgeting later in this tutorial. Direct Cost Categories Primary direct cost budget categories. • Begin preparing the budget using standard budget categories (unless instructed otherwise). Personnel Consultants Equipment Supplies Travel Patient Care Alterations and Renovations Other Expenses Subrecipients (Consortium/Contractual) Personnel Category Includes both salary and the applicable fringe benefit budgeting rates. Personnel include faculty, staff and students employed by UCD|AMC, such as the PI, research personnel, and technical personnel. • Each person identified as "personnel" in the budget must be a UCD|AMC employee paid through UCD|AMC payroll. • Non-UCD|AMC paid employees must be identified in the budget as subrecipients or consultants. Consultant Costs Individuals who will add expertise and skill to the project. Consultants are commonly listed in the budget as being paid on a daily rate plus travel costs. Some sponsors limit the daily rate that may be paid to a consultant. Equipment Category An article of non-expendable, tangible equipment: • Useful life of more than one year • An acquisition cost of $5,000 or more. This includes equipment • Purchased or acquired via transfer • Donation • Equipment being constructed where component parts may be less than $5,000 each, but the total cost will be $5,000 or more. Supplies Category Otherwise known as consumables • Supplies for sponsored projects are to be purchased out of the direct costs for the project. • Supplies related to the general operation of the administrative unit are to be covered as a part of Facility and Administrative Cost Recovery Revenue. (e.g., paper, pens, printer cartridges, excluding supply items stored and used in a laboratory setting) Travel Direct Cost Category Travel includes only travel activities by UCD|AMC personnel necessary to conduct and benefit a project. Patient Care Costs Costs of routine and secondary services carried out with persons who are participating in a research project. Alterations and Renovations Most agencies specifically define allowable costs for space alterations and renovations. • In some cases, it may be necessary to determine whether or not space will be available at UCD|AMC to accommodate the requested change. • Contact Institutional Planning for assistance developing appropriate budget amounts Other Expenses Category Items not included in any other category should be listed as other expenses. Check the sponsoring agency's guidelines for any specific items to include here. Listing by major categories is allowable. Common expenses in this section include, but are not limited to: • Equipment maintenance • Equipment rental • Subject reimbursement • Trainee costs Subrecipients Category Subrecipient The legal entity that has agreed to work in collaboration with UCD|AMC if the proposal is awarded. Also known as Consortium or Contractual costs. Work to be performed will usually be developed into a formal subrecipient agreement for substantive portion of work performed. Third party entity – NOT an individual Agreement developed upon receipt of an approved award. Accountable to the UCD|AMC for the use of the funds provided. Facilities and Administrative (F&A) Costs For sponsored project costing purposes, costs that are incurred for common or joint objectives (research, instruction, public service, or patient care) of the institution and, therefore, cannot be identified readily and specifically with a particular sponsored project, an instructional activity, or any other UCD|AMC activity, such as clerical and administrative personnel. • Also referred to as indirect costs, overhead costs, or administrative costs. • Most sponsoring agencies allow reimbursement of F&A costs as a percentage of certain direct costs of the project (this is known as the MTDC the Modified Total Direct Costs). • UCD|AMC has established a federally negotiated F&A cost rate agreement which sets out the percentage rates to be applied to all proposal budgets unless another mandatory sponsor policy applies. F&A Cost Rate Determination The cost rate for a project is determined by: • The location of the project – On or off campus location • The type of activity being proposed. F&A Cost Rate Determination Some sponsoring agencies specify the F&A percentage rate to be used. If the percentage rate is not specified by an agency, follow UCD|AMC policy. – All federally-funded projects are subject to the UCD|AMC's Negotiated Rate Agreement unless otherwise specified by the federal sponsor. – For non-profit, charitable associations, foundations and societies that do not have an established policy, the UCD|AMC project must initially be proposed at an F&A cost rate of no less than 10% of the Total Direct Cost (TDC). All other F&A cost rates are to be applied to a Modified Total Direct Cost (MTDC) base unless indicated otherwise. For more information on how to determine what F&A rate to use and how to calculate F&A see the F&A Costs Guide. Cost Sharing The portion of a sponsored project or program that is not supported financially by the sponsor. • When the PI, department, and UCD|AMC agree to provide any type of cost share to a sponsor, UCD|AMC is then committed to provide those stated services or assets in the performance of the program or project if awarded. • Any commitments made in the budget, budget justification, proposal narrative and award documents are all binding on the institution at the time of the award and thus require approval and institutional endorsement. Cost Sharing • Usually provided through the contributed effort of PI’s or their staff and paid from the unrestricted fund, auxiliary and self-funded activity fund and/or gift programs. • The effectiveness and expected benefits of each cost sharing agreement should be weighed considering the administrative and financial requirements and responsibilities inherent for the PI, the administrative unit, and UCD|AMC. • Cost sharing is not normally appropriate on programs or projects supported by “for-profit” entities. Types of Cost Share Three types of cost sharing: • Mandatory Required as a condition of the award. • Obligatory A “committed” cost share is offered in the proposal by UCD|AMC, but is not a requirement to obtain the award once offered cost share becomes a requirement of the award. • Voluntary Provided in excess of mandatory or obligatory cost sharing requirements. Payment of Cost Share Cost sharing between sponsored projects is not normally allowable. For example: federal funds cannot be used for cost share on another project. Covering Cost Share Obligations • Cost sharing may be funded by unrestricted general fund programs, auxiliary and self-funded activity fund programs, or gift fund programs. • Cost share can only identify or commit funds one time. i.e. Dollars committed to cost sharing on one project cannot be committed again on another project. • Budgets that commit quantifiable cost sharing outside of the PI’s administrative unit personnel must include authorization from the appropriate department chair/designee and dean/designee. If third party cost sharing is proposed, an authorized official of the organization must approve the commitment in writing. • It is the responsibility of the PI and the originating department to ensure that all cost sharing is identified and documented appropriately in the proposal. • OGC reports cost share obligations to the sponsor if an award is made to UCD|AMC, as required. Examples of Cost Share • Faculty, staff or students salaries and related fringe benefits for those working on the project • Laboratory supplies used on the project • Travel benefiting the project Unallowable Cost Share Examples of Unallowable Cost Share: – Expenditures which are normally charged as F&A, such as administrative salaries or office supplies – Unallowable direct costs such as alcoholic beverages, entertainment, or any costs disallowed by the sponsor – Equipment unless required by the sponsor – Service Center expenses The same cost principles for direct costs covered earlier in the tutorial apply to the charging of cost share. The expenditure must be appropriate as a direct expense. Requirements for cost sharing are found in OMB Circular A-110, including the allowable methods for documenting such cost sharing. F&A Used as Cost Sharing • With the appropriate approvals, waivers or reductions of the facilities and administrative (indirect) cost rate may be used as cost sharing. • These waivers or reductions must have prior approval of the awarding agency and must be formally requested and processed through the UCD|AMC waiver approval process if the rate is different than the normal rate. See the following for additional information: – Fiscal Policy 4-4, Facilities & Administrative Costs and Distribution of Recovery – Fiscal Policy 4-8, Cost Sharing Budget Preparation - Conclusion • While racing to get the proposal ready on time, remember that good planning and good budgets save time later. • There are no set rules that apply to all of the numerous sponsoring agencies, but the general guidelines presented above apply to any good budget preparation. • The best method to ensure a properly-prepared budget is to consult the sponsoring agency's guidelines prior to beginning your budget preparation! Proposal Submission Process (Module 5.00) In this Module Regulatory and Safety Issues Proposal Review and Approval What is Routing Document Transfer to OGC The Purpose of Routing OGC Review and Approval Routing Benefits the PI Regulatory & Safety Issues While preparing a proposal for submission to OGC, the following regulatory and safety issues need to be considered and addressed as required. • Facilities Usage at UCD|AMC • Completion of Conflict of Interest (COI) disclosure through the Office of Regulatory Compliance • Animal Subjects • Human Subjects • Radiation and Safety • Biosafety Facilities Usage at UCD Is adequate space available to perform the proposed project? • If no facilities are available for the project or program, the Planning Office must be consulted for additional space or new space. For more information see the Office of Institutional Planning. • If facilities are available for the project, be prepared to identify the primary location as “on” or “off” campus (see Fiscal Policy 4-4). Familiarity with all fiscal policies is critical to ensure compliance. List of University of Colorado Denver | Anschutz Policies and Guidelines • Fiscal Policy 2-4, Use of Facilities and Equipment by Outside Parties or for Private Gain, Fiscal Policy 3-11 • Use of Campus Facilities, Space and Services by External Entities, and/or Fiscal Policy 3-12 • Real Estate Management-Space Acquisition and Use may become applicable in certain circumstances. Disclosure of Financial Interests UCD is committed to: Maintaining the integrity and truthfulness of its research and scholarship through the responsible and ethical conduct of its faculty, staff and students And has instituted policies and procedures for the disclosure of potential conflicts of interest and for handling any perceived conflicts that are disclosed. A financial conflict of interest is not inherently wrong as long as it is disclosed to the institution and is managed, reduced, or eliminated. The CU Administrative Policy Statement, Conflict of Interest Policy refers to situations in which outside relationships or activities conflict (such as professional consulting for a fee) or have the appearance of conflicting, with an employee's commitment to his/her University duties or responsibilities. Acceptable when: • They comply with University policy • Promote professional development of faculty and student employees, and enrich the individual's contributions to the institution, to their profession and to the community For Example, Consulting relationships may serve to create conduits for the exchange of information and technologies that enhance the University environment and permit faculty to test the soundness of their ideas. Separate policies may apply to faculty; for example, in the School of Medicine, faculty are subject to separate guidelines and required to direct all outside professional activities through University Physicians, Incorporated (UPI).” Disclosure of Financial Interests Any UCD|AMC faculty or staff engaging in employment or financial activities outside of UCD|AMC should be familiar with current UCD|AMC policy regarding conflict of interest and the appropriate disclosure rules. *Contact the Office of Regulatory Compliance for additional information.) OGC requires disclosure of financial interests for each new proposal received. Faculty are to keep their chair and dean or supervisors fully apprised of situations that are or could be potentially perceived as being a conflict of interest. Animal Subjects If animals will be used for the project, the PI is responsible for contacting the Animal Care and Use Committee (IACUC) office for the necessary forms and approval procedures. • During the proposal review “routing” process, OGC will ensure: Date of committee approval and protocol number is completed on the routing form in order to approve the proposal. Approval to use animals is obtained prior to submission of all nongovernmental proposals.* * Some federal sponsors like the Public Health Service (PHS) may accept approvals after the grant application submission. Be sure to review sponsor guidelines as needed for more information on what is or is not required. You may also contact OGC should you need assistance. Human Subjects If human subjects are proposed in a research project, UC Denver must review and approve the research protocol before human subject research can be conducted. This includes continuing review and approval. • The PI must obtain approval for human subjects research protocols and is responsible to work with the Institutional Review Board (IRB) – – Colorado Multiple Institution Review Board (COMIRB) Western Institutional Review Board (WIRB) • IRB approval must be obtained before a sponsored project involving human subjects can be established in the UCD|AMC financial system. Lack of an approved protocol will delay award setup. • Many sponsors accept proposals with a “pending” human subject protection protocol. Federal agencies often utilize a “Just-in-Time” procedure which postpones the requirement to submit an approved protocol until after the peer review process and just prior to the funding. Radiation and Safety If using radioactive materials Approval is required from the Committee on Ionizing Radiation (CIR). The PI is responsible for contacting this office to complete the necessary forms and procedures. Biosafety If the project involves the use of biohazards Infectious agents Infectious genetic material Human gene therapy Recombinant DNA or RNA Select Agents PI must complete the appropriate documentation & submit it to the Biosafety Officer, Health and Safety Division. Subject to institutional review and approval by: Environmental Health and Safety Committee Infectious Agents Committee and/or Institutional Biosafety Committee. Proposal Review and Approval OGC is responsible for all research, instructional, or public service activities that are related to the mission of the UCD|AMC and sponsored by external agencies or entities. All extramural requests for program funding and sponsorship, including grant applications and contract proposals must obtain institutional authorization prior to being submitted to the sponsor. • Route all documentation to OGC per campus guidelines Gifts, bequests, and donations should be submitted to the CU Foundation rather than OGC. Proposal Routing – What to Route Involves the process of completing and submitting proposal applications for internal approvals: • Approval of Application for Grant or Contract (Routing Form) • Contract proposal (or any other form of request for extramural funding) • The required signatures for processing the routing forms: Principal Investigator Department Chair, Dean or Administrator Office of Grants and Contracts Official Other signatures obtained only when applicable include Technology Transfer, Resident Counsel (legal review), the Vice Chancellor, and/or the Chancellor. Proposal Routing – What to Route The PI is responsible to obtain all appropriate or special signature approvals in the routing process. • • • • • Facilities Human subjects Lab animals Hazardous materials Bio-safety agents At time of submission to OGC, the proposal should be complete administratively and scientifically for the final review and signature unless arrangements have been made for OGC to complete a preview. The PI may be required to sign other documents either by OGC or the sponsor. Any required approval by UCD|AMC or the institutional official are to be signed by the OGC's authorized official for UCD|AMC. Proposal Routing – What to Route • Any document or documentation that is submitted to a sponsor or that is considered an attachment to a proposal. • All such documents should be included in the package of information routed to OGC. • Route a copy of any special project guidelines to assist OGC in the review process. Proposal Routing - Grant Review Grant applications should be routed with sufficient lead-time. Consider what needs to be achieved and the steps in the process to reach that goal. • To complete the routing, allocate time to: Secure the department and Dean signatures Obtain OGC’s review and comment on the application This includes allowing OGC time to identify any problems and for the PI or designee to submit any corrections that need to be made to the routing or application in order to obtain institutional endorsement. Obtain Institutional Endorsement • A good rule of thumb for minimum lead-time on grant applications is to have the application submitted to the Dean’s office 5-7 working days prior to the sponsor’s application submission deadline. Proposal Routing - Contract Review Contract proposals typically take more time to review and approve compared to grant applications. • Often require the negotiation of contract language. • A Contract Specialist will work with the PI or designee to negotiate the terms and conditions of the contract with the sponsor as appropriate. Contract proposals should be submitted with INCREASED lead time Follow the lead time recommendations for Grant Proposals Add an additional 2-3 days if your proposal include the need for contract review Expect the minimum lead-time on Contract applications to be 8-10 working days prior to the sponsor’s application submission deadline. Document Transfer to OGC Begin the routing process as early as possible. When to Route Route new proposals and continuing proposals that deal with new monies: When Not to Route Actions that need OGC approval but do not require routing: Funds that have not already been awarded to UCD|AMC Any new or additional award monies require the completion of an Approval of Application for Grant or Contract (Routing Form). Award notices for proposals that have already been routed Executed agreements that have already been routed Requests or authorizations for additional time Requests for carry forward of monies already awarded What is the Purpose of Routing? Routing provides internal approval to OGC of: • • • • Institutional Regulatory Safety information Written documentation of approval PI’s should review the certifications contained in the routing materials before signing the routing form and any other institutional or proposal documentation. What is the Purpose of Routing? PI provides UCD|AMC with the assurance and certification: • The routing and corresponding proposal is accurate and complete. • If awarded, PI is aware that he/she is responsible for compliance with award terms and conditions and University policies and procedures. – Particularly for the technical conduct of the work, submission of technical reports, regulatory compliance and financial management. • Arrangements have been made for funding any cost sharing requirements. (continued) What is the Purpose of Routing? • Disclosures have been made of any items requiring special consideration by the Dean, Chancellor’s Office, Planning Office or Resident Architect. • If a Research Program or Career Development Award, Disclosure of Financial Interests to Sponsored Research has been completed. • If there is a joint appointment with the Veterans Administration, a Memorandum of Understanding has been executed between UCD|AMC & VA – Full disclosure has been made to the NIH or other sponsors as required; and the PI’s time and effort will not be double billed for the same effort. If Clinical Trial research, PI also certifies: • Faculty and staff should have a proportionate amount of their compensation charged to the clinical trial directly or billed to the clinical trial through UPI for related faculty services. • Clinical trial data collection and analysis expenditures are billed appropriately to the clinical trial and not to medical insurance carriers. • Patient care billed to a third party commercial or governmental insurance plan is in accordance with the third party commercial or governmental insurance plan requirements. (continued) If Clinical Trial research, PI also certifies: • Associated income must be deposited into the UCD|AMC financial system through OGC and/or the OGC lock box mechanism. • PI understands that a residual balance of equal to or greater than $25,000 at the conclusion of the clinical trial is to be reported through the “Disclosure of Financial Interests Related to Sponsored Research” form (Fiscal Policy 4-9) – Reported through annual reporting of conflict of interest to the chair/unit director – Reported as required under COMIRB policy. • It is the PI’s responsibility to apply the accounting practices (allowability, allocability, and reasonableness) for costs associated with the agreement. Costs that are allocable to a particular agreement may not be shifted to other sponsored agreements, to other government or commercial health insurance payers or to the patient. OGC Review and Approval OGC reviews proposals for the following: Does the proposal have the appropriate internal approvals? Does it meet all sponsor guidelines? Is the budget appropriate? For example, does the budget calculate correctly? Is the proposal in compliance with University policies and procedures? – PI eligibility – Terms and condition Routing Benefits the PI Routing benefits the PI because it: Helps the PI present the best proposal to the sponsor. Reduces surprises. The division/department, school and University are all on board with proposal commitments. May reduce negotiations between OGC and sponsor. May reduce time or administrative efforts handling Post-Award issues after the award is received Sponsor approvals, cost transfers, etc. Improves relations with sponsors and may improve future funding opportunities. Award Negotiation, Award Approval and Set-Up (Module 6.00) In this module Awards Records Why is the Award So Important? Award Set-Up Academic Freedom Gift Awards Approvals Pre-Awards How Awards are Made Billing and Payment Award Acceptance Residual Balances Award Monitoring Payments 112 The Proposal Award Awards: Provides funds from a sponsor for support of a sponsored project. • This term is used for the original award, and subsequent supplements or modifications. (Could also be referred to as an agreement.) • The award sets out the obligations of the parties. – A written, legally enforceable document between an institution and sponsor. – Involves the expectation of an economic benefit and the generation of: • • • • Tangible product Report Service Other consideration to the sponsor – The benefits to the sponsor might include: • • • • Receipt of technical reports Evaluation, testing or evaluation of proprietary products, Development or construction of equipment Access to data, patents, copyrights, or consulting services. Agreements can take many forms including grants, cooperative agreements, contracts, sponsored research agreements, or any other agreement that is used to fund a sponsored project. Awards from… Grant Applications Contract Proposals Once the proposal has been sent to the sponsor Many times once the draft contract is received by OGC A waiting process before the PI or the institution is informed by the sponsor that an award will or will not be granted. There may be a delay finalizing the contract while terms and conditions are negotiated. Why is the Award so Important? The award document defines how the project can be carried out. Awards may: • Set limitations on the amount of freedom the PI and staff have to carry out the work. • Establish the number and complexity of financial and technical reports to be completed. • Limit how funds can be spent and restrict re-budgeting without prior approvals. The potential that the award document may restrict the PI and/or the institution, requires that the award be read, understood, and if necessary negotiated before it is accepted by the institution. Why is the Award so Important? The terms and conditions of the award are typically included in the award document and/or may point the reader to the source of such terms and conditions. For example, on federally funded awards there are standard regulations that apply and/or typically referenced rather than given in full text. • Office of Management and Budget (OMB) Circulars A-21 and A-133 are applicable to all federal awards, including both grants and contracts. • OMB Circular A-110 is applicable only to federal assistance awards. (grants; cooperative agreements) • Federal Acquisition Regulations (FAR) are applicable to federal contracts. Federal awards are governed by standardized rules and regulations (OMB Circulars and FARs), although each may also have unique terms. Non-federal awards do not have standardized rules and regulations, but usually have sponsor specific terms and conditions. Why is the Award so Important? Some awards require negotiation of terms and conditions before the award is acceptable. These terms and conditions may include: The designation of confidential information Publication rights Intellectual property ownership Indemnification (liability and risk) Terms and termination of the agreement Choice of law Confidential information Use of the University’s name Compensation and payment Expenditure of funds Ownership of equipment acquired under the agreement Why is the Award so Important? For the award to be acceptable, it must: Be in compliance with UCD|AMC, State of Colorado, and Federal policies and procedures. Terms and conditions must: Be reasonable under the circumstances and acceptable to the PI. For example, publishing rights are governed at the University by the concept of academic freedom and the Classified Research Policy. Administrative Policy Statement on Restricted, Proprietary and Classified Research The University functions on the premise of academic freedom and the University continually works to achieve an atmosphere of free inquiry and discussion. Academic Freedom A fundamental concept and defined as The freedom to inquire, discover, publish and teach truth as the faculty member sees it. Subject to no control or authority and save the control and authority of the rational methods by which truth is established. Academic freedom becomes an important issue when paired with sponsored research since: Sponsors of extramurally funded research often want to impose some restrictions on the PI and those working on the project. One of the reasons UCD|AMC reviews awards prior to acceptance is to Ensure that academic freedom is protected. This includes the requirement that faculty have complete freedom to study, learn, do research, and communicate the results of these pursuits to others. Academic freedom includes students who must be able to freely study and discuss issues. Academic Freedom This freedom will be restricted if the award offered by the sponsor: • Limits the ability to publish • Too broadly defines confidential information • Too broadly defines a sponsor’s ownership rights to intellectual property, including data and copyrights Academic Freedom The University of Colorado has an established policy on the acceptance of classified research. • Classified research is either: – Federally funded research with a designated security classification, or – Industrially funded research in which the sponsor requires a delay in publication in the open literature in excess of six months from the date of submission of the final project report by the PI to the sponsor. The policy excludes “routine testing services” and personal consulting by faculty members. • If the award document is in conflict with the policy on academic freedom or classified research: – OGC will pursue negotiation with the sponsor to reach agreement on acceptable language. Approvals Prior to UCD|AMC’s acceptance of an award, the PI may be responsible for obtaining any required approvals not already obtained in the routing process: Approvals might include: • • • • Human subjects Lab animals Hazardous materials Bio-safety agents The PI is also responsible for Answering project-specific questions of the sponsor Working with OGC to resolve any award issues that may need to be negotiated with the sponsor. OGC acts as primary institutional contact point for all Federal and non-federal sponsoring agencies. How Are Awards Made? OGC considers an award to be made when the award document is received by OGC and properly executed. Awards from Grant Applications Awards from Contract Proposals The PI and/or OGC normally receive written notification of the sponsor's decision regarding award of a grant application or the denial of funding. Awards made by contractual agreements are usually more complicated than awards made with grants. Contracts take longer to review, negotiate and approve than grant awards; be prepared for the inherent delays. Awards received must be reviewed by OGC, the PI, and/or designee to determine the terms and conditions that must be adhered to. Initial discussions between sponsor representatives and UCD|AMC faculty or staff are encouraged as necessary to confirm mutual interest. Contract Review and Approval Before any commitment is made, the following need to be submitted and approved through regular internal review procedures: • A routing form • An agreement (including a budget) must be submitted and approved through regular internal review procedures • Approved by an OGC authorized institutional official. Typical types of contracts include: Clinical trials Corporate sponsored agreements Federal contracts State agreements Contract Review and Approval OGC is responsible to negotiate contracts with industry, agencies or state and the Federal government, local municipalities and non-profit organizations before the award is approved. OGC will review: The terms and conditions of the award before obtaining an authorized signature (when a UCD|AMC signature is required for award acceptance). Agreements and award documents for • Comprehensiveness • Appropriate language • Compliance with guidelines set by the sponsor as well as the UCD|AMC and State requirements. The award notice for special terms and conditions, including prior approval requirements, and cost sharing. Negotiate terms and conditions for all UCD|AMC awards as needed. Intellectual Property issues (e.g., ownership of inventions and confidentiality) Requires the review by the Office of Technology Transfer. Contract Review and Approval OGC will review the award language to ensure that: • The terms are clear. • The essential elements of a contract are included and appropriate based upon the scope of the contract. • There is a budget providing for compensation of the work performed. • Terms of payment are clear, appropriate and manageable. • The sponsor’s invoicing requirements are appropriate and clear, including how the sponsor will be invoiced. Contract Language Some contracts have terms and conditions that are likely to cause problems down the road. Some examples of real problems include: • Contracts with reporting terms that could not be fulfilled by UCD|AMC and thus jeopardized payment by the sponsor. • Terms that included “payment will be withheld” meant that UCD|AMC was never paid. Also consider the financial stability of the company and the ability of the sponsor to meet the obligations of the contract. Acceptable agreements are to be signed by the authorized representative of the parties involved. Award Acceptance Award documents requiring a signature for acceptance must be signed by an authorized official of UCD|AMC. • Only those persons specifically authorized by the Regents of the University of Colorado or authorized delegates may legally sign agreements for the Regents, acting for and on behalf of UCD|AMC. Gentlemen's Agreements and/or Handshakes ≠ Awards! • Awards requiring a signature for acceptance are not considered final until all parties have signed the agreement and one original of the fully executed agreement is received by OGC|AMC. • Awards not requiring a signature for acceptance by UCD|AMC will be reviewed before the award is accepted internally by OGC. • When a UCD|AMC signature is required for award acceptance, OGC in consultation with the PI, will review the budget, terms, and conditions of the award before obtaining an authorized signature. Award Acceptance Important Points: The award is to UCD|AMC The award is not the PI’s personal spending money Most awards have restrictions Most awards require some accountability Award has been Accepted: Now Monitor it! Award Monitoring • UCD|AMC is required to keep separate records of each award that is funded. • This separation of records is maintained in a paper file in OGC while financial information is maintained in the PeopleSoft financial system. • In addition to institutional records, it is critical that the PI and department keep records (segregated by award) to keep track of the day-to-day activities of the project. – The record should include: Hiring Expenditures Reporting activities Keep Good Records! The PI or designee should establish a filing system for award monitoring: • Each award should be maintained separately, with the complexity of the record retention method being dependent on the type of award, reporting requirements including financial and technical reporting, the term of the award, purchasing and subrecipient arrangements, cost sharing, human, animal or bio-safety documentation, approvals and other requirements. • All documents related to the preparation, negotiation, award acceptance, expenditure activities including electronic Personnel Effort Reports (ePERs), hiring activities, monthly project or program statements, reports, subrecipient agreements or other services agreement should be maintained. Award Set-up An awarded proposal will be given a particular designation in the financial system. • Awards will be set up in the PeopleSoft Financial System based on the type of award. • The PeopleSoft Financial System is the centralized electronic financial system for the University: Processes on-line purchasing documents Provides financial status updates and Produces monthly accounting reports. Restricted Funds Fund 30 - Federal, State & Private Sponsors Records financial activity as a result of grant or contract awards to the UCD|AMC where the sponsor of the activity is a Federal, State, or private sponsor. Fund 31 - Local Government Sponsors Records financial activity as a result of grant or contract awards to UCD|AMC where the sponsor of the activity is a level of local government, such as a city or county within Colorado. Fund 34 - Gift Funds Records monies accepted by the CU Foundation as charitable contributions and subsequently transferred to UCD|AMC for use by UCD|AMC exclusively to fulfill its exempt purpose(s). There can be no expectation of economic benefit on the part of the donor; i.e., no deliverable. Account Codes in PeopleSoft PeopleSoft utilizes categories and subcategories for budgeting and spending on a project. • Subcategories allow the funds to be recorded and monitored in finer detail. For example: there is an account code to use when charging UCD|AMC projects for UPI physician services called UPI Physician Billing. • Correct recording of expenditures is beneficial, helping to reduce accounting and reporting problems later. • PeopleSoft can work to the advantage of the PI, administrative unit, and UCD|AMC if used correctly. Account Codes It is the Office of Grants and Contracts responsibility to: • Set up the project in the financial system (PeopleSoft) • Establish the appropriate budget for the project, in accordance with the sponsor’s award. A project number will be set-up and assigned. OGC will contact the designated departmental administrator with the awards’ project number(s) and speed type number(s). These numbers should be used to appropriately charge the financial activity (deposits and expenditures) for the award. • Always check the budget in PeopleSoft to ensure it fits with your understanding of the award. • Clinical trials are not set-up with budgets in PeopleSoft given the nature of the work and the funding. Gift Funds The CU Foundation handles gifts, therefore, gift funds should only be deposited with the CU Foundation. Handled differently from Grant or Contract funding Gift funds should never be: Directly deposited into a program fund at the campus level Deposited in a bank account outside of the University Deposited with UPI Transferred into a program fund from another project or program (either by crediting a revenue or expenditure account). See Fiscal Policy 4-14, Accounting for and Deposit of Gifts. Pre-Awards The mechanism used to set up a project in the financial system prior to the actual receipt and acceptance of an award document. What is a Pre-Award? How do I apply for a Pre-Award? For more information and Guidelines, Read the Fiscal Policy 4-10 “Establishing a Sponsored Program/Project Without an Award Document” Pre-Award Procedure To request a Pre-Award for a proposed project Submit the following to OGC in accordance with Fiscal Policy 4-10: Completed Routing of the Proposal Application with Approvals Completed Departmental Guarantee Memorandum Form (Pre-Award Request Form) If a Pre-Award is granted It will result in the assignment of a financial system project number being set up. The PI can then charge expenditures to that project number within the restrictions placed on the pre-award. The department assumes full financial responsibility For ALL expenditures incurred on a pre-award basis. Note! It is inappropriate (and at times even considered fraud) to incur costs on other sponsored projects with the intent to transfer those costs later to another project. There is a risk! If an award is not received, (and a contract goes unexecuted, or a sponsor decides to disallow pre-award costs regardless of the reason) the department must transfer any disallowed or unfunded costs to the unrestricted account designated on the Guarantee Memorandum. Billing and Payment Once the award is set-up in PeopleSoft • There is the expectation by UCD|AMC that funding (in whole or in part) will be received to cover the expenditure activity of the project. The cash management expectations of awards will vary based on the funding mechanism and sponsor. Funding Mechanisms There are several funding mechanisms that may be used when UCD|AMC enters into a sponsored project. The three primary types of funding mechanisms are: • Cost Reimbursement • Fixed-Price • Fixed-Rate Cost Reimbursement Funding Mechanism The cost reimbursement type of payment mechanism is set up so that the sponsor will reimburse UCD|AMC for actual dollars spent on allowable expenditures to carry out a project. • Also known as “Pay after the fact” • Agreements are normally performed on a best efforts basis and create the least amount of risk for the University. • Many federal agencies will provide grant award funds for a specified budget period in advance. These are still considered cost reimbursement. A common component of federally funded cost reimbursement grant awards is that any monies paid in advance, which are not spent, are to be returned to the sponsor at the end of the budget period (unless indicated otherwise). • UCD|AMC can only keep funds that have been spent appropriately. • Any advance payments may also place a requirement on UCD|AMC to pay interest to the sponsor. Fixed-Price Funding Mechanism Occurs when UCD|AMC agrees to provide services or deliver a product for a fixed level of compensation. • If the cost of providing such service or product exceeds the fixed amount of funding, UCD|AMC (and thus the administrative unit) would be required to cover any uncompensated costs. • A fixed-price funding structure is more complicated if the award is terminated early. Termination may require UCD|AMC to negotiate final payment amounts based on actual expenditures. • PI’s often view a fixed-price funding structure as more favorable, but this method carries with it additional risk For example: Cost Over-runs • Fixed-price funding structures are not appropriate for certain types of research. For instance: Basic or development research with defined deliverables that specify certain results would not be appropriate. Fixed-Rate Funding Mechanism The Fixed-Rate funding mechanism structure occurs when: • Payment is not based on actual costs expended, but on a mutually agreed upon rate per activity performed. Fixed-price and fixed-rate agreements may result in large residual balances at the end of a project if expenses are lower than budgeted. Residual Balances Large residual balances raise suspicions that expenditures were charged inappropriately • A red flag for auditors is finding large residual balances (excess funds) at the end of an award. Examples of Suspicions raised by red flag items: • Charges were made to another project inappropriately • Patient billing was not handled appropriately • A conflict of interest may be present Keep this in mind when managing fixed price and fixed rate agreements Payments Payments are received by UCD|AMC from a sponsor in one of the following ways: • • • • • • Advance payment of the entire award amount Scheduled payments made on receipt of deliverable(s) or at a given time frame Payments made upon receipt of invoice(s) that include actual expenditure information Mixed payment method, For example: An advance partial payment and then scheduled payments on receipt of deliverables. Many non-federal or federal flow-through agreements require UCD|AMC to invoice the sponsor in order to receive payment. OGC will prepare and submit invoices to the sponsor based on expenditures made and recorded appropriately in PeopleSoft Non-federal Clinical Trials are normally based on patient information and accordingly are not billed by OGC. • OGC also manages accounts receivable for projects. OGC bills and assists in pursuing prompt payment of sponsor commitments. Final responsibility is with the departments. Invoicing If PI’s signature is required on the invoice The signed invoice must be returned to OGC as soon as possible. If the PI is required to provide additional information to the sponsor for billing purposes It is the PI and department’s responsibility to provide necessary documentation on a timely basis to OGC. Clinical Trails In the case of Clinical Trials, it is appropriate for the PI to work directly with the sponsor to receive payment. If the sponsor requires receipt of a deliverable then it is the PI’s responsibility to provide such information in a timely manner. For Example: A technical report, case report forms, etc. For clinical activities • It is the responsibility of the PI to ensure expenditures are charged to the project appropriately. • This includes ensuring that (if any) - Invoicing/financial reporting - Hospital/patient care charges - Billing for patient care charges - Medicare billing is handled appropriately - The project functions on a positive cash basis See Fiscal Policy 4-1, Clinical Trials for details • Departments with multiple clinical trial awards may want to consider establishing a Service Center for the provision of services to the clinical trials due to the variety of payment methods. See Internal Service Centers and Core Laboratories policy for more information. Wire Transfers Wire transfers can be set up for receipt of payment from sponsors. • Contact OGC for wire Information and assistance. Receipt of Payments When payment is received for a project OGC will attempt to determine where the payment should be recorded. OGC will contact departments as needed for assistance. For information about payments received, check PeopleSoft or contact your Post-Award Administrator.