Standard Oil Co. of California v. US (1949)

advertisement

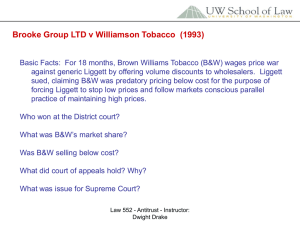

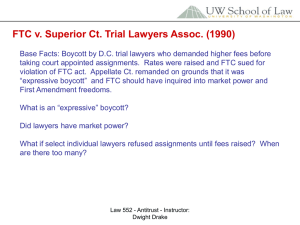

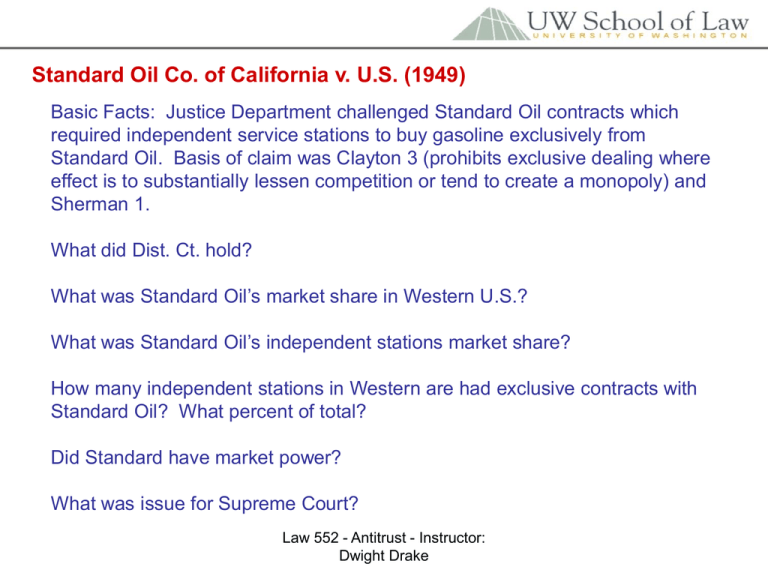

Standard Oil Co. of California v. U.S. (1949) Basic Facts: Justice Department challenged Standard Oil contracts which required independent service stations to buy gasoline exclusively from Standard Oil. Basis of claim was Clayton 3 (prohibits exclusive dealing where effect is to substantially lessen competition or tend to create a monopoly) and Sherman 1. What did Dist. Ct. hold? What was Standard Oil’s market share in Western U.S.? What was Standard Oil’s independent stations market share? How many independent stations in Western are had exclusive contracts with Standard Oil? What percent of total? Did Standard have market power? What was issue for Supreme Court? Law 552 - Antitrust - Instructor: Dwight Drake Standard Oil Co. of California v. U.S. (1949) What was Court’s basis for holding that requirement of Clayton 3 was satisfied? How was Court influenced by fact that Standard Oil’s competitors all used exclusive requirement contracts? What was Court’s view of relative short-term and long-term effects? How did Court view the use of economic tests to evaluate requirements contracts? Dissent (Jackson, Vinson, Burton); Ct adopts per se. Requirements contracts often “wage” competition, not suppress it. Business demands of industry justify such agreements. Shouldn’t use “lash of antitrust” when businessmen develop successful method to compete. Law 552 - Antitrust - Instructor: Dwight Drake Tampa Electric Co. v. Nashville Coal Co. (1961) Facts: Nashville contracted to supply all Tampa’s coal needs for new plant at stated price. Prices jumped up, Nashville reneged, claiming contract violated Clayton 3 and Sherman Act. What did Court say was key consideration for Clayton 3? What factors lead Court to conclude this factor not satisfied? What was relevant market? How was it impacted by contract? How did Court distinguish Standard Oil Case? Law 552 - Antitrust - Instructor: Dwight Drake Barry Wright Corp. v. ITT Grinnell Corp. (1st Cir. 1983) Facts: Grinnell, nuclear plant pipe installer and buyer of 50% of snubbers in U.S., was customer of Pacific, only snubber manufacturer in U.S. To secure alternative source, Grinnell financed Barry and agreed to buy all 1977 needs from Barry. When Pacific dropped price and Barry missed deliveries, Grinnell entered into large fixed dollar amount contract with Pacific for 1977-79. Barry sued under Clayton and Sherman. What did court say about per se rule as applied to exclusivity or requirements contracts? What was Grinnell’s market share? How much competition did the agreement foreclose? What factors impacted court’s decision that Dist. Ct. could conclude Grinnell’s contracts with Pacific were not “exclusionary” and thus not unlawful under antitrust? Law 552 - Antitrust - Instructor: Dwight Drake Barry Wright Corp. v. ITT Grinnell Corp. (1st Cir. 1983) Facts: Grinnell, nuclear plant pipe installer and buyer of 50% of snubbers in U.S., was customer of Pacific, only snubber manufacturer in U.S. To secure alternative source, Grinnell financed Barry and agreed to buy all 1977 needs from Barry. When Pacific dropped price and Barry missed deliveries, Grinnell entered into large fixed dollar amount contracts with Pacific for 1977-79. Barry sued under Clayton and Sherman. What did court say about per se rule as applied to exclusivity or requirements contracts? What was Grinnell’s market share? How much competition did the agreement foreclose? What factors impacted court’s decision that Dist. Ct. could conclude Grinnell’s contracts with Pacific were not “exclusionary” and thus not unlawful under antitrust? Law 552 - Antitrust - Instructor: Dwight Drake Valley Liquors Inc. v. Renfield Importers (7th Cir. 1982) Facts: Liquor distributor reordered distributors and eliminates price-cutter distributor with no explanation. Dismissal was affirmed, Posner stating: - Elimination of price-cutter may not have negative effect on intraband comp. - Reduction in intrabrand competition not presumed illegal. - In restricted distribution case, P must show consumer worse off after consideration of intrabrand and interbrand competition. - Market power is key factor to prove harm to consumers. If no market power, can’t afford to take actions harmful to consumers. - Even if “powerless firm” use distribution practices that have anticompetitive effect, it too small to warrant “trundling out the great machine of antitrust.” Law 552 - Antitrust - Instructor: Dwight Drake United States v. Microsoft (D.C. Cir. 2001) (Exclusive Dealing) Facts: Microsoft gave AOL desktop space and AOL agreed not to promote any non-Microsoft browser except at customers request and then no more than 15% of non-Microsoft Browsers. How much of internet access providers had Microsoft tied up? Why had Sherman 1 claim against Microsoft been dismissed, not appealed? How did court generally view exclusive contracts? How significant was Microsoft’s monopoly power in OS system to condemnation of exclusive contracts? What was Microsoft’s alleged justification for exclusive contracts? Law 552 - Antitrust - Instructor: Dwight Drake EU Exclusive Dealing What were two primary conditions per European Court of Justice in Stergious Delimitis v. Henninger Brau AG, the beer case? What were the compelling factors that struck down the exclusive “ice cabinets” in Scholler Lebensmittel (the ice cream case)? What was the market share in ice cream case? How does the analysis in EU cases differ from rule of reason analysis of Microsoft, Jefferson Parish, Valley Liquors? Law 552 - Antitrust - Instructor: Dwight Drake Principe v. McDonald’s Corp (4th Cir. 1981) What were alleged tied products? What was P’s complaint about economics of building lease requirement? Were the lease, note and license deemed separate products for tying purposes? How did court distinguish Chicken Delight, which found illegal tying? Given court’s rationale, could McDonald’s ever go to far and expose itself to antitrust? Law 552 - Antitrust - Instructor: Dwight Drake Queen City Pizza v. Domino’s Pizza, Inc. (3rd Cir. 1997) What did Domino’s agreement require regarding “ingredients, supplies and materials for making pizza? How much of ingredient aftermarket did Dominos control with its franchisees? What had franchisees done to develop other sources? Had they succeeded? Why? What had Dominos done to frustrate efforts? What was District Ct.’s rational for dismissing antitrust claims? Note P’s six distinct antitrust claims top of page 599. How did court view contract restrains impact on relevant market? How did court distinguish Kodak after-market result? Note treatment of information and switching challenges of Kodak holding. Note how court used its market power conclusion to deny all P’s antitrust claims, noting P might have contract claims. Law 552 - Antitrust - Instructor: Dwight Drake Queen City Pizza v. Domino’s Pizza, Inc. (3rd Cir. 1997) Dissent: How did dissent’s view of relevant market differ from majority view? How did dissent view information, switching costs and lock-in problems? Are Domino’s franchisees more or less vulnerable than ISOs in Kodak? Is that relevant? How about consumers? Was Kodak’s product any more unique than Domino’s from consumer perspective? How relevant is the uniqueness factor? Law 552 - Antitrust - Instructor: Dwight Drake