Word - The Compassionate Friends

advertisement

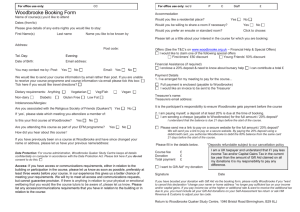

The Compassionate Friends Donations & Gift Aid Form CAF REF FS2944 Please complete payment method A or B or C or D and circle letter as appropriate: A. I WISH TO MAKE A REGULAR DONATION BY DIRECT DEBIT Please complete the direct debit mandate overleaf. B. BY BANK TRANSFER I confirm I have made a transfer of £____________by BACs to The Compassionate Friends at the Charities Aid Foundation Bank ; A/C No. 00087690: sort code 405240 Signature ___________________________________________________ Date____________________ C. BY CHEQUE and enclose a cheque for the sum of £_____________ made payable to The Compassionate Friends. D. BY CREDIT/DEBIT CARD I authorise you to debit my account with the amount £_________ Card type MASTERCARD / VISA / DELTA / SWITCH / OTHER ________________ Cardholders Name Card Number Start Date ______________________________________ Expiry Date __ Switch Card Issue No. ____Security Code _____ Gift Aid Declaration Please complete this section if you are a UK taxpayer. Using Gift Aid means that for every pound you give, we get an extra 25 pence from the Inland Revenue, helping your donation to go further. This means that £10 can be turned into £12.50 just so long as donations are made through Gift Aid. Imagine what a difference that could make and it doesn’t cost you a thing. So if you want your donation to go further, Gift Aid it – simply tick the statements below, sign and date, and return it with your payment details. Please treat as Gift Aid donations all qualifying gifts of money made. Please tick all boxes you wish to apply: □Today □In the past 4 years □In the future □ I confirm I have paid or will pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April to 5 April) that is at least equal to the amount of tax that all the charities or Community Amateur Sports Clubs (CASCs) that I donate to will receive on my gifts for that tax year. I understand that other taxes such as VAT and Council Tax do not qualify. I understand the charity will reclaim 25p of tax on every £1 that I give. Signature____________________________________________ Date ___________________________ Please return the whole completed application form with your payment to: The Compassionate Friends, 14 New King Street, Deptford, London SE8 3HS. Tel: 0345 120 3785 info@tcf.org.uk www.tcf.org.uk Charity no: 1082335 Company no: 04029535 Instruction to your Bank or Building Society to pay by Direct Debit Charity Name: The Compassionate Friends Name and full postal address of your Bank or Building Society Service User Number To: The Manager 6 9 1 2 1 3 CAF, Kings Hill, West Malling, Kent, ME19 4TA Bank/Building Society Instruction to your Bank or Building Society Please pay Charities Aid Foundation Direct Debits from the account detailed in this Instruction subject to the safeguards assured by the Direct Debit Guarantee. I understand that this Instruction may remain with Charities Aid Foundation and, if so, details will be passed electronically to my Bank/Building Society. Address Postcode Name(s) of Account Holder(s) Signature(s) Bank/Building Society account number Branch Sort Code Banks and Building Societies may not accept Direct Debit Instructions from some types of account This is not part of the Instruction to your Bank or Building Society My Details Donation Details Name I would like to make a regular donation of Mr Mrs Ms Other (Please Specify) Quarterly 01 15 Address Half Yearly / / Monthly / / £ Annually Commencing or Gift Aid Declaration I confirm I have paid or will pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April to 5 April) that is at least equal to the amount of tax that all the charities or Community Amateur Sports Clubs (CASCs) that I donate to will reclaim on my gifts for that tax year. I understand that other taxes such as VAT and Council Tax do not qualify. I understand the charity will reclaim 25p of tax on every £1 that I give and that Gift Aid cannot be claimed where my family or I receive a personal benefit. Postcode Tick for Gift Aid to apply This guarantee should be detached and retained by the Payer The Direct Debit Guarantee • This guarantee is offered by all Banks and Building Societies that accept instructions to pay Direct Debits • If there are any changes to the amount, date or frequency of your Direct Debit, Charities Aid Foundation will notify you ten working days in advance of your account being debited or as otherwise agreed. If you request Charities Aid Foundation to collect a payment, confirmation of the amount and date will be given to you at the time of the request • If an error is made in the payment of your Direct Debit, by Charities Aid Foundation or your Bank or Building Society, you are entitled to a full and immediate refund of the amount paid from your bank or building society - If you receive a refund you are not entitled to, you must pay it back when Charities Aid Foundation asks you to • You can cancel a Direct Debit at any time by writing to your Bank or Building Society. Written confirmation may be required. Please also send a copy of your letter to us.