Lecture-28

advertisement

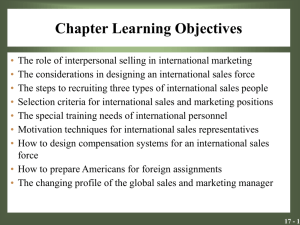

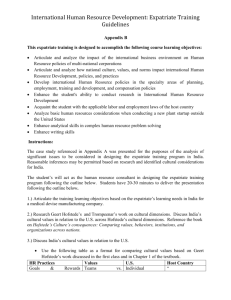

Global Business Management (MGT380) Lecture #28 Global Human Resource Management Learning Objectives To recognize how management development and training programs can increase the value of human capital in the international business firm. To understand how and why performance appraisal systems might vary across nations. Understand how and why compensation systems might vary across nations. Understand how organized labor can influence strategic choices in the international business firm. Quick recap of the last lecture Human resource management (HRM) - the activities an organization carries out to utilize its human resources effectively These activities include i) determining human resource strategy ii) staffing performance evaluation iii) management development iv) compensation labor relations v) Firms need to ensure there is a fit between their human resources practices and strategy HRM can help the firm reduce the costs of value creation and add value by better serving customer needs HRM must also determine when to use expatriate managers i)citizens of one country working abroad ii) who should be sent on foreign assignments iii) how they should be compensated iv) how they should be trained v) how they should be reoriented when they return home Staffing policy is concerned with the selection of employees who have the skills required to perform a particular job can be a tool for developing an promoting the firm’s corporate culture the organization’s norms and value system; a strong corporate culture can help the firm implement its strategy 1. 2. 3. Three main approaches to staffing policy The ethnocentric approach - fill key management positions with parentcountry nationals The polycentric approach recruit host country nationals to manage subsidiaries in their own country, and parent country nationals for positions at headquarters The geocentric approach seek the best people, regardless of nationality for key jobs Firms using an ethnocentric or geocentric staffing strategy will have expatriate managers Expatriate failure is the premature return of an expatriate manager to the home country The main reasons for U.S. expatriate failure are i) the inability of an expatriate's spouse to adapt ii) the manager’s inability to adjust iii) other family-related reasons iv) the manager’s personal or emotional maturity v) the manager’s inability to cope with larger overseas responsibilities A global mindset may be the fundamental attribute of a global manager cognitive complexity cosmopolitan outlook After selecting a manager for a position, training and development programs should be implemented Training focuses upon preparing the manager for a specific job Management development is concerned with developing the skills of the manager over time Cultural training - fosters an appreciation for the host country's culture Language training - an exclusive reliance on English diminishes an expatriate's ability to interact with host country nationals Practical training - helps the expatriate and her family ease themselves into day-to-day life in the host country But, studies show only about 30% of managers sent on one- to five-year expatriate assignments received training before their departure Why Is A Global Mindset Important? A global mindset may be the fundamental attribute of a global manager cognitive complexity cosmopolitan outlook A global mindset is often acquired early in life from a family that is bicultural living in foreign countries learning foreign languages as a regular part of family life What Is Training And Management Development? After selecting a manager for a position, training and development programs should be implemented Training focuses upon preparing the manager for a specific job Management development is concerned with developing the skills of the manager over time gives the manager a skill set and reinforces organizational culture Historically, most firms focus more on training than on management development Why Is Training Important For Expatriate Managers? Training can reduce expatriate failure Cultural training - fosters an appreciation for the host country's culture Language training - an exclusive reliance on English diminishes an expatriate's ability to interact with host country nationals Practical training - helps the expatriate and her family ease themselves into day-to-day life in the host country But, studies show only about 30% of managers sent on one- to five-year expatriate assignments received training before their departure What Happens When Expatriates Return Home? Training and development should include preparing and developing expatriate managers for reentry into their home country organization need good programs for re-integrating expatriates back into work life within their home country organization utilizing the knowledge they acquired while abroad Why Is Management Development Important To Firm Strategy? Management development programs increase the overall skill levels of managers through ongoing management education rotations of managers through jobs within the firm to give them varied experiences Management development can be a strategic tool to build a strong unifying culture and informal management network support both transnational and global strategy How Should Expatriates Be Evaluated? Evaluating expatriates can be especially complex typically, both host nation managers and home office managers evaluate the performance of expatriate managers But, both types of managers are subject to unintentional bias home country managers tend to rely on hard data when evaluating expatriates host country managers can be biased towards their own frame of reference How Can Performance Appraisal Bias Be Reduced? To reduce bias in performance appraisal more weight should be given to an on-site manager's appraisal than to an off-site manager's appraisal a former expatriate who has served in the same location should be involved in the process home office managers should be consulted before an on-site manager completes a formal termination evaluation What Are The Key Issues In Compensating Expatriates? 1. 2. Two key issues on compensation How to adjust compensation to reflect differences in economic circumstances and compensation practices How to pay expatriate managers How Should National Differences In Compensation Be Treated? Currently, there are substantial differences in executive compensation across countries Research shows a top U.S. executive made an average of $525,923 in the 2005-2006 period, compared to $278,697 in Japan, and $158,146 in Taiwan How Should National Differences In Compensation Be Treated? Question: Should pay be equalized across countries? Many firms have recently moved toward a compensation structure that is based on global standards especially important in firms with a geocentric staffing policy But, most firms still set pay according to the prevailing standards in each country How Should Expatriates Be Paid? Most firms use the balance sheet approach equalizes purchasing power across countries so employees have the same living standard in their foreign posting as at home and adds a financial incentive to take the position Note that home-country outlays for the employee are designated as income taxes, housing expenses, expenditures for goods and services (food, clothing, entertainment, etc.), and reserves (savings, pension contributions, etc.). The balance sheet approach attempts to provide expatriates with the same standard of living in their host countries as they enjoy at home plus a financial inducement (i.e., premium, incentive) for accepting an overseas assignment. The balance sheet approach is the most widely used approach by organizations and its main idea is to maintain the expatriate’s standard of living throughout the assignment at the same level as it was in his/her home country. In other words, it is about ensuring the same purchasing power, which helps to maintain the home country’s lifestyle. Another important notion is that the balance sheet approach implies matching the expatriate’s salary with home-country peers, not with the host-country colleagues. There are two common methods of calculating the balance sheet approach. The home-based method, a term often used interchangeably with balance sheet, bases the expat’s pay on the salary for a comparable job in his or her home city. On the other hand, the headquarters-based method starts with the salary for a comparable job in the corporate headquarters’ city. For example, an expat from a Dallas office of a New York City-based company would receive a salary structured from New York City rates. The same goes for an expat from a London or Tokyo office of the same company. 1. 2. 3. 4. 5. 6. In general, a pure home-based balance sheet calculation of expatriate pay works something like this: Start with home-based gross income, including bonuses. Deduct home tax, social security and pension contributions (either a hypothetical tax or a real tax). Add or subtract a cost-of-living allowance. Usually, companies don’t subtract. Instead, they allow the expatriate to benefit from the negative differential. Add a housing allowance, either with or without a housing norm deduction. Add incentive premiums, including general mobility premiums and sometimes hardship premiums. Add or subtract to equalize taxes. In other words, gross the net salary to protect against the double tax obligations in the home and host countries. How Should Expatriates Be Paid? 1. A compensation package has five components Base salary - normally in the same range as the base salary for a similar position in the home country 2. can be paid either in the home currency or in the local currency Foreign service premium - extra pay the expatriate receives for working outside his country of origin generally offered as an incentive to accept foreign assignments How Should Expatriates Be Paid? 3. 4. Various allowances - hardship, housing, cost-ofliving, education Tax differentials - may have to pay income tax to both the home country and the host-country governments no reciprocal tax treaty exists 5. company usually covers extra tax assessments Benefits – many firms provide the same level of medical and pension benefits abroad that employees receive at home Why Are International Labor Relations Important? Question: Can organized labor limit the choices available to an international business? Labor unions can limit a firm's ability to pursue a transnational or global strategy HRM needs to foster harmony and minimize conflict between management and organized labor What Are The Concerns Of Organized Labor? Organized labor is concerned that 1. 2. 3. Multinationals can counter union bargaining power by threatening to move production to another country Multinationals will farm out only low-skilled jobs to foreign plants making it easier to switch production locations Multinationals will import employment practices and contractual agreements from their home countries and reduce the influence of unions How Does Organized Labor Respond To MNC Power? Organized labor has responded to the increased bargaining power of multinational corporations by 1. 2. 3. Trying to set-up their own international organizations Lobbying for national legislation to restrict multinationals Trying to achieve regulation of multinationals through international organizations such as the United Nations So far, these efforts have had only limited success How Are MNCs Responding To Organized Labor? Many firms are centralizing labor relations to enhance the bargaining power of the multinational vis-à-vis organized labor in the past, labor relations were usually decentralized to individual subsidiaries The way in which work is organized within a plant can be a major source of competitive advantage so it is important for management to have a good relationship with labor Summary of the lecture A global mindset may be the fundamental attribute of a global manager i)cognitive complexity ii) cosmopolitan outlook A global mindset is often acquired early in life from i) a family that is bicultural ii) living in foreign countries iii) learning foreign languages as a regular part of family life Training focuses upon preparing the manager for a specific job Management development is concerned with developing the skills of the manager over time ---gives the manager a skill set and reinforces organizational culture Cultural training - fosters an appreciation for the host country's culture Language training - an exclusive reliance on English diminishes an expatriate's ability to interact with host country nationals Practical training - helps the expatriate and her family ease themselves into day-to-day life in the host country But, studies show only about 30% of managers sent on one- to five-year expatriate assignments received training before their departure Management development programs increase the overall skill levels of managers through i) ongoing management education ii)rotations of managers through jobs within the firm to give them varied experiences Evaluating expatriates can be especially complex typically, both host nation managers and home office managers evaluate the performance of expatriate managers But, both types of managers are subject to unintentional bias i) home country managers tend to rely on hard data when evaluating expatriates ii) host country managers can be biased towards their own frame of reference To reduce bias in performance appraisal i) more weight should be given to an on-site manager's appraisal than to an off-site manager's appraisal ii)a former expatriate who has served in the same location should be involved in the process Two key issues on compensation 1. 2. 3. 4. 5. 1. How to adjust compensation to reflect differences in economic circumstances and compensation practices 2. How to pay expatriate managers A compensation package has five components Base salary - normally in the same range as the base salary for a similar position in the home country-can be paid either in the home currency Foreign service premium - extra pay the expatriate receives for working outside his country of origin Various allowances - hardship, housing, cost-of-living, education Tax differentials - may have to pay income tax to both the home country and the host-country governments no reciprocal tax treaty exists company usually covers extra tax assessments Benefits – many firms provide the same level of medical and pension benefits abroad that employees receive at home