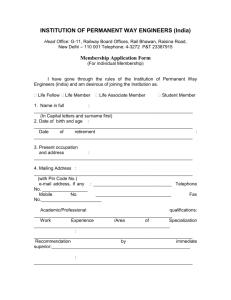

Name: V NATARAJAN

advertisement

From PK Ranganathan BRIEF FOR SECRETARY DOPT. Past pensioners are entitled to a certain minimum pension, every time the pay scale/pension is revised through the recommendations of the central pay commissions. On the principle of modified parity, this minimum pension is linked to the minimum of the corresponding new pay scales,( being 50% of the minimum pay ) under the new CPC regime. With the introduction of the concept of Pay Band, in the 6th CPC, several 5th CPC pay scales were grouped into 4 pay bands. Though the distinct differentiation of the erstwhile pay scales were retained by creation of corresponding concordance for the hierarchy of scales within each of the pay bands, a misinterpretation that the minimum of the pay band and the minimum of the corresponding pay within the pay band are same, resulted in completely nullifying the protection of minimum pension envisaged in the resolution accepting the 6th CPC recommendations and guaranteed under the pension rules. A majority of pensioners, , had represented against this injustice to authorities in the government, in some cases right up to the PM/President of India. Several pensioner groups were pushed to approach the courts of law. Resulting in: CAT PRINCIPAL BENCH observations/ DIRECTIONS: 29. From the above extracted portion it is clear that the principle of modified parity, as recommended by the V CPC and accepted by the VI CPC and accepted by the Central Government provides that revised pension in no case shall be lower than 50% of the sum of the minimum of the pay in the pay band and grade pay corresponding to revised pay scale from which the pensioner had retried. According to us, as already stated above, in the garb of clarification, respondents interpreted minimum of pay in the pay band as minimum of the pay band. This interpretation is apparently erroneous, for the reasons: Quote “In view of what has been stated above, we are of the view that the clarificatory OM dated 3.10.2008 and further OM dated 14.10.2008 (which is also based upon clarificatiory OM dated 3.10.2008) and OM dated 11.02.2009, whereby representation was rejected by common order, are required to be quashed and set aside, which we accordingly do. Respondents are directed to re-fix the pension of all pre-2006 retirees with effect from 1.1.2006, based on the resolution dated 29.08.2008 and in the light of our observations made above. Let the respondents re-fix the pension and pay the arrears thereof within a period of 3 months from the date of receipt of a copy of this order. OAs are allowed in the aforesaid terms, with no order as to interest and costs.” Unquote. The above directions of the CAT principal bench, has reached its absolute legal finality, after judicial scrutiny through a writ in the high court, SLP in the HSC, review on its dismissal and curative petition on the rejection of review, all from the government side and dismissed. It will be obvious that the above verdict is the enunciation of the principles for fixing the pension in terms of Government resolution and covers ALL Pre 2006 pensioners with effect from 01-01-2006., the observations of the CAT leading to the above directions clarify that the minimum pension shall be the min at 50% of the corresponding table of concordance for each scale within the different pay bands. Your attention is invited to DOP&PW OM F.No 38/37/08-P&PW (A) dated 20-01-2013, authorizing stepping up of pension of pre 2006 pensioners with effect from 24/09/2013, as per the concordance table. In terms of the legal directions above, this revision of pension is due from 01-01-2006, with accrued arrears thereon Facts Admitted by GOI ( DOP&PW ) Lok sabha question and reply. A group of employees had approached the Central Administrative Tribunal (CAT) on the issue (d): Based on some petitions filed in the Central Administrative Tribunal by pre-2006 retirees, Hon’ble Tribunal held that the clarification issued vide OM No.38/37/08-P&PW(A) dated 3.10.2008 and 14.10.2008 were not in conformity with the recommendations of the Sixth Central Pay Commission and the O.M. dated 1.9.2008. Central Administrative Tribunal directed to re-fix the pension of all pre-2006 retirees w.e.f. 1.1.2006, based on the resolution dated 29.08.2008 and in the light of the observations made in the judgement dated 1.11.2011 of the Hon’ble CAT. (e): The Government has filed a Writ Petition in Delhi High Court challenging the judgement dated 1.11.2011 of the Hon’ble CAT. The matter is sub-judice. Para ‘S” of Curative petition : After the OM of 28.01.2013 which is prospective l.e. appl icable w.e. f. 24.09.10 12, all pre-2006 pensioners are entitled to draw the stepped up pensionary benefits. The present Petition therefore is limited to the question of giving them the stepped-up pensionary benefits retrospectively i.e. from 1.1.2006 till 23 September 2012 which as stated above is likely to cost the public exchequer over Rs. 1400 crores. Para12,13,23,15 and26 of MA/ 12 That with regard to the clarification issued on the question of the minimum of pay which is to be reckoned for the purpose of computing revised pension in terms of oara 4.2 of OM dated 1.9.2008, this Hon'ble Tribunal observed that the contention of the Covemment fur treating the starting point of the pay band as the minimum pay in the pay band cannot be accepted. This Hon'ble Tribunal observed that the minimum pay for the purpose of para 4.2 is the minimum pay adrr issible to a serving employee as on 1.1.2000 in accordance with the fitment table for fixation of pay of the serving employee. The Hon'ble Tribunal directeu the fixation of pension in te rns of para 4.2 accordingly. 13.. It is also submitted that the only issue which was dealt with in the order dated 01.11.2011 of this Hon'ble Tribunal, related to t'ie minimum pay in the pay band which was to be reckoned for the purpose of calculating pension in terms of para 4.2 of the OM dated 1.9.2008. The order dated 01.11.2011 of this Hon'ble Tribunal did not deal with any other clarification issued in the OM dated 3.10.2008 and the subsequent OMs issued by the Department of Pension and PW 23. That in the meantime an OM dated 2S.01.2013 was issued by the Ministry of Personnel, Public Grievances and Pensions, Department of Pension and Pensioners' Welfare containing a decision to further f ~l:;pup to pension of pre-2006 pensioners as revised w.e.f In terms of para 4.1 or para 4.2 of the OM dated 1.9.200S with reference to the fitment tables annexed to the Ministry of Finance, Department of Expenditure OM aateo so" August, 2008. The said OM dated 28.01.2013 was issued in pursuance of a Cabinet decision taken on the recommendations of a Committee of Secretaries and the benefit approved for Armed Forces personnel has also been extended to the Central Civil pensioners. Although this decision of the Cabinet was an An independent and fresh decision to be implemented from a prospective date in reference to the fitment tables annexed to the OM dated 30.0B.200B, however, it takes care of the demand of pre-2006 retirees (including petitioners herein) w.e.f. 24.09.2012. A copy of OM order dated 28.01.2013 is annexed hereto and marked as Annexure A-B. 25. As already submitted in the above paras, the only issue which was dealt with in the order dated 01.11.2011 related to the minimum pay in the pay band which is to be reckoned for the purpose of calculation of revised pension of pre-2006 retirees and that this Hon'ble Tribunal had no intention to ouash all other clarifications issued in the OM dated J.t 0.200B. 26. It is, therefore, most humbly prayed that this Hon'ble Tribunal maykindly pass a suitable clarificatory order cIarifying that tile order dated 01.11.2011 of this Hon'ble Tribunal is confined to the issue related to the minimum pay in the pay band which is to be reckoned for the purpose of calculation of revised pension of pre-2006 retirees in terms of para 4.2 of OM dated 1.9.200B and that the said order dated 01.1'1.2011 will have no effect on any other clarification issued vide OM dated 3.10.200B, including the the clarification that the pension calculated in terms of para 4 2 dated 1 9.2008 will be reduced pro-rata where the pensioners had less than the maximum required service for full pension. Facts legally established. Dismissal of the writ petition 8. We are in complete agreement with the reasoning of the Division Bench of the Punjab & Haryana High Court and adopt the same and do not burden ourselves any further. We conclude by noting that as regards the substance of the view taken by the Tribunal, even the Central Government accepts its correctness, but insists to make the same applicable prospectively. 9. The writ petitions are dismissed. The decision of the Full Bench of the Tribunal is upheld but without any order as to costs. Dismissal of SLP by the HSC “We are not inclined to interfere with the order passed by the High Court. Consequently, the special leave petitions are dismissed. However, the petitioners are at liberty to raise all points before the Tribunal as and when the appea CAT PB Final Disposal Of CP and MA C.P. No.158/2012 This is an application for initiating contempt proceedings against the respondents for not carrying out the judgment/order of the Tribunal dated 01.11.2011 in O.A. No.655/2010 and connected cases. 2. At the outset, Shri Rajesh Katyal, the learned counsel appearing on behalf of the respondents, on instructions from Ms. Tripti Ghosh, Director and Shri Harjit Singh, Dy. Secretary, submits that the Curative Petition preferred by them has already been rejected by the Hon ble Apex Court by order dated 30.04.2014, and that the Ministry of Law has advised the Department to implement the aforesaid order of the Tribunal AS (qua ) the petitioners. He submits that some reasonable time may be given to them to implement the aforesaid order. 3. In view of the above, we are of the view that no purpose would be served by keeping this matter pending and it would be appropriate to dispose of the matter with direction to the respondents to implement the directions of the Tribunal expeditiously, preferably within three months. 4. With the above order, this Contempt Petition stands disposed of. Notices issued to the alleged respondents/contemnors are discharged. M.A. No. 1228/2014 In view of the fact that Curative Petition has been rejected by the Hon ble Apex Court and also in view of the submission made by Shri Rajesh Katyal, the learned counsel appearing on behalf of the respondents, on instructions made by the departmental representatives, that they have been advised by the Ministry of Law to implement the order of this Tribunal, in our view the Miscellaneous Application No.1228/2014 has become infructuous, and the same is, therefore, rejected." Pasted from <http://www.gconnect.in/orders-in-brief/pension/pre-2006pensioners-to-get-arrears-from-1-1-2006.html> 25. As already submitted in the above paras, the only issue which was dealt with in the order dated 01.11.2011 related to the minimum pay in the pay band which is to be reckoned for the purpose of calculation of revised pension of pre-2006 retirees and that this Hon'ble Tribunal had no intention to quash all other clarifications issued in the OM dated 0.200B. Parliament reply A group of employees had approached the Central Administrative Tribunal (CAT) on the issue (d): Based on some petitions filed in the Central Administrative Tribunal by pre-2006 retirees, Hon’ble Tribunal held that the clarification issued vide OM No.38/37/08-P&PW(A) dated 3.10.2008 and 14.10.2008 were not in conformity with the recommendations of the Sixth Central Pay Commission and the O.M. dated 1.9.2008. Central Administrative Tribunal directed to re-fix the pension of all pre-2006 retirees with effect from 1.1.2006, based on the resolution dated 29.08.2008 and in the light of the observations made in the judgment dated 1.11.2011 of the Hon’ble CAT. (e): The Government has filed a Writ Petition in Delhi High Court challenging the judgment dated 1.11.2011 of the Hon’ble CAT. The matter is sub-judice. From S.C. Maheshwari Pasted from <http://www.gconnect.in/orders-in-brief/pension/pre-2006pensioners-cat-case.html> BPS Sub: Implementation of the order dated 1.11.2011 of Hon’ble CAT, Principal Bench, New Delhi in OA No. 655/2010. 1 Kindly connect DOP &PW letter No. 38/7 7-A/09-P8.PW (A) dated 29th May 2014 addressed to the Secretary (Shri sant Bhushan Lal) Central Government SAG (S-29) on the above subject. 2. At the outset. we will like to point out that the above letter is in the nature of continuation of willful defiance of the CAT’s order by DOP &PW and is intended to GO AGAINST THE judicial directives. What is displayed in this letter under reference is a deliberate misinterpretation and distortion of the Hon’ble CAT’s order dated 15. 5.2014. Para 2 of the above letter states that ‘As directed by the Hon’ble CAT, the order dated 01.11.2011 of Hon’ble CAT, Principal Bench, New Delhi is required to be implemented in respect of petitioners in OA No. 655/2010″ which is factually incorrect and misleading. Hon’ble CAT-PB vide its order dated 01.11.2011 quashed clarificatory OM dated 03.10.2008 and directed to refix the pension of all pre-2006 retirees w.e.f. 1.1.2006, based on the Resolution dated 29.08.2008. While dismissing WP (C) No 153512012 of UOI on 29-4-2013, Hon’ble Delhi High Court upheld the verdict of the CAT PB. Dismissing SLP (C) No.23055/2013 filed by UOI against the judgment of Hon’ble Delhi High Court on 29-7-2013 and then Review Petition (C) No 2492/2013 on 12-11-2013 and finally Curative Petition (C) No 12612014 on 30.4.2011, Hon’ble Supreme Court upheld the Judgment of the Hon’ble Delhi High Court with this, CAT verdict dated 1-11-2011 has attained legal finality. 3. On 15.05.2014, the Hon’ble CAT-PB disposed of Contempt Petition No 158/2012 directing the UoI to implement the directions of the Tribunal Honble Delhi High Court upholding the verdict of CAT PB, took note of DOP letter F.No. 38137/08-P&PW (A) dated 28th January, 2013 whereby the pension of all pre-2006 pensioners was stepped up from an arbitrary date of 24-9-2012 as per the Resolution dated 29-8-2008. Further in Para 2 & 3 of the Judgment it is noted that the Government of India has tacitly admitted that it was in the wrong and that the Tribunal is correct and the only issue that survives are the denying arrears to be paid to the pensioners with effect from January 01, 2006 4. The operative part of the Hon’ble CAT’s order dated 15-5-2014 is contained in Para 3 and reads as “It would be appropriate to dispose of the matter with direction to the respondents to implement the directions of the Tribunal expeditiously, preferably within three months.” (Emphasis added). The direction of the Tribunal is with reference to its order dated 1-11-2011. The Hon’ble CAT never diluted its order dated 1.11.2011 nor could it have done so in its contempt jurisdiction especially when its order dated 1.11.2011 had got merged with the judgment dated 29.4.2013 of the Hon’ble Delhi High Court in WP (C) No. 1535/2012. 4.1 Consequently, contention of implementing this directive only in respect of the members of the SAG S-29 Association up to the date of filing of OA No. 06550010 is not valid. All retired Central Government employees covered under the category of pre-2006 pensioners are entitled for re-fixation of pension from 1-1-2006 as per the directive of the CAT-PB dated 1-11 -2011, which has been upheld right up to the Apex Court while dismissing SLP/Review petition/curative Petition in this case. 5. We, therefore, earnestly request you to please implement judicial verdict in its true spirit and content by issuing necessary instructions to the concerned authorities to disburse the arrears of pension tor the period 1-12006 to 23-9 2012 and stop further harassment and hardship to the aged pensioners in 70s and 80s (and a number of them being above 80-85 years at age) in their sunset years. For this, all that is required is to issue a corrigendum to your OM No 38140/12-P&PW(A) dated 28-1-2013 making it effective w.e.f. 1-1-2006. Pasted from <http://www.gconnect.in/orders-in-brief/pension/revision-ofpre-2006-pension-with-effect-from-01-01-2006.html -----------------------------------------------------------------------------------------The Prime Minister, on occasions more than one, has made his pain felt at the litigation initiated by the Ministry of Defence against disabled soldiers in the Supreme Court. The issue also forms a part of the manifesto of the ruling party. The ruthlessness of the Department of Ex-Servicemen Welfare (DESW) of the Ministry of Defence is bewildering, and it is also a cause of concern that the Three Services Headquarters have not protested this sadism strongly enough in the recent past. It is thus very clear that the Prime Minister, and also the current Defence Minister, who in all probability are very busy in the upcoming budget, are unaware that it is business as usual for junior functionaries of the DESW and that the said department and Govt lawyers in the Supreme Court are continuing with their tirade against disabled soldiers and other pensioners. It is however heartening to note that people have taken a lead in informing the political executive of this malaise and one such letter written to the Prime Minister can be accessed by clicking here. It is also heartening to see that the apex body of pensioners’ organisations- the Bharat Pensioners’ Samaj has also brought the applicability of the revised pensions from 01January 2006 rather than 24 September 2012 again to the knowledge of thePersonnel Secretary. It may be recalled that the Curative Petition filed by the last Govt against the relief granted to pensioners has already been dismissedby the Supreme Court but the Union of India still continues to contest similar cases right till the Apex Court. It is the duty of all of us to ensure that the sentiments of old and infirm pensioners, both civilian as well as military, and of disabled soldiers and military widows, are brought to the knowledge of the Prime Minister and the concerned Ministers, so that the dubious intentions of junior functionaries of the Govt are not allowed to override law, equity and justice or even to contravene the opinion expressed by the Prime Minister. -------------------------------------------------------------------------------------------LETTER CITED FOR CLICKING REPRODUCED: -------------------------------------------------------------------------------------------From: Maj Gen (Retd) Satbir Singh, SM Chairman IESM Mob: +919312404269, 0124-4110570 Email ID: satbirsm@gmail.com To: Sh Narendra Modi Hon’ble PM of India PMO, North Block New Delhi-110001 Sh Arun Jaitley Hon’ble Raksha Mantri Ministry of Defence South Block, New Delhi- 110011 Sh Ravi Shankar Prasad, Hon’ble Law Minister Ministry of Law & Justice Shastri Bhawan, New Delhi- 110001 Sh Mukul Rohatgi Attorney General of India N-234 A, Greater Kailash-I New Delhi-110048 04 July 2014 CONTINUANCE AND FRESH INITIATION OF LITIGATION AND APPEALS IN THE SUPREME COURT BY OFFICIALS OF MINISTRY OF DEFENCE AGAINST DISABLED AND WAR DISABLED SOLDIERS SUPPORTED BY GOVT LAWYERS, JUST AS WAS THE CASE IN THE UPA GOVT ERA, WHICH IS AGAINST THE INTENTIONS EXPRESSED BY THE HON’BLE PRIME MINISTER Sirs 1. The Hon’ble Prime Minister has made it known publically that he is against the massive amount of litigation initiated by the Ministry of Defence against its own disabled and war disabled soldiers in the Supreme Court. It may be pointed out here that maximum number of appeals filed by the Ministry of Defence under the UPA Govt and pending in the Supreme Court are against disabled and war disabled soldiers against their disability pension benefits amounting to (at times) as little as under Rs 1000/- per month. It is not only financially impossible for our soldiers to fight the mighty Govt at the Supreme Court level but also a morale wrecker to see the establishment fight tooth and nail against its own soldiers. 2. The PM has made it known that he was not in favour of such litigation and this was emphatically highlighted even during his rally for ex-servicemen in Rewari, Haryana. The ruling party had also made this a part of the manifesto wherein it was emphasized that such appeals would be minimized. 3. However, much against the wishes of the PM and the manifesto, Government lawyers, including those now appointed by the NDA Government, are continuing to fight pending cases against disabled soldiers and are also filing fresh cases on the instructions of the Department of Ex-Servicemen Welfare (DESW) of the Ministry of Defence. It is learnt that thousands of more such cases are in line to be filed in the Supreme Court against relief granted to disabled soldiers by the High Courts and Armed Forces Tribunals. Approval of such appeals and massive litigation against disabled soldiers was given by the last Raksha Mantri, Sh AK Antony, on the demand of DESW. 4. Many of such cases/appeals are against the concept of “broad-banding” of disability percentage of disabled soldiers who were released from service on completion of tenure or superannuation. Though the issue is now squarely covered by a judgment of the Supreme Court in Civil Appeal No 5591/2006 Capt KJS Buttar Vs UOI, allowed on 31st March 2011, the Government is still filing fresh appeals and not withdrawing pending appeals based on the said dicta. In fact, the DESW of MoD had obtained an opinion of the (then) Solicitor General Mr Gopal Subramanium on continuance of filing of such appeals and the Solicitor General had also advised the MoD to file a Review Petition in the ibid Capt KJS Buttar’s case. A Review Petition was then filed by the UPA Govt (RP 2688/2013) but the same has also been dismissed on 21st January 2014 effectively closing the issue once and for all. But still, by creating an artificial distinction and by looking for excuses, the MoD is continuing with the earlier UPA policy of forcing disabled military veterans to Court on the same very subject. 5. Since it seems that the PM’s intentions and the contents of the Manifesto are not known to the Law Officers representing the current Government in the Supreme Court, universal directions may kindly be issued to stop the harassment of such soldiers and for withdrawal of all litigation initiated against the soldiers specially disabled and war disabled soldiers in the Supreme Court. Suitable directions may also be issued by the Raksha Mantri to the Secretary of DESW and the Defence Services HQs. 6. We have high hopes from the current Government to look after the welfare and morale of our soldiers and veterans, and it would not only be ethically and morally, but also legally correct to initiate withdrawal of all such unprincipled litigation so as to boost the spirit of our soldiers and their families, rather than weaken it. 7. May we also request for an audience with the PM and the RM to apprise them for issues concerning the defence fraternity on date and time convenient to them. A meeting for half an hour each with PM and RM are requested. Thanking You Maj Gen (Retd) Satbir Singh, SM -------------------------------------------------------------------------------------------- From: RAJENDRA KUMAR C L ‘PENSIONERS WELFARE’ OR ‘PENSIONERS HARASSMENT’? The so called Department of Pensions and Pensioners Welfare of the Ministry of Personnel continues to harass old and aged pre 2006 pensioners, mostly in their 70s/80s and even older, by continuing to defy and circumvent the repeated judicial verdicts right up to the Hon’ble Supreme Court over the last more than four and a half years. The Pay Commission had recommended that the “revised pension, in no case, shall be lower than 50% of the sum of the minimum of the pay in the pay band and the grade pay thereon corresponding to the pre-revised pay scale from which the pensioner had retired”. This was in conformity with the consistent rulings of Hon’ble Supreme Court that a homogenous group of pensioners can not be divided into two based on an arbitrary cut off date and that if a person was entitled to pension at the time of retirement, the benefit of subsequent liberalization of the scheme can not be denied to him. This recommendation was accepted by the Government as incorporated in its Resolution dated 29-8-2009. This was unauthorisedly modified, under the garb of clarification, on 3-10-2008 stipulating that “The pension calculated at 50% of the minimum of the pay in the pay band plus grade pay would be calculated (i)at the minimum of the pay in the pay band irrespective of the prerevised scale of pay plus the grade pay corresponding to the pre-revised pay scale”. On receipt of several representations, even the then MOS (F) took up this matter under his DO letter dated 10-11-2008 to the then Prime Minister and, in response, the then MOS (P) in his letter dated 9-1-2009 agreed with it and a proposal to rectify was submitted by DOP to DOE. Unfortunately, the latter rejected this proposal at the level of Director and Secretary, without putting up to MOS(F), on the erroneous ground of involving heavy financial implications. It may be emphasized that correction of this unauthorized alteration did not entail any additional financial burden because such a fixation of pension was envisaged by Commission in its recommendations and duly accepted by Government and consequently the financial implications had already been taken into account while announcing decision on CPC’s recommendations. If anything, the Government has saved this money and earned interest thereon over the last 6 years at the cost of old and aged pensioners. Being aggrieved with reduction in pension and summary rejection of various representations made by them, some of the S 29 (Senior Administrative Grade) pensioners groups sought justice from Central Administrative Tribunal (CAT) Principal Bench New Delhi. After more than 1 ½ years proceedings, CAT ruled in favour of the aggrieved pensioners. The operative part of the CAT order contained in para 30 of its order dated 111-2011, is reproduced below: “In view of what has been stated above, we are of the view that the clarificatory OM dated 3.10.2008 and further OM dated 14.10.2008 (which is also based upon clarificatiory OM dated 3.10.2008) and OM dated 11.02.2009, whereby representation was rejected by common order, are required to be quashed and set aside, which we accordingly do. Respondents are directed to re-fix the pension of all pre-2006 retirees w.e.f. 1.1.2006, based on the resolution dated 29.08.2008 and in the light of our observations made above. Let the respondents re-fix the pension and pay the arrears thereof within a period of 3 months from the date of receipt of a copy of this order”. Instead of complying with this judicial verdict, which was common to 4 OAs, Department preferred Writ petitions in Delhi High Court. In the meantime, GOI issued orders dated 28-1-2013 allowing the modified parity, as originally envisaged by Pay Commission and GOI decision thereon as contained in Resolution dated 29-8-2008 but made it effective w.e.f. 24-9-2012, thus once again denying the legitimate dues to the aged pensioners for the period 1-1-2006 to 23-9-2012. These writ petitions were dismissed by a common order dated 29-4-2013 and upheld the decision of CAT. Undeterred and contrary to its own Litigation Policy not to be a compulsive litigant, the Department selectively filed SLP only in one case in Supreme Court, which was dismissed on 29-7-2013 and the Review Petition was also dismissed on 12-11-2013. It went on to file a Curative Petition in the Supreme Court which has also been dismissed on 30-4-2014 with which the CAT verdict has attained legal finality. In the meantime, contrary to the principle of Res-Judicata, 3 SLPs were separately filed in 3 other cases, also covered by the same common order of CAT and Delhi High Court and on this ground denial of legitimate dues to the aged pensioners continued. Finally, on the basis of a Contempt Petition filed by Central Government SAG (S 29) Pensioners Association in CAT, the Tribunal has once again directed the Government on 15-5-2014 to comply with their directions expeditiously, preferably within 3 months. Not inclined still to comply fully with repeated judicial verdicts, the so called Pensioners Welfare Department has now found a novel way of continuing harassment of old pensioners by writing to the Association that only the members up to filing of OA in early 2010 will be covered, thus depriving other members of the Association, not to talk of other similarly placed pensioners, of their legitimate dues even after 6 years and despite clear judicial verdicts right up to Hon’ble Supreme Court. The Association has disputed this distorted interpretation of judicial verdicts. Thus the game of harassing old pensioners continues. Of about 660 members of the Association, about 25 have already expired after institution of legal proceedings in early 2010 and perhaps DOP&PW are waiting for the rest of the pensioners also to expire so that the problem is automatically solved. ************************************************************* No. 38/77-A/09-P&PW(A) Government of India Ministry of Personnel, PG & Pension Department of Pension and Pensioners' welfare 3rd Floor, Lok Nayak Bhawan, Khan Market, New Delhi New Delhi, the 29th May, 2014 To The Secretary (Shri sant Bhushan Lal) Central Government SAG (S-29) Pensioners' Association C5/21, Grand Vasant Vasant Kunj, New Delhi 110070 Subject:- Implementation of the order dated 1.11.2011 of Hon'ble CAT, Principal Bench, New Delhi in OA No 655/2010 Sir, I'm directed to forward herewith a copy of order dated 15.5.2014 of the Hon'ble Central Administrative Tribunal, Principal Bench, New Delhi in the above matter. 2. As directed by the Hon'ble CAT, the order dated 1.11.2011 of Hon'ble CAT, Principal Bench, New Delhi is required to be implemented in respect of petitioners in OA No 655/2010. The petitioner/applicant in the aforesaid OA is an Association, namely Central Government SAG (S -- 29) Pensioners Association. No details regarding the membership of the Association are available in the OA. 3. In order to implement the above order of Hon'ble CAT in respect of petitioners in OA No 655/2010, this Department requires the following details in respect of members of the Association:- (i) Names and addresses of the Office Bearers of the Association; (ii) Is the Association registered with the Registrar of Societies or with any other authority? If so, a copy of Registration Certificate may be provided. (iii) Following particulars/documents in respect of the members of the Association at the time of filing of the OA No 665/2010:- (a) Names of the members on the date of filing of OA No 655/2010 with evidence corroborating such membership on the date of filing of OA No 655/2010. (b) Addresses of Members mentioned at (a) above. (c) Designation of the members. (d) Details of Head of department/Head of Office/Pension Sanctioning authority (e) Details of the Pay and Account Office concerned. (iv) An Undertaking regarding the truthfulness and correction of the details given by the Association; (v) A confirmation that all the members of the Association in respect of whom the above details are given are retired Central Government Civil employees. 4. It is requested that the above details/documents may be sent to the Department by 4 our.06.2014. 5. It may please be noted that the Pension sanctioning authority is concerned will be asked to implement the orders of the Hon'ble CAT only in respect of those members whose details (with the proof) are furnished by your Association. This Department will not be responsible for delay/non-revision of pension in respect of any member of the Association whose particulars are not furnished by the Association. This issue with the approval of competent authority. Enclosure:- a.a. sd/-29/5/2014. (SK Makkar) Under Secretary to the Government of India -----------------------------------------------------------------------------------------MOST URGENT SENIOR CITIZENS PENSIONERS CASE (AGED 7080 YEARS AND ABOVE) To 28-6-2014 Dated Shri S.K.Makkar Under Secretary, Department of Pensioners & Pensioners Welfare, Lok Nayak Bhavan, 3rd Floor, Khan Market, New Delhi 110003 Dear Sir, Sub: - Implementation of the order dated 1.11.2011 of Hon’ble CAT, Principal Bench, New Delhi in OA No.655/2010 Please refer to your letter No. 38/77-A/09-P&PW (A) dated 29th May, 2014 on the above subject. 2. At the outset, we will like to point out that your above letter is in the nature of continuation of will full defiance of the CAT’s order and is intended to GO AGAINST THE judicial directives. What is displayed in your letter under reference is a deliberate misinterpretation and distortion of the Hon’ble CAT’s order dated 15.5.2014. Para 2 of your above letter states that “As directed by the Hon’ble CAT, the order dated 1.11.2011 of Hon’ble CAT, Principal Bench, New Delhi is required to be implemented in respect of petitioners in OA No. 655/2010” which is factually incorrect and misleading. Hon’ble CAT-PB vide its order dated 01.11.2011 quashed clarificatory OM dated 03.10.2008 and directed you to re-fix the pension of all pre-2006 retirees w.e.f. 1.1.2006, based on the Resolution dated 29.08.2008. While dismissing WP (C) No. 1535/2012 of UOI on 29-4-2013, Hon’ble Delhi High Court upheld the verdict of the CAT-PB. Dismissing SLP (C) No.23055/2013 filed by UOI against the judgement of Hon’ble Delhi High Court by Apex Court on 29-7-2013 and then Review Petition (C) No.2492/2013 on 12-11-2013 and finally Curative Petition (C) No. 126/2014 on 30-4-2014, Hon’ble Supreme Court upheld the Judgment of the Hon’ble Delhi High Court. With this, CAT verdict dated 1-11-2011, referred to by you, has attained legal finality. 3. On 15.05.2014, the Hon’ble CAT-PB disposed of Contempt Petition No.158/2012 directing the UOI to implement the directions of the Tribunal. Hon’ble Delhi High Court, upholding the verdict of CAT-PB, took note of DOP letter F.No.38/37/08-P&PW (A) dated 28TH January, 2013 whereby the pension of all pre-2006 pensioners was stepped up from an arbitrary date of 24-9-2012 as per the Resolution dated 29-8-2008. Further in Para 2 & 3 of the judgement it is noted that the Government of India has tacitly admitted that it was in the wrong and that the Tribunal is correct and the only issue that survives are the denying arrears to be paid to the pensioners with effect from January 01, 2006. 4. The operative part of the Hon’ble CAT’s order dated 15-5-2014 is contained in Para 3 and reads as “It would be appropriate to dispose of the matter with direction to the respondents to implement the directions of the Tribunal expeditiously, preferably within three months.” (Emphasis added). The direction of the Tribunal is with reference to its order dated 1-11-2011. The Hon’ble CAT never diluted its order dated 1.11.2011 nor could it have done so in its contempt jurisdiction especially when its order dated 1.11.2011 had got merged with the judgment dated 29.4.2013 of the Hon’ble Delhi High Court in WP (C) No. 1535/2012. 4.1 Consequently, your contention of implementing this directive only in respect of the members of the Association up to the date of filing of OA No. 0655/2010 (as implied in Para 3(iii) (a) of your letter) is not valid. The Association was formed with common interests and registered under the Societies Registration Act XXI of 1860 (Registration No. 68702/2010). Consequently, all the members of the Association are fully covered under the directive dated 1-11-2011 of CAT-PB. 5. Notwithstanding, the above background and legal position, the information called for by you under Para 3 of your letter, to the extent relevant to establishing our legal standing, however, is being furnished in the following paragraphs: (i) Names and address of the Office Bearers of the Association: The names of the Office Bearers of the Association are given in the margin of this letter head. The registered Office of the Association is C5/21, Grand Vasant, Vasant Kunj, New Delhi -110070. (ii) As mentioned earlier, the Association is registered with Registrar Societies, Delhi, under Societies Registration Act XXI of 1860 (Registration No. 68702/2010). A copy of the Registration Certificate is enclosed. (iii) 2 copies of the list of Members of the Association were handed over to GOI Advocate on 15-5-2014 at the time of hearing of the Contempt Petition in CAT. (iv) It is confirmed that the particulars given in the list of members of the Association given to your Advocate on 15-5-2014 are correct as per our records. (v) It is also confirmed that the names given in the list handed over to your Advocate on 15-5-2014 are all members of the Association as per the eligibility criteria of the Association. They are all retired Central Government employees and covered under the category of pre-2006 pensioners entitled for re-fixation of pension at Rs 27350 from 1-1-2006 as per the directive of the CAT-PB dated 1-11-2011, which has been upheld right up to the Apex Court while dismissing SLP/Review petition/Curative Petition in this case. 6. We, therefore, earnestly request you to please implement judicial verdict in its true spirit and content by issuing necessary instructions to the concerned authorities to disburse the arrears of pension for the period 1-12006 to 23-9 2012 and stop further harassment and hardship to the aged pensioners in 70s and 80s (and a number of them being above 80-85 years of age) in their sunset years. For this, all that is required is to issue a corrigendum to your OM No.38/40/12-P&PW(A) dated 28-1-2013 making it effective w.e.f. 1-1-2006, under advice to the undersigned. Thanking you, Yours faithfully, (PRATAP NARAYAN) PRESIDENT From V Natarajan IMPORTANT DOCUUMENT I am attaching the scanned copy of the RTI reply DT 3 jULY 2014 received by me FROM DOP ON THE SUBJECT OF CURATIVE PETITION DISMISSAL ON 30 APRIL 2014 AND FOLLOW UP ACTIONS OF DOP THEREOF.. THIS DOCUMENT CAN BE VITAL AS A CAUSE OF ACTION SUPPORT IF NEEDED. Intentions OF DOP are clear. THEY HAVE INTERPRETED THE CAT JUDGMENT TO BE IN AGREEMENT WITH THEIR SUBMISSION ON MOLAW'S ADVICE TO IMPLEMENT THE CAT VERDICT OF 1 II 20111 IN OA655/2010 QUA PETITIONERS. REPLY IS AUDACIOUS/ ARROGANT/.EVEN CAT IS TAKEN IN and in short it reveals their stubbornness niot to accommodate even a single inch beyond their stand already made know in letters to CGSAGPA to STICK TO TYHEIR DECISION TO IMPLEMENT THE CAT VERDICT TO OA 655/ 2010 PETITIONERS ONLY REPEAT ONLY; and to supply file note copies only when a final decision is atken in SLP SITER GRPO CASES by the HSC. I can make more noise as a member---even be irresponsible- prvent the "aproper course of action".... and the go for another freah roiund of LITIGASTION" That is the stategy DOP has adopted... nior dividing our memebrs which is a very samll thing, AS WE ARE CAPABLE OF DOING THAT OURSELVES.... But heir main agenda is to saomehow make us go for a FRESH ROUND OF LITIGATION-..TO MAKE US TO CHALLENGE THEIR INTERPRETATION OF CAT JUDGMENT IS WROMG....TO GO TO CAT FOR "CLARIFICATORY PETITION"- THEN CHALLENGE THE SAME AT DHC- THEN HSCSLP/RP/CUR PETN.... This has happened in alll the important cases...even recently in RANK PAY cae when they interpred the HSC VERDICT/ ORDER ITSELF---- changking the expressioin ..." from 1 1 1986",,,, to "as on 1 1 1986"....and the goofing military pensioners went for a fresh round of chal;lenge withgout gettiing an ordewr ....and iot went in circles for more than 3 years till now....(rest shro mbr can explain as he appears to have read the case crfitically.....) BABUDONM IS DESTRUCTIVE..... THEY NECER SEE ANY REASON....WHAT THEY HAVE DECIDED STANDS.... IT ISD ONLY CGSAGPA WHO HAVE WON A CASE IN 4 YEARS AND ODD.... NOW WESALL SURRENDER MEEKLY TO THEIR STRATEGIC PLAN........ . I WAS WONDERING HOW PR BENCH CAT CAN MAKE ANY OMISSION IN ITS ORDER OF 15 MAY 2014 WRT "QUA PETITIONERS" EXPRESSION. That PETITIONERs in the said judgment can be clearly established in the top part of the order itself , wh is reproduced : -------------------------------------------------------------------------------------------CENTRAL ADMINISTRATIVE TRIBUNAL PRINCIPAL BENCH C.P. No.158/2012 O.A. No. 655/2010 M.A. No. 1228/2014 New Delhi, this the 15th day of May, 2014 HON BLE MR. JUSTICE SYED RAFAT ALAM, CHAIRMAN HON BLE MR. V. AJAY KUMAR, MEMBER (J) HON BLE DR. BIRENDRA KUMAR SINHA, MEMBER (A) 1. Central Government SAG (S-29) Pensioners Association Through its Secretary Shri Sant Bhushan Lal, C-5/21, Grand Vasant, Vasant Kunj, New Delhi-110 070. 2. Shri Satish Varma, Retd. Chief Engineer, Central Water Commission, Ministry of Water Resources, Govt. of India, Resident of B-6/8, Vasant Vihar, New Delhi-110 057. .. Petitioners (By Advocate : Shri Nidesh Gupta, Sr. Advocate with Shri Sushil Malik, Shri M.K. Ghosh and Shri Tarun Gupta) Versus 1. Mr. R.C. Misra, Secretary to the Government of India, Department of Pensions and Pensioners Welfare, Ministry of Personnel, Public Grievances and Pensions, Lok Nayak Bhawan, Khan Market, New Delhi-110 003. 2. Mr. Sumit Bose, Secretary to the Government of India, Department of Expenditure, Ministry of Finance, North Block, New Delhi. .. Proposed Contemnors/ Respondents (By Advocate : Shri Rajesh Katyal and with Shri D.S. Mahendru with departmental representatives Ms. Tripti Ghosh, Director and Shri Harjit Singh, Dy. Secretary) ORDER (ORAL) By Hon ble Mr. Justice Syed Rafat Alam C.P. No.158/2012 This is an application for initiating contempt proceedings against the respondents for not carrying out the judgment/order of the Tribunal dated 01.11.2011 in O.A. No.655/2010 and connected cases -------------------------------------------------------------------------------------------------------------------2. Therefore we are on firm ground and we should not fall into the trap of DOP for further litigations in any (Exec Petn in CATDHC) mode....even in case of Clarificatory Application if it has to be in a legal mode involving DOP again .....we may have to examine the same thoroughly , 3.Consequently, we may now send a full correct list, reiterate in our forwarding letter (to be drafted powerfully covering all points, disputing the unilateral interprentation/ segmental implementation aspect etc....) and also point out at the very start that as per the PR BENCH CAT JUDGMENT ORDER of 15 May 2014 , the CGSAGPA are the 'PETITIONERS' in letter & spirit on the day of cp judgment ie 15 MAY 2014 and we can not accept anything short of implementation of the judgment for all the Member-Petitioners of CGSAGPA in even time, without discrimination, omission, manipulation, misinterpretation of Cat verdict etc. 4. MY FURTHER RESEARCH SHOWS THAT MANY DEPARTMENTS ARE ALLOWED UP TO SIX MONTHS TO IMPLEMENT THE TRIBUNAL / COURT ORDERS (an internal arrangement they have evolved ...may be DOPT has given such a scope...) and so Babus my dilly dally for six months - to test our patience- or even make us go for litigation. RTI-Online APPLICATION (on qua petitioners)DP&PW/R/2014/60344 dt 20 7 2014 My latest RTI query sent today on the issue of DOP's vested interpretation of PR BENCH CAT's disposal order dt 15 May 2014 in the CP 158/2012 , claiming the CAT has "agreed' for their submission to CAT based on the MOLAW advise to implement CAT Verdict of 1 11 2011 qua petitioners- viz applicants of OA 655/ 2010. . VN ----------------------------------------------------------------------------------------Online RTI Request Form Details Public Authority Details :- * Public Authority Department of Pensions & Pensioners Welfare Personal Details of RTI Applicant:* Name V NATARAJAN Gender Male * Address 7 JAYARAM AVENUE, , SASTRI NAGAR, ADAYAR PO,, CHENNAI Pincode 600020 Country India State Tamilnadu Status Urban Educational Status Literate Above Graduate Phone Number +91-4424924296 Mobile Number +91-9884253887 Email-ID v_nattu[at]hotmail[dot]com Request Details :Citizenship Indian * Is the Requester Below Poverty Line ? No (Description of Information sought (upto 500 characters) * Description of Information Sought Dear CPIO Sir, Kind attention is invited to your letter No 38/7/2014-P&pw(A) dt 3 July 2014 in reply to my RTI application dated 5.6.2014. Query: Drawing your attention to para 2 of the letter wherein it is categorically stated :THE HON BLE TRIBUNAL HAS AGREED TO THE SUBMISSION MADE BY GOVERNMENT THAT ORDER DATED 1.11.2011 IS DECIDED TO BE IMPLEMENTED IN RESPECT OF PETITIONERS OF OA NO. 655/2010 ONLY : a. KINDLY FURNISH COPIES OF ALL MATERIAL INFORMATION TO SUBSTANTIATE CATEGORICALLY THE ABOVE STATEMENT b.. IS THE INFORMATION THAT IS CONTAINED IN THE ABOVE STATEMENT- AN INTERPRETED PART OF THE JUDGMENT / ORDER DT 15 5 2014 OF THE HON BLE TRIBUNAL DISPOSING THE CONTEMPT PETITION NO 158/2012 OR AN ACTUAL EXTRACT . IF SO PROVIDE COPIES OF RELATED MATERIAL INFORMATION ON THE SAME. c. Kindly furnish RELATED FILE NOTE copies on the above. Additional charges if any will be remitted as per your directions. Truly yours, V NATARAJAN * Concerned CPIO Nodal Officer RTI ONLINE REGISTRATION: Dear Sir/Madam, Your RTI Request has been filed successfully on RTI Online Portal. The following are the details:Registration Number: DP&PW/R/2014/60344 Name: V NATARAJAN Date of Filing: 20/07/2014 Request filed with: Department of Pensions & Pensioners Welfare Contact Details:Telephone Number: 01127492567 Email Id: mkumar.mol@nic.in ---------------------------------------------------------------------------------------------------------------------------------- Administrative Tribunals Act [SBC 2004] CHAPTER 45 -----------------------------------------------------------------------------------------------------------------Amendment to final decision 53 (1) If a party applies or on the tribunal's own initiative, the tribunal may amend a final decision to correct any of the following: (a) a clerical or typographical error; (b) an accidental or inadvertent error, omission or other similar mistake; (c) an arithmetical error made in a computation. (2) Unless the tribunal determines otherwise, an amendment under subsection (1) must not be made more than 30 days after all parties have been served with the final decision. (3) Within 30 days of being served with the final decision, a party may apply to the tribunal for clarification of the final decision and the tribunal may amend the final decision only if the tribunal considers that the amendment will clarify the final decision. (4) The tribunal may not amend a final decision other than in those circumstances described in subsections (1) to (3). (5) This section must not be construed as limiting the tribunal's ability, on request of a party, to reopen an application in order to cure a jurisdictional defect. ---------------------------------------------------------------------------------------------------------------------------------------------------From G Natarajan Sorry for the delay in responding. In fact I was busy searching case law that the benefit of an order/judgment should be extended to the similarly placed persons. Later, I realised that it is unnecessary for the present since the original order of CAT is categorical in ordering the benefit of its order to all the pre-2006 pensions without any qualification/disqualification. Anyway, if need be, at a later stage, I will invest my time in searching the case law in case need arises. So, for the present, I will only dilate on the grounds on which a clarification application could be filed. Precisely, the grounds may be: 1. UOI is acquiesced in its stand that the financial constraint stressed upon by it relates to all the pre-2006 pensioners. It could not have submitted limited application; nor could the CAT agree to it. Thus doctrine of Acquiescence applies. 2. Having argued against payment of arrears to the pre-2006 pensioners in Toto and having failed before the CAT, HC and the SC (in SLP, Review and even in Curative Petition), UOI is estoped from raising the plea of qua the petitioners only. Hence doctrine of Estopal is applicable. 3. CAT having ordered payment of arrears to all pre-2006 pensioners and it having been upheld up to SC, even CAT itself cannot restrict it to petitioners qua. The contempt petition prayed for implementation of CAT order. And when it has ordered implementation of its earlier order, it is absolutely unqualified or unrestricted. 4. Doctrine of Legitimate Expectation is also applicable since all the pre2006 petitioners got the arrears from September, 2012 and have a logical, legitimate expectation that they will get arrears from Jan. 2006 as well. This legitimacy and its expectation cannot be brushed aside either by the UOI or CAT. 5. Strictly speaking, there is no specific order on the shaky ground on the basis of advice from Ministry of Law that the benefits would be restricted to petitioners qua. 6. Neither the Ministry of Law nor the Ministry of Finance or the Ministry of Personnel cannot give an interpretation to the CAT order on contempt. Such an interpretation shows the high handedness on the part of UOI and should be construed to be interference in the judicial process, and sidetracking the core issue. 7. UOI is expected to be a model employer and not a meddling employer, playing with the lives of lakhs of pensioners. CAT should have taken note of it and passed an order on the empty/hallow claim of the UOI. 8. CAT is thus required to clarify its order or reiterate its order and should specifically spell out that the petitioners qua claim put forward by the UOI is categorically and emphatically negatived. The above according to me, are valid grounds for approaching CAT with a clarification application. You may consider the above and add any other ground that might occur to you because of your involvement over the last few years. From PK Ranganathan * Public Authority Department of Pensions & Pensioners Welfare Personal Details of RTI Applicant:* Name P.K.RANGANATHAN Gender Male * Address Flat No 204,Signet Castle, 30/2,Valmikistreet, Thiruvanmiyur,Chennai. Pincode 600041 Country India State Tamilnadu Status Urban Educational Status Literate Graduate Phone Number +91-4424425558 Mobile Number +91-9445380116 Email-ID Ranganathan.perumbadi@gmail.com Request Details :Citizenship Indian * Is the Requester Below Poverty Line ? No (Description of Information sought (upto 500 characters) * Description of Information Sought Dear Sir, Kindly refer to CAT Principal Bench,Delhi, judgement order dated 01-112011,in OA No 655/2010, Quote . "Respondents are directed to re-fix the pension of all pre-2006 retirees w.e.f. 1.1.2006, based on the resolution dated 29.08.2008 and in the light of our observations made above. Let the respondents re-fix the pension and pay the arrears thereof within a period of 3 months from the date of receipt of a copy of this order. OAs are allowed in the aforesaid terms, with no order as to interest and costs." The above order has been upheld in the WP No 15359/2012 in the Delhi High Court and SLP (C)No 23055/2013,Review Petition (C) No 2492/2013 and ultimately in the Curative Petition (C) No1261/2014 in the Supreme Court,thus attaining legal finality. Hearing the Contempt Petition (C) No 158/2012, for non implimentaton of their above order on OA 655/2011, CAT Principal Bench, on 15/05/2014, taking note of the "submissions made by the learned counsel appearing on behalf of the respondents, on instructions made by the departmental representatives, that they have been advised by the Ministry of Law to implement the order of this Tribunal" disposed of the contempt and connected MA No 1228/2014.with direction to the respondents to implement the directions of the Tribunal expeditiously, preferably within three months. Kindly furnish the factual material information on the actions taken till date wrt re-fixation of pension of all pre-2006 pensioners. Kindly furnish RELATED FILE NOTE copies and orders if any issued ,on the above. Additional charge if any will be remitted as per your directions. Yours Sincerely, P.K.Ranganathan. From V Natarajan NOTE ON PRE 2006 PENSIONERS’ PLIGHT- COMPULSIVE LITIGATIONS-GRIEVANCE: Submission on 25 7 2014. While implementing the Sixth CPC recommendations for revision of pension of pre 2006 pensioners in accordance with the Cabinet Decision notified vide DOP’s Resolution dt 29 8 2008 / Executive Instruction vide OM dt 1 9 2008 , the said orders were improperly modified through OMs dtd 3 /14 Oct 2008 which resulted in reduced pensions (Rs 198 to Rs3650 pm basic ) wef 1 1 2006 for segments of pre 2006 pensioners in pre-revised pay scales S29 (all), 21-23 and few more . As all appeals made to the authorities for remedy were rejected en masse (vide OM dt 11 2 2009) , aggrieved Pensioners/ Pensioner Associations/ Groups went for legal redressal thru PR BENCH CAT, which gave the verdict on 1 11 2011 in favour of the pensioners , ordering that revised pension must be in terms of the Cabinet Decision/ Gaz Resolution dt 29 8 2008, wef 1 1 2006 , and arrears to be paid within 90 days (para 30 of PB CAT Judgment dt 1 11 2011 common to CGSAGPA’s OA No 655/ 2010 and 3 more groups). Authorities went in appeal to Delhi High Court (DHC) thru 4 writ petitions, against the 4 groups , against the common PBCAT judgment referred above. On 29 4 2013 , the DHC dismissed all the four writ petitions and also made an observation on the OM dt 28 Jan 2013 issued unilaterally by the authorities (for Enhanced Revised Pension wef 24 9 2012 instead of wef 1 1 2006 for the pre 2006 pensioners ) that by this OM the authorities have tacitly agreed to their omission and what all remains to be settled is the arrears for the period 1 1 2006 to 23 9 2012. DHC in their order upheld the PB CAT judgment in toto. Not respecting the DHC / CAT judgments, authorities singled out one Group –CGSAPA and filed an SLP in Hon Supreme Court (HSC) against them on the verdicts of PB CAT and DHC which was dismissed on 29 7 2013. Authorities continued with Review Petition and Curative Petition in HSC against the CGSAPA contesting the verdicts pertaining to their cases alone, which were dismissed on 12 11 2013 and 30 4 2013. THIS LENGTHY LEGAL BATTLE BROUGHT LEGAL FINALITY TO THE CASE OF CGSAGPA IN OA 655/2010 on 30 APRIL 2014. Thus PB CAT judgment dated 1 11 2011 is merged with the HSC judgment finally and none can change its content or meaning in any way. Authorities are to kindly appreciate and help old pensioners get justice. “PETITIONERS” CGSAGPA THRU ITS SECRETARY SANT BHUSHAN LAL AND MEMBER SATISH VARMA ,in early May 2014, REVIVED THE PENDING CONTEMPT PETITON CP 158/2012 (PENDING AT THE PB CAT SINCE FEB 2012 TO ACCOMMODATE THE REQUEST OF AUTHORITIES TO MAKE THEIR APPEAL AT DHC ) AND ON 15 MAY 2014, THE PB CAT ALLOWED THE SAME NOT ONLY FOR THE PETITIONERS BUT ALSO REITERATED THE RESPONDENTS TO IMPLEMENT THEIR ORIGINAL JUDGMENT DT 1 11 2011 FOR ALL PRE 2006 PENSIONERS. No divisive order was made by them in any way. There was no ambiguity in their order. Again, instead of implementing the above orders of the PBCAT that too after the Curative Petiton dismissal, authorities have resorted to discriminative/divisive approach, misinterpreting the PBCAT verdict by issuing letters to CGSAGPA seeking lengthy details on membership and resorting to restrict the payment of arrears only to its MEMBERS as at the time of filing of OA 655/2010 in CAT. The authorities in an RTI Reply dated 3 July 2014 have even claimed that PB CAT HAS AGREED on this , a stand never found OR SUBSTANTIATED in any of the PB CAT judgments and in records available to the “Qua Petitioners”.May I on behalf of the aggrieved/ harassed lot of pre 2006 pensioners appeal to you to intervene and bring justice to all concerned. (Relevant Documents enclosed for reference) Submitted by V NATARAJAN Pre 2006 Pensioner/ Sr Citizen to Hon. Secretary to GOI, Dept of Pensions Dt 25 july 2014 at Anna Institute of Management ,Chennai. Enclosures included PB CAT CP Verdict 158/2012 dt 15 May 2014; Cur Petn Dismissal 126/2014 Order dt 30 4 2014; RTI reply to VN dtd 3 Juky 2014. No.BPS/SG/2014/3 Dated : 30-05-2014 Shri Narendra ModiJee Hon’ble Prime Minister of India Prime Minister’s Office New Delhi. Esteemed Sir, I, on behalf of ‘Bharat Pensioner’s Samaj’, extend hearty greetings to you on your taking over as Prime Minister of India following a land-slide victory in 2014 LokSabha Elections of the largest democracy in the world which had been facing a fractured mandate during the past decades. It is hoped that with your vision in cooperation with your learned and able cabinet colleagues, you will succeed in uplifting the stature of India in various fields especially removal of corruption and uncontrolled inflation, sexual abuse of women& eradication of poverty etc. Poverty anywhere is a source of danger to prosperity resulting the masses going astray and the youth resorting to anti-social activities. May God grant you a long, healthy & prosperous life to serve the Nation and the Humanity at-large. I am sorry to encroach upon your valuable time in the busy-schedules. However, your personal indulgence is sought in few problems of the pensioners. ‘Bharat Pensioner’s Samaj’ is pensioners Federation with over 550 Central Govt. Pensioners Associations including those of Railways, Defence Civilians, Telecommunications affiliated to it and 4000 individual members of Central Govt. , State Govts., PSUs etc., is the oldest Pensioners Federation in the country looking after the welfare of Pensioners since 1955. BPS has the distinction to have found a mention in UNFPA publication. By virtue of this, it is a stake holder in all activities of Pensioners. Two problems of the Pensioners need your personal focus pending release of the recommendations of VII Central Pay Commission setup recently.( 1)to compensate the erosion of the financial position of the pensioners with rising cost of living, Dearness Relief requires merger with pension wherever it goes beyond 50%. Employees get automatic relief; by way of 25% increase in their allowances but pensioners do not get this advantage. To strike a balance, it is requested that Dearness relief be merged with Pension automatically whenever it crosses 50% mark. (2) Government often indirectly pressurizes Courts by appealing again & again to get judgments reversed in its favor. Vth CPC had recommended in Para 126.5 of their report that any Court Judgment involving a common policy matter of pay / pension to a group of employees / pensioners, should be extended automatically to similarly placed employees / pensioners without driving every affected individual to the Courts of Law. To help pensioners in the evening of their lives it is requested that Vth CPC afore quoted recommendation may kindly be implemented in letter & spirit. Sir, acceptance of these two requests would go a long way in giving Central Govt. pensioners & family pensioners a cheer and comparatively peaceful life. BPS sure you will endeavour to add life to the years of pensioners who in their hay days had ceaselessly toiled for the development of the country. May I assure you, Sir, pensioners would not lagbehind in extending their whole hearted cooperation, whenever and wherever needed? With warm regards, Yours faithfully, Sd/ (S.C. Maheshwari) Secretary General Shri Arun JaitleyJee Hon’ble Minister of Finance, Govt. of India New Delhi. Respected Sir, I, on behalf of ‘Bharat Pensioner’s Samaj’(BPS)greet you on assuming the charge of Ministry of Finance at a time when the nation is facing problems of inflation, corruption and various other social-economic problems. I am sure that with your wisdom, out-standing ability and experience in various fields, you will tackle these effectively & efficiently. ‘Bharat Pensioner’s Samaj’is confident that you will also be considerate enough in giving relief to Pensioners in the matter of income-tax etc. and in simplifying various tax returns much to the advantage of a common citizen with an eye to plug the loop holes and increase in Government revenues. ‘Bharat Pensioner’s Samaj’(BPS) is a Federation of over 550 affiliated Central Govt. Pensioners Associations including those of Defence , Railways &PSUs.BPS is in existence since 1955 and finds mention in the UNFPA publication. BPS seeks your intervention in meeting the just demands of the pensioners pending release and implementation of the recommendations of VII Central Pay Commission setup recently. i) Dearness Relief – 100% neutralization with automatic merger with Pension whenever it goes to 50% : Pension undergoes revision only once in 10 years during which period the pension structure gets seriously misaligned as 50% increase in prices takes place in less than 5 years resulting in considerable erosion of the financial position of Pensioners. Working employees get automatic relief by way of 25% increase in their allowances. No such relief is available to pensioners. To strike a balance, it is requested that DR may automatically be merged with pension whenever it goes to 50%. ii) Govt. should not indirectly pressurize Courts by appealing again and again to get judgments in its favors. Instead of implementing Court Judgments in case of all similarly placed persons as recommended by V CPC in Para 126.5 of their report. Govt. in spite of losing in the highest Court is going in appeals again and again not only to harass helpless pensioners but also to waste public money & court’s valuable time. It is therefore requested that instead of forcing the Pensioners to approach legal forums again & again for the same relief in the evening of their lives. Court Judgment involving a common policy matter of pay / pension to a group of employees / pensioners should be extended automatically to similarly placed employees / pensioners. I am sorry to have encroached upon your valuable time but I am sure your personal attention & directives will go a long way in giving solace to pensioners. May God grant you a long healthy, happy and prosperous life in the years to come. With kindest regards, Yours faithfully, Sd/ (S.C. Maheshwari) Secretary General -------------------------------------------------------------------------------------------Shri Ravi Shankar Prasad Hon’ble Minister of Law & Justice, Govt. of India New Delhi. Dear Sir, I, on behalf of ‘Bharat Pensioner’s Samaj’ (BPS), convey to you the heartiest congratulations on taking over charge of the Ministry of Law &Justice. I wish you a long and successful tenure. Fully realizing that you are busy in getting acquainted with various aspects of your ministry vis-avis working of the departments under your charge, I cannot restrain myself from bringing to your kind notice a burning problem of the Central Govt. Pensioners which, at present, is agitating their minds. To recall, a group of pre 1.1.2006 pensioners in the matter of incorrect implementation of modified parity recommended by VI th Central Pay Commission, had approached the honourable CAT New Delhi vide OA No.655/2010 a favorable order was issued on 01.11.2011and after great struggle up-to highest court got the final compliance orderon15/5/2014 in CP No.158/2012, OA No.655/2010 & MA No.1228/2014 refers (copy enclosed) from PCAT New Delhi. This final compliance order of 15-05-2014 has been delivered after dismissal of all Govt. Appeals, SLPs and Curative petition to the Honourable Apex Court. BPS earnestly appeals to your good- self to issue directive for implementation of orders dated 15-05-2014 to all similarly placed pre-2006 pensioners/family pensioners in tune with the recommendations of V CPC contained in Para 126.5 of their report without, driving every affected individual Pensioner/family pensioner to the Court of Law. With warm regards, Yours faithfully, Sd/ (S.C. Maheshwari) Secretary General Similar treatment for similarly situated - Extension of benefit of Judgment to all aggrieved “the entire class of employees who are similarly situated are required to be given the benefit of the decision whether or not they were parties to the original writ, in cases where a principle or common issue of general nature applicable to a group or category of Government employees is concerned” "Only because one person has approached the court that would not mean that persons similarly situated should be treated differently". For kind information pl. Best Regards Jai Shri Krishna. Central Administrative Tribunal - Ernakulam A.S.Peethambaran, S/O Late ... vs Union Of India, Represented By The ... on 19 September, 2012 ERNAKULAM BENCH O.A No.1013 /2011 Wednesday, this the 19th day of September, 2012. "(b) In Inder Pal Yadav v. Union of India, (1985) 2 SCC 648, the Apex Court has held as under:&quot;... those who could not come to the court need not be at a comparative disadvantage to those who rushed in here. If they are otherwise similarly situated, they are entitled to similar treatment, if not by anyone else at the hands of this Court. (c) The V Central Pay Commission in its recommendation, in regard to extension of benefit of court judgment to similarly situated, held as under:&quot;126.5 - Extending judicial decisions in matters of a general nature to all similarly placed employees. - We have observed that frequently, in cases of service litigation involving many similarly placed employees, the benefit of judgment is only extended to those employees who had agitated the matter before the Tribunal/Court. This generates a lot of needless litigation. It also runs contrary to the judgment given by the Full Bench of Central Administrative Tribunal, Bangalore in the case of C.S. Elias Ahmed and others v. UOI &amp; others (O.A. Nos. 451 and 541 of 1991), wherein it was held that the entire class of employees who are similarly situated are required to be given the benefit of the decision whether or not they were parties to the original writ. Incidentally, this principle has been upheld by the Supreme Court in this case as well as in numerous other judgments like G.C. Ghosh v. UOI, [ (1992) 19 ATC 94 (SC) ], dated 20-7- 1998; K.I. Shepherd v. UOI [(JT 1987 (3) SC 600)]; Abid Hussain v. UOI [(JT 1987 (1) SC 147], etc. Accordingly, we recommend that decisions taken in one specific case either by the judiciary or the Government should be applied to all other identical cases without forcing the other employees to approach the court of law for an identical remedy or relief. We clarify that this decision will apply only in cases where a principle or common issue of general nature applicable to a group or category of Government employees is concerned and not to matters relating to a specific grievance or anomaly of an individual employee.&quot; (d) In a latter case of Uttaranchal Forest Rangers' Assn. (Direct Recruit) v. State of U.P.,(2006) 10 SCC 346, , the Apex Court has referred to the decision in the case of State of Karnataka vs C Lalitha (2006) 2 SCC 747 as under: &quot;29. Service jurisprudence evolved by this Court from time to time postulates that all persons similarly situated should be treated similarly. Only because one person has approached the court that would not mean that persons similarly situated should be treated differently.&quot;" Respected Sir, Namaskar Jai Shri Krishna. My GC post of date is reproduced hereunder, for advising me to edit if so required to the extent of your kind advice. It is already appearing in the Gconnect forum as posted by me now. Any corrections, that may be required in the common interest, can be made immediately on receipt of your kind reply. "The submission of the Respondents in the Contempt Case as per CAT decision dated 15.5.2014 as reproduced hereunder, appears to be an indication of their preparedness to implement now their OM dated 28.1.2013 that allowed implementation of CAT Verdict dated 1.11.2011 only w.e.f. 24.9.2012, retrospectively from 1.1.2006. "the Ministry of Law has advised the Department to implement the aforesaid order of the Tribunal qua the petitioners. He submits that some reasonable time may be given to them to implement the aforesaid order". If the effective date indicated, viz. 24.9.2012 only is required to be preponed to 1.1.2006, the implementation of CAT verdict dated 1.11.2011 as such, involves only a corrigendum to OM dated 28.1.2013 to the extent of its revised effective date. At the same time, a significant question will arise With the implementation of Hon. CAT verdict dated 1.11.2011 as it is, whether the OM dated 3.10.2008 will stand quashed and if so, whether it is for alll pre-2006 pensioners as a whole or OTHERWISE? If at all the OM stands quashed on implementation of CAT verdict dated 1.11.2011 as it is, whether the proportionate reduction of minimum revised pension based on length of qualifying service, viz. <33 years will also get nullified? Similarly, whether the Resolution No.12 of 29.8.2008 as per which the revised pension of alll pre2006 pensioners is required to be fixed w.e.f. 1.1.2006 in accordance with the Hon. CAT verdict dated 1.11.2011, is applicable for alll pre-2006 pensioners as a whole or OTHERWISE? Till now, the pre-2006 pensioners community as a whole firmly believe that the Resolution No.12 of 29.8.2008 as well as the OM dated 1.9.2008 willl be made applicable for alll pre-2006 pensioners in accordance with the spirit of 1.11.2011 by Hon. CAT PR Bench, Delhi. Incidentally, I wish to submit the following extracts of Hon. CAT Ernakulam Bench Judgmentn in the case of K.K.Vijayan, S/O Krishnankutty ... vs The Principal Registrar on 13 July, 2012 for kind information of all. "In fact, the Apex Court in a number of cases and the V CPC in para 126.5 have emphasized such a practice. It is appropriate to cite the same as hereunder:- (a) The Apex Court as early as in 1975 in the case of Amrit Lal Berry v. CCE, (1975) 4 SCC 714 , held as under:We may, however, observe that when a citizen aggrieved by the action of a government department has approached the Court and obtained a declaration of law in his favour, others, in like circumstances, should be able to rely on the sense of responsibility of the department concerned and to expect that they will be given the benefit of this declaration without the need to take their grievances to court. (b) In Inder Pal Yadav v.Union of India, (1985) 2 SCC 648, the Apex Court has held as under:"... those who could not come to the court need not be at a comparative disadvantage to those who rushed in here. If they are otherwise similarly situated, they are entitled to similar treatment, if not by anyone else at the hands of this Court. (c) The V Central Pay Commission in its recommendation, in regard to extension of benefit of court judgment to similarly situated, held as under:"126.5 - Extending judicial decisions in matters of a general nature to all similarly placed employees. - We have observed that frequently, in cases of service litigation involving many similarly placed employees, the benefit of judgment is only extended to those employees who had agitated the matter before the Tribunal/Court. This generates a lot of needless litigation. It also runs contrary to the judgment given by the Full Bench of Central Administrative Tribunal, Bangalore in the case of C.S. Elias Ahmed and others v. UOI & others (O.A. Nos. 451 and 541 of 1991), wherein it was held that the entire class of employees who are similarly situated are required to be given the benefit of the decision whether or not they were parties to the original writ. Incidentally, this principle has been upheld by the Supreme Court in this case as well as in numerous other judgments like G.C. Ghosh v. UOI, [ (1992) 19 ATC 94 (SC) ], dated 20-7-1998; K.I. Shepherd v. UOI [(JT 1987 (3) SC 600)]; Abid Hussain v. UOI [(JT 1987 (1) SC 147], etc. Accordingly, we recommend that decisions taken in one specific case either by the judiciary or the Government should be applied to all other identical cases without forcing the other employees to approach the court of law for an identical remedy or relief. We clarify that this decision will apply only in cases where a principle or common issue of general nature applicable to a group or category of Government employees is concerned and not to matters relating to a specific grievance or anomaly of an individual employee." (d) In a latter case of Uttaranchal Forest Rangers' Assn. (Direct Recruit) v. State of U.P.,(2006) 10 SCC 346, , the Apex Court has referred to the decision in the case of State of Karnataka vs C Lalitha (2006) 2 SCC 747 as under: "29. Service jurisprudence evolved by this Court from time to time postulates that all persons similarly situated should be treated similarly. Only because one person has approached the court that would not mean that persons similarly situated should be treated differently". In continuation of my previous mail, I submit hereunder, the extracts of the Hon. CAT PR Bench Delhi Judgment dated 22.1.2013 in the case of Original Application No.1750/2012 filed by Dr. O.P. Nijhawan and others. "19. The next case relied upon by the applicant is that of Girdhari Lal vs. Union of India (supra). In the instant case the applicant claimed the benefit of a judgment of the Tribunal in TA No.19/1995 decided on 24.9.1997 in Balwant Singh and others vs. Union of India, as if he too were a party therein. The Honble Supreme Court held therein: [B][COLOR="red"]In view of the decision of the Honble Tribunal in TA No.319/1985 it is appropriate that the Union of India treat all much persons alike and to grant them the same benefits instead of driving each one of them to litigation in the course of which the Union of India itself is required to spend considerable public money. This aspect appears to have been overlooked also by the Honble Tribunal.[/COLOR][/B] 20. This position of the Honble Supreme Court is very relevant to the facts of the instant case. 21. In conclusion we would like to take a case leaf out of the case of Girdhari Lal vs. Union of India (supra). [B][COLOR="red"]The Government itself has extended the benefit of the decisions cited vide the order dated 13.5.2009 to the Scientists falling within the eligible categories without making a distinction of the date of retirement or between those who came to this Tribunal and those who did not. We have also seen that admittedly the concession of including the special pay as a part of the emoluments to be reckoned for pension and post retrial benefits has been given as a measure of exception and there has been no change in rules which continue to hold good. Further, the Government reserves the right of taking recourse to legal remedies as the matter of law has been left open. We, therefore, respect this position emerging and only hold that the respondent authorities should provide the benefits of the OM dated 13.5.2009 irrespective of the fact that whether the eligible persons have come to this Court or not. It has to be appreciated that where all the eligible persons come to this Court turn by turn, it would impose a serious efficiency burden upon functioning of this Tribunal and also cause harassment and expenses to the applicants. This, in short is also likely to be a wasteful exercise thereby exposing this Central Administrative Tribunal to directly unproductive and futile exercise"[/COLOR][/B]