McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 07 Revenue and Collection Cycle

Learning Objectives

1.

2.

3.

4.

5.

Discuss inherent risks related to the revenue and collection cycle

with a focus on improper revenue recognition

Describe the revenue and collection cycle, including typical source

documents and control procedures.

Give examples of tests of controls over customer credit approval,

delivery, and accounts receivable accounting

Give examples of substantive procedures in the revenue and

collection cycle and relate them to assertions about account

balances at the end of the period.

Describe some common errors and frauds in the revenue and

collection cycle, and design some audit and investigation

procedures for detecting them.

7-2

Overall Audit Approach

CONTROL RISK

Low

Moderate

High

Low

High

Detection Risk

Moderate to High

Detection Risk

Moderate

Detection Risk

Moderate

Moderate to High

Detection Risk

Moderate

Detection Risk

Low to Moderate

Detection Risk

High

Moderate

Detection Risk

Low to Moderate

Detection Risk

Low

Detection Risk

INHERENT

RISK

INHERENT RISKS:

Improper Revenue Recognition

Cut-off

Bill and Hold

Channel Stuffing

Returns and Allowances

Collectibility of Receivables

7-3

Revenue Recognition

• Must be (1) realized or realizable and (2) earned

• SEC guidance (SAB 104)

– Persuasive evidence of an arrangement exists,

– Delivery has occurred or services have been rendered,

– The seller's price to the buyer is fixed or determinable,

and

– Collectibility is reasonably assured

7-4

REVENUE AND COLLECTION CYCLE:

Key Control Procedures

•

SEGPARATION OF DUTIES

– Separate functions for recording, authorization, custody

•

AUTHORIZATION OF TRANSACTIONS

– Write-offs

– EDI transactions

– Credit checks prior to approval of sale

– Pricing

•

ACCESS TO ASSETS

•

– Shipping department

– Lock box account

ADEQUATE DOCUMENTS AND RECORDS

–

–

•

Pre-numbered sales orders, shipping documents (bills of lading), sales invoices

Remittance advice

INDEPENDENT CHECKS ON PERFORMANCE

–

–

A/R subsidiary ledger to general ledger

Monthly statement to customer

7-5

Audit Evidence in Management

Reports and Data Files

•

•

•

•

•

•

•

•

Pending order master file

Credit check/approval files

Price list master file

Sales detail file (sales journal)

Sales analysis report

Accounts receivable aged trial balance

Cash receipts listing

Customer Statements

7-6

Other Controls

•

•

•

•

•

•

•

•

No sales order without customer order.

Credit approval.

Restricted access to inventory.

Restricted access to terminals and invoices.

All documentation in order to record sales.

Proper dating.

Invoices compared to BOLs and orders.

Pending order files reviewed.

7-7

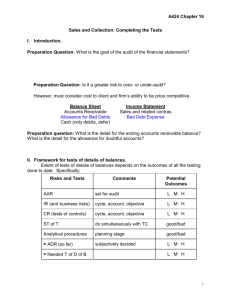

AUDITING ACCOUNTS RECEIVABLE

• Test Accounts Receivable Aged Trial Balance

(Exhibit 7.8)

• Confirm balances.

• Perform analytical procedures

• Test sales cut-off

7-8

USING CONFIRMATIONS

•

•

Especially useful for verifying EXISTENCE.

Factors likely to affect the reliability of confirmations

– Previous audit experience

– Intended recipient of the confirmation

– Type of information being confirmed

• The auditor may confirm entire BALANCES or individual TRANSACTIONS.

– Type of confirmation being sent

TYPES OF CONFIRMATIONS

•

•

•

Positive Confirmations

– small number of accounts are involved

– large number of errors are anticipated

Negative Confirmations

– the combined assessed level of inherent and control risk is low

– a large number of small balances is involved

– the auditor has no reason to believe that the recipients of the requests are unlikely to give them

consideration.

Blank Confirmations should be used if the recipient is likely to return a positive confirmation

without verifying the accuracy of the information.

7-9

CONFIRMATION CONSIDERATIONS

•

•

•

•

•

•

Responses to positive and blank confirmations provide more reliable

evidence than negative non-responses.

Recipients of accounts receivable confirmations might not report

understatements.

Auditors must have heightened professional skepticism for electronic

responses (fax or e-mail).

Non-response to Positive/blank confirmation requests

– Follow up with second and sometimes third requests.

– A lower than expected response rate could be indicative of fictitious

customer accounts.

– Alternative procedures.

Non-response to negative confirmation requests

– Only limited evidence concerning financial statement assertions.

– Alternative procedures are not necessary for unreturned negative

confirmation requests.

Follow-up on all exceptions

7-10

ALTERNATIVE PROCEDURES

• Vouch subsequent cash collections

– usually sufficient evidence of existence,

valuation.

• Examine shipping documents

• Examine client-generated supporting

documentation, such as invoices.

– Depends on internal controls

• Inspect correspondence files

7-11

Other Matters Related to

Confirmation

• There are three sets of circumstances that could justify the

omission of the confirmation of a client's accounts

receivable.

– Not material to the financial statements.

– If the RISK OF MATERIAL MISSTATEMENT is low, and the

assessed level of evidence from analytical procedures and other

tests of details is sufficient to reduce audit risk to an acceptably

low level, confirmation of accounts receivable may be inefficient.

– Confirmation of accounts receivable is expected to be ineffective

(based on previous years' audit experience).

7-12

UNCOLLECTIBLE

ACCOUNTS

• Inspect customer files for collectibility

• Recalculate ALLOWANCE and BAD DEBT

EXPENSE

• Verify reasonableness of ALLOWANCE and

BAD DEBT EXPENSE

• Verify appropriateness of accounts written off

– Verify attempts to collect receivable

– Verify authorization is appropriate.

7-13

ANALYTICAL PROCEDURES

• Sales Revenue

– Comparisons with previous periods

– Comparisons with industry

• Allowance for Doubtful Accts, Bad Debt Expense

– Bad Debt Expense as a percentage of Sales

– Allowance for Doubtful Accounts as a percentage of

Gross Receivables

• Accounts Receivable

– Days Sales in Accounts Receivable

– Accounts Receivable Turnover

7-14

SALES CUTOFF PROCEDURES

• Used to verify whether Sales/Revenues

recorded in the CORRECT ACCOUNTING

PERIOD.

• Examine SALES INVOICES and

SHIPPING DOCUMENTS shortly prior to

and after year-end.

• Examine returns after year-end.

7-15