FINANCE - power point presentation

advertisement

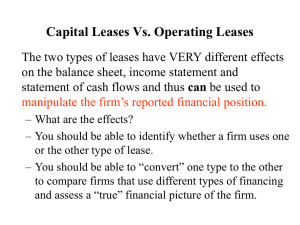

FINANCE IN A CANADIAN SETTING Sixth Canadian Edition Lusztig, Cleary, Schwab CHAPTER TWENTY-FIVE Leasing Learning Objectives 1. Discuss the advantages for the lessor and the lessee under a lease agreement. 2. Compare the differences between operating and financial (or capital) leases. 3. Discuss the three most important cash flows under a lease. 4. Compare the internal rate of return (IRR) and net present value (NPV) methods of evaluating leasing costs. State why one is preferable to the other. 5. Identify three major reasons for the popularity of leasing. Introduction Most leases fall into the class of intermediate-term financing Under a lease two parties are involved: 1. lessor – owns the asset 2. lessee – has full use of the asset and makes periodic lease payments to the lessor Leasing has become a popular alternative to buying assets Introduction Introduction Operating leases contract covers a period that is shorter than the life of the asset usually longer than a year operating leases are advantageous for lessee when: the assessment of risk of obsolescence for an asset is higher than that of the lessor managers want the flexibility to exchange assets on short notice without penalties Introduction Financial leases also called “full payout” leases a long-term contract that allows the lessor to recover the full cost of the asset plus a return during the period of the lease financial leases can take two forms: direct lease – lessee gets the use of an asset not previously owned sales and leaseback – lessee sells an asset to a financial institution which than leases the asset back to the lessee Introduction Tax-leveraged leases developed to meet the financing of milliondollar capital equipment projects with economic lives between 10 to 25 years lessor provides 20 to 40 percent of the capital needed to purchase the equipment while the remainder is provided by a financial institution lessor as the owner of the asset is permitted to deduct CCA on the leased asset for income purposes Evaluation of Financial Leases Relevant cash flow must be estimated to determine the economic desirability of leasing versus purchasing an asset The lessee avoids the initial outlay of capital required in purchasing the asset but subsequent costs are incurred including: 1. direct cash outflows associated with the lease contract periodic lease payments minus taxes 2. opportunity costs associated with not owning the asset tax shields from CCA Evaluation of Financial Leases Leasing as a form of debt financing lease and debt financing affects a firm’s financial position in the way they are committed to fixed payments before any earning are accrued to shareholders Framework for discounted cash flow analysis both NPV and IRR can be used to analyse leases if IRR > than after-tax borrowing cost, borrowing is preferred and vice versa if NPV of the leasing cost is > than the asset value, borrowing is preferred and vice versa Evaluation of Financial Leases Residual value when evaluating whether to lease or purchase an asset, we have to charge a lease with the loss of any residual value The present value of net benefit from salvage is equal to: S n S n dT 1 (1 k ) (d r ) (1 k ) n residual values are often difficult to estimate because a judgmental risk-adjusted discount rate needs to be applied Reasons For Leasing Leasing and taxes Many firms find it advantageous to lease rather than borrow because of the differential tax treatments between lessors and lessees Leases and accounting to overcome the effects of leasing on companies balance sheets, the CICA provides guidelines on distinguishing between operating and financial leases and how to treat financial leases Reasons For Leasing Other reasons for leasing include: 1. ready availability companies with poor credit ratings can sometimes obtain 100 percent financing through a lease compared to only partial loan financing on the same asset 2. payment provisions If payments on a loan are variable while lease payments are fixed, the borrowing option contains an additional element of risk, giving incentive to lease Reasons For Leasing Organizational considerations some leases are written simply to circumvent organizational restrictions on capital expenditures Lease financing through manufacturers terms under a manufacturers lease may be more attractive than those that a customer could get under a comparable loan Flexibility and obsolescence leases provide the lessee with flexibility and insurance against obsolescence Summary 1. The lessor retains title to the asset and makes it available to a lessee in return for periodic lease payments. The lessor takes capital cost allowance (CCA) and any residual value on the asset at the end of the lease agreement. 2. Operating leases provide for a contractual commitment that is short relative to the life of the asset. The risk of obsolescence rests with the lessor. Summary 3. Financial (or capital leases) call for a contractual arrangement of sufficient length to allow the lessor to recover the full costs of the asset plus a return. From the viewpoint of the lessee, reliance on a financial lease is very similar to raising funds through debt. Financial leases may take the form of direct leases or sale-and-leaseback arrangements, and they may be two-party leases or thirdparty, tax-leveraged leases. Summary 4. The quantitative analysis of leasing versus borrowing is carried out within the framework of discounted cash flow analysis. The relevant cash flows under a lease consist of: the initial financing obtained in the amount of the purchase price of the asset (an inflow or saving) subsequent direct cash outflows in the amount of the after-tax lease payments subsequent indirect costs that consist of the tax savings lost by being unable to claim CCA on the asset, and net benefits lost through foregoing any residual value that the assets may have at the end of the lease period Summary 5. The effective cost of a lease is given by its internal rate of return (IRR). The IRR is compared to the aftertax interest cost of a term loan, and the alternative with the lower cost is preferred. 6. The lease’s net present value (NPV) is given by: NPV leasing = + purchase price of asset - present value of after-tax lease payments - present value of tax savings from lost capital cost allowance - present value of lost net benefits from residual value Summary 7. The discount rate employed in calculating the NPV is the after-tax interest cost on a comparable term loan. A higher, risk-adjusted discount rate, however, may be appropriate for the residual value. Summary Major reasons that have contributed to the popularity of leasing include: differences in tax rates and regulations applicable to lessor and lessee different accounting treatments of lease and debt financing different provisions governing lessors and creditors in case of default Summary 9. Other considerations that may play a role in evaluations of leasing and borrowing include differences in payment provisions (fixed versus variable payments), organizational restrictions regarding capital acquisitions, and differences in the flexibility afforded.