Ending retained earnings (SE basis) Dividends declared

advertisement

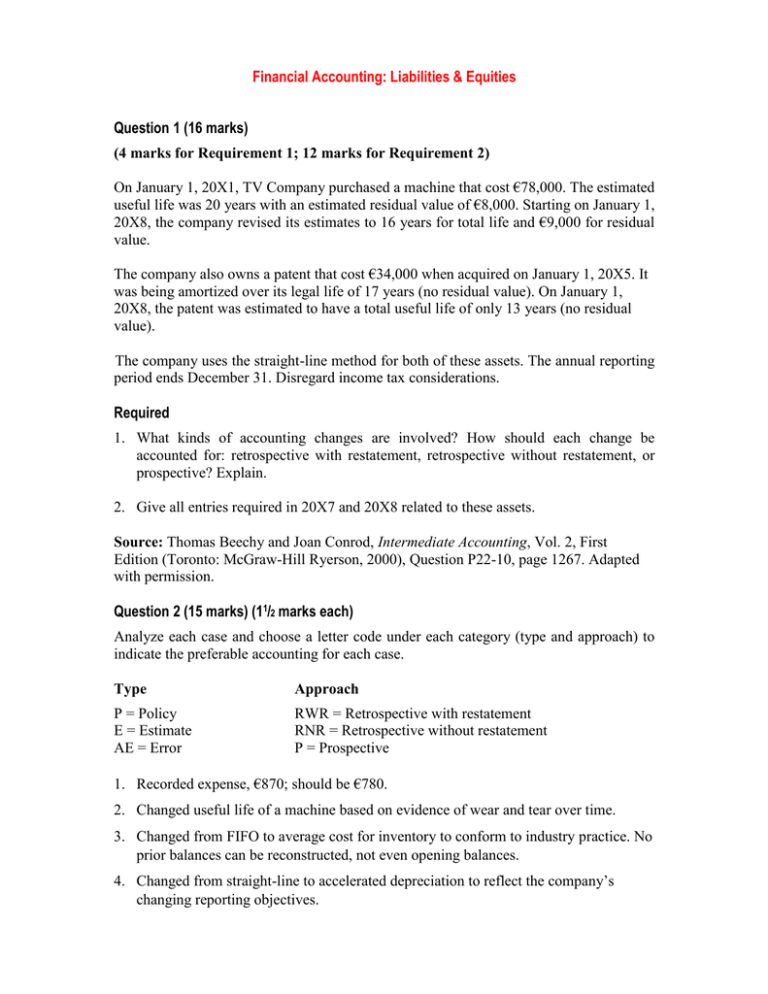

Financial Accounting: Liabilities & Equities Question 1 (16 marks) (4 marks for Requirement 1; 12 marks for Requirement 2) On January 1, 20X1, TV Company purchased a machine that cost €78,000. The estimated useful life was 20 years with an estimated residual value of €8,000. Starting on January 1, 20X8, the company revised its estimates to 16 years for total life and €9,000 for residual value. The company also owns a patent that cost €34,000 when acquired on January 1, 20X5. It was being amortized over its legal life of 17 years (no residual value). On January 1, 20X8, the patent was estimated to have a total useful life of only 13 years (no residual value). The company uses the straight-line method for both of these assets. The annual reporting period ends December 31. Disregard income tax considerations. Required 1. What kinds of accounting changes are involved? How should each change be accounted for: retrospective with restatement, retrospective without restatement, or prospective? Explain. 2. Give all entries required in 20X7 and 20X8 related to these assets. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question P22-10, page 1267. Adapted with permission. Question 2 (15 marks) (11/2 marks each) Analyze each case and choose a letter code under each category (type and approach) to indicate the preferable accounting for each case. Type Approach P = Policy E = Estimate AE = Error RWR = Retrospective with restatement RNR = Retrospective without restatement P = Prospective 1. Recorded expense, €870; should be €780. 2. Changed useful life of a machine based on evidence of wear and tear over time. 3. Changed from FIFO to average cost for inventory to conform to industry practice. No prior balances can be reconstructed, not even opening balances. 4. Changed from straight-line to accelerated depreciation to reflect the company’s changing reporting objectives. 5. Change in residual value of an intangible operational asset based on changed economic circumstances. 6. Changed from deferral to liability basis for accounting for income taxes to conform to new accounting standard. 7. Changed from percentage-of-completion to completed-contracts for long-term construction to reflect change in reporting objectives. All prior balances can be reconstructed. 8. Changed from average cost to FIFO for inventory to facilitate a new system of record keeping. Only opening balances can be reconstructed. 9. Changed to a new accounting principle required by a revised IFRS. 10. Discovered that a plant and equipment with a 10-year life had been expensed when acquired five years ago. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question E22-2, page 1257. Adapted with permission. Question 3 (17 marks) (1 mark for Requirement 1; 6 marks for Requirement 2; 4 marks for Requirement 3; 2 marks each for Requirements 4, 5, and 6) Bite Corporation has always deferred product promotion costs and amortized the asset balance on a straight-line basis over the expected life of the related product. The company decided to change to a policy of immediately expensing such costs to more closely conform to tax treatment, a recently adopted corporate reporting objective. The change was adopted at the beginning of 20X7. Costs incurred are as follows: 20X3 20X4 20X5 20X6 20X7 Amount Life span €68,000 40,000 20,000 52,000 45,000 10 years 4 years 5 years 10 years 9 years Required 1. Identify the type of accounting change involved. Which approach should be used: current, retrospective with restatement, or retrospective without restatement? Explain. 2. Prepare the entry(ies) to appropriately reflect the change in 20X7, the year of the change, including the entry to record 20X7 expenditures. Disregard income tax. 3. Explain how the change should be reported on the 20X7 financial statements, which include the 20X6 results for comparative purposes. 4. Prepare the entries to reflect the change in the accounts in 20X7, including the 20X7 expenditures, if only the opening 20X7 balance can be reconstructed. What would change in financial statement presentation? 5. Prepare the entries to reflect the change in the accounts in 20X7, including the 20X7 expenditures, assuming that no restatement of any balances was possible. 6. Explain how classification of the costs on the cash flow statement would change as a result of the new accounting policy. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question E22-7, pages 1259 and 1260. Adapted with permission. Question 4 (20 marks) (5 marks for Requirement 1; 13 marks for Requirement 2; and 2 marks for Requirement 3) Note: In Requirement 2, you must complete two years of comparative information on the retained earnings statement. (That is, the retained earnings statement should include 20X6, 20X5, and 20X4.) Also prepare the accounting policy disclosure note regarding the changes. In 20X6, Digger Oil Company changed its method of accounting for oil exploration costs from the successful efforts method (SE) to full costing (FC) for financial reporting because of a change in corporate reporting objectives. Digger has been in the oil exploration business since January 20X3; prior to that, the company was active in oil transportation. Pre-tax income under each method is as follows: 20X3 20X4 20X5 20X6 SE FC € 5,000 22,000 25,000 40,000 €15,000 25,000 35,000 60,000 Digger reports the result of years 20X4 through 20X6 in its 20X6 annual report and has a calendar fiscal year. The tax rate is 30%. Additional information Ending retained earnings (SE basis) 20X3 20X4 20X5 20X6 €18,000 23,000 31,000 n/a Dividends declared € 9,000 10,400 9,500 18,000 Required 1. Prepare the entry in 20X6 to record the accounting change. Use “natural resources” as the depletable asset account. 2. Prepare the comparative retained earnings statement. 3. Describe how the accounting policy change would affect the cash flow statement. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question P22-8, page 1266. Adapted with permission. Question 5 (10 marks) (2 marks for Requirement 1 and 8 marks for Requirement 2) In 20X6, Cathode Company, a calendar fiscal year company, discovered that depreciation expense was erroneously overstated €1,000 in both 20X4 and 20X5, for financial reporting purposes. The tax rate is 30%. Additional information Beginning retained earnings Profit, as reported with error Dividends declared 20X6 20X7 €28,000 18,000 8,000 €18,000 16,000 6,000 Required 1. Record the entry in 20X6 to correct the error. 2. Provide the comparative retained earnings statement for 20X6, including any required note disclosure. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question P22-13, page 1269. Adapted with permission. Question 6 (22 marks) Case analysis Carpanthian Technologies Ltd. (CTL) is a long-established company involved in manufacturing heavy equipment, used mostly by mining companies in Siberia. In the past ten years, three of its products have accounted for 70% of its sales and are relatively stable. However, four years ago, the company began a relatively risky project to design and develop a machine incorporating new technology and materials, which was expected to be significantly more efficient that the existing alternatives. There was considerable optimism surrounding the project. However, as time went on, the project became plagued with problems. There were cost overruns. Prototypes were not capable of delivering the operational efficiencies promised. There was significant turnover among the engineering staff and the project took far longer than expected as a result. Throughout this three-year time period, all costs associated with the project were deferred. These costs appropriately met the deferral criteria for development cost category. At the end of 20X4, the deferred development costs associated with this project amounted to €11,567,000. In 20X5, another €3,112,000 was spent, making the total cost €14,679,000. The project was finally ready for commercial production. At this time, markets for the product were formally reassessed, with poor results. Both the size of the market and the price per unit were found to have been overestimated; as a result, the deferred development costs could not be recouped through future sales. It was estimated that deferred costs would have to be written down by €8,500,000. This amount has been reviewed by the external auditors, and all are in agreement that the amount is appropriate and that there will be future sales to support the remaining €6,179,000 of development costs. These remaining development costs will be amortized as units are sold, resulting in normal profit margins. At this point, there is some debate about how to account for the €8,500,000 write-down. One member of the management team believes that it should be accounted for as an error, since the past estimates of future sales were obviously significantly incorrect. If correct sales forecasts had been available, a major portion of the development costs would have been written off to expenses in the last three years. The president prefers to treat this change as a retrospective change in accounting policy: a change in the amount of development expenses that are eligible for deferral. Specifically, accounting policy would change to exclude the cost of rework and the cost of delays caused by staff turnover or human error in the development category. These would be expensed as incurred. The bulk of the writeoff would then affect retained earnings. One of the vice-presidents believes that this is a change in an estimate — the sales estimate — and thus should be treated completely on a prospective basis. That is, all that should change is that more annual expenses should be charged each year. In this scenario, there would be no immediate write-down, the deferred asset would stay intact at €14,679,000, but future expenses would be higher. The final scenario is to treat the amount as a writedown in 20X5, as an unusual item on the income statement. You have been asked to provide your advice on the issue. You are aware that the company has more debt financing now than ever before, as debt was taken on to finance this new project. Lenders are fully secured, but are anxious to see profits from the company. Required Prepare a report addressing the issue raised. Note: Case analysis is limited to 1,000 words. A maximum of two marks is awarded for the quality of written communication. Suggested solutions Question 1 (16 marks) Requirement 1 (4 marks) Each situation involves a change in estimate. A change in estimate is accounted for using the prospective approach. Under this approach, the effect of the change is allocated to the current and future periods. Requirement 2 (12 marks) a. December 31, 20X7, adjusting entries (prior to the changes) Depreciation expense, machine ....................................... Accumulated depreciation, machine ......................... 3,500 3,500 Computation: (€78,000 €8,000) 20 yrs = €3,500 Amortization expense, patent ......................................... Accumulated amortization, patent ............................. 2,000 2,000 Computation: €34,000 17 yrs = €2,000 b. 20X8, Year of change No entry required to record a change in estimate. c. December 31, 20X8, adjusting entries Depreciation expense, machine ....................................... Accumulated depreciation, machine ......................... Computation: Cost of machine ......................................................... Depreciation to date (€70,000 7/20) ....................... Revised residual value ............................................... Remaining amount to be depreciated ........................ Annual depreciation, SL [€44,500 (16 7 yrs)] .... Amortization expense, patent .......................................... Accumulated amortization, patent ............................. Computation: Cost ............................................................................ Amortization to date (€34,000 3/17) ...................... Remaining amount to be amortized ........................... Annual amortization [€28,000 (13 3 yrs)]. .......... 4,944 4,944 € 78,000 (24,500) (9,000) € 44,500 € 4,944 2,800 2,800 € 34,000 (6,000) € 28,000 € 2,800 Question 2 (15 marks) (11/2 marks each) Type P = Policy E = Estimate AE = Error Approach RWR RNR P 1. Recorded expense, €870 not €780. AE RWR 2. Changed useful life of a machine. E P 3. Changed from FIFO to AC; no restatement possible. P P 4. Changed from straight-line to accelerated amortization. New reporting objectives. P RWR 5. Change in residual value of an intangible operational asset. E P 6. Changed from accrual to liability for tax: accounting standard changed. P RWR 7. Changed from percentage-of-completion to completed contracts for long-term construction contracts; all prior balances can be reconstructed. P RWR 8. Changed from average cost to FIFO for inventory; only opening balances can be reconstructed. P RNR 9. Changed to a new accounting principle required by the revised IFRS. P Case (event or transaction) 10. Property, plant and equipment expensed five years ago. RWR (unless P or RNR specified in section) AE Question 3 (17 marks) Requirement 1 (1 mark) The change is a change in accounting policy, to be applied retrospectively with restatement. RWR Requirement 2 (6 marks) Amount 20X3 20X4 20X5 20X6 Beginning of 20X7 Cumulative Net Book Amortization Value Life Yearly Span Amortization € 68,000 40,000 20,000 52,000 € 180,000 10 4 5 10 € 6,800 10,000 4,000 5,200 € 26,000 (4) (3) (2) (1) € 27,200 30,000 8,000 5,200 € 70,400 Effect on 20X3 – 20X6 profit: Expense, new policy ........................................................ Amortization, old policy .................................................. Decrease in NI ................................................................. € 40,800 10,000 12,000 46,800 € 109,600 € (180,000) 70,400 € (109,600) Effect on 20X7 profit: Expense, new policy ........................................................ Amortization, old policy (€26,000 + €5,000*) ................ Decrease in NI ................................................................. * €45,000/9 = €5,000 € (45,000) 31,000 € (14,000) Journal entries Retained earnings (cumulative effect of change in accounting policy) ........... Deferred promotion expenditures .................................... Promotion expense................................................................. Cash ................................................................................. 109,600 109,600 45,000 45,000 Requirement 3 (4 marks: 1/2 mark for items 1 and 3 and 1 mark for each other item) The change would be reported as follows: 1. 20X7 expense would be €45,000, following the new policy. 2. 20X7 opening retained earnings would be reduced by the cumulative effect of the accounting change, €109,600. 3. 20X6 expense would be changed from €26,000 to €52,000 (a difference of €26,000). 4. 20X6 opening retained earnings would be reduced by the remaining cumulative effect of the accounting change, €83,600 (€109,600 – €26,000). 5. Note disclosure would describe the change and the effect on 20X7 and 20X6 profits (€14,000 and €26,000 decrease, respectively). Requirement 4 (2 marks) If prior years could not be reconstructed, the journal entries recorded in Requirement 2 would remain unchanged, as opening balances only are affected by the journal entries. Retained earnings (cumulative effect of change in accounting policy) ........... Deferred promotion expenditures .................................... 109,600 109,600 Promotion expense................................................................. Cash ................................................................................. 45,000 45,000 Reporting would involve items 1 and 2 listed in Requirement 3. Items 3 and 4 would not be feasible; the note disclosure would discuss the effect on 20X7 profit only, and explain that the comparatives are not restated. Requirement 5 (2 marks) No restatement possible Promotion expense................................................................. Cash ................................................................................. 45,000 45,000 The change in policy would be applied prospectively, for 20X7 expenditures only. Expenditures made prior to 20X7 may be written off if there is evidence that the value of these expenditures has been impaired, or they may be amortized until their useful life expires. Requirement 6 (2 marks) Before the change, the expenditures would have been reported as an outflow under investing activities. Amortization would have been an add-back under operations (indirect disclosure of the operating activities section). After the change, the expenditures are reported in operations, as part of the profit figure (indirect disclosure) or as an operating outflow (direct disclosure). Question 4 (20 marks) Requirement 1 (5 marks) Entry to record accounting change, 20X6 Natural resources ................................................................... Retained earnings, effect of accounting change1 ............. Future income tax liability ............................................... 1 23,000 16,100 6,900 Total difference in pretax income for the two methods for 20X3 – 20X5 is €23,000 [(€5,000 + €22,000 + €25,000) – (€15,000 + €25,000 +€35,000)] = €23,000 70% = €16,100 (FC has higher income.) Requirement 2 (13 marks; 3 marks for 20X6, 4 marks for 20X5, 4 marks for 20X4, and 2 marks for disclosure note) DIGGER OIL COMPANY Retained Earnings Statement Years ended December 31 Beginning balance, as previously reported ................ Cumulative effect of accounting change, net of €6,900, €3,900, and €3,000 tax .................... Beginning balance restated ........................................ Profit (after 30% tax) ................................................. Dividends ................................................................... Ending balance........................................................... 1 2 3 20X6 20X5 20X4 € 31,000 € 23,000 € 18,000 16,100 1 47,100 42,000 (18,000) € 71,100 € 9,100 2 7,000 3 32,100 25,000 24,500 17,500 (9,500) (10,400) 47,100 € 32,100 €16,100 = [€23,000 (1 – 0.3)] amount from entry covering all years affected €9,100 = [€13,000 (1 – 0.3)] after-tax income difference for 20X3-20X4 €7,000 = [€10,000 (1 – 0.3)] after-tax income difference for 20X3 Disclosure note: The company changed from the successful efforts to the full costing method of accounting for oil exploration costs in 20X6. The after-tax effects of the change on income are as follows: Effect of change on: Increase in profit ........................................... 4 5 6 20X6 €14,000 4 20X5 € 7,000 5 20X4 € 2,100 6 €14,000 = (€60,000 – €40,000) (1 – 0.3) €7,000 = (€35,000 – €25,000) (1 – 0.3) €2,100 = (€25,000 – €22,000) (1 – 0.3) Requirement 3 (2 marks) Under SE, all development expenses for unsuccessful properties would be reflected in operations, either directly, listed as a cash outflow under the direct method of presentation, or indirectly, as part of profit under the indirect method of presentation. Under FC, the expenditures would be shown as an outflow under the investing activities section. Question 5 (10 marks) Requirement 1 (2 marks) 20X6 entry to correct error Accumulated amortization ..................................................... Future income tax liability (€2,000 30%)..................... Retained earnings, error correction.................................. 2,000 600 1,400 Requirement 2 (8 marks: 3 marks for 20X6 and 5 marks for 20X5) CATHODE COMPANY Retained Earnings Statement Year ended December 31 20X6 Beginning retained earnings, as previously reported ............. € 28,000 Error correction, amortization, net of €600 and €300 tax, respectively ......................................................................... 1,400 1 Beginning balance restated .................................................... 29,400 Profit ................................................................................... 18,000 Dividends declared ................................................................ (8,000) Ending balance....................................................................... € 39,400 1 2 3 20X5 € 18,000 700 2 18,700 16,700 3 (6,000) € 29,400 See entry After-tax effect of error on 20X4 income, (€1,000 70%) €16,000 + (€1,000 (20X5 error) 70%) Disclosure note: In 20X6, the company discovered that amortization expense was overstated by €1,000 in both 20X4 and 20X5. The 20X5 statements are restated to reflect the correct amortization. The error decreased 20X5 profit by €700. Question 6 (22 marks) Case analysis solution Overview Carpanthian Technologies Ltd. (CTL) is a long-established company. It has fully secured lenders who are anxious to see profits from a new project; the level and pattern of earnings is important to this group. Issue Classification and treatment of an accounting change — error, estimate, policy and retrospective, one-year write-off, or future write-off. Analysis Development costs were deferred in the past, but this deferral was too aggressive and current estimates of future sales indicate the need for a write-down of €8,500,000. This write-down could be viewed as an error — prior estimates were in error. If prior sales estimates had been correct, the costs would not have qualified for deferral in the past as they would not meet the test of probable future recovery. Past expenses would have been higher, and assets and retained earnings lower. Correcting an error would involve retrospective restatement of assets, expenses, and retained earnings. This would largely bypass this year’s (20X5) income statement. This treatment might reassure lenders by not excessively affecting 20X5 income. With lower future depreciation of the lower asset values, future income patterns would be more reassuring for lenders as well. However, a change in a sales estimate is not an error and the change is not included under this category. This was not an accidental mis-estimate, so it does not qualify as an error. Another suggestion is that this is a change in estimate and should only be accounted for prospectively. This would result in the asset remaining on the books, with higher future depreciation. There are a number of problems with this approach. First, although users may be reassured by the presence of the asset, future (higher) depreciation will result in low or negative earnings from this project. It has been stated that the full amount of the deferred development costs would not be recoverable from normal sales, which certainly implies that unadjusted depreciation would exceed gross profit. This would not reassure lenders, and is contrary to the desired result. Finally, it is not acceptable to leave a deferred development cost on the books when that has no future benefit. The future benefit is the future cash flow from the revenue stream. If the revenue stream will not support the full amount of the deferred costs, then a write-down is necessary. Assets must have integrity. Furthermore, prospective treatment of a change in estimate means that the change is accounted for in current and future periods, not just future periods. Thus, this suggestion is not acceptable. Another suggestion is that there should be a write-down in the current year, followed by lower future depreciation. This write-down would be an unusual item on the income statement. This is analogous to a “lower of cost or market” write-down for any asset and is supportable. It is the logical result of deciding that this change is a change in estimate. (The estimate is of future sales.) Recording a large write-down will result in very low income this year (a bath) and respectable earnings in the future. The future earnings will be acceptable to lenders, although the current year results will be a shock. Perhaps lenders should be consulted about the situation as soon as possible to cushion the shock. The final solution is to treat the change as a change in policy: a change in the types of costs that are eligible for capitalization. It seems logical to suggest that the costs of human error, rework, turnover and so on are not appropriate for deferral and that this accounting policy change is correctly treated on a retrospective basis. This means that the bulk of the write-off would affect retained earnings and comparative earnings. This action results in more stable current and future earnings — current earnings do not have to bear the cost of the write-down and future earnings are protected through the lower depreciation. However, it is necessary to consider whether this really is a change in policy. It would, of course, be helpful to know what others in the industry do when categorizing development costs. Is this a change to comply with industry practice? Conclusion It seems that the driving force behind the write-down is the reduced sales estimates. This is a change in an estimate and supports the write-down in 20X5 (unusual item) treatment. The suggestion to use retrospective treatment consistent with a change in policy appears to be more manipulative and brought up after the fact to support an accounting treatment that might look attractive to users. It is not ethical to manipulate accounting information in this way. Accordingly, the accounting treatment that seems the most appropriate is to record the write-down in the current year as an unusual item. Note: Students may support the change in policy treatment and retrospective restatement. If their position is appropriately justified, it is acceptable. Marking key Note: This marking key is provided for guidance and is not intended to be a complete solution. Since there is no right answer to a case analysis, the marking key provides for more than the maximum mark allocation. Use considerable judgment in applying the key. Award marks for valid approach and commentary and keep in mind that no student will cover all the points. Overview Long established company (½) Lenders looking for profits from new project (1) Level and pattern of earnings important (1) Maximum 2 Issues Classification and treatment of accounting change (1/2) Maximum 1/2 Analysis Error Prior sales were in error (1) Costs would have been written off as incurred (1) Past expenses higher, assets and RE lower (1) Correct error with retrospective approach (1) Avoid this IS (1), restate prior years (1/2) Lenders might prefer — current NI higher (1), future NI higher (1) Not accidental misstatement, though (1) Other valid points (1 each) Estimate, prospective, future only Asset still on books, future earnings lower (1) Users might like asset, but not lower future earnings (1) Future earnings would be negative (1) No future benefit to support asset (2) Lenders not well served (1) Other valid points (1 each) Write down this year, lower future depreciation Analogous to LCM (and so on) (1) Logical result after change of estimate (1) Unusual item (why) (1) Bath this year (1) Future earnings respectable (1) Effect on lenders (1) Other valid points (1 each) Change in policy Policy is types of costs eligible for deferral (1) Treatment is retrospective: avoid IS (1) Future amort still low (½) Effect on lenders; stable pattern? (1) Window dressing? (1) Other valid points (1 each) Maximum 18 Recommendations A sensible recommendation, consistent with analysis 0 for no recommendation or illogical recommendation 1 for a weak recommendation 2 for an intelligent recommendation Maximum 2 Communication Organization, quality of expression 0 for unacceptable communication skills 1 for weak communication skills 2 for acceptable communications skills Maximum 2 Overall — maximum 22