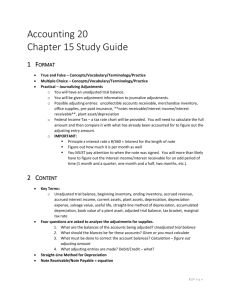

Accounting Cycle Completion: Adjusting & Closing Entries

advertisement

Chapter 9 Completing the Accounting Cycle Created by D. Gilroy Heart Lake Secondary School 1 The Adjustment Process The Adjusting Process We now know that financial statements are used extensively to assist in making business decisions. It is the accountants responsibility to ensure that these financial statements are accurate, up-to-date, and consistent from year to year. 3 The Adjusting Process When preparing the financial statements, the accountant must ensure: All accounts are brought up to date; All late transactions are taken into account; All calculations have been made correctly; and All GAAPs have been complied with. 4 The Adjusting Process Bringing the account data up-to-date at statement time is known as “making the adjustments”. The accounting entries produced by this process are known as adjusting entries. In most cases adjusting entries assign amounts of revenue or expense to the appropriate accounting period before the books are finalized for the fiscal period. 5 The Adjusting Process Adjusting entries are necessary because the books of account are allowed to become inaccurate between statements dates. Some accounts do not need to be perfectly accurate at the end of each business day BUT do need to be adjusted in order to determine the correct net income of net loss for the period. 6 The Adjusting Process The first three adjusting entries are: Adjusting entries for Supplies; Adjusting entries for Prepaid Expenses; and Adjusting entries for Late-Arriving Purchase Invoices. 7 Adjusting Entries for Supplies When supplies are purchased, their cost is debited correctly to the Supplies account. As supplies are used, which is usually daily, no accounting entries are made to record this usage. During the accounting period, the balance of the Supplies account represents the balance at the beginning of the period plus any new supplies purchased. 8 Adjusting Entries for Supplies The balance of Supplies Expense is zero. In order to satisfy the Matching Principle, both of these accounts must be adjusted to reflect the usage (i.e. expense) during the fiscal period. To book the adjusting entry, you must first determine the supplies inventory (by counting the remaining supplies). You then determine the cost of the supplies used (i.e. difference between the inventory count and the balance of the supplies account). 9 Adjusting Entries for Supplies Assume the Supplies on hand at December 31, 2007 are $1,386 (i.e. the supplies inventory). 2007 2007 6,514 1,386 6,514 6,514 2007 10 Adjusting Entries for Prepaid Expense There are times in business when expense items are paid for in advance. This presents no problem if the expense item falls entirely within the fiscal period . If the expense item affects more than the current fiscal period, then it must be treated as a prepaid expense. A prepaid expense is an item paid for in advance, but one where the benefits extend into the future. 11 Adjusting Entries for Prepaid Expense Insurance is the most common prepaid expense. A business can purchase insurance to cover possible losses on automobiles, buildings, contents, crops, etc. When you purchase insurance, you usually pay for one year’s coverage in advance. ( Note: occasionally, the period can be greater than one year.) 12 Adjusting Entries for Prepaid Expense When prepaid expenses are purchased, they are usually debited to a prepaid expense account. Prepaid expenses accounts have value and are therefore classified as assets. If, for example you were to cancel an insurance policy, all (or a portion) of the prepaid insurance expense would be refunded by the insurance broker / company. 13 Adjusting Entries for Prepaid Expense Prepaid annual insurance premium on September 1, 2007. 2007 2007 600 1,200 600 600 $1,800 x 4/12 14 Adjusting Entries for Late-Arriving Purchase Invoices Goods and services are often bought and received toward the end of an accounting period. The invoices for these items may not arrive until the subsequent fiscal period. The Matching Principle states that expenses are to be recognized in the same period as the revenue that they help to earn. 15 Adjusting Entries for Late-Arriving Purchase Invoices The financial statements are not “typically” prepared until two or three weeks after the fiscal year end. During this waiting period, the accounting department must analyze all purchase invoices in order to find those that affect the fiscal period that just ended. 16 Adjusting Entries for Late-Arriving Purchase Invoices Prior to financial statement preparation, the accountant discovers there were two latearriving invoices: telephone $212 and utilities $315. 17 Class / Homework Students should complete questions in section 9-1 and start questions and exercises section 9-2 in workbook 18 Adjusting Entries and the Work Sheet Adjusting Entries and the Work Sheet The first place that adjusting entries are recorded is on the work sheet. As the work sheet is prepared, adjusting entries are calculated and recorded in a section headed Adjustments. 20 1 954.90 2 2494.00 3 626.00 3 85.00 3 45.00 3 496.00 Supplies Expense Insurance Expense 1 954.90 2 2494.00 An analysis of prepaid A clerk discovered The insurance physical determined inventory three “late” purchase ofthat supplies the balance at Dec.at31 invoices belonging to Dec. totaled 31 should $526. 2007…telephone $45, What be adjusting $4,070. entry truck repair $496 & Whatisadjusting required?entry printer repair $85. is required? Extending Balancingthe theWork Work Balancing Sheet Sheet… the … add determine Work or Sheet subtract the…diff. thebetween adjustments the Balance the Adjustments Columns. twofrom income the trial statement total balance each columns and of the record last the four two in the balance columns last four sheet columns. columns 1 2 3 3 3 3 1 2 Net Income 526.00 4,070.00 3,136.00 Journalize Adjusting Entries So far, the adjusting entries have been recorded only on the work sheet Once the work sheet is complete / balanced, the adjusting entries must be recorded in the books of accounts. Journalize and post all entries that appear in the adjustments section of the work sheet. 23 Journalize Adjusting Entries 24 Class work and homework Students should complete up to end of section 9-2 questions and exercises 25 Closing Entries Closing Entries Concepts The Time Period Concept states that financial reporting, or net income in particular, is done in equal period of time. After you do your adjusting entries and prepare your formal income statements, the accounts must be made ready for the next accounting cycle. 27 Closing Entries Concepts Determine which accounts have balances that continue from one period to the next and which do not. There are two types of accounts … real accounts and nominal accounts. All asset and liability accounts, as well as the owner’s capital account, are considered to be real accounts. 28 Closing Entries Concepts Real accounts have balances that continue into the next fiscal period. Nominal accounts (revenue, expense and drawings accounts) have balances that do not continue into the next fiscal period. Nominal accounts, with the exception of drawings, are related to the income statement. 29 Closing Entries Concepts A special nominal account, called the Income Summary account, is used only during the closing entry process. Once the income statement for a period has been completed, the balances in the nominal accounts are no longer useful … their balance must be taken to zero in preparation for the next accounting cycle. 30 Closing Entries Concepts Closing an account means to cause it to have no balance. Any changes in equity during the period are contained in the Revenue, Expense, and Drawings accounts. Closing these nominal accounts moves the values collected in these accounts into the one real equity account, the Capital account. 31 Complete Accounting Cycle Performed by accounting clerks Performed daily Transactions occur. Source documents. Accounting entries recorded in the journal. Performed monthly Ledger balanced by means of a trial balance. Journal entries posted to the ledger accounts. Work sheet prepared. Formal income stmt. & balance sheet prepared. Closing entries journalized & posted. Adjusting entries journalized & posted. Performed Performed at end of by each fiscal accountants period Post-closing trial balance. Class / Homework p. 324, Exercises 1 p. 326, Exercises 4 33 Journalizing and Posting the Closing Entries Closing Closing Closing Entry Entry Entry 3: 2: 1: transfer 4:transfer transfer thethe balances thebalances balances in Income ininthe Drawings expense revenue Summary account(s) accounts Account account to a newto to nominal the the Income owner’s account Summary Capital called account. account. Income Summary. 1 2 3 3 3 3 1 2 Net Income Summary of Closing Entries Post-Closing Trial Balance Extending the Work Balancing Sheet … theadd Work or Sheet subtract … the adjustments Balance the Adjustments Columns. from the trial total balance each and of the record last four in the columns last four columns. Post-Closing Trial Balance 1 2 3 3 3 3 1 2 526.00 4,070.00 3,136.00 Capital Account Calculating your Post-Closing Balance 4 P. Marshall, Capital $42,000.00 $28,895.42 66,836.09 $42,000.00 3 $95,731.51 $53,731.51 39 Post-Closing Trial Balance P. Marshall, Capital $42,000.00 $28,895.42 66,836.09 $42,000.00 $95,731.51 $53,731.81 40 Class / Homework Students should complete section 9-3 questions and exercises 41 Adjusting for Depreciation Adjusting for Depreciation Assets that are used to produce revenue over several fiscal periods are known as fixed assets. Fixed assets are also known as “long-lived assets”, “capital equipment”, and “plant and equipment”. Except for land, all fixed assets will be used up in the course of time and activity. 43 Adjusting for Depreciation Fixed assets decrease or depreciate in value. Depreciation refers to an allowance made for the decrease in value of an asset over time. It is not possible to calculate depreciation until the end of the asset’s life … only then, can you say how many years it was used and determine its final worth. 44 Adjusting for Depreciation The matching principle dictates that depreciation must be included on every year-end income statement. To do this, accountants must estimate depreciation while the asset is still in use. The two most common methods of calculating depreciation are the: Straight-Line method and Declining-balance method. 45 Straight-Line Depreciation The simplest way to estimate depreciation. The Straight-Line method of depreciation divides up the net cost of the asset equally over the years of the asset’s life. Straight-Line Depreciation for one year = Original Cost Estimated of Asset - Salvage Value Estimated Number of Periods in the Life of the Asset 46 Straight-Line Depreciation You purchased a truck for $78,000 on January 1, 2007. It is estimated that the truck will be used for six years, and at the end of that time, could be sold for $7,800. What is the annual depreciation? Straight-Line Depreciation for one year = = = Original Cost Estimated of Asset - Salvage Value Estimated Number of Periods in the Life of the Asset $78,000 - $7,800 6 $11,700 47 Straight-Line Depreciation You purchased furniture for $5,120 on January 1, 2007. It is estimated that the furniture will be used for 10 years, and at the end of that time, could be sold for $500. What is the annual depreciation? Straight-Line Depreciation for one year = = = Original Cost Estimated of Asset - Salvage Value Estimated Number of Periods in the Life of the Asset $5,120 - $500 10 $462 48 Adjusting Depreciation When adjusting for depreciation you would expect to DR Depreciation Expense CR Asset In order to show the value of the Asset at cost, you would not CR Asset for the depreciation … rather you CR Accumulated Depreciation. 49 Accumulated Depreciation Accumulated depreciation is a valuation or contra account. A contra account is one that is displayed alongside an associated account and has a balance that is opposite to the account it is associated with. Accumulated depreciation is also known as a valuation account … an account that is used, together with an asset account, to show the true net value (or net book value) of the asset. 50 Adjusting Entry for Depreciation In the truck example, the adjusting entry would be: DR Depreciation Expense 11,700 CR Accumulated Amortization 11,700 In the furniture example, the adjusting entry would be: DR Depreciation Expense CR Accumulated Amortization 462 462 51 Financial Statement Presentation Income Statement Depreciation expense is shown on the income statement. Each depreciation expense item is shown separately (e.g. Depreciation Expense – Truck). Balance Sheet Accumulated depreciation is deducted from its respective fixed asset account on the balance sheet. Each asset, with its related accumulated depreciation, is shown separately. For example: Truck $78,000 Less: Accumulated Depreciation 11,700 $66,300 52 Depreciation for Part Year Sometimes an asset is used for only part of a year. For example, you purchase a building on May 1, 2007 for $120,000. The building is expected to be used for 30 years, after which it will be worth $30,000. Your company issued financial statements quarterly (i.e. every 3 months). Annual depreciation = (120,000 – 30,000) / 30 = $3,000 Monthly depreciation = 3,000 / 12 = $250 per month The depreciation expense would be 1st quarter $ 0 and 53 2nd quarter $500. Declining-Balance Depreciation The declining-balance method is an alternative to the straight-line method of calculating depreciation. The declining-balance method is common because the government of Canada requires a variation of this method for income tax purposes. This method calculates the annual depreciation by multiplying the remaining undepreciated cost (i.e. net book value) by a fixed percentage. 54 Declining-Balance Depreciation Some of the percentage rates set by the government are as follows: Canada Customs and Revenue Agency Rates of Capital Cost Allowance (Depreciation) Class Description Rate 3 6 8 10 12 Buildings of brick, stone, or cement Buildings of frame, lot, or stucco Office furniture and equipment Automobiles, trucks, tractors, computer equipment Computer software (except system software) 5% 10% 20% 30% 100% 55 Declining-Balance Depreciation Example: you purchase computers on January 1, 2006 for $22,000. The rate, per the previous slide, is 30%. Depreciation expense would be calculated as follows: 2006: Original Cost $22,000 Less: Depreciation ($22,000 x 30%) 6,600 Undepreciated cost (net book value) $15,400 2007: Undepreciated Cost $15,400 Less: Depreciation ($15,400 x 30%) 4,620 Undepreciated cost (net book value) $10,780 56 Comparison of the Two Methods of Depreciation For straight-line, assume the computers have an 8 year life with an ending value of $2,000. The straight-line method produces depreciation figures that are the same each year. The net book value (NBV) or undepreciated cost gradually reduces until it reaches the estimated Salvage value. $22,000 - $2,000 8 = $2,500 / year 57 Comparison of the Two Methods of Depreciation The decliningbalance method produces depreciation figures that are the larger in the early years and smaller in the later years. The estimated final value is ignored using this method. 58 Tax Regulations Canada Customs and Revenue Agency (CCRA) requires businesses to use the declining-balance method when calculating depreciation for tax purposes. In addition, the CCRA generally allows 50% of the asset’s cost to be eligible for depreciation in its first year of use … regardless of the month it was purchased. The CCRA refers to this as the “50% Rule” 59 Tax Regulations How would the “50% Rule” look? 60 Class / Homework p. 348, Exercise 1 p. 349, Exercise 2 (do all the parts, plus in part B, calculate with and without the “50% rule”) p. 350, Exercise 3 … prepare the adjusting entries and an adjusted trial balance. 61 Comprehensive Exercise p. 361, Exercise 1 62