chapter4

advertisement

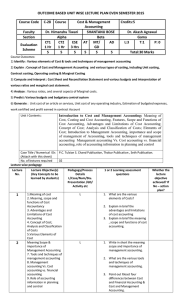

Management Accounting Chapter 4 Traditional Cost Management Systems Department of Accounting Management Accounting Chapter 4 objectives: 1. 2. 3. 4. 5. 6. 7. 8. To be able to understand job order costing systems To be able to understand how using job bid sheets is effective for estimating product costs in a job order costing system To be able to use cost driver rates to apply support activity costs to products To be able to discuss why cost systems with multiple cost driver rates give different cost estimates than cost systems with a single rate To be able to evaluate a cost system to understand whether it is likely to distort product costs, explain the importance of recording actual costs, and compare them with estimated costs To be able to appreciate the importance of conversion costs and the measurement of costs in multistage continuous-processing industries To be able to understand the significance of differences between job order costing and multistage-process costing systems To be able to understand the two-stage allocation process and service department allocation methods Department of Accounting Management Accounting Cost Management Systems Traditional tools: Job order costing systems: A process that estimates the costs of manufacturing products for different jobs required for specific customers Process costing systems: A costing method that computes and allocates an equal amount of cost to each product Recently developed tool: Activity-Based-Costing (ABC): A system based on activites that links organizational spending on resources to the products and services produced and delivered to customers Department of Accounting Management Accounting Job Order Costing and Cost Flow Model Inventories in a manufacturing company • Raw materials inventory • Work-in-process • Finished goods inventory Department of Accounting Management Accounting Job Order Costing and Terminology Job bid sheet: Format for estimating job costs Job cost sheet: Same as a job bid sheet except that the direct materials and direct labor costs on the job cost sheet represent actual costs incurred on the job Cost driver rate: activity expense_______________ total quantity of activity cost driver Job costs: Expenses involved with the direct material, direct labor and support costs for a job Margin: An additional amount added to job costs in order to make a profit Bid price: Equals the total job costs plus the markup (margin) Markup rate: The percent by which job costs are marked up Rate of return: Ration of net income to investment Full absorption costing: A costing method in which alle production costs become product costs Variable costing: A costing method in which only flexible costs are included product costs Department of Accounting Management Accounting Job Order Costing, monitoring and follow-up Melissa’s Auto Service Company Introduction, page 113 Exhibit 4-3, page 120 Exhibit 4-4, page 121 Exhibit 4-5, page 122 Exhibit 4-6, page 123 Exhibit 4-7, page 123 Famous Flange Company Exhibit 4-1, page 115 Exhibit 4-2, page 119 Exhibit 4-9, page 126 Exhibit 4-10, page 126 Exhibit 4-11, page 127 Department of Accounting Management Accounting Job Order Costing and Markup Markup, among other things, depends of: • • • • • • The amount of costs excluded from the cost driver rate Target ”rate of return” Competitive intensity Past bidding strategies adopted by key competitors Demand conditions Overall product-market strategies Depending upon conditions, markup rates may differ for different product groups and/or for different market segments. Department of Accounting Management Accounting Job Order Costing and Cost Drivers Cost driver rate: activity expense_______________ total quantity of activity cost driver Cost pool: Each subset of total support costs that can be associated with a distinct cost driver • Discussing fluctuating cost driver rates (exhibit 4-2) • Discussing how many cost driver rates • Discussing how many cost pools (exhibit 4-8) Department of Accounting Management Accounting Job Order Costing and Actual Job Costs • Registrations • Implications • Monitoring • Action Department of Accounting Management Accounting Multistage Process Costing Systems • Homogeneous manufacturing of products. • Cost are measured only for process stages, and cost variances are determined only at the level of the process stages instead of at the level of individual jobs. • Using conversion costs = costs to convert the materials or product at each stage. Department of Accounting Management Accounting Multistage Process Costing Systems Calcut Chemical Company •Exhibit 4-13 •Exhibit 4-14 •Exhibit 4-15 Department of Accounting Management Accounting Two-Stage Cost Allocations Direct Allocation Method Stage 1 Assignment of costs accumulated in the service department directly to the production departments or activities. Stage 2 Assignment of costs accumulated in production departments and activities to individual products. Department of Accounting Management Accounting Two-Stage Cost Allocations Direct Allocation Method - Distortions Risk of distortions in two-stage allocations typically are: Allocations based on unit-related measures Differences in relative consumption ratios Department of Accounting Management Accounting Two-Stage Cost Allocations Sequential Allocation Method Allocates service departments costs to production departments and other service departments in a sequential order. Department of Accounting Management Accounting Two-Stage Cost Allocations Reciprocal Allocation Method Allocates service departments costs to production departments and other service departments in a reciprocal order. Needs to be resolved by developing two or more equations. Department of Accounting