Document

advertisement

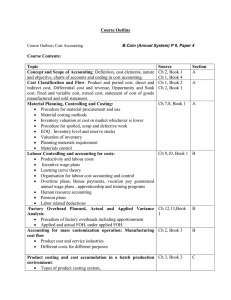

13-1 Standard Costing, Variable Costing, and Throughput Costing Prepared by Douglas Cloud Pepperdine University 13-2 Objectives Describe standard costing and explain why it is After reading this the predominant costing method. chapter, you should Develop standard fixed overhead rates and be able to: apply fixed overhead to products. Prepare standard absorption costing income statement. Compare, contrast, and distinguish actual, normal, and standard costing. Continued 13-3 Objectives Explain why variable costing offers advantages over absorption costing for internal reporting purposes. Prepare variable costing income statements. Describe throughput costing and prepare income statements. 13-4 Standard Absorption Costing Under standard costing inventories appear at standard cost, not actual or normal cost. 13-5 Standard Absorption Costing An important reason for using standard costing is that it integrates standard costs and variances into the company’s record. 13-6 SMP Company, Operating Data 20X1 Production in units Sales in units, at $80 each Ending inventory in units Actual production costs: Variable Fixed Selling and administrative expenses: Variable at $5 per unit Fixed Standards and budgets: Budgeted fixed production costs Standard variable production costs 110,000 90,000 20,000 $2,255,000 $3,200,000 $450,000 $1,400,000 $3,000,000 $20 per unit 13-7 Calculating A Standard Fixed Cost The standard fixed cost per unit depends on two things: (1) The choice of a measure of activity (e.g., direct labor hours, machine hours, setup time etc.). (2) A level of activity. 13-8 Calculating A Standard Fixed Cost Normal activity is the Theoretical activity average activity is the absolute expected or budgeted Practical activity is maximum that a over the coming two the maximum plant can produce, to five years. activity the company with no interruptions can achieve given or problems at all. the usual kinds of interruptions. 13-9 Calculating A Standard Fixed Cost SMP’s management decides to set the standard perunit fixed cost using normal capacity of 100,000 units. Budgeted fixed production costs Standard fixed = cost per unit Level of activity = = $3,000,000 100,000 $30 per unit 13-10 Variances Total actual variable production cost (for source of data, turn click on button below) Standard variable costs (110,000 x $20) Unfavorable variable cost variances $2,255,000 2,200,000 $ 55,000 13-11 Variances Total actual fixed overhead $3,200,000 Fixed overhead applied (110,000 x $30) 3,300,000 Overapplied overhead $ 100,000 13-12 Variances Budgeted fixed overhead Actual fixed overhead $3,200,000 Applied fixed overhead $3,000,000 $3,300,000 (110,000 x $30) $300,000 F $200,000 U Budget variance Volume variance $100,000 F Overapplied overhead 13-13 SMP Company, Fixed Overhead, 20X1 Applied at 110,000 units $3,300,000 $3,200,000 Volume Variance $300,000 F Budget variance, $200,000 U $3,000,000 Dollars Budget Variance $200,000 U Budget Actual $3,200,000 Applied, $30 x units produced 100,000 Production in Units 110,000 13-14 SMP Company, Income Statement for 20X1 Sales Standard cost of sales: Beginning inventory Standard variable production costs Applied fixed production costs Cost of goods available for sale Ending inventory Standard cost of sales Standard gross margin Continued $7,200,000 $ 0 2,200,000 3,300,000 $5,500,000 1,000,000 4,500,000 $2,700,000 13-15 Standard gross margin $2,700,000 Variances: Fixed manufacturing cost budget variance $200,000 U Fixed manufacturing cost volume variance 300,000 F Variable manufacturing cost variance 55,000 U 45,000 F Actual gross margin $2,745,000 Selling and administrative expenses 1,850,000 Profit $ 895,000 13-16 SMP Company, Income Statement for 20X1 Sales Cost of sales: Standard cost of sales Variances: Fixed manufacturing cost budget variance Fixed manufacturing cost volume variance Variable manufacturing cost variances Cost of sales Gross margin Selling and administrative expenses Profit $7,200,000 $4,500,000 Alternative Format 200,000 U 300,000 F 55,000 U 4,455,000 $2,745,000 1,850,000 $ 895,000 13-17 Review Problem SMP, 20X1 Production, in units Sales, in units, at $80 each Ending inventory, in units Actual production costs: Variable Fixed Selling and administrative expenses: Variable at $5 per unit Fixed Standard variable production cost (per unit) Budgeted fixed production costs 95,000 100,000 15,000 $1,881,000 $2,950,000 $ 500,000 $1,400,000 $20 $3,000,000 13-18 SMP Company, Income Statement for 20X1 Sales $8,000,000 Standard cost of sales: Beginning inventory $1,000,000 Standard variable production costs 1,900,000 Applied fixed production costs 2,850,000 Cost of goods available for sale $5,750,000 Ending inventory 750,000 Standard cost of sales $5,000,000 Variances: Fixed mfg. cost budget variance 50,000 F Fixed mfg. cost volume variance 150,000 U Continued Variable mfg. cost variances 19,000 F 13-19 Sales (100,000 x $80) Cost of sales Gross margin Selling and administrative expenses Profit $8,000,000 5,081,000 $2,919,000 1,900,000 $1,019,000 Variances: Variable cost: $1,881,000 – ($20 x 95,000) = $19,000 F 13-20 SMP Company Example Actual fixed overhead Budgeted fixed overhead Applied fixed overhead $2,950,000 $3,000,000 ( 95,000 x $30) $2,850,000 $150,000 U $50,000 F Budget variance Volume variance $100,000 Total fixed overhead variances 13-21 Multiple Products and Activity-Based Costing ARG Company Portable Model Standard direct labor hours Number of component parts Budgeted production Total budgeted use of components Table Model 8 100 6,000 12 200 2,000 600,000 400,000 Standard fixed overhead rate per component ($500,000/(600,000 + 400,000) = $0.50 13-22 Multiple Products and Activity-Based Costing ARG Company Portable Model Material related: Portable model ($100 x $0.50) Table model (200 x $0.50) Direct labor-related: Portable model (8 hours x $4) Table model (12 hours x $4) Standard fixed overhead cost per unit Table Model $50 $100 32 48 $82 $148 13-23 ARG Company Example Actual Cost Budgeted Cost $510,000 $500,000 Applied Cost $550,000 $50,000 F $10,000 U Budget variance Volume variance $40,000 Total overapplied overhead 13-24 Comparison of Standard and Normal Costing Manufacturing Costs Direct Materials Direct Labor Overhead Actual cost system Actual Actual Actual Normal cost system Actual Actual Applied Standard cost system Standard Standard Standard 13-25 Variable Costing Variable costing excludes fixed production costs from the unit costs of inventories, and treats all fixed costs as expenses in the period incurred. 13-26 Flow of Costs in a Manufacturing Firm Materials Inventory Direct Labor Variable Manufacturing Overhead Fixed Manufacturing Overhead Work in Process Inventory Finished Goods Inventory Cost of Goods Sold on income statement Absorption costing Expense on income statement 13-27 SMP Company, Income Statement for 20X1—Actual Variable Costing Sales $7,200,000 Variable cost of sales: Beginning inventory $ 0 Actual variable production costs 2,255,000 Cost of goods available for sale $2,255,000 Ending inventory 410,000 Variable cost of sales 1,845,000 Variable manufacturing margin $5,355,000 Variable selling and administrative exp. 450,000 Contribution margin $4,905,000 Actual fixed costs 4,600,000 Profit $ 305,000 13-28 SMP Company, Income Statement for 20X2—Actual Variable Costing Sales $8,000,000 Variable cost of sales: Beginning inventory $ 410,000 Actual variable production costs 1,881,000 Cost of goods available for sale $2,291,000 Ending inventory 297,000 Variable cost of sales 1,994,000 Variable manufacturing margin $6,006,000 Variable selling and administrative exp. 500,000 Contribution margin $5,506,000 Actual fixed costs 4,350,000 Profit $ 1,156,000 13-29 SMP Company, Standard Variable Costing Income Statement for 20x2 Sales Variable standard cost of goods sold Standard variable manufacturing margin Variable manufacturing cost variances Variable manufacturing margin Variable selling and administrative Contribution margin Actual fixed costs: Budgeted fixed mfg. costs Fixed mfg. cost budget variance Selling and administrative Profit $8,000,000 2,000,000 $6,000,000 19,000 F $6,019,000 500,000 $5,519,000 $3,000,000 $50,000 F 1,400,000 4,350,000 $1,169,000 13-30 Reconciliation of Incomes—Variable and Absorption Costing Variable costing net income Absorption costing net income Difference to be explained Explanation of income differences: Fixed production costs-beg. inventory Fixed production costs during year Less fixed production costs-end. inventory Total fixed costs expensed—absorption costing Total fixed costs expensed—variable costing Difference in incomes 20x1 20x2 $ 295,000 $1,169,000 895,000 1,019,000 $ (600,000 ) $ 150,000 $ 0 3,200,000 $3,200,000 600,000 $2,600,000 3,200,000 $ (600,000 ) $ 600,000 2,950,000 $3,550,000 450,000 $3,100,000 2,950,000 $ 150,000 13-31 Throughput Costing An extreme form of variable costing which follows the principles of the Theory of Constraints. It is a radical departure from other methods in that it treats all costs except unused materials as expenses. It does not record work in process or finished goods inventories. It treats all direct labor and manufacturing overhead costs as period costs expensing them as they are incurred. 13-32 Income Statement Comparison Absorption Costing Sales Variable Throughput Costing Costing $180,000 $180,000 $180,000 Cost of sales 90,000 63,000 50,000 Gross margin 90,000 117,000 130,000 30,000 50,000 Other expenses: Other mfg. costs Selling and admin. 15,000 15,000 15,000 Total other expenses 15,000 45,000 65,000 Income $ 75,000 $ 72,000 $ 65,000 13-33 Chapter 13 The End 13-34 13-35 SMP Company, Operating Data 20X1 Production in ;units Sales in units, at $80 each Ending inventory in units Actual production costs: Variable Fixed Selling and administrative expenses: Variable at $5 per unit Fixed Standards and budgets: Budgeted fixed production costs Standard variable production costs Return to Slide 13-10 110,000 90,000 20,000 $2,255,000 $3,200,000 $450,000 $1,400,000 $3,000,000 $20 per unit