FIRST NATION FINANCIAL CODE TOOLBOX TRAINING SEMINAR

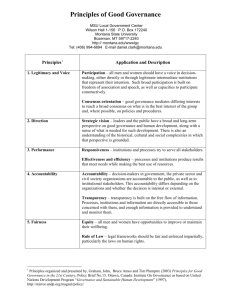

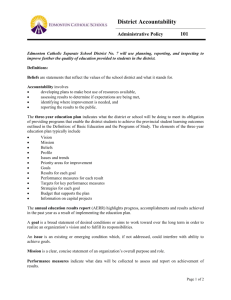

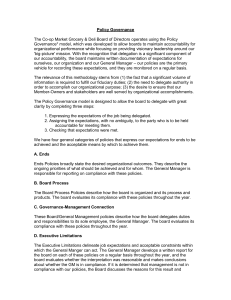

advertisement

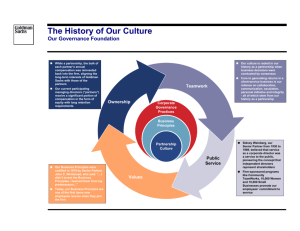

AFOA Canada National Conference Calgary, AB February 27, 2004 Session 6 – Improving Financial Management and Accountability with the Financial Management Toolbox Points to Ponder #1 Ham and Eggs: Just a day’s work for a chicken but a lifetime commitment for a pig. Why do toasters always have a setting that burns the toast to a horrible crisp, which no decent human being would eat? Why is there a light in the fridge and not in the freezer? Presented by ABORIGINAL FINANCIAL OFFICERS ASSOCIATION OF BC Welcome & Overview of Seminar Facilitators Clay Harmon, Director Mike Mearns, General Manager Moderator Susan E. Wood, President – AFOA-BC Welcome & Overview of Seminar This seminar will overview the five toolbox chapters: First Nations Governance Concepts Financial Management By-Law Financial Management Manuals Strategic Planning Capacity Building How did the Financial Code Project begin? In the development of the First Nations Financial Code Toolbox, the Financial Management and Accountability Project committee members realized the importance of “beginning at the beginning”. Who are the Committee Members? AFOABC Board Members Susan E. Wood, President Chris Bolton, Vice-President Clay Harmon, Director Carol Kelly, Interim Vice-President Lynn Anderson, Secretary-Treasurer Mike Mearns, General Manager AFOABC Members Chad Mason, Gitwangak Band Council Jay Norton, DeGruchy, Norton and Company Margaret White, Nanaimo First Nation Myrna Jacobson, Old Massett First Nation Sharlene Wilson, Nil/Tu Child and Family Services Trevor Morrison, Gitksan Watershed Authorities How did the Financial Code Project begin? WHAT DOES EACH TOOL BOX CHAPTER COMPRISE OF? The committees recommendations of successful applications developed throughout the country. Most have been developed by the Aboriginal Financial Officers Association of BC Others have been used by permission by the authors. What is the definition of “CODE”? A systematic body of laws A set of rules or conventions (an agreement between nations, a treaty; established usage, social custom) What is AFOABC’s interpretation of a Financial Code? WHAT IS A FINANCIAL CODE? The first task of the committee was to define what a Financial Code is and what it means. Through a brainstorming session the committee agreed that the following defined their thoughts of a First Nations Financial Code. What is AFOABC’s interpretation of a Financial Code? A FIRST NATION FINANCIAL CODES IS A SET OF PRINCIPLES THAT: Respects the culture, traditions and history of a First Nation. Protects, maintains and increases the resources of a First Nation through effective planning and control. Defines and implements the “Best Practices” for the preparation and communication of quality reporting. Provides high standards and ethical leadership for the equal and confidential treatment for all. What is the First Nations Governance Toolbox? WHAT DOES A FINANCIAL CODE TOOLBOX COMPRISE OF? The second task of the committee was to outline the toolbox “chapters”. This step was important to the creation of the toolbox since it would eventually lead a First Nation into adapting a governance structure that encompassed the First Nation Financial Code principles. It was also important that an order of evolution was outlined. This would guarantee the success of the toolbox application for a First Nation. What is the First Nations Governance Toolbox? The committee agreed the following chapters would be: First Nations Governance Concepts Financial Management Bylaw Financial and Human Resource Policy and Procedures Manuals Strategic Management and Planning Capacity Building COMMUNITY DIRECTION Vision Mission Values CONSTITUTION Founding Provisions Rights and Freedoms Government Structure GOVERNANCE MODEL INSTITUTIONS Government Organization Core Branches Programs & Services BYLAWS Financial Management Human Resources Administration POLICIES & PROCEDURES Financial Human Resources Operations Chapter One: First Nation Governance Concepts A constitution is a solid foundation for First Nation’s with a strong community vision to move ahead in: Treaty Self-government Other Nation building initiatives. First Nation Governance Concepts Part 1 – First Nations Constitution Development This section includes information that relates to importance of having a constitution that provides a solid foundation for: codes, by-laws and policies development. First Nation Governance Concepts Some of the standard components of a First Nations constitution include the following: Founding Provisions Rights and Freedoms of Citizens First Nation Government Structure Government Officials Roles and Responsibilities Financial Management and Accountability Lands and Resources General Provisions First Nation Governance Concepts The constitution would be specific for their community needs and would serve the purpose of: who you are how you are governed how the membership has input into governance key positions for governance SAMPLE ORGANIZATIONAL CHART COMMUNITY MEMBERS CHIEF AND COUNCIL BAND ADMINISTRATOR ADMINISTRATION HUMAN RESOURCES SOCIAL DEVELOPMENT FINANCE EDUCATION SKILLS TRAINING K - 12 - 12 HOUSING LANDS RESOURCES FISHERIES FORESTRY First Nation Governance Concepts Part 2 – Government Organization This section provides information about First Nation government organizational structure that supports the development of: various laws policies procedures administration guidelines necessary for good government First Nation Governance Concepts Government organization in broad terms is a constitution. The structure is developed to create: structure departments committees reporting and accountability systems First Nation Governance Concepts Financial management systems are an integral part of organization structure and are required for: budget planning allocation audit requirements First Nation Governance Concepts Some examples of government organization components are: Government Organization Council size, committee structure Core Branches or Departments Administration, Finance and HR Programs and Services Health, SA, Education, Resource Mngt First Nation Governance Concepts Financial Accountability Policy Sample Is a solid basis for developing and adopting a policy to your own First Nation. The success of any policy is to give “life” to the document by ensuring that all members, staff and council is fully trained and understands the basis of the policy. As with all other policies that are adopted, it becomes a living document that all abide by. First Nation Governance Concepts The policy provides sample wording for: Compliance with Policy Financial Decision-Making Process Conflict of Interest Guidelines Procedures for Financial Information Disclosure Dispute Resolution. First Nation Governance Concepts Appendix A – Building a Community Constitution This Appendix is used by permission by the Institute on Governance. The handbook was developed in collaboration with the Samagok Anishnawbek First Nation and Canadian Executive Services Organization, Aboriginal Services in January 2001. First Nation Governance Concepts The handbook was born out of the Samagok workshop, and is meant as a guide for others First Nations during their constitution-building process. The handbook summarizes both international and Sagamok experiences, and outlines the basic process of developing a constitution. First Nation Governance Concepts It is organized around the four questions that formed the basis of the Sagamok workshop: What is a constitution? Why have a constitution? What should a constitution contain? How can a community develop its constitution? Points to Ponder #2 If the professor on Gilligan’s Island could make a radio out of coconut, why can’t he fix a hole in a boat? Gargling is a good way to see if your throat leaks. If a thing is worth doing, wouldn’t it have been done already? Failure is not an option. It’s bundled with your software. He who dies with the most toys is still dead. Chapter Two: Financial Management By-Law WHAT IS A FINANCIAL MANAGEMENT BYLAW? A key component of the First Nations Financial Code Toolbox is the ability for First Nations to make laws and enforce them. Financial Management By-Law Section 83 of the Indian Act provides for the development of laws in variety of areas. Some First Nations have undertaken the development of a financial management by-law, in particular those that entering into the area of taxation, claims management and economic development. Financial Management By-Law Key components of the Financial Management Bylaw includes: 1. Council Responsibilities planning and budgeting for service and capital projects hiring of competent financial management staff council responsibilities in the areas of annual budgeting, expenditures, information on contracts and tenders, financial statements and audit requirements is covered. Financial Management By-Law 2. Conflict of Interest Guidelines In the development of financial management bylaws conflict of interest guidelines are needed to ensure transparency in financial management procedures. Financial Management By-Law 3. Financial Information Disclosure This relates to the need for accountability to membership and access to financial information. Disclosure also deals with Council member's requirement to provide information about potential financial benefits through Council decisions. Financial Management By-Law 4. Dispute Resolution This section of the by-law ensures there is a process for redress where a band member feels they would be adversely affected by a Council or administrative decision. This area also includes a process for mediation or arbitration. Financial Management By-Law This toolbox chapter includes sample policies that your First Nation can adopt. The policies are: Conflict of Interest Disclosure Contracts and Tenders Optional Committees and Boards Financial Management By-Law In conclusion, law making is an important part of First Nations governance and will requires sound judgment in their creation. Provided laws are based on a shared vision and constitutional provisions that will meet the needs of the community. This will in turn provide a solid base for health, social and economic development. Chapter Three: Financial and Human Resource Policy and Procedures Manual The focus of this First Nations Financial Code Toolbox chapter is on policy and procedure development and its role in helping your First Nation achieve its desired administrative goals. Included are sample policies and procedures for financial management and human resources that your organization may use as a template in the creation of your own. Financial/HR Management Manual WHAT ARE POLICIES? Policies and procedures help ensure that behaviours in the workplace conform to the expectations of the organization and to legal requirements. Different policies and procedures relate to general governance, function, strategic decisions or the administration of specific programs or activities. Financial/HR Management Manual The development of your own effective policies should support the vision, mission and values of your organization. It is important to consider these issues in your development: input from all affected stakeholders relevant, complete and understandable content effective communication to all stakeholders Financial/HR Management Manual all policies documented in a consistent format appropriate authorization and accountability for administering the policy a periodic review process to validate appropriateness and completeness Financial/HR Management Manual Policies should contribute to the growth and development of a high performance organization. Key components of effective policies contain: purpose/objective scope authority policy content They may also contain an effective date and consequences of non-compliance/redress. Financial/HR Management Manual WHAT ARE PROCEDURES? is a step-by-step list of activities required to conduct a certain task. ensure that routine tasks are carried out in an effective and efficient fashion, and in accordance with policy. should contain the following key components: the purpose of the procedure and the policy to which it relates. Financial/HR Management Manual step-by-step instruction on performing the given task. illustrations of any form involved and specific instructions regarding their use. any requirements related to review, approvals and signatures. any requirement relates to the communication of information. the position or person with primary responsibility. Financial/HR Management Manual In conclusion, it is important to remember that this process is irrelevant if all users do not receive and apply your published policy and procedures to their daily practice. Your new manual will be well received by all users if they are easy to understand, develops effective solutions and if there is a communication or training plan in place. Financial/HR Management Manual WHAT SAMPLES DOES THIS TOOLBOX CONTAIN? This toolbox chapter contains a sample Financial Procedures Manual a sample Human Resource Manual which includes samples of Codes of Conduct. Each sample includes samples of various forms, terms of reference for auditors, performance evaluation charts, grievance steps and oath of confidentiality forms. Financial Procedures Manual SAMPLE FINANCIAL PROCEDURES MANUAL This sample contains procedures for administration staff and council on the correct and approved methods of financial control from the recording receipts, depositing funds, disbursement procedures capital assets annual year-end audits. Financial Procedures Manual Good or Service Invoiced to First Nation Is there a BCR approving the expenditure? Ensure that expense is brought to Chief and Council for approval Release Cheques No Yes Attach a copy of signed BCR to invoice No Approval Granted? Yes On scheduled cheque- run days, process cheques for invoices and forward for bank account signatories Data enter invoice into computer accounting program Yes No Attach a copy of purchase order to invoice Forward invoice to department head or purchasing staff for verification and approval. Yes No Are all the cheques signed? Does the invoice reference a purchase order? Yes Notify vendor that invoice is not approved for payment. No Sample Accounts Payable Process Is the good or service amount exceeding cost limits set by Chief and Council? Yes Forward invoice to accounts payable Yes Accounts Payable Attach all packing slips, work orders, waybills, purchase orders, etc to invoice Code expense to appropriate department and forward to department head for approval Approval Granted? Approval Granted? Invoices returned to accounts payable for proper documentation or coding No No Notify vendor that invoice is not approved for payment. Human Resource Manual SAMPLE HUMAN RESOURCE MANUAL This sample contains policies for managing staff. It defines: the conditions of employment benefit entitlement reporting performance evaluations and redress Human Resource Manual It complies with the Canadian Labour Code and would work in cooperation with an Operations Manual. This is the single important document that would provide your First Nation with a healthy workplace. The First Nation that regularly reviews and amends their Human Resource Manual seldom has recruitment or retention problems. Points to Ponder #3 If Wile E. Coyote had enough money to buy all that ACME equipment, why didn’t he just buy dinner? If corn oil is made from corn, and vegetable oil is made from vegetables, then what is baby oil made from? Did you ever notice that when you blow in a dog’s face, he gets mad at you, but when you take him on a car ride, he sticks his head out of the window? Chapter Four: Strategic Management & Planning The focus is strategic planning for First Nations The information contained in this chapter was written by Jim Pealow, MBA, CMA, CAFM and being used by permission It is also course content reading for AFM4 – Strategy and Decision Making of the Certified Aboriginal Financial Manager program of the Aboriginal Financial Officers Association of Canada Strategic Management & Planning This publication will inform those in First Nations leadership positions about strategic management and accountability Highlight some practices that will assist in improving the quality of First Nations’ activities in planning and accountability. Strategic Management & Planning Information is presented in five sections First an introduction and addresses the current situation. The second is information on strategic management. The third looks at accountability and related issues. Strategic Management & Planning The fourth is a section of examples and best practices are presented to allow the reader to measure against and consider potential improvements. The last section includes sources of information to provide additional knowledge for those wishing to examine topics further. Strategic Management & Planning Learning Objectives By using the information in this publication, you will be able to: Gain a better understanding of accountability and how it benefits an organization. Develop an accountability program. Strategic Management & Planning Understand the relationship between accountability and strategic management. Gain a better understanding of strategic management and how it benefits an organization. Assess strategic management activities in an organization. Strategic Management & Planning What is Strategic Management? Strategic management can be defined as the art and science of formulating, implementing, and evaluating cross-functional decisions that enable an organization to achieve its objectives. Strategic Management & Planning Other definitions bring in different elements integral to a strategic management process. This definition, however, clearly describes the heart of strategic management. Strategic management focuses on integrating all organizational activity for the purpose of achieving organizational success. Strategic management can be viewed as a formal planning process that allows a First Nation to pursue proactive rather than reactive strategies. Strategic Management & Planning Feedback Internal Audit Establish Vision, Mission, & Values Establish Goals & Critical Success Factors Generate & Select Strategies & Performance Measures Establish Policies, Action & Budgets Allocate Resources & Do It! Measure and Evaluate Performance External Audit Strategy Formulation Strategy Implementation Strategy Evaluation Strategic Management & Planning How Do You Implement Strategic Management? Strategy implementation requires: policy support for the selected strategies related tactics objectives the necessary resources. Strategic Management & Planning First Nations are able to formulate strategy but run into implementation problems because of financial capacity, lack of supportive policy or employee/volunteer motivation problems. Strategy implementation usually requires a supportive culture, appropriate organizational structure, and readjustment of current activities. Strategic Management & Planning Strategy implementation is the action stage and is sometimes referred to as “Where the rubber hits the road.” Everyone needs to be committed and understand the role they play in the success of the organization. Commitment will be achieved more easily if everyone participates in developing and understanding the strategy, what they must do to implement the strategy and get the job done. Strategic Management & Planning Key elements in strategy implementation are: flexibility training continuous improvement, policy decision making problem solving Strategic Management & Planning The best way to support implementation of strategy is to develop a business/work plan. The business plan is: a consolidation of all programs and activities outline the strategies, related assumptions and activities to support the strategies performance indicators financial information such as budgets indicates who will do what and when. Strategic Management & Planning If your process is easy to follow, and not overly prescriptive, you can be flexible It takes more time and effort to amend a 200page business plan than one with 24 pages. Keeping it brief can be helpful. Size can impact perception. Some people would rather hold off on new innovative tactics than go through the tedious process of submitting a revision to a long document. Strategic Management & Planning What is Strategy Evaluation? Strategy evaluation is the stage of the strategic management process that is often neglected. This stage provides the opportunity to assess how well strategies are doing. and is important in terms of supporting accountability. Measuring performance to the goals that were set beforehand allows the assessment of progress. Strategic Management & Planning It also identifies areas where corrective action is necessary. Trends upon which the original strategies were developed change and, therefore, evaluations are required on a regular basis to assess impacts. There may be a need for abandonment, adjustment or new strategies. Strategic Management & Planning First Nations need to undertake a formal process to evaluate strategy. Since strategic direction is usually long term, a bad strategy can seriously influence a First Nation’s health and can be difficult to change. Therefore, timely and effective evaluations to identify problems or potential problems are critical. Strategic Management & Planning What is Accountability? Put simply, accountability is the same thing as responsibility – responsibility to a person or group of people. Accountability is used to make sure people do the things they should, and don’t do the things they shouldn’t. Strategic Management & Planning Types of Accountability: Political/Managerial Program or Administrative Fiscal Individual Stakeholder or Member Strategic Management & Planning Major Components of an Accountability Program: Planning and Performance Reporting Policies and Procedures Roles and Responsibilities Strategic Management & Planning Link Between Accountability and Strategic Management: To meet the accountability needs of an organization strong planning knowledge and skills are necessary The better conceived an organization’s strategy and the more competently executed with accountability and measurement, the more likelihood of success Strategic Management & Planning What Tools, Examples and Best Practices does the Toolbox Chapter contain? Strategic Management Questionnaire Strategic Management Policy Example Strategic Plan Example – Ucluelet First Nation Accountability Best Practices Strategic Management Best Practices Problem Solving and Decision Making Tool Priority Setting Tool Activity Plans Chapter Five: Capacity Building Once the key elements of governance are in place and function efficiently, attention to maintaining high standards becomes important. This chapter was designed specifically to assist financial managers become aware of the need for capacity building in their work with First Nations Capacity Building What is capacity building? Simply put... it is building competencies, relationships and models. Why do we need capacity building? To improve job performance and efficiencies. Capacity Building The competencies capture the shift from the financial manager being primarily a scorekeeper to an expanded role of providing advice and leadership on all financial activities. This becomes important as financial management of First Nations becomes more complex due to self-government initiatives, economic development and new partnerships. Capacity Building Provincial Level AFOABC exists to provide support to its membership in capacity building in a number of ways: 1. Training and Development Conferences AFOABC hosts 3-4 training conferences or events per year that serve to inform and train members in matters related to administrative and financial management. In conference planning, core competencies are used as guide to develop workshops and training sessions. Capacity Building 2. Aboriginal Financial Manager Certificate Program The Aboriginal Financial Management Certificate Program is an innovative part-time 18-credit program offered by Capilano College on behalf of AFOABC. This program offers students working in the finances offices of First Nations an opportunity to improve their skills in financial management and administration. Capacity Building Students are trained in basic and intermediate accounting, computer applications, Aboriginal and business law, strategic management and leadership and communications. This program is offered when student demand and sufficient funds are available. Capacity Building National Level At national level, AFO Canada is the professional organization in Canada responsible for certification of First Nations financial managers and setting high standards for Aboriginal financial management. Competency Standards for Aboriginal financial management have been established. Capacity Building These standards are the basis for development of curriculum used in granting credits towards the Aboriginal Financial Manager Program certificate, diploma, and the professional designation. They are also used in assessment of practical experience and the professional CAFM exam. Capacity Building What is Competency Modeling? Competency modeling is the process of identifying the key responsibilities in a specific job function and the observable outcomes and behaviours that can be expected at the learning, full performance and superior performance levels. Competency modeling enables practitioners, peers, clients and supervisors to reach consensus on skills, motives, attitudes or other personal characteristic that differentiates superior from average performers. Capacity Building The Need for Modeling The development of a validated model would add a much-needed visual dimension to the current listing of Financial Manager competencies. Most importantly, the process would enable Aboriginal Financial Officers Association members to reach consensus on the observable outcomes and behaviours associated with superior level performance by Financial Managers. Capacity Building Consensus on this subject will be vital in establishing a course of action to improve the financial management capacity in every First Nations community. The modeling process would also identify and document ‘best practices’ in the role of the Financial Manager that could then be shared with all First Nations communities. Capacity Building Applications and Benefits A Financial Manager competency model would provide a visual reference of the specific attributes at three distinct levels of performance and would be used in a variety of applications including: Serving as a base for curriculum development. Identifying and measuring work experience requirements. Developing continuing professional development services. Capacity Building Conducting guided assessments to identify professional development needs Recruitment and selection. Providing a source of best practices to support governance initiatives and sound financial management. Conducting performance appraisals. Compensation Analysis. Capacity Building The Core Competency Domains for a Certified Aboriginal Financial Manager are: Aboriginal History and Cultures Management Information Systems Communications & Personal Skills Economics Financial Accounting Law Management Accounting Quantitative Methods Computer Applications Strategy and Decision Making Financial Management Aboriginal Human and Fiscal Issues Capacity Building This toolbox chapter includes the Financial Officer Competency Model Workbook The model was developed by Aboriginal Financial Officers Association BC members The model illustrates the different outcomes and behaviours that can be observed at the learning stage, full performance and superior performance levels Participant Feedback & Wrap-Up Please take this time to ask questions and provide feedback to the facilitators regarding the Financial Code Toolbox Participant Feedback & Wrap-Up Please take a few moments to complete the training session’s evaluation form. Your comments and suggestions assist AFOABC in planning future events Participant Feedback & Wrap-Up Thank-you for attending the Aboriginal Financial Officers Association of BC’s Improving Financial Management and Accountability with the Financial Management Toolbox Session and have a safe trip home!