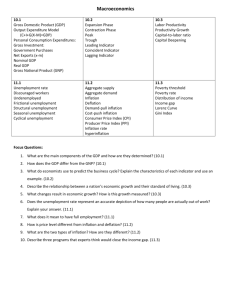

Chapter 8

advertisement

8 C HAPTE R Introduction to Economic Growth and Instability 8-1 ECONOMIC GROWTH Two definitions of economic growth: The increase in real GDP, which occurs over a period of time. The increase in real GDP per capita, which occurs over time. Economic growth is calculated as a percentage rate of growth per year or quarter. 8-2 Per-capita GDP = GDP/population It is the share of each inhabitant of the GDP on average. • This definition is superior if comparison of living standards is desired. For Example: • China’s 2001 GDP was $1131 billion compared to Kuwait’s $36 billion, • But per capita GDP’s were $890 and $18000 respectively. 8-3 Growth in real GDP does not guarantee growth in real GDP per capita. • If the growth in population exceeds the growth in real GDP, real GDP per capita will fall (lower standards of living). • Expansion of total output relative to population results in: – Rising real wages and income – Higher standards of living 8-4 Arab Countries: Growth Rates in Real GDP Annual Average Growth Rate (2000 - 2005) 10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 8-5 Dr. Reyadh Faras 5 Kuwait: The rate of growth of real GDP year GDP constant GDP current Growth of real prices prices GDP 1993 1994 1995 1996 1997 1998 1999 2000 8702.5 7379.8 9453.2 8113.9 9583.4 9429.1 9323.9 9206.7 9435.2 7906.5 9733.2 9169.7 9255.2 11356.7 9946.1 10445.7 average 33.759 8.626 1.377 -2.708 1.194 3.158 -4.911 7.465 5.995 Note: Growth rate excluding 1993 equals 2.029 8-6 War and liberation effect Growth as a Goal Growth is an important economic goal because it means more material abundance and ability to meet the economizing problem. Expansion of output relative to population results in rising real wages and incomes and thus higher standards of living. A growing economy is better able to meet people’s wants and resolve socioeconomic problems. In sum, growth lessens the burden of scarcity and enable a nation to attain its economic goals more readily. 8-7 Arithmetic of Growth: Rule of 70 The “rule of 70” uses the absolute value of a rate of change, divides it into 70, to tell us about the number of years it will take for some measure to double (in compound rates). For Example: If growth rate = 3%. It will take 23 years to double GDP Small changes in the rate of growth are important. If the rate of growth increased to 4%. It will take about 18 years only to double GDP. In USA with a $12.5 trillion GDP, the difference between the rate of 3% and 4% equals 125 billion. 8-8 Main sources of growth Society can increase its real output and income in two ways, by: Increasing its inputs of resources (Quantity). Increasing productivity of resources (Quality). productivity = real output per unit of input productivity of labor productivity of labor = real output / No. labor units • Two thirds of growth in USA result from improved productivity. • Only one-third of U.S. growth comes from more inputs 8-9 Main Sources of Growth How can we improve productivity of labor?? Productivity rises with: 1) improvement in: health, training, education, and motivation of workers. 2) use of more and better machines and resources. 3) better organization and management of production. 4) reallocation of labor from less to more efficient firms. 8 - 10 The Business Cycle The term business cycle refers to alternating rises and declines in economic activity. • Individual cycles vary substantially in duration and intensity: - short cycle - medium cycle - long term cycle 8 - 11 The Business Cycle Peak Level of Real Output Peak Peak Trough Trough Time 8 - 12 Durable and nondurable industries affected differently 26- • Phases of the Business Cycle Four phases of the business cycle are identified over a several-year period. 1. A peak is when business activity reaches a temporary maximum with near/full employment and near full capacity output. • - At peak: Full employment Real output is close to capacity Prices likely to be high 8 - 13 2. A recession • There is a decline in total output, income, and employment, lasting six months or more. • It is marked by a widespread concentration of business activity in many sectors of the economy • Prices fall only if a depression occurs (many prices are sticky) 8 - 14 3. A trough (recession or depression) • is the bottom of the recession period. Output and employment bottom out at their lowest levels 4. A recovery • is when output and employment are expanding toward the full-employment level. Price level may increase before full employment. 8 - 15 There are several theories about causation 1. Momentous innovations: Major innovations may trigger new investment and/or consumption spending. • Railroads, automobiles, and micro-chips, have great impact on investment spending and thus on output, employment and prices. • Contribute to variability of economic activity 8 - 16 2. Changes in productivity may be a related cause: • When productivity expands, the economy booms. • When productivity falls the economy recedes. 3. Monetary causes: • • Too much money leads to inflationary boom Too little money triggers recession 8 - 17 4. Changes in total spending: • • Most economists agree that the level of aggregate spending is important, especially changes on capital goods and consumer durables. When total spending sinks, output, income and employment fall. When total spending rises, output, income and employment rise. 8 - 18 Cyclical Impact: Durables and Nondurables • Durable goods output is more volatile than nondurables and services because spending on the latter usually cannot be postponed. Capital goods and consumer durables are affected the most. • In recessions, firms delay the purchase of new machines and equipments and consumers repair their old appliances. • In booms, firms replace their capital and consumers buy new appliances. • Nondurable consumer goods are little affected by recessions. 8 - 19 Unemployment (One Result of Economic Downturns) The population is divided into three groups: • Those under age 16: “not potential members of the labor force” • Adults not looking for work: not in the labor force. • Labor force: includes those in age 16 and over who are willing and able to work, and actively seeking work. 8 - 20 Unemployment (USA 2007) Under 16 And/or Institutionalized (71.8 Million) Not in Labor Force (78.7 Million) Total Population (303.6 Million) 8 - 21 Employed (146.0 Million) Unemployed (7.1 Million) Labor Force (153.1 Million) Source: Bureau of Labor Statistics 26- • The unemployment rate is defined as the percentage of the labor force (not of population) that is not employed. Unemployment rate 8 - 22 unemployed = labor force x 100 Unemployment Rates in Five Industrial Nations: 1995-2005 8 - 23 Source: Bureau of Labor Statistics 26- • In USA the unemployment rate is calculated by random survey of 60,000 households nationwide. • Two factors cause the official unemployment rate to understate actual unemployment: a. Part-time workers are counted as “employed.” b.“Discouraged workers” who want a job, but are not actively seeking one, are not counted as being in the labor force, so they are not part of unemployment statistic. 8 - 24 Types of unemployment 1. Frictional unemployment: Workers between jobs. Consists of those searching for jobs or waiting to take jobs soon; it is regarded as somewhat desirable, because it indicates that there is mobility as people change or seek jobs. Types: • Voluntarily moving from one job to another • Fired and seeking another job • Housewives who decided to work • New graduates looking for jobs for the first time Note: this type of unemployment is unavoidable 8 - 25 2. Structural unemployment is due to changes in the structure of demand for labor; e.g., when certain skills become obsolete or geographic distribution of jobs changes. • Difference between frictional and structural is that frictional unemployed have salable skills. Structurally unemployed will find it difficult to find a job 8 - 26 3. Cyclical unemployment is caused by the recession phase of the business cycle, which is sometimes called deficient demand unemployment. • When demand for goods and services falls, employment falls and unemployment increases. 8 - 27 GDP (billions of 1996 dollars) Unemployment (USA – 1985-2006) 12,000 12,000 The GDP Gap 11,000 11,000 GDP gap (positive) Potential GDP 10,000 10,000 9,000 9,000 8,000 8,000 GDP gap (negative) 7,000 7,000 6,000 6,000 Actual GDP 5,000 5,000 1985 1985 1987 1987 1989 1989 1991 1991 1993 1993 1995 1995 1997 1997 1999 1999 2001 2003 2001 2003 1999 2001 20012003 2005 2005 Unemployment (percent of civilian Labor force) 10 10 8 8 6 6 4 4 2 2 0 0 1985 8 - 28 The Unemployment Rate 1985 19871987 1989 1989 1991 1991 1993 1993 1995 1995 19971997 1999 2005 2003 2005 Source: Congressional Budget Office & Bureau of Economic Analysis 26- Definition of “Full Employment” 1. Frictional and structural unemployment is unavoidable, hence, full employment is something less than 100%. Full employment does not mean zero unemployment. 2. The unemployment rate consistent with full-employment is equal to the total of frictional and structural unemployment. 3. The “full-employment” rate of unemployment is also referred to as the natural rate of unemployment NRU. 8 - 29 4.The natural rate is achieved when labor markets are in balance; the number of job seekers equals the number of job vacancies. • Hence at NRU • The economy is producing its potential output Note: • It is not necessary that the economy will work at NRU. At times of recession unemployment will be greater than NRU. 8 - 30 • The natural rate of unemployment is not fixed, but depends on the demographic makeup of the labor force and the laws and customs of the nations. • Recently in USA the natural rate has dropped from 6% to 4 or 5%. This is attributed to: a. The aging of the work force as the baby boomers approach retirement. b. Improved job information through the Internet and temporary-help agencies. c. The doubling of the U.S. prison population since 1985. 8 - 31 Economic cost of unemployment 1. Foregone output. Failure to create enough jobs leads to loss of potential output (NRU). This is measured by GDP gap: the difference between potential and actual GDP. GDP gap = Actual GDP - Potential GDP • GDP gap and Okun’s Law: Economist Arthur Okun quantified the relationship between unemployment and GDP as follows: For every 1 percent of unemployment above the natural rate, a negative GDP gap of 2 percent occurs. This is known as “Okun’s law.” 8 - 32 2. Unequal Burdens: Burden of unemployment is unequally distributed. • Occupations: workers in lower skilled occupations have higher unemployment rates • Age: teenagers have much higher unemployment rates than adults (less skills and less experience). • Race and ethnicity: rate is high among AfricanAmericans and Hispanics. • Education: rate is higher among less educated. • Duration: most unemployment lasts shorter periods. 8 - 33 3. Non-economic costs • • • • • • Loss of skills Loss of self respect Family disintegration Sociopolitical unrest Racial and ethnic tensions Other diseases include suicide, homicide, fatal heart attacks and mental illness. 8 - 34 Inflation: Defined and Measured Definition: Inflation is continuous rise in the general level of prices. - A continuous rise: a one shot rise in the price level is not inflation (price rise). - The general price level: it is not necessary that all prices must increase at the same time. During inflation some prices can go down. 8 - 35 • The main index used to measure inflation is the Consumer Price Index (CPI). • Measuring Inflation: the percentage change in CPI 2002 CPI = 123 2003 CPI – 127 Inflation = ((127-123)/123)% = 3.25% • The “rule of 70” permits quick calculation of the time it takes the price level to double: Divide 70 by the percentage rate of inflation and the result is the approximate number of years for the price level to double. If the inflation rate is 7 percent, then it will take about ten years for prices to double. 8 - 36 Inflation Rates in Five Industrial Nations: 1995-2005 8 - 37 Source: Bureau of Labor Statistics 26- Kuwait: Inflation Rate (2001 – 2008) 12 Inflation Rate (%) 10 8 6 4 2 0 2001 2002 2003 2004 2005 2006 2007 Year 8 - 38 Dr. Reyadh Faras 38 2008 Types of inflation Demand-pull inflation: • When resources are already fully employed, businesses cannot respond to excess demand by expanding output. • So excess demand bids up the prices of the limited output. • Spending increases faster than production. 8 - 39 Cost-Push inflation: • Prices rise because of a rise in per-unit production costs. • Per unit cost = total input cost/units of output. • Rising costs squeeze profits and reduce output firms are willing to produce at current prices. • Supply of goods decreases and prices go up 8 - 40 Note a. Output and employment decline while the price level is rising. b.Supply shocks (due to higher cost of inputs) have been the major source of cost-push inflation. These typically occur with dramatic increases in the price of raw materials or energy. 8 - 41 Redistributive effects of inflation • Nominal and real income • Nominal income is the number of KDs received as wages, rent, interest and profits • Real income is a measure of the amounts of goods and services income can buy. Therefore; Real income = nominal income / price level • % change in real income = % change in nominal income – percentage change in price level 8 - 42 • Unanticipated inflation has stronger impacts; those expecting inflation may be able to adjust their work or spending activities to avoid or lessen the effects. Who is hurt by inflation? Fixed income receivers: People whose incomes are fixed see their real incomes fall when inflation occurs. 8 - 43 Savers • will be hurt by unanticipated inflation, because interest rate returns may not cover the cost of inflation. Their savings will lose purchasing power. e.g., - A 1000 CD with a 6% interest and inflation 13%, after one year - Nominal value = 1060 - Real value = (1060/1.13) = 938 8 - 44 • • • Creditors: They can be harmed by unanticipated inflation. Interest payments may be less than the inflation rate. Borrowers are paying back money that have less purchasing power for the lender. If inflation is anticipated, the effects of inflation may be less severe, since wage and pension contracts may have inflation clauses built in, and interest rates will be high enough to cover the cost of inflation to savers and lenders. 8 - 45 Who is Unaffected by inflation? • Flexible-Income receivers: they can avoid inflation’s harm or even benefit from it. • They benefit more from unanticipated inflation. Debtors: they pay back less valuable money whose purchasing power has been eroded by inflation. • Real income is redistributed away from creditors to debtors. • The government, as a debtor, benefits as it pays back its debt with money that has less purchasing than the original money it borrowed. 8power - 46 • • Anticipated Inflation Redistribution effects of inflation are less severe if inflation was expected. People can adjust their nominal incomes to reflect the expected rise in the price level. • “Inflation premium” is amount that the interest rate is raised to cover effects of anticipated inflation. • “Real interest rate” is defined as nominal rate minus inflation premium. 8 - 47 ANTICIPATED INFLATION 11% = + 5% Nominal Interest Rate 8 - 48 Real Interest Rate 6% Inflation Premium Output Effects of Inflation A. Cost-push inflation, where resource prices rise unexpectedly, could cause both output and employment to decline. Real income falls. B. Mild inflation (<3%) has uncertain effects. It may be a healthy by-product of a prosperous economy, or it may have an undesirable impact on real income. C. Danger of creeping inflation turning into hyperinflation, which can cause speculation, reckless spending, and more inflation 8 - 49