Business Environment and the Incorporation Decision

advertisement

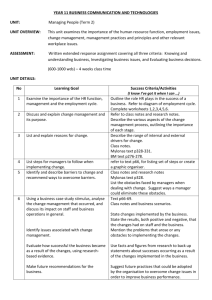

Business Environment and the Incorporation Decision Asli Demirguc-Kunt Inessa Love Vojislav Maksimovic Motivation • Without transaction costs corporate form is irrelevant - all benefits can be obtained by private contracting (Easterbrook and Fischel, 1985) • With transaction costs and some property rights protection the corporate form may be important • Corporate form followed industrialization and economic development; – Form affects legal transactions and raising capital. Potential advantages of incorporation • Corporations can derive advantage from: – More efficient contracting (separate legal identity) – Limited liability – Freer transferability of shares – Regulatory and tax structure • These advantages will depend on the business environment The Adaptive View • Firms will choose corporate form to adapt to their environment (and minimize costs) – Corporations may be better adapted when disputes are mediated by courts (well functioning legal system) – Businesses incorporate until the benefits equal costs for the marginal firm • In better legal systems this will result in more incorporated businesses Questions • How business environment affects the choice of corporate form? • Does the corporate form affect the firm’s operation and growth? • Does business environment affect the relative benefits that firms derive from incorporation? Our tests • 1. Predict the probability that the business incorporates as a function of firm characteristics and business environment • 2. Test for differences in obstacles faced by firms – As function of corporate form, function of business environment and interactions • 3. Test for differences in growth rates Data • WBES – 52 countries, 4200 firms, 1999 (cross-section) – Corporation / non-corporation (partnership, sole proprietorship) – Legal, financial, corruption and regulatory obstacles • Business environment: – Law and order, financial development, GDPPC, creditor and shareholder rights, duration of entry, bankruptcy process (absolute priority, time in bankruptcy, percent of bankruptcies), tax disadvantage (corp. tax- income tax) Results/Choice of incorporation • Firm-level: more likely to incorporate if: – Foreign owned, large, non-service • Business environment: – Financial and legal development increases incorporation – More efficient bankruptcy process (time, number, absolute priority) increases incorporation – High costs of incorporation decrease incidence: • Longer incorporation process, higher taxes Results/Obstacles • Corporations report lower obstacles • This is especially so in an environment where these effects are likely to be material – Lower financing obstacles in countries with more developed financial systems – Lower legal obstacles in countries with stronger law and order traditions – Lower corruption obstacles in countries with less corruption – Lower tax and regulation obstacles in countries with lower tax disadvantage and lower regulatory burden Results/Growth • On average growth rates are not different • However, in countries with better business environment corporations grow faster. – Consistent with previous findings that corporations have less obstacles in countries with better business environment Conclusions • Corporations are better adapted in countries where formal legal system is used in conflict resolution. • Partnership and Sole Proprietorships are better in a reputation-based environment. • Advantages of corporate form only manifest in countries with better business environment.