Practice Final Engineering Economics Fall 2012 Question 1 – FE

advertisement

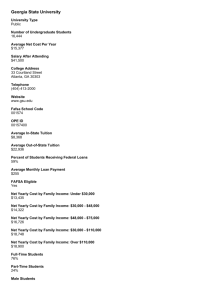

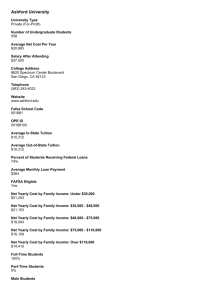

Practice Final Engineering Economics Fall 2012 Question 1 – FE Exam Like Problems A- Mindy McDonalds dropped out of high school and took a job for $12,000 per year. Each year her earnings increased by 2%. Most nearly how much does she make per year after 10 years? a. b. c. d. $9,850 ___ $14,400 ___ $14,630 _ __ $15,220 ___ B- After 12 years of work Mindy McDonalds is making $15,220 per year, however inflation has been 3% per year. Most nearly how much is Mindy making in real dollar terms based on dollars 12 years ago? a. $10,675 ___ b. $10,900 ___ c. $15,220 ___ d. $21,700 ___ C- Cattle Pillar Inc has secured a contract to supply Big Moo Farms with tractors. Cattle Pillar’s profit margin is $70,000 on each tractor sold. They will sell 1 tractor now and an additional tractor every 3 years there-after forever. The salesman, Todd Tractor gets a 5% bonus from the Net Present value of every contract he sets up. The NPV is evaluated at 9% annual interest. Most nearly how big is Todd’s sales bonus? a. $11,870 ___ b. $38,900 ___ c. $177,190 ___ d. $237,300 ___ D- Wally Warehouse has just completed a $100,000,000 warehouse complex. Wally will depreciate the warehouse complex over 39 years after which the warehouse complex will have a salvage value of $10,000,000. After 10 years what is most nearly the book value of Wally’s warehouse complex? a. $2,308,000 ___ b. $2,564,000 ___ c. $66,974,000 ___ d. $76,974,000 ___ Question 2 The Class Supermarket chain sells groceries and targets customers by household income. The store uses facial recognition software cross-referenced to a database of your household income. As you approach the store automatic doors open to the portion of the store with products and services targeted to your income class. Class Supermarkets is looking to build a store that will last for 39 years in the city of Chipndale. Starting Store Class Supermarket starts with the “Ultra Class” store. Only people with a household income of over $220,000 are admitted. This group of people buy a lot of high class and high profit items, but the store and its services are very fancy. The problem is that only 5% of local customers qualify for admission. Expansion #1 Class Supermarket’s next level of expansion is to convert “Ultra Class” into “Elite” and make the store bigger. The “Elite” group has incomes of over $96,000 per year. The expenditures and mark-up on products is smaller but 20% of local customers qualify for admission. Expansion #2 Class Supermarket next builds a completely separate part of the store that admits people with incomes of at least $57,000 but less than $96,000. This “Upper Class” area serves an additional 20% of the population. The trend of the group spending less and not having as high a mark-up on items continues. Expansion #3 Class next builds a separate store area called “Middle Class” for the 20% of the people between $35,000 and $57,000. Expansion #4 Class builds a separate area called “Working Class” for the 20% of the people between $22,000 and $35,000. Expansion #5 Class builds a store area called “Humble Class” for the bottom 20% of the population. The store has an express lane for people using food stamps and Link cards. This store area is a dirt floor barn with cases of food stacked on pallets and cinder blocks. The store is barely heated and has no air conditioning and only a few high pressure sodium lights. Most of the stores personnel are plain cloths security people out to catch shoplifters. The cost and earning of each store phase are listed in the table below. Basic Store Building Cost $20,000,000 Operating Cost $9,300,000 Cost of Goods $10,250,000 Sales $20,500,000 With Expansion 1 $25,000,000 $13,000,000 $32,300,000 $54,444,520 With With Expansion 2 Expansion 3 $39,500,000 $52,980,000 $18,400,000 $22,150,000 $59,645,794 $86,100,000 $93,479,100 $129,700,000 With Expansion 4 $65,805,000 $25,750,000 $111,700,000 $161,700,000 With Expansion 5 $73,785,000 $30,200,000 $137,400,000 $192,000,000 In the table, Building Cost is the initial cost to build the store with a 39 year life. Sales is the amount of merchandise sold each year for each of the 39 years. Cost of goods is what the store pays each year for the groceries on its shelves. Operating cost is what it costs each year to ship the goods and then pay store personnel and supply the utilities and other costs necessary to run the store and sell the items. Obviously the stores annual profit on goods sold is Sales – Cost of Goods – Operating Cost. This income must ultimately justify the initial investment to build the store. Using the incremental investment technique you will determine how many of the 5 expansions should be built if the company uses a 10% interest rate and the next most competitive project has a PVR of 1.3. The PVR for the basic store is 0.46 If one adds the first expansion the PVR for the entire project becomes 3.57 The incremental PVR of expansion 2 is 4.23 The incremental PVR of expansion 3 is 4.36 Question A what is the incremental PVR of Expansion 4? Show how you got the answer. Question B what is the incremental PVR of Expansion 5? Show how you got the answer. Question C Using the PVR numbers given and calculated, how many of the expansions should be built? Explain how the PVR numbers lead you to this conclusion. Question 3 – Let us suppose that Class Supermarkets decides to build a $65,800,000 dollar store in Chipndale. In this problem you will consider the impact of leverage and ownership structure on aftertax NPV and PVR. We will ignore the actual tax practice of using the midyear convention – in other words depreciation in year 1 will be for a full year – not six months. Class Supermarkets considers 3 way of acquiring the store space. Option A – Just use investor money and pay for the building. Option B – Use investor money for 5% of the building cost and borrow 95% of the money at 5% simple interest over 39 years (the interest paid remains the same each year). Option C – Get Ralley’s Retail Space to build the building and then lease the building from them. The cash flow table is shown below. For each option the table shows what the time 0 cash flow will be, what the cash flow will be every year from year 1 to year 39, and what the cash flow will be in year 40. Many of the numbers are already in the table, but the shaded spaces call for you to do the calculations. (The questions below will have you do most of the work to fill in the table). Capital Expenditure for Building Down Payment for Building Payment Due at Lease Signing Option A Option B Time 0 Years 1 to 39 Year 40 Time 0 Years 1 to 39 Year 40 $65,800,000 $0 $0 $0 $0 $0 $0 $0 $3,290,000.00 $0 $0 $0 $0 $0 $0 Gross Sales Revenue Cost of Goods Sold Operating Cost Yearly Loan Amount Paid Off Yearly Interest Paid On Loan Yearly Lease Payment Yearly Property Tax Yearly Depreciation Allowed Yearly Amortization Allowed Yearly Depletion Allowed Taxable Income Tax Paid (at 39% rate) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Salvage Value from Building Capital Gains Capital Gains Tax Paid (39%) $0 $0 $0 $161,700,000 $111,700,000 $25,750,000 $0 $0 $0 $2,000,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $161,700,000 $111,700,000 $25,750,000 $0 $10,000,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2,000,000 Option C Time 0 Years 1 to 39 Year 40 $0 $0 $0 $0 $0 $4,000,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $161,700,000 $111,700,000 $25,750,000 $0 $0 $4,000,000 $2,000,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $10,000,000 $0 $0 $0 $0 $0 $0 After Tax Cash Flow Question A – If Class Supermarkets uses leverage to build the store they will have to borrow $62,510,000 at 5% interest for 39 years. What is the size of the annual payment required? If the interest paid is the same each year, how much interest will be paid each year? (this answer fills in one of the blanks above). How much is paid each year toward paying off the building? (this answer also fills in one of the blanks. Show how you calculated this. Question B – Does the amount of depreciation Class Supermarkets can take off their taxable income each year change with whether they paid for the building outright (Option A), borrowed most of the money (Option B) or never bought the building but rather leased it from someone else (Option C)? Explain why it makes a difference. Show how you calculated the amount of depreciation allowed each year. Question C- Does the amount of amortization that Class Supermarkets can take off their taxable income each year change depending on whether they built the building or leased it from someone else? Explain why? Show how you calculated the amount of amortization allowed each year. Question D- Does the amount of Depletion that Class Supermarkets can take off their taxable income each year depend on how they paid for the building or whether they ever owned the building? Explain why. Show how you calculated the amount of Depletion allowed each year. Question E – Show how you calculated the taxable income for cases A (paid for the building outright), B (borrowed most of the money to build the building), and C (never built or owned the building but just leased it). Question F – What is a Capital Gain? Show and explain how you calculated the Capital Gains tax that needed to be paid in year 40 for cases A, B, and C. Question G – Fill in the blanks in the table above. Your answers to the questions above will provide most of the answers. Show and explain here how you calculated the after tax cash flow for cases A, B, and C. Question H- Calculate the NPV and PVR at 10% for each of the three cases 123456- What is the NPV of case A _______________ What is the PVR of case A ______________ What is the NPV of case B ______________ What is the PVR of case B ______________ What is the NPV of case C ______________ What is the PVR of case C ______________ Question I - If I were an investor with plenty of money but I could only build one more store which of the 3 options would I use to get a store in Chipndale? Explain why I would make this choice? If I were a “Bang for the Buck” investor trying to get the maximum return on every dollar I invested which of the 3 options would I use to get a store in Chipndale? Explain why I would make this choice? Limited Answer Key (This key contains only enough information to allow students to check the types of answers they are getting and does not illustrate the full scope of the answer that would be required on the final exam). Question 1 C A A D Question 2 2.13 0.16 4 expansions Question 3 Capital Expenditure for Building Down Payment for Building Payment Due at Lease Signing Option A Option B Time 0 Years 1 to 39 Year 40 Time 0 Years 1 to 39 Year 40 $65,800,000 $0 $0 $0 $0 $0 $0 $0 $3,290,000.00 $0 $0 $0 $0 $0 $0 Gross Sales Revenue Cost of Goods Sold Operating Cost Yearly Loan Amount Paid Off Yearly Interest Paid On Loan Yearly Lease Payment Yearly Property Tax Yearly Depreciation Allowed Yearly Amortization Allowed Yearly Depletion Allowed Taxable Income Tax Paid (at 39% rate) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Salvage Value from Building Capital Gains Capital Gains Tax Paid (39%) $0 $0 $0 After Tax Cash Flow NPV PVR $161,700,000 $111,700,000 $25,750,000 $0 $0 $0 $2,000,000 $1,687,179.49 $0 $0 $20,562,820.51 $8,019,500.00 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $10,000,000 $0 $10,000,000 $0 $3,900,000 ($65,800,000) $14,230,500.00 73181000 2.11 $6,100,000 Option C Time 0 Years 1 to 39 Year 40 $0 $0 $0 $0 $0 $4,000,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $161,700,000 $111,700,000 $25,750,000 $0 $0 $4,000,000 $2,000,000 $0 $102,564.10 $0 $18,147,435.90 $7,077,500.00 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $10,000,000 $10,000,000 $3,900,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 ($3,290,000) $10,721,125.00 $6,100,000 ($4,000,000) $11,172,500.00 $0 $0 $161,700,000 $0 $111,700,000 $0 $25,750,000 $0 $1,602,820 $0 $3,125,500 $0 $0 $0 $2,000,000 $0 $1,687,179.49 $0 $0 $0 $0 $0 $17,437,320.51 $0 $6,800,555.00 $0 $0 $0 101450322 31.84 105009600 27.25 Skills list Question 1 A and B - skill – select the correct “magic number” to convert money at one point in time to money at another point in time. These questions are typical AXB=C FE exam style questions. Question 1 C skill – converting an interest rate for one compounding period to an interest rate for another compounding period – handling perpetual annuities – doing simple percentage calculations. Question 1 D skill – Doing depreciation calculations and keeping track of book value. Question 2 skill – Producing and evaluating incremental cash flows – calculating NPVs and PVRs. Question 3 skill - Calculating simple interest – calculating depreciation, amortization, and depletion. Calculating taxable income – doing simple capital gains tax calculations – calculating NPVs and PVRs – Doing comparative investment problems with matching the most appropriate investment measure to different types of investors.