ch06

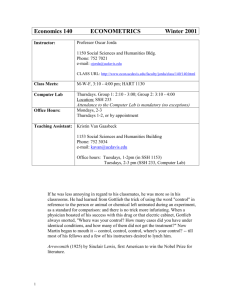

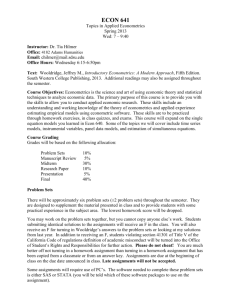

advertisement

ECON 4550 Econometrics Memorial University of Newfoundland Further Inference in the Multiple Regression Model Adapted from Vera Tabakova’s notes 6.1 The F-Test 6.2 Testing the Significance of the Model 6.3 An Extended Model 6.4 Testing Some Economic Hypotheses 6.5 The Use of Nonsample Information 6.6 Model Specification 6.7 Poor Data, Collinearity and Insignificance 6.8 Prediction Principles of Econometrics, 3rd Edition Slide 6-2 Si 1 2 Pi 3 Ai ei (6.1) H 0 : 2 0 H1 : 2 0 Si 1 3 Ai ei Principles of Econometrics, 3rd Edition (6.2) Slide 6-3 SSER SSEU J F SSEU N K (6.3) If the null hypothesis is not true, then the difference between SSER and SSEU becomes large, implying that the constraints placed on the model by the null hypothesis have a large effect on the ability of the model to fit the data. Principles of Econometrics, 3rd Edition Slide 6-4 Hypothesis testing steps: 1. Specify the null and alternative hypotheses: H 0 : 2 0 H1 : 2 0 2. Specify the test statistic and its distribution if the null hypothesis is true F 3. SSER SSEU 1 SSEU 75 3 F(1, 72) Set and determine the rejection region Using α=.05, the critical value from the -distribution is Fc F(.95,1,72) 3.97 . Thus, H0 is rejected if F 3.97 . Principles of Econometrics, 3rd Edition Slide 6-5 4. Calculate the sample value of the test statistic and, if desired, the p-value F SSER SSEU J 2961.827 1718.943 1 52.06 SSEU N K 1718.943 75 3 p P[ F(1,72) 52.06] .0000 5. State your conclusion Since F 52.06 Fc , we reject the null hypothesis and conclude that price does have a significant effect on sales revenue. Alternatively, we reject H0 because p .0000 .05 . Principles of Econometrics, 3rd Edition Slide 6-6 The elements of an F-test : 1. The null hypothesis consists of one or more equality restrictions J. The null hypothesis may not include any ‘greater than or equal to’ or ‘less than or equal to’ hypotheses. 2. The alternative hypothesis states that one or more of the equalities in the null hypothesis is not true. The alternative hypothesis may not include any ‘greater than’ or ‘less than’ options. 3. The test statistic is the F-statistic F Principles of Econometrics, 3rd Edition SSER SSEU J SSEU N K Slide 6-7 4. If the null hypothesis is true, F has the F-distribution with J numerator degrees of freedom and N-K denominator degrees of freedom. The null hypothesis is rejected if F Fc , where Fc F(1, J , N K ) . 5. When testing a single equality null hypothesis it is perfectly correct to use either the t- or F-test procedure; they are equivalent. Principles of Econometrics, 3rd Edition Slide 6-8 yi 1 xi 22 xi 33 H 0 : 2 0, 3 0, xiK K ei , K 0 H1 : At least one of the k is nonzero for k 2,3, (6.5) K yi 1 ei Principles of Econometrics, 3rd Edition (6.4) (6.6) Slide 6-9 N N i 1 i 1 SSER ( yi b1* )2 ( yi y ) 2 SST ( SST SSE ) / ( K 1) F SSE / ( N K ) Principles of Econometrics, 3rd Edition (6.7) Slide 6-10 Example: Big Andy’s sales revenue Si 1 2 Pi 3 Ai ei 1. H 0 : 2 0, 3 0 H1 : 2 0 or 3 0, or both are nonzero ( SST SSE ) / (3 1) SSE / (75 3) 2. If the null is true F 3. H0 is rejected if F 3.12 4. F 5. Since 29.95>3.12 we reject the null and conclude that price or advertising expenditure or both have an influence on sales. F(2,72) ( SST SSE ) / ( K 1) (3115.485 1718.943) / 2 29.25 SSE / ( N K ) 1718.943 / (75 3) Principles of Econometrics, 3rd Edition Slide 6-11 Figure 6.1 A Model Where Sales Exhibits Diminishing Returns to Advertising Expenditure Principles of Econometrics, 3rd Edition Slide 6-12 S 1 2 P 3 A e (6.8) S 1 2 P 3 A 4 A2 e (6.9) E ( S ) E ( S ) 3 24 A A ( P held constant) A Principles of Econometrics, 3rd Edition (6.10) Slide 6-13 yi 1 2 xi 2 3 xi 3 4 xi 4 ei yi Si , xi 2 Pi , xi 3 Ai , xi 4 Ai2 Sˆi 109.72 7.640 Pi 12.151 Ai 2.768 Ai2 (se) (6.80) (1.046) Principles of Econometrics, 3rd Edition (3.556) (.941) (6.11) Slide 6-14 6.4.1 The Significance of Advertising Si 1 2 Pi 3 Ai 4 Ai2 ei Si 1 2 Pi ei (6.12) (6.13) H 0 : 3 0, 4 0 H1 : 3 0 or 4 0 Principles of Econometrics, 3rd Edition Slide 6-15 SSER SSEU 2 F SSEU 75 4 F(2,71) Fc F(.95,2,71) 3.126 P [ F(2,71) 8.44] .0005 Since F 8.44 Fc 3.126 , we reject the null hypothesis and conclude that advertising does have a significant effect upon sales revenue. Principles of Econometrics, 3rd Edition Slide 6-16 Economic theory tells us that we should undertake all those actions for which the marginal benefit is greater than the marginal cost. This optimizing principle applies to Big Andy’s Burger Barn as it attempts to choose the optimal level of advertising expenditure. E ( S ) 3 24 A A ( P held constant) 3 24 Ao 1 12.1512 2 (2.76796) Aˆo 1 Principles of Econometrics, 3rd Edition Slide 6-17 Big Andy has been spending $1,900 per month on advertising. He wants to know whether this amount could be optimal. The null and alternative hypotheses for this test are H 0 : 3 2 4 1.9 1 H 0 : 3 3.8 4 1 Principles of Econometrics, 3rd Edition H1 : 3 2 4 1.9 1 H1 : 3 3.8 4 1 Slide 6-18 (b3 3.8b4 ) 1 t se(b3 3.8b4 ) var(b3 3.8b4 ) var(b3 ) 3.82 var(b4 ) 2 3.8 cov(b3 , b4 ) 12.6463 3.82 .884774 2 3.8 3.288746 .427967 Principles of Econometrics, 3rd Edition Slide 6-19 1.6330 1 .633 t .9676 .427967 .65419 Because 1.994 .9676 1.994 , we cannot reject the null hypothesis that the optimal level of advertising is $1,900 per month. There is insufficient evidence to suggest Andy should change his advertising strategy. Principles of Econometrics, 3rd Edition Slide 6-20 Si 1 2 Pi (1 3.84 ) Ai 4 Ai2 ei (Si Ai ) 1 2 Pi 4 ( Ai2 3.8 Ai ) ei (1552.286 1532.084) /1 F .9362 1532.084 / 71 Fc 3.976 tc2 (1.994)2 p-value P[ F(1,71) .9362] P[t(71) .9676] P[t(71) .9676] .3365 Principles of Econometrics, 3rd Edition Slide 6-21 H 0 : 3 3.8 4 1 H1 : 3 3.8 4 1 Reject H0 if t ≥ 1.667. t = .9676 Because .9676 < 1.667, we do not reject H0. There is not enough evidence in the data to suggest the optimal level of advertising expenditure is greater than $1900. Principles of Econometrics, 3rd Edition Slide 6-22 E ( S ) 1 2 P 3 A 4 A2 1 62 1.9 3 1.9 2 4 80 H 0 : 3 3.8 4 1 and 1 6 2 1.9 3 3.614 80 F 5.74 and the p-value = .0049 Principles of Econometrics, 3rd Edition Slide 6-23 ln(Q) 1 2 ln( PB) 3 ln( PL) 4 ln( PR) 5 ln( I ) (6.14) ln(Q) 1 2 ln PB 3 ln PL 4 ln PR 5 ln I 1 2 ln( PB) 3 ln( PL) 4 ln( PR) 5 ln( I ) (6.15) 2 3 4 5 ln( ) Principles of Econometrics, 3rd Edition Slide 6-24 2 3 4 5 0 (6.16) ln(Qt ) 1 2 ln( PBt ) 3 ln( PLt ) 4 ln( PRt ) 5 ln( I t ) et (6.17) Principles of Econometrics, 3rd Edition Slide 6-25 Principles of Econometrics, 3rd Edition Slide 6-26 4 2 3 5 ln(Qt ) 1 2 ln( PBt ) 3 ln( PLt ) 2 3 5 ln( PRt ) 5 ln( I t ) et 1 2 ln( PBt ) ln( PRt ) (6.18) 3 ln( PLt ) ln( PRt ) 5 ln( I t ) ln( PRt ) et PBt 1 2 ln PRt Principles of Econometrics, 3rd Edition PLt 3 ln PRt It 5 ln PRt et Slide 6-27 PBt ln(Qt ) 4.798 1.2994ln PRt (se) (0.166) PLt 0.1868ln PRt (0.284) It 0.9458ln (6.19) PR t (0.427) b4* b2* b3* b5* (1.2994) 0.1868 0.9458 0.1668 Principles of Econometrics, 3rd Edition Slide 6-28 6.6.1 Omitted Variables FAMINC i 5534 3132 HEDU i 4523WEDU i (se) (11230) (803) ( p-value) Principles of Econometrics, 3rd Edition (.622) (.000) (1066) (6.20) (.000) Slide 6-29 Principles of Econometrics, 3rd Edition Slide 6-30 FAMINC i 26191 5155 HEDU i (se) (8541) (658) ( p-value) (.002) (.000) yi 1 2 xi 2 3 xi 3 ei Principles of Econometrics, 3rd Edition (6.21) (6.22) Slide 6-31 bias(b ) E (b ) 2 3 * 2 * 2 cov( x2 , x3 ) (6.23) var( x2 ) FAMINC i 7755 3211 HEDU i 4777WEDU i 14311 KL6i (se) ( p-value) (11163) (797) (1061) (5004) (.488) (.000) (.000) (.004) Principles of Econometrics, 3rd Edition (6.24) Slide 6-32 FAMINC i 7759 3340 HEDU i 5869WEDU i 14200 KL6i 889 X i 5 1067 X i 6 (se) ( p-value) (11195) (1250) (2278) (5044) (2242) (1982) (.500) (.010) (.005) (.692) (.591) (.008) Principles of Econometrics, 3rd Edition Slide 6-33 1. Choose variables and a functional form on the basis of your theoretical and general understanding of the relationship. where 2* c 2 and x* x c 2. If an estimated equation has coefficients with unexpected signs, or unrealistic magnitudes, they could be caused by a misspecification such as the omission of an important variable. Principles of Econometrics, 3rd Edition Slide 6-34 3. One method for assessing whether a variable or a group of variables should be included in an equation is to perform significance tests. That is, t-tests for hypotheses such as H 0 : 3 0 or F-tests for hypotheses such as H 0 : 3 4 0 . Failure to reject hypotheses such as these can be an indication that the variable(s) are irrelevant. 4. The adequacy of a model can be tested using a general specification test known as RESET. Principles of Econometrics, 3rd Edition Slide 6-35 yi 1 2 xi 2 3 xi 3 ei yˆi b1 b2 xi 2 b3 xi 3 Principles of Econometrics, 3rd Edition (6.25) Slide 6-36 yi 1 2 xi 2 3 xi 3 1 yˆi2 ei (6.26) yi 1 2 xi 2 3 xi 3 1 yˆi2 2 yˆi3 ei (6.27) Principles of Econometrics, 3rd Edition Slide 6-37 H 0 : 1 0 F 5.984 p-value .015 H 0 : 1 2 0 F 3.123 p-value .045 Principles of Econometrics, 3rd Edition Slide 6-38 6.7.1 The Consequences of Collinearity yi 1 2 xi 2 3 xi 3 ei var(b2 ) 2 (1 r ) ( xi 2 x2 ) 2 23 Principles of Econometrics, 3rd Edition N 2 (6.28) i 1 Slide 6-39 The effects of imprecise information: 1. When estimator standard errors are large, it is likely that the usual t- tests will lead to the conclusion that parameter estimates are not significantly different from zero. This outcome occurs despite possibly high or F-values indicating significant explanatory power of the model as a whole. Principles of Econometrics, 3rd Edition Slide 6-40 2. The estimators may be very sensitive to the addition or deletion of a few observations, or the deletion of an apparently insignificant variable. 3. Despite the difficulties in isolating the effects of individual variables from such a sample, accurate forecasts may still be possible if the nature of the collinear relationship remains the same within the new (future) sample observations. Principles of Econometrics, 3rd Edition Slide 6-41 MPG = miles per gallon CYL = number of cylinders ENG = engine displacement in cubic inches WGT = vehicle weight in pounds MPG i 42.9 3.558 CYLi (se) (.83) (.146) ( p-value) (.000) (.000) Principles of Econometrics, 3rd Edition Slide 6-42 MPG i 44.4 .268 CYLi .0127 ENGi .00571WGTi (se) (1.5) (.413) ( p-value) (.000) (.517) Principles of Econometrics, 3rd Edition (.0083) (.0071) (.125) (.000) Slide 6-43 Identifying Collinearity 1. Examining pairwise correlations. 2. Using auxiliary regression xi 2 a1 xi1 a3 xi 3 aK xiK error If the R2 from this artificial model is high, above .80 say, the implication is that a large portion of the variation in is explained by variation in the other explanatory variables. Principles of Econometrics, 3rd Edition Slide 6-44 Mitigating Collinearity 1. Obtain more information and include it in the analysis. 2. Introduce nonsample information in the form of restrictions on the parameters. Principles of Econometrics, 3rd Edition Slide 6-45 yi 1 xi 22 xi 33 ei (6.29) y0 1 x022 x033 e0 ŷ0 b1 x02b2 x03b3 Principles of Econometrics, 3rd Edition Slide 6-46 var( f ) var[(1 2 x02 3 x03 e0 ) (b1 b2 x02 b3 x03 )] var(e0 b1 b2 x02 b3 x03 ) 2 2 var(e0 ) var(b1 ) x02 var(b2 ) x03 var(b3 ) 2 x02 cov(b1 , b2 ) 2 x03 cov(b1 , b3 ) 2 x02 x03 cov(b2 , b3 ) Principles of Econometrics, 3rd Edition Slide 6-47 a single null hypothesis with more than one parameter auxiliary regressions collinearity F-test irrelevant variable nonsample information omitted variable omitted variable bias overall significance of a regression model regression specification error test (RESET) restricted least squares Principles of Econometrics, 3rd Edition restricted sum of squared errors single and joint null hypotheses unrestricted sum of squared errors Slide 6-48 Principles of Econometrics, 3rd Edition Slide 6-49 (SSER SSEU ) / J F SSEU / ( N K ) (6A.1) ( SSER SSEU ) V1 2 (2J ) (6A.2) ( SSER SSEU ) ˆ V1 ˆ 2 (2J ) (6A.3) ( N K )ˆ 2 V2 2 Principles of Econometrics, 3rd Edition (2N K ) (6A.4) Slide 6-50 V1 / m1 F V2 / m2 SSER SSEU N K ˆ 2 2 2 J N K Principles of Econometrics, 3rd Edition F (m1 , m2 ) SSER SSEU ˆ 2 J F J , N K (6A.5) Slide 6-51 Vˆ1 F J H 0 : 3 4 0 Si 1 2 Pi 3 Ai 4 Ai2 ei F 8.44 2 16.88 Principles of Econometrics, 3rd Edition p-value .0005 p-value .0002 Slide 6-52 H 0 : 3 3.8 4 1 F .936 2 .936 Principles of Econometrics, 3rd Edition p-value .3365 p-value .3333 Slide 6-53 yi 1 2 xi 2 3 xi 3 ei yi 1 2 xi 2 vi Principles of Econometrics, 3rd Edition Slide 6-54 * 2 b ( xi 2 x2 )( yi y ) 2 wi vi 2 ( xi 2 x2 ) (6B.1) ( xi 2 x2 ) wi 2 ( x x ) i2 2 b2* 2 3 wi xi 3 wi ei Principles of Econometrics, 3rd Edition Slide 6-55 E (b2* ) 2 3 wi xi 3 ( xi 2 x2 )xi 3 2 3 2 ( x x ) i2 2 ( xi 2 x2 )( xi 3 x3 ) 2 3 2 ( x x ) i2 2 2 3 Principles of Econometrics, 3rd Edition cov( x2 , x3 ) var( x2 ) 2 Slide 6-56