2. Why - Capacity4Dev

advertisement

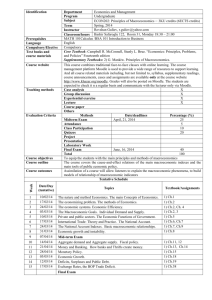

Budget support training Module 3 Stability of macro-economic framework (second eligibility criterion) Version October 2013 Buzzing exercise Why is macro-economic stability important for budget support? 2 Outline 1. What is a stable macroeconomic framework? 2. Why is macroeconomic stability an eligibility criterion for BS? 2a A precondition for sustainable growh 2b Macroeconomic stability and Domestic Revenue Mobilisation (fiscal apsects of DRM) 3. How to assess the stability of the macroeconomic framework? 4. Supplementary document to the action fiche and the payment dossier 3 A stable macroeconomic framework. What does it mean? Macroeconomic instability rupture of the macrofinancial balances and major risk that budget support cannot achieve its goals : unsustainable external and internal deficits, swings in economic activity, high and/or volatile inflation, and excessive volatility in exchange rates and financial markets. Macroeconomic stability prerequisite for sustainable growth and poverty reduction 4 Outline 1. What is a stable macroeconomic framework? 2. Why is macroeconomic stability an eligibility criterion for BS? 2a A precondition for sustainable growh 2b Macroeconomic stability and Domestic Revenue Mobilisation (fiscal apsects of DRM) 3. How to assess the stability of the macroeconomic framework? 4. Supplementary document to the action fiche and the payment dossier 5 Why is it an eligibility criterion? Macroeconomic stability: Precondition for Macroeconomic instability sustained economic growth stable government budget budget outcomes diverge from plan income growth of poor people sustained funding of poverty reduction policies financial programming becomes ineffective 6 Domestic Revenue mobilisation DRM: direct taxes, indirect taxes, non-tax revenues. DRM has macro-economic policy and PFM aspects DRM is part of 2 eligibility criteria: macro-economic stability and quality of PFM. Improving DRM should be core component of fiscal policy, PFM reform strategy and policy dialogue. Tax income in LIC is 10-20% of GDP; in OECD 36% on average. See EC Communication “Tax and development: cooperating with developing countries on promoting good governance in tax matters” (2010). 7 Increasing DRM: + and - + • Lower deficit (increased financial sustainability) • Reduced aid dependency • More scope for development and poverty reduction expenditures • Higher tax burden-> risk of disincentive for economic operators Key issues: equity and incentives: • How to spread the tax burden (including informal sector) • Using tax and non tax to protect natural resources and the environment (specific case of extractive industries) 8 Outline 1. What is a stable macroeconomic framework? 2. Why is macroeconomic stability an eligibility criterion for BS? 2a A precondition for sustainable growh 2b Macroeconomic stability and Domestic Revenue Mobilisation (fiscal apsects of DRM) 3. How to assess the stability of the macroeconomic framework? 4. Supplementary document to the action fiche and the payment dossier 9 3.1 Demonstration of eligibility Eligibility has to be demonstrated at programme approval and for the disbursement of each tranche Same methodology is applied for all eligibility criteria and for all types of contracts: eligibility assessment is based on the relevance and the credibility of the policies in place and announced, at formulation stage and during implementation 10 3.2 Importance of the relation of the country with the IMF Satisfactory implementation of an IMF programme (programme on track): good assurance of stability orientation, but still need to understand underlying economics of the operation Unsatisfactory implementation of IMF programme: country may still be eligible if the objectives of the BS support programme are not at risk. No IMF program: not automatically a sign of absence of a stability oriented macroeconomic policy. Commission takes final decision 11 3.3. Scope of the macro-economic analysis 1° Analyse the main macroeconomic aggregates and identify the (potential) sources of instability (imbalances); 2° : Assess macroeconomic policies and their contribution to macroeconomic stabilisation and to social balance; Pay a particular attention to the consistency of fiscal policy with macroeconomic/debt stability (i.e. efforts to strengthen domestic revenue mobilisation, increasing the efficiency of expenditures); 3° : Assess the vulnerability of the economy to external shocks and efforts to strengthen macro-economic resilience. 12 1° Identification of macro-economic imbalances Real and monetary developments Low or decreasing GDP growth, High and/or increasing inflation Public sector High and/or increasing deficit of Government budget High and/or increasing Public Debt (central government, public enterprises) Debt service and debt burden. External sector Increasing deficit current account of Balance of Payments and/or decreasing foreign exchange reserves Unattractive and/or deteriorating business climate Existence and evolution of arrears of payments 13 1° Identification of macro-economic imbalances : assessing the causes of the imbalances External or internal shocks Policy mistakes Political instability Insufficient capacity to react to changing circumstances Institutional weaknesses in public sector Rigid economic structures and absence of economic transformation processes Weak adaptive capacity in economic sectors Etc. 14 2° Assessing the macroeconomic policy Is the policy mix conducive to the correction of macro imbalances? Fiscal policies : overall revenue and expenditure level, financing of the deficit, debt sustainability, etc Monetary policies: control of inflation, money growth, regulation of the banking sector, credit requirements, regulation of the financial market, etc. Is the policy mix conducive to stability? Are fiscal, monetary exchange rate policy concurring into balancing the economy? 15 2° Assessing the macroeconomic policy: DRM policy Analyse: Tax ratios: tax & non tax/GDP (trends and comparisons Tax effort (taxes collected/potential) Composition of taxes Tax incentives (exemptions, reductions, tax holidays, free zones, etc.) Commitment to strengthening DRM (MTFF projections, measures taken to increade DRM, policies regarding natural resources….) 16 2° Assessing the macroeconomic policy What if the policy is not stability oriented? In this case it is important to try to understand the reasons of that situation: • Socio-political constraints • Trade offs between conflicting policy objectives Conclusions for the provision of BS need to take these factors into consideration 17 3° Vulnerability to external shocks decline of external demand. deteriorating terms of trade (import prices up and/or export prices down). decline of foreign aid and FDI. adverse climatic circumstances. political instability in neighbouring countries and/or trading partners. etc. 18 Strengthening macro-economic resilience Build up fiscal reserves in good years (= decreasing public debt as % of GDP). Build up forex buffers in good years (> 3 months import). Set up a well targeted and efficient social safety net (to be used in case of food price surges and/or bad harvests). Diversify production structure. Diversify exports. 19 Outline 1. What is a stable macroeconomic framework? 2. Why is macroeconomic stability an eligibility criterion for BS? 2a A precondition for sustainable growh 2b Macroeconomic stability and Domestic Revenue Mobilisation (fiscal apsects of DRM) 3. How to assess the stability of the macroeconomic framework? 4. Supplementary document to the action fiche and the payment dossier 20 a) Content of the Introduction of the macroeconomic assessment paper Brief overview of the performance and structure of the economy. Indicators of inclusiveness of economic growth: distribution of income and wealth, access to public services, pattern of economic growth and productivity gains, etc. Most pressing economic challenges and risks. Environmental risks and sustainability of economic growth. Relationship of the country with the IMF and the latter’s opinion on macro-economic performance and policies. 21 b) Data collection Collect data for tables 1-4 of annex 4 of the BS Guidelines, for the last 3 years, present year and 2 next years. Focus analysis on trends and imbalances which need to be addressed by the Government. 22 Major sources of information Medium term economic policy documents of the Government. Annual Budget Framework Papers of the Government. Letter of Intent of the Government supporting a credit arrangement with IMF. MTFF and MTEF. Budget execution reports. Letter of Development Policy of the Government, which support funding requests submitted to the WB. Other economic policy documents of the Government. Economic research papers of universities and other institutes. 23 Result of the assessment (formulation BS) Decision on eligibility based on Findings of the four assessments mentioned before Opinions of other specialised institutions (notably the IMF). Format: Authorities pursue a credible and relevant stability oriented macro-economic policy aiming at ….., or; There is as yet no sufficient evidence that the authorities pursue a credible and relevant stability oriented macro-economic policy, but they have embarked on negotiations with the IMF …. It is expected that …, or; The Delegation considers that the macro-economic criterion is not fulfilled, because ….. 24 Key messages (1) Keep in mind that : Effective macro-economic policies and trends of the indicators are more important than the actual values of the indicators; Sound analyses are more important than long lists of statistics; Special attention should be paid to fiscal policies and targets, including domestic revenue mobilisation, and the consistency with macro-economic stability (see EC Communication on BS). 25 Key messages (2) Focus the assessment on: Links between identified imbalances and policy responses. Fiscal policies : overall revenue and expenditure level, financing of the deficit, debt sustainability, sector allocation of resources, etc. Monetary policies: control of inflation, increase supply of money, supervision of banks. Balance of payments: exchange rate policies, external debts, foreign exchange reserves. Policies to promote economic growth and restructuring the economy. Employment generation. 26