Group Conflict Intervention

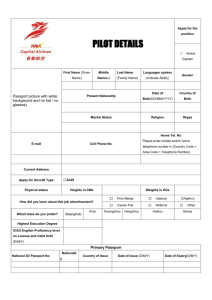

advertisement

Introduction to Aviation Economics The economic characteristics of the Airlines Business Introduction to Airline industry • Air travel remains a large and growing industry. • It facilitates economic growth, world trade, international investment and tourism and is therefore central to the globalization taking place in many other industries. • Travel for both business and leisure purposes grew strongly worldwide Introduction to Airline industry • In domestic and international competitive market, aviation economic should be well managed with the existence of LCC airline companies. • To compete with the LCCs, aviation fraternity should understand the concept of aviation economics characteristics and strategies. Overview • Economists usually describe the certificated airline industry as an oligopolistic economic structure • That is, this industry composed of few firms (can be 5/ 10/ 100) producing either similar or differentiated products. • Apart of few sellers and typically characterized by high barriers to entry • Airline business also has its own distinguish feature • Q: Name other possible oligopolistic industries Other characteristics of oligopolistic industry • Substantial economic scale: Increase of size in operations leads to decrease of firm’s costs in a long term – Large scale of production afforded by intensive labor and management specialization of job responsibilities, technological and products utility efficiency make possible of low costs – So, if market demand only sufficient to support few large firms of optimum size, only few such firms will survive – It’d be hard for new and small firms to compete with these large firms Other characteristics of oligopolistic industry • Growth merger: Many of oligopolies resulted from mergers of competing firms (i.e. Am Bank, CIMB) – The purpose of “merging” is to gain • Substantial increase in market share • Greater economies of scale • More buying power in purchasing of resources Other characteristics of oligopolistic industry • Mutual Dependence: When there are only few firms in a market, it matters very much what their rivals do (i.e. Malaysia Airlines vs. Air Asia) – The competitor’s reactions play a vital role when setting prices – In these games, the participants try to win by formulating strategies that anticipate the counter-reactions of their opponents Other characteristics of oligopolistic industry • Price rigidity and non-price competition: Firms are more likely to maintain their constant prices – As a result, firms engage in various forms of non-price competition like advertising and customer service – Price reductions occur only under severe pressures resulting from weakened demand ad excessive capacity (i.e. The case of Malaysia Airlines) However, other economic characteristic : The Airlines as an Oligopolists? • We have discussed earlier on characteristics of oligopolistic industry • Apparently the airline industry also share some of the oligopolistic features: – Small Number of carriers and market share – High barriers of entry – Economies of scale – Growth through merger – Mutual Dependence – Price rigidity and non-price competition Number of carriers and market share • Recently there has been increment in airline firms with the addition of small certificated airlines and demise of some larger airlines (A once in a blue moon in M’sia but an apparent situation in the U.S. and Europe) • BUT, they either liquidated, merged or never operated or decertified. • So, the largest airline own and retain the power in market share Number of carriers and market share • Unquestionably, with this small numbers of airline companies and concentration of market share (Just like the aviation climate in M’sia).. • It meets the first characteristic of oligopolistic industries High Barriers of Entry • In recent years, it is difficult to get access to many markets due to – Difficulty to obtain terminal space at many hub airports – The financial outlays risk (i.e., advertising, personnel and aircraft operation cost) compete with the airline at its hub – Airport terminal capacity (i.e. Air Asia competing with M’sia Airlines at KLIA) High Barriers of Entry • So, it is difficult to enter the airline industry and it is even harder during the start-up stage as the major airlines dominated the power to buy in the market • This phenomenon match with the second criterion of oligopolistic firms High Barriers of Entry • Defunct airlines AIRLINE IATA ICAO CALLSIGN COMMENCED OPERATIONS CEASED OPERATIONS August 1, 2006 September 30,2007 January 20, 2004 2006 Borneo Airways FlyAsianXpress D7 Ked-Air Malaysia-Singapore Airlines MH MAS MALAYSIAN 1966 1972 Pelangi Air PG PEG PELANGI AIRWAYS 1989 2001 Saeaga Airlines SG SGG SAEAGA 1995 1998 Growth through Merger • Airlines in particular growth through merger (Although, it is not the case in M’sia) • Merger can – Increase market share – Increase market power (greater ability to control the market for and the price of its service than does a smaller, more competitive producer) – Eliminating bankruptcy and competition Growth through Merger • Like in the U.S: Merger decrease no. of certificated airlines (From 17 in 1950 to remaining 12 in 2002) • This merger for growth feature makes the airline business fits as oligopolistic business Mutual Dependence • Airlines industry involves rivalry among a number of airlines • An action taken by a particular airline would yield counter-reactions of their rivals or opponents • Like, MAS vs. Air Asia (at domestic level) and MAS vs SIA (at international level) • It is a fact that rivalry in airlines industry counter react with one another for profit gain Price Rigidity and Nonprice Competition • Airline industry also oligopolistic in its price • Airliners are much comfortable maintaining constant price rather than rocking the boat, so to speak… • Why? – Mutual Dependence – Fear of Price War • Oligopolistic pricing has become the norms in airline industry The Airlines Special Economic Characteristics: • • • • • Government Financial Assistance High Technological Turnover High Labor and Fuel Expenses Sensitivity to Economic Fluctuations Close Government Regulation Government Financial Assistance • Unlike other oligopolistic industries (i.e. Mobile and Internet services), the government units have played a major roles in the growth of airport-airways systems (i.e. Malaysia Airlines) • National airways system was maintained by the federal government at minimal cost to users of the system Government Financial Assistance • Most commonly, the fees charged for landing aircraft, maintaining office and operational space do not repay the operating costs of the airport (Take the case of LCCT eg: exclude insurance) • As a result, airline industry benefited from the financing of the airport-airways system (which is the major cost element) High Technological Turnover • Technological advances in flight equipment over the short span of 30 years have come at an extremely rapid pace • Airlines spend lots of money on flight reequipment cycle, approximately at every 8 years • Plus, capital spending in hiring and training personnel, and in modifying facilities to accommodate the new aircraft and associated equipment High Labor & Fuel Expenses • These are two biggest expenses (Typically 60%) • Labor: Airline employees are men and women with highly developed skills and with correspondingly high incomes – Plus, airline needs a large number of manpower • Fuel: No other industry has been subjected to the severe increases of fuel prices that the airlines have experienced over the past 15 years. High Labor & Fuel Expenses • Fuel price Costs Ticket Price = Less Passenger, Less Profit… • At times, purchasing fuel-efficient aircraft (that burn less fuel than others) also can be very costly than do less-efficient aircraft • Moreover, the actual price of fuel far outside any airline’s span of control Sensitivity to Economic Fluctuations (Recession) • Unlike other durable good like automobile industries, whenever recession takes place, it is much slower for the airline industry to recover • Why? Because of the apparent impacts of recession on air travel – People postpone long-distance travel – Companies cut back business trip/ no/ of people sent on a given trip – Fewer people travel first class Sensitivity to Economic Fluctuations (Recession) • Unlike other industries, airlines still have to continue make payments to creditors and outstanding debtors (primarily flight equipment) even during recession • Further, although airline can furlough certain volume related employees, it’d involve extensive retraining costs when personnel are brought back or new personnel are hired Close Government Regulation • Impact on generating the economics activities. • Carry the country’s name to a worldwide standard. • Avoid accidents of surely death that would harm the country’s value. • Avoidance of terrorist, illegal product enter the country. The major questions • If the airline industry is oligopolistic – How can a new airliner enter and survive in this industry? – How would existing airliners compete with the new airliner and retain themselves in the industry? • How to overcome to these oligopolistic barriers in airline business? – Airlines can independently make profits in each areas of aviation economic activities • This is where aviation economics deals with profit making and lowering costs in aviation activities Airlines Profitable Economic Activities • There are five major parts of economic activities: – Part I: The Demand for Airline Services – Part II: Airline Route Feasibility/ Planning – Part III: Fixed-Base Operation (FBO) – Part IV: Fleet Planning – Part V: Maintenance, Repair, Overhaul (MRO) • Each of these share the aims on how to lower the costs and gain profit Part 1: The Demand of Airline Services • Demand is defined as the various amounts of a product or service that consumers are willing and able to purchase at various prices at a particular period of time • Determining the demand would the help the airlines in setting the price, estimating and managing their costs and calculating how they can gain profits Part 1: The Demand of Airline Services • This is where the airlines will deal with how certain forecasting methods can help the airline gain profit • Forecasting is – The attempt to quantify in a future time period – It is about predicting and estimating some future volume or financial situation Part 2: Airline Route Planning/ Feasibility • This where airlines deal with the application of forecasting method in determining the costs of a route of one flight from one destination to another either – Domestic or – International • In terms of … – – – – Flight personnel Fuel consumption Facilities and Airport cost Passenger Movement and Air Cargo PART 3: Fixed Based Operations (FBO) • In the aviation industry, a fixed base operator (also known as fixed base of operation), or FBO, is a service center at an airport that may be a private enterprise or may be a department of the municipality that the airport serves. PART 3: Fixed Based Operations (FBO) • At a minimum, most FBOs offer aircraft fuel, oil, and parking, along with access to washrooms and telephones. Some FBOs offer additional aircraft services such as hangar (indoor) storage, maintenance, aircraft charter or rental, flight training, deicing, and ground services such as towing and baggage handling. • FBOs may also offer services not directly related to the aircraft, such as rental cars, lounges, and hotel reservations. • Among services provided by FBOs are – Ground Handling • • • • Cabin Service Catering Ramp Service Passenger Service – Field Operations Service Ground Handling • Many airlines subcontract ground handling to an airport or a handling agent, or even to another airline. • Ground handling addresses the many service requirements of a passenger aircraft between the time it arrives at a terminal gate and the time it departs on its next flight. • Speed, efficiency, and accuracy are important in ground handling services in order to minimize the turnaround time (the time during which the aircraft must remain parked at the gate) Ground Handling • Airlines with less-frequent service or fewer resources at a particular location sometimes subcontract ground handling or on-call aircraft maintenance to another airline, as it is a short-term cheaper alternative to setting up its own ground handling or maintenance capabilities. • Most ground services are not directly related to the actual flying of the aircraft, and instead involve other tasks. Cabin Services • These services ensure passenger comfort. They include such tasks as cleaning the passenger cabin and replenishment of onboard consumables or washable items such as soap, pillows, tissues, blankets, etc. Catering • Catering includes the unloading of unused food and drink from the aircraft, and the loading of fresh food and drink for passengers and crew. • Airline meals are typically delivered in trolleys. The empty or trash-filled trolley(s) from the previous flight is replaced by a fresh one. • Meals are prepared mostly on the ground in order to minimize the amount of preparation (apart from chilling or reheating) required in the air. Ramp Service • This includes services on the ramp or apron, such as: – Guiding the aircraft into and out of the parking position (by way of Aircraft marshalling – Water cartage (to refill fresh water tanks) – Refueling, which may be done with a refueling tanker truck or refueling pumper – Passenger stairs (used instead of an aerobridge or air stairs, some budget airlines use both to improve turnaround speed) etc. Passenger Service • This includes services inside the airport terminal such as: • Providing check-in counter services for the passengers departing on the customer airlines. • Providing Gate arrival and departure services. The agents are required to meet a flight on arrival as well as provide departure services including boarding passengers, closing the flight, etc. • Staffing the Transfer Counters, Customer Service Counters, Airline Lounges, etc. Field Operation Service • This service dispatches the aircraft, maintains communication with the rest of the airline operation at the airport and with Air Traffic Control. PART 4: Fleet Planning; Aircraft lease and Purchase • Aircraft leases are a number of types of leases used by Airlines and other aircraft operators. • Airlines lease aircraft from other airlines or leasing companies for two main reasons; to operate aircraft without the financial burden of buying them, and to provide temporary increase in capacity. PART 4: Fleet Planning; Aircraft lease and Purchase • The industry has two main leasing types, wet leasing which is normally used for short term leasing and dry leasing which is more normal for the longer term leases. • The industry also uses combinations of wet and dry when for example the aircraft is wet-leased to establish new services then as the airlines flight or cabin crews become trained they can be switched to a dry lease. PART 4: Fleet Planning; Aircraft lease and Purchase • When purchasing aircraft, it allows an airline to purchase additional aircraft in the future at an agreed price and date • When placing orders for new aircraft, airlines commonly obtain options from the aircraft manufacturer, for example Airbus or Boeing. • These options allow the airline to delay the purchase of additional aircraft until market conditions become clearer and the purchase can be justified. It also reserves the airline a place in the manufacturing queue, for a guaranteed delivery slot. PART 4: Fleet Planning; Aircraft lease and Purchase • When the airline finally exercises its options, it can place its order without having to join the beginning of the queue which otherwise may delay the delivery of the aircraft for years. • If future conditions don't justify expansion of the airline's fleet, the airline is not obligated to purchase the aircraft PART 4: Fleet Planning; Aircraft lease and Purchase • Depending on economic conditions, manufacturers often sell aircraft purchasing options below the real value of the aircraft • Therefore, in this case determining of the demand, need and costs is important for an airline to decide whether to lease or purchase aircraft. PART 5: Maintenance Repair Overhaul (MRO) • Aircraft MRO is the overhaul, repair, inspection or modification of an aircraft or aircraft component • Maintenance includes the installation or removal of a component from an aircraft or aircraft subassembly, but does not include: – Elementary work, such as removing and replacing tires, inspection plates, spark plugs, checking cylinder compression, etc PART 5: Maintenance Repair Overhaul (MRO) – Servicing, such as refueling, washing windows – Any work done on an aircraft or aircraft component as part of the manufacturing process, prior to issue of a certificate of airworthiness or other certification document Question 1 The market structure of airline industry has undergone important changes that construct a dynamic economic model structure. a)Describe what do you understand about the general characteristics of oligopolies and prove that aviation industry is oligopolistic. (9 marks) b) Name three other possible oligopolistic industries. State your reason. (3 marks) c) From your opinion why competition in aviation industry has been has been substantially increasing in Malaysian market? (3 marks) Question 2 The aviation industry faced one of the biggest development in the new era, riding on the wave of the new economy and a greater demand for travel. a)Explain in your own word the airlines special economic characteristics. (8 marks) b) Discuss the concept of price rigidity and non-price competition in aviation industry. Provide example to support your answer. (4 marks) c) From your observation, why food and education industries are not badly impact as aviation industry to economic downturn. (3 marks) Question 3 Airlines can independently make profits in each areas of aviation economic activities which deals with profit making and lowering costs in aviation activities. a)Explain in your own word the airlines profitable economic activities.(9 marks) b) What are the two major operating expenses in airline industry and why are they so high? (3 marks) c) In your own words, which aviation economic activities could obtain the highest gross profit and state your reasons. (3 marks) Question 4 In the aviation industry various factors such as authorities, airports, airlines and passengers combine to determine the affect the airline strategy and business organization. a)Explain in your own word the reason for the small number of certificated airliners.(5 marks) b) Define economies of scale, and discuss how they relate to the airline industry. (5 marks) c) In your own words, discuss the types of aircraft leasing. Which types of aircraft leasing would you prefer and state your reason. (5 marks)