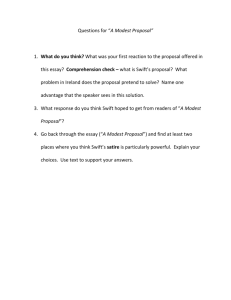

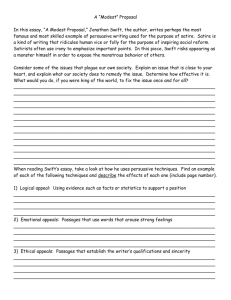

Presentation title

advertisement

Introduction to SWIFT FIRMA Conference Dennis Goodenough Senior Business Manager, SWIFT 18 April 2011 Agenda • Overview – – – – – – – – History Governance Membership Organization Oversight Products Figures Standards • Securities • Payments and cash management • Q&A Introduction to SWIFT - FIRMA - 18 April 2011 2 SWIFT history First Sibos 1978 First Operating Centre opens Asia 1976 Securities 1980 1970s 1987 1980s First corporates join SWIFT SWIFTNet live 1996 1990s 2001 2000+ 1973 1977 1986 1996 2004 SWIFT founded SWIFT goes Live Value-Added services Volumes exceed 3M messages/ day SWIFTNet migration complete 1979 North America Introduction to SWIFT - FIRMA - 18 April 2011 3 SWIFT - Governance Oversight National Bank of Belgium and G-10 Central Banks Governance Board Board committees National member groups National user groups SWIFT members SWIFT community Introduction to SWIFT - FIRMA - 18 April 2011 4 Oversight: Co-operating central banks from the G-10 countries Lead overseer: National Bank of Belgium • Bank of Canada • De Nederlandsche Bank • Deutsche Bundesbank • Sveriges Riksbank • European Central Bank • Swiss National Bank • Banque de France • Bank of England • Banca d' Italia • The Federal Reserve System (USA), represented by • Bank of Japan Introduction to SWIFT - FIRMA - 18 April 2011 the Federal Reserve Bank of New York and the Board of Governors of the Federal Reserve System 5 SWIFT - User categories Supervised Financial Institutions SWIFT Community Non-Supervised Entities active in the financial industry Closed User Groups/ Corporates Introduction to SWIFT - FIRMA - 18 April 2011 6 SWIFT – A customer-centric user community Banks Payment Systems Corporates Clearing & Settlement Systems Insurance Companies Government Institutions Broker-Dealers Customer Securities MI’s Stock Exchanges Depositories Payments MI's IMI's Introduction to SWIFT - FIRMA - 18 April 2011 Trustees 7 SWIFT – Members (shareholders) • Eligible shareholders: – Banks – Broker/dealers – Investment Management Institutions • Non-shareholding member – threshold of five shares • Upon joining, the organisation can buy one share or opt out until the next reallocation of shares Introduction to SWIFT - FIRMA - 18 April 2011 8 Countries’ organisation • National Member Groups – All SWIFT shareholders within same country – Advisory role for membership matters: local admission criteria and new users – Nominate Directors who are then appointed by the shareholders • National User Groups – All SWIFT users within same nation – Advisory role for operational and technical matters Introduction to SWIFT - FIRMA - 18 April 2011 9 SWIFT – Board of Directors Board of Directors Banking & Payments Committee Securities Steering Committee Technology and production Committee Standards Committee Community input Audit & Finance Committee Introduction to SWIFT - FIRMA - 18 April 2011 Human Resources Committee 10 Oversight • SAS 70 report • Self assessment of performance against the overseers’ High Level Expectations for SWIFT Introduction to SWIFT - FIRMA - 18 April 2011 11 Data Protection • Data Privacy Working Group – SWIFT group – 12 experts in data privacy from EU, US, Australia, Canada – Review policies • Contractual Policies – – – – – Commitment to the confidentiality and protection of users data Data retrieval policy, Personal Data Protection Policy Available on swift.com Audited SAS70 Introduction to SWIFT - FIRMA - 18 April 2011 12 Data Retrieval Policy • Principles – Traffic data: limited usage permitted, for billing, pricing, market and service analysis – Message data: strictly confidential, usage and disclosure must be permitted by customers or required for problem investigation • Exceptions – Collective request: request of message data by, for example, a market infrastructure, for statistical purpose – Mandatory request: legally enforceable request by a judicial, administrative, governmental or other competent authority Introduction to SWIFT - FIRMA - 18 April 2011 13 Platform – the SWIFT product stack Payments SWIFT Solutions Treasury Securities Trade Standards Rules Messaging services Directories & Information services Interfaces Testing Services & Prof Svcs Secure IP Network (SIPN) Secure, reliable and resilient platform Introduction to SWIFT - FIRMA - 18 April 2011 14 SWIFT in figures Introduction to SWIFT - FIRMA - 18 April 2011 15 SWIFT in figures (January 2011 YTD) • • • • • • > 4.0 billion messages per year 9,693 customers 210 countries and territories ~ 2,000 employees Average daily traffic 17.2 million messages Peak day of 18.9 million messages – 1 March 2011 • Note: SWIFT does not ‘own’ the data contained in messages it transports Introduction to SWIFT - FIRMA - 18 April 2011 16 SWIFT standards • SWIFT sets standards because a common language for international financial transactions: – – – – Improves automation Ensures human understanding of the data Reduces errors Helps save costs • SWIFT message standards are recognised by the International Organisation for Standardisation (ISO) • SWIFT works with the financial community to coordinate standards convergence worldwide and avoid unnecessary duplication Introduction to SWIFT - FIRMA - 18 April 2011 17 FIN message categories • Category 1 – Customer Payments & Cheques (16 messages) • Category 2 – Financial Institution Transfers (16 messages) • Category 3 – Treasury Markets – Foreign Exchange, Money Markets & Derivatives (26 messages) • Category 4 – Collections & Cash Letters (18 messages) • Category 5 – Securities (67 messages) • Category 6 – Treasury Markets – Metals & Syndications (19 messages) • Category 7 – Documentary Credits & Guarantees (29 messages) • Category 8 – Travellers Cheques (11 messages) • Category 9 – Cash Management & Customer Status (21 messages) • Category 0 – Service and System Messages (66 messages) Name of Presentation – Confidentiality: External 4 ISO 15022 53 ISO 15022 18 Standards The current and future message landscape Payments, Cash and Trade (111 messages) Securities, FX and Derivatives (112 messages) - including 57 ISO 15022 messages Service & System Messages (66) 346 live messages Payments, Cash and Trade (127 messages) Securities, FX and Derivatives (160 messages) FIN & ISO 15022 (MTs) 287 completed messages Current ISO 20022 Future ISO 20022 Payments, Cash, Trade and Cards Payments, Cash and Trade (132 messages) Securities, FX and Derivatives (173 messages) Securities, FX and Derivatives > 300 messages in progress Name of Presentation – Confidentiality: External 19 ISO 20022 messages 287 completed messages Payments, Cash, Trade and Cards Securities, FX and Derivatives • • Settlement & Reconciliation (29) • Corporate Actions (13) • Investment Funds Payments and Cash Management – Account Management • • Change/Verify Account Identification (3) Bank Account Management (15) – Payments Initiation • • • Initiation (4) Mandate (4) Creditor Payment Activation Request (2) – Payment Clearing and Settlement (6) – Cash Management • • • • Bank-to-Customer Cash Management (3) Notification to Receive and Account Reporting Request (4) Exceptions and Investigations (17) Trade – Trade Services Initiation • • Cards and Related Retail Financial Transactions – Acceptor to Acquirer Card Transactions (15) 127 messages Name of Presentation – Confidentiality: External Securities Trade (30) and Settlement (16) Reference Data (3) and Acct Mgmt (5) Securities Management (7) Cash Management (6) Funds Processing Passport (2) • Other Securities – Securities Transaction Regulatory Reporting (4) – Proxy Voting (8) – Issuers’ Agents Communication (22) • Foreign exchange and OTC Derivatives Invoice Financing Request (3) Financial Invoice (1) – Trade Services Management (50) • – – – – – – Non-Deliverable Forwards (7) – Currency Options (4) – Generic (4) 160 messages 20 ISO 20022: The standards community • Registration Management Group, RMG – Overall governance, court of appeal – Approve business justifications for new standards – Create Standard Evaluation Groups (SEGs) • Standards Evaluation Groups, SEGs 68 financial professionals from 21 countries and 12 liaison organizations – Represent future users in specific financial areas – Validate candidate message standards • Registration Authority, RA – Ensure compliance with the standard – Maintain and publish ISO 20022 Repository • Technical Support Group, TSG – Assist RMG, SEGs, RA and submitting organizations Introduction to SWIFT - FIRMA - 18 April 2011 21 ISO 20022 messages 287 completed messages Payments, Cash, Trade and Cards Securities, FX and Derivatives • • Settlement & Reconciliation (29) • Corporate Actions (13) • Investment Funds Payments and Cash Management – Account Management • • Change/Verify Account Identification (3) Bank Account Management (15) – Payments Initiation • • • Initiation (4) Mandate (4) Creditor Payment Activation Request (2) – Payment Clearing and Settlement (6) – Cash Management • • • • Bank-to-Customer Cash Management (3) Notification to Receive and Account Reporting Request (4) Exceptions and Investigations (17) Trade – Trade Services Initiation • • Cards and Related Retail Financial Transactions – Acceptor to Acquirer Card Transactions (15) 127 messages Name of Presentation – Confidentiality: External Securities Trade (30) and Settlement (16) Reference Data (3) and Acct Mgmt (5) Securities Management (7) Cash Management (6) Funds Processing Passport (2) • Other Securities – Securities Transaction Regulatory Reporting (4) – Proxy Voting (8) – Issuers’ Agents Communication (22) • Foreign exchange and OTC Derivatives Invoice Financing Request (3) Financial Invoice (1) – Trade Services Management (50) • – – – – – – Non-Deliverable Forwards (7) – Currency Options (4) – Generic (4) 160 messages 22 SWIFT in Securities Introduction to SWIFT - FIRMA - 18 April 2011 23 Securities standards on FIN (MTs) • There are 67 category 5 securities messages, covering the following business areas: – Pre-Trade / Trade (trade initiation and confirmation) – Settlement & Reconciliation (settlement instructions, confirmations and statements) – Corporate actions (asset servicing) – Securities lending and borrowing – Collateral • Securities industry players also widely use payments, cash management (categories 1 and 2) and foreign exchange messages (category 3) Introduction to SWIFT - FIRMA - 18 April 2011 24 Securities settlement – a typical scenario MT 502 block Order MT 513 Advice of Execution Client 1 = 300 shares Investment manager PEFIGB22 MT 514 Allocation (1) 300 MT 515 Confirmation (1) 300 Broker dealer BDAPGBPP MT 509 Status (optional, to DK) MT 543 Deliver Against Payment MT 541 Receive Against Payment MT 541 Receive Against Payment Custodian GLOBGB22 Introduction to SWIFT - FIRMA - 18 April 2011 MATCH CSD CRSTGB22 27 Securities settlement – a typical scenario MT 502 block Order MT 513 Advice of Execution Client 1 = 300 shares Investment manager PEFIGB22 MT 514 Allocation (1) 300 MT 515 Confirmation (1) 300 Broker dealer BDAPGBPP MT 544 Confirmation Delivery MT 509 Status (optional, to DK) MT 543 Deliver Against Payment MT 541 Receive Against Payment MT 541 Receive Against Payment Custodian GLOBGB22 MT 545 Confirmation Receipt Custodian a/c MATCH CSD CRSTGB22 Broker a/c Shares Introduction to SWIFT - FIRMA - 18 April 2011 $$$$ 28 Securities settlement – a typical scenario 1 MT 502 block Order MT 513 Advice of Execution Client 1 = 300 shares Investment manager PEFIGB22 3 MT 514 Allocation (1) 300 MT 515 Confirmation (1) 300 9 2 MT 545 Confirmation Receipt 5a 4 Broker dealer BDAPGBPP MT 544 Confirmation 8a Delivery 5b MT 543 Deliver Against Payment MT 541 Receive Against Payment 6 MT 541 Receive Against Payment Custodian GLOBGB22 Client 1 a/c + Shares Introduction to SWIFT - FIRMA - 18 April 2011 $$$$ - MT 545 Confirmation Receipt 8a Custodian a/c MATCH 7 CSD CRSTGB22 Broker a/c Shares $$$$ 29 MT 3xx messages FX & currency options Loans and deposits OTC derivatives + 450 customers Independent of counterparty Accord for Securities Trade matching on Accord Accord for Treasury NEW OTC Equity & Fixed Income Transactions For Prime & Executing Brokers and Custodians Community driven Live since May 2009 Accord for Securities – Prime/Executing Broker Solution for hedge fund transactions Executing Broker Hedge Fund 2. Real time status updates + exception handling on GUI + full reporting in MT 998 Daily Trade report Prime Broker 1. Automated pre-matching, 4. Settlement OK 3 . PSET agents’ local code is x-ref to a BIC in Accord Custodian Introduction to SWIFT - FIRMA - 18 April 2011 Custodia n Agent CSD (PSET) Agent 31 Accord for Treasury Single-slide overview Deal FX, FX Options, Money markets, OTC Derivatives, Commodities Confirmations: (MT 300,305,306,320, 330,340,341,360, 361,362,392, MT 600) Accord Subscribers (>475 in 70 countries) • Banks • Brokers • Custodians • Fund mgrs • Corporates (strong growth) • Real-time reporting & exception handling • Integration available for various Back-Office Systems Introduction to SWIFT - FIRMA - 18 April 2011 SWIFT Copies of confirmations Accord subscriber or nonsubscriber Copies of non-SWIFT data: fax, e-mail, e-FX portals, Broker feeds, Reuters, etc. Accord • Real-time Confirmation Matching Service • Availability of >99.97% last 5 years • >90K msgs/hour observed matching capacity • Common matching rules + user-defined rules • Financial Liability for Matching results 32 SWIFT in Payments and Cash Management Introduction to SWIFT - FIRMA - 18 April 2011 33 Common Payments Messages • MT 103 Scope – This message type is sent by or on behalf of the financial institution of the ordering customer, directly or through (a) correspondent(s), to the financial institution of the beneficiary customer. – It is used to convey a funds transfer instruction in which the ordering customer or the beneficiary customer, or both, are non-financial institutions from the perspective of the sender. • MT 202 Scope – This message is sent by or on behalf of the ordering institution directly, or through correspondent(s), to the financial institution of the beneficiary institution. – It is used to order the movement of funds to the beneficiary institution. Introduction to SWIFT - FIRMA - 18 April 2011 34 Payments and cash management processes Customer-to-Bank Interbank Bank-to-Customer INITIATION Customer Credit Transfer Initiation Customer Direct Debit Initiation CLEARING & SETTLEMENT Payment Status Report ACCOUNT REPORTING ACCOUNT REPORTING B2C Account Report B2C Account Report B2C Account Statement B2C Account Statement B2C DebitCreditNotification Introduction to SWIFT - FIRMA - 18 April 2011 B2C DebitCreditNotification 35 High level message flow (Wire transfers) Originator Settlement path can change based on information exchanged using SWIFT messages Community Bank IBK # 1 Payment Initiation IBK # 2 Beneficiary’s Bank Beneficiary SETTLEMENT Fed SWIFT MESSAGING Introduction to SWIFT - FIRMA - 18 April 2011 36 Cover payments – Timing aspects Pay $1000 Pay $1000 Mr. Jones London It’s only 03:00 ET! 103 Bank A London It’s 22:01! 103 09:00 ET Introduction to SWIFT - FIRMA - 18 April 2011 09:00 ET CET Bank C New York 910 09:01 ET 09:01 ET Mr. Ueda Tokyo 202 09:00 Bank C New York 103 Bank B New York 09:00 CET Bank B New York 103 It’s only 03:00 ET! 202 Bank A London 09:00 CET Bank D Tokyo Mr. Jones London Bank D Tokyo Here it’s 16:00 Mr. Ueda Tokyo 37 Cover payments – Cost aspect Pay $1000 Pay $1000 Mr. Jones London Mr. Jones London Charges $20 103 Bank A London Bank A London 103 $980 Bank C New York 910 Bank C New York $1000 Charges $10 Charges $10 Mr. Ueda Mr. Ueda Tokyo $1000 No customer charges $1000 $965 Bank D Tokyo 202 103 Charges $15 103 Bank B New York $1000 Bank B New York $1000 No customer charges 202 $955 Introduction to SWIFT - FIRMA - 18 April 2011 Bank D Tokyo Mr. Ueda Mr. Ueda Tokyo $990 38 Q&A ? Introduction to SWIFT - FIRMA - 18 April 2011 39 Thank you Introduction to SWIFT - FIRMA - 18 April 2011 40