Estimating the Effect of Crime Risk on Property Values and Time on

advertisement

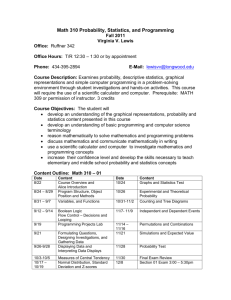

Personal Finance Scott Wentland wentlandsa@longwood.edu 434-395-2160 Longwood University 201 High Street Farmville, VA 23901 Longwood University Markets Part 1 – What are markets? Longwood University Individuals and Value • Where does value really come from? – Individuals (last lecture) • Looked at how individuals determine value for themselves (subjective value for goods we consume) • Individuals think “on the margin” – Diamonds are more valuable than water, because an additional diamond makes us much happier than an additional bottle of water (assuming we’re not in desert) – But this story is incomplete… • Diamonds would be valuable to you, even if you didn’t like diamonds… Longwood University Markets and Value • Even if you didn’t like diamonds, you could always sell a diamond on the market… – Markets (this lecture) • Markets are made up of individuals (consumers and producers) who trade with one another – Buying/selling is the market’s way to address scarcity – Prices help buyers and sellers make good decisions and help make the market “efficient” • Markets can be best understood by understanding the laws of supply and demand Longwood University What is a market? • Markets are everywhere and anywhere, where people buy and sell something for a price – This is a VERY general definition – Examples: • • • • • Stock market Shopping mall or flea market Grocery store Street corner (illegal or black markets are still markets) Ebay or Amazon (markets don’t have to even be a physical place) • Labor market (selling your services…wage = price) – Prices don’t even have to be in cash, they can be barter exchanges Longwood University Why markets? • Why do we have markets? – We don’t live in a world where everyone begins with everything he or she will ever want/need – We learn this at lunch in grade school • Mom packed pudding, I want chips • Joe’s mom packed chips, Joe wants pudding – I trade my pudding for Joe’s chips – We’re both happier a more efficient allocation • Markets help us allocate resources efficiently – (This is just one of many things markets do…) • Why is resource allocation important? Longwood University Scarcity • We live in a world of scarcity – Humans have infinite wants and needs • Our resources are finite. – In economics, scarcity is the idea that our wants/needs exceed our resources • Even if our physical resources were infinite, we would still be constrained by time we cannot escape scarcity • Markets help us get the most out of what we’ve got – Also provide incentives for advancement (more on this later) Longwood University Markets vs. Central Planning • An economy that lets markets (i.e. buyers/sellers) produce, control, and allocate resources is a market economy. – Goods and services are freely traded at mutually agreeable prices – Factors of production (land, labor, capital) or inputs are primarily owned privately (not by government) – Low government involvement in the day-to-day economy – Also called capitalism, free market capitalism, or laissez faire capitalism • Are markets the only way to allocate resources? Longwood University Markets vs. Central Planning • Planned (or command) economy – The government (or “The People”): • Decides what to produce, who produces it, and who gets it • Decide how resources are allocated • Own the factors of production (land/natural resources, labor, capital) and plan how they are used • Buying and selling in markets are largely prohibited – Also called central planning or communism Longwood University A Spectrum of Economies Longwood University A Spectrum of Economies Longwood University A Spectrum of Economies Longwood University A Spectrum of Economies Also called “mixed economies”…most economies are “mixed” Next lecture: how do markets work? Longwood University Markets Part 2 – How do markets work? A (very brief) intro to supply & demand Longwood University How do markets work? • Supply and demand – Supply represents the sellers • In a pure free market many sellers – Demand represents the buyers • In a pure free market many buyers • In markets, buyers and sellers come together to exchange – For any given good, a price emerges as a market price, as a result of negotiations between them Longwood University Demand • Consumer have a limited income and want to maximize utility (or happiness) – Buyers always want the lowest price they can get – When something becomes cheap, consumers tend to buy more – When something becomes expensive, consumers economize and cut back on quantity of that • Common sense, right? Longwood University Law of Demand • Law of demand: “an increase in a product’s price results in a decrease in quantity demanded” holding all else constant 1. Income 2. # of buyers in the market 3. Prices of other goods 1. Substitutes 2. Complements 4. Expectations 5. Tastes • These may “shift demand” if they change – More about that in a full microeconomics course… Longwood University Demand Curve The Demand Curve for Oil is a Function Showing the Quantity of Oil Demanded at Different Prices Price of Oil per Barrel $55 $20 $5 Price Quantity Demanded $55 5 $20 25 $5 50 Demand 5 25 50 Longwood University Quantity of Oil (MBD) Supply • Producers/sellers want to maximize profit – Profit margin = Price – Average Cost • They always want the highest price they can get – When something becomes more expensive, businesses want to supply/sell more of their product Longwood University Law of Supply • Law of supply: “an increase in a product’s price will result in an increase in quantity supplied by the market” holding all else constant • Holding what else constant? 1. Technological Innovations 2. Input Prices 3. Taxes and Subsidies 4. Expectations 5. Entry or Exit of Producers 6. Changes in Opportunity Costs Longwood University Supply Curve The Supply Curve for Oil is a Function Showing the Quantity of Oil Supplied at Different Prices Price of Oil per Barrel Supply Curve for Oil $55 $20 Price Quantity Supplied $55 50 $20 30 $5 10 $5 Quantity of Oil (MBD) 10 30 Longwood University 50 Equilibrium • Buyers want the lowest price • Sellers want the highest price – When they come together, they generally meet somewhere in the middle – They work out mutually beneficial exchanges and a market price emerges • Supply = Demand Longwood University Equilibrium Price is Determined by Supply and Demand Price of Oil per Barrel Supply Curve Equilibrium Price $30 Demand Curve 65 Equilibrium Quantity Longwood University Quantity of Oil (MBD) In Equilibrium • An optimal price emerges out of buyers and sellers interacting in the market • Why is this price optimal or efficient? # Supplied = # Demanded (at the equilibrium price) – The lowest cost, most efficient sellers are the ones who supply at that price – The highest valued buyers are the ones who buy at that price – All possible mutually beneficial trades have taken place at that price • There are no sellers left who want to sell at a price that another buyer would agree to. Longwood University In Equilibrium • If we were to design an allocation of stuff at the beginning we would want: – The people who are best, lowest cost producers to make stuff • We don’t want people in Alaska to grow oranges wasteful and inefficient – The people who have the highest value for stuff to get it and consume it • We don’t want people who don’t like oranges to get them wasteful and inefficient • Markets get us this efficient outcome, without anyone planning it Longwood University Equilibrium • An equilibrium will emerge in any free market – Check Ebay for the price of a specific product • Buyers bid until a price settles on some equilibrium price • If a similar item goes up for auction, it sells for about the same amount (assuming nothing else has changed) – Compare travel sites for any given flight • Equilibrium price is very close • That equilibrium may change, as other things that affect supply and demand change – Supply and demand conditions constantly change – Markets are dynamic prices change Longwood University Value • Back to our diamond/water paradox… – Diamonds are also valuable because they have a high market price as a result of supply and demand • In the last lecture, we talked about from an individual buyer’s perspective • Here, we take the entire market perspective – Diamonds have a: • Low supply – very rare, hard to find, labor intensive, few sellers • High demand – Many uses, many buyers want them relative to supply • High price. – Water’s low market price is largely due to high supply Longwood University Conclusions • Understanding markets through supply and demand helps us understand – Value and prices in a market economy – How market economies allocate resources efficiently • Full microeconomics course – Learn a lot more about supply and demand • How to use supply and demand to understand markets better • Predict prices based on particular events • Predict how certain government policies (e.g. minimum wage) affects markets Longwood University Thank You http://en.wikipedia.org/wiki/Scarcity http://en.wikipedia.org/wiki/Market_economy http://en.wikipedia.org/wiki/Social_market_economy http://en.wikipedia.org/wiki/Planned_economy http://en.wikipedia.org/wiki/Factors_of_production http://en.wikipedia.org/wiki/Supply_and_demand Longwood University