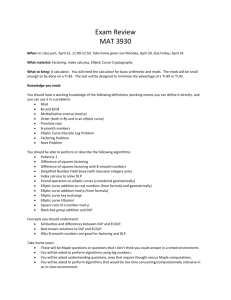

Smart Card Technology in Electronic Commerce

advertisement

Part 1 Card Technology

Card Era

credit cards have become part of our

daily life as forms of plastic money

since its first launch in 1960

a magnetic card verse a smart card

Magnetic Card

composed of a layer of magnetic

material for storing information

easy to carry

can be use for authentication

what is its principles?

Information on Magnetic Card

the stripe is

8.5cm X 1.2cm

data is constructed

based on ISO

7811/2

maximum 3 stripes

can store around

1K bits

ISO Standards

Based on ISO 7811

Track 1 is developed by International Air

Transportation Association (IATA) which contains

adaptive 6-bit alphanumerical characters

Track 2 is used by American Bankers Association

(ABA) which stores 4-bit numerical information

containing identification number and control

information.

Track 3 is originated by Thrift Industry which

contains information which is intended to be updated

with each transaction.

3.250”

0.223”

TRACK 1

IATA

ANSI X4.16 — 1983

ISO 3554

0.110”

TRACK 2

ABA

ANSI X4.16 — 1983

ISO 3554

0.110”

TRACK 3

THRIFT

ANSI X4.16 — 1983

ISO 3554

0.110”

Track 1

SS

FC

PAN

FS

Primary Acc.

No.

(19 digits max.)

NAME

FS

Name

(26 alphanumeric

characters max.)

SS Start Sentinel %

FC Format Code

FS Field Seperator {

ES End Sentinel ?

Additional Data

ES LRC

Exipiry Date

4

Restriction or Type 3

Offset or PVN

5

Discretionary Data

LRC Longitudinal Redundany Code

Track 2

SS

FC

PAN

Primary Acc.

No.

(19 digits max.)

FS

Additional Data

ES LRC

Exipiry Date

4

Restriction or Type 3

Offset or PVN

5

Discretionary Data

SS Start Sentinel ;

FC Format Code

FS Field Seperator =

ES End Sentinel ?

LRC Longitudinal Redundany Code

Magnetic stripe Content of Financial Cards

Capacity

Track Record

1

2

3

density bits/inch

210

75

210

Capacity

79 (7 bits/char.)

40 (5 bits/char.)

107 (5 bits/char)

Fraud card activities

Stealing — A legal card may be stolen and used in

ATMs or EPOSs.

Altering and re-embossing a genuine card, that is

modifying the visual features of card.

Skimming or altering the original electronic data

stored on the magnetic stripe, for example the expire

date or the credit limit.

Buffering or re-encoding the original data to the

magnetic card. This technique is commonly used in

producing card counterfeits of store-value ticket.

Copying of data from a genuine card to another in

an on-line fashion “white plastic fraud”

Counterfeiting — “color plastic fraud” may be

prepared by reading another legal card and

encoding the same information onto another fraud

card in an off-line fashion.

Valid Card

Fraud Card

Design of card protection technologies

Validation by Appearance — this is a visual

mean to protect against illegal duplication

of plastic card. The aim is to make the

appearance of card so unique and difficult

to duplicate that shopkeepers or card

handlers can identify the genuine card

instantly.

Verification on Access — this validation

relies on the interaction with the card

holder, the objective of the protection

mechanism is to identify the person

accessing the card is an authorized one.

Protection on Data — this is a machine

readable protection to avoid data from being

access and duplication illegally. The

importance of stripe data protection is .to

ensure the security of electronic transaction

and provide an alternative verification

mechanism of magnetic card.

Card Protection Technologies

Visual Protection

Technologies

Holograms

Protection on

Access

Verification by

Card Content

Photocard

Embossed

Information

Ultraviolet

Pattern

PIN

Signature

Protection on

Modification

Protection on

Duplication

DNA

Microprints

PVV

CVC

Magnetic Stripe

Protection

Xsec

Smart Card

Xshield

Memory Card

Holomagnetic

Valugard

Magneprint

Sandwich

Watermark

P Card

6.5.1 Validation by Appearance

Computer Chip

Hologram

IN GOD WE TRUST

Magnetic Stripe

Logo

MR. B

Printed &

Embossed Data

12/95

Bar Code

But Counterfeits Still Exists!

VISB

Fine Printings

Photo ID

Authorized Signature

Signatures

Holograms

are the most notable marking for credit cards

produced by a combination of photography

and laser beams

initially counterfeit holograms were crude

and manufactured by stamping tin foils

recently counterfeit holograms were

produced by professional technical

knowledge is needed to validate the

authenticity of holograms

Embossed characters

are some raised marks implemented on the

plastic surface of card

the embossed information includes the user

name, expiry date, card number and unique

embossed symbol — VISA embossed a

symbol like “CV” besides the expiry date.

However, the card material is a thermal

plastic by warming the card to about 50C,

it allows “debossing” of the characters and

re-embossing with fraud information.

Photocards

are introduced by CitiBank Corporation

the effectiveness of photocard on marketing

purposes seems to be greater than that on

security

it is not an effective mean to stop card fraud

because counterfeiters had the ability to

imitate laser engraved photographs and

signatures in rather low cost using a

photomachine of around US$ 5000.

Ultra-violet dove, bank identifying

number (BIN) and micro-printings

can also be duplicated under the existing

technology

technical knowledge is needed to recognize

a counterfeit card from a genuine one

most card reading terminals contain no

visual detector to validate these visual

protection features while human eyes are

not a reliable mean of verification

difficult to validate a genuine card

Protection on Card Access

the card holder is requested to prove his

identity or the authorized user will be

acknowledged about the transaction

methods:

signature

biometrices

PIN

Signature

Signature is the most popular way of

verification.

When a transaction is made, the card holder

is requested to sign and the signature will be

verified visually.

this method is simple

not useful in protection against “color plastic

fraud” where the criminal can sign their own

signature in the fraud card.

Biometrics

biometrics features were developed such as

speed of writing, fingerprint or iris pattern

implementation cost is high

their accuracy is questionable

Personal identifying number (PIN)

PIN is a unique number given by the bank to

each user which is effectively fixed by the

customer

account

number

and

the

cryptographic key used in the derived PIN

computation.

PIN offset or password is a value that relates a

derived PIN to actual PIN value.

When a card holder transfer or withdraw his

money from a bank account, a 6-digits

password is inputted before transaction

processed.

The password will be validated by comparing

with the one stored inside the magnetic

card by offset or in a centralized database

in the bank.

The security of password is relied on the

encryption algorithm of PIN, the PIN

management scheme and the secrecy of

password.

PIN does not provides defense against data

copied from another card which contains

the correct card verification value.

Moreover, the encryption algorithm

adopted in validation codes may be

tampered and decoded by professional

hackers with some insider information.

Protection on Data

the major magnetic card protection

techniques have included

Watermark

Magnetic Print

Valugard

Xsec-Jitter

Macaps

Smart Card

Integrated Circuit chip

originated from

France

invented in 70 and

matured in 90

Magnetic Card

replacement

Types of Smart Card

Memory Card

MPU IC card

Cryptoprocessor card

Contactless card

Memory Card

Primitive type

composed of

EEPROM/PROM

simple function

as prepay card

Cypto-processor IC Cards

composed of

cypto-processor

& PROM

a powerful MPU

can recognise

illegal signal and

security features

MPU IC Smart Card

Composed of

MCU/MPC

software driven

have flexibility

and primitive

intelligence

some security

features

Contactless Smart Card

similar to contact

smart card

with RF

transceiver to

increase

robustness and

security

Advantages of Smart Card

Large storage capacity

more security features

multiple functions

flexibility in use - intelligent, lower power

consumption, effective packaging

as access card, electronic purse, debit/credit

cards, ID card etc. - particular off-line

applications

Hardware Technologies

new memory technologies - EEPROM and

flash-EPROM

new silicon technologies - 1.3 m to 0.65 or

even 0.18m for more storage and security,

lower power consumption

new packaging technologies - against

breakage, rubbing and bending

Smart Card Software

Intelligent Chip Operating System -COS

Encryption techniques - RSA & DES

Multiple Application OS (MAOS)

Mondex, EMV, GSM, Loyalty

New requirements

hot list, trust key management

6.6.4 Smart Card Worldwide

Use Distribution 40% Western Europe, 25%

Asia, 15% North America, 8% South

America and 12% others

Major user is France over 130M cards

Germany 80 M health insurance

over 20 countries use GSM and electronic

purse

Smart Card Project Worldwide

Mondex - UK

Barclay/Mercury one-2-one project (UK)

Detemobil Toll Collection (UK)

Advantages Card in RSA

ID card in Taiwan

Mastercard &Visa + Netscape and Microsoft

- COS project

Credit Card in USA

Some Difficulties Worldwide

Bank card project cancellation - Taiwan

Mondex tampering slow down bank sector

development - RSA and New Zealand

Mastercard - year 2000 delay of massive

launching

Visa - adoption of magnetic card in RSA

debit card project

Major concern - COST EFFECTIVENESS

Smart Card in Hong Kong

Mondex

Visa Cash

City Smart

Octopus - smart travelling card

Jockey Club -pre-pay card

New airport - access control card

HKT - telephone card

Parking Meter - prepay card project

Smart Card in Electronic Commerce

Electronic Data Interchange (EDI)

Tradelink

Electronic Purchasing

Home Banking

Internet Shopping

New Technologies Required

Data Storage Management - information

protection

authentication process

biometric: fingerprint, facial features, iris

identification, dynamic signature recognition,

speech recognition

encryption methods

Elliptic Curve Cryptography, chaotic

techniques

THE SMART CARD MARKET IN THE YEAR 2000

(in millions – Source: Philips Communication Systems)

Application

Phone cards

GSM cards

Health cards

Bank cards

ID cards

Transport tickets

Pay TV cards

Access control

City cards /Misc

Total

France Europe Others Total

140.8 553.1 640.0 1334

4.0 15.0 42.0

61

10.0 55.0 92.0

157

25.0 85.0 75.0 185

4.5

24.0 81.0

110

1.8

3.0

5.0

10

24.0

55.1 64.3

143

210.1 790.2 999.3 2000

Some Difficulties Worldwide

Bank card project cancellation - Taiwan

Card tampering slow down bank sector

development - RSA and New Zealand

MasterCard - year 2000 delay of massive

launching

Visa - adoption of magnetic card in RSA

debit card project

Major concern - COST EFFECTIVENESS

Smart Card in Electronic

Commerce

Electronic Data Interchange (EDI)

Tradelink

Electronic Purchasing

Home Banking

Internet Shopping

New Technologies Required

Data Storage Management - information

protection

authentication process

biometric: fingerprint, facial features, iris identification,

dynamic signature recognition, speech recognition

encryption methods

Elliptic Curve Cryptography, chaotic techniques

Smart Card in Mobile Phone

Applications

Wireless Application Protocol (WAP) emerges for

a mobile Internet access

Research work launched in Japan indicates a good

market if available.

Mobile operators will provide add on WAP

gateways and WAP services to enable wireless

internet services:

Banks, financial institutions, restaurants, retailers,

Utilities, transit operators, hotels,

entertainment and media, selling goods and information

Limitation, the SIM card inside the WAP

phone cannot provide complicated the PKI

authentication process thus security is an

issue.

A possible solution is to introduce an

additional smart card interface (either

contact or contactless) to enable the

authentication process. (MasterCard – dual

card phone)

New technologies requirements:

The development of m-PKI (mobile PKI) in the

multiple-application OS is more essential and

practical

The development of high security low power

card modules

A better interface to new wireless internet

platform, other ancillary technologies, such as

Bluetooth and Wireless Wallets are also

important

Java Card

More powerful processor & memories

Allow download of applications

Open software platform for code

transportability

For multi-function, e-purse, loyalty, health

care database and Internet/Intranet access

card

Smart Card in Hong Kong

Mondex

Visa Cash

Campus card

Octopus - smart traveling card

Jockey Club -pre-pay card

New airport - access control card

Telephone card & SIM Card

Parking Meter - prepay card project

Residential access card

Possible new ID card, Road Toll Pay Card

Governing Body

The Hong Kong Monetary Authority will set

rules on use of smart card for financial

applications

only banks may issue general purpose cards

HKMA can authorize other non-bank issuer

core use relating to business of the issuer

needs to establish a business case an non-core

uses

non-core uses subject to limits determined by

HKMA

Exemptions

Risk to payment system and card holders is

slight

replace an existing non-regulated payment

instrument like travelers’ cheques

soundness of issuer

max. of HK$1000 limits on card

only allow 15% for non core uses

use in a limited and distinct areas

Examples

Mondex : equivalent to bank note, and no

audit trail

Visa Cash: equivalent to cheques, link to

accounts and have audit trails

Mondex scheme

Issue of Bank Notes

Origination of Mondex Value

Notes Issuing

Bank

Adjustment to

interbank A/C

Mondex

Originator

Adjustment to

interbank A/C

Bank notes

Other Banks

Adjustment to

customer A/C

Member Banks

Adjustment to

customer A/C

Bank notes

Notes holder A

Notes holder B

Bank notes

Goods/Services

Mondex value

Mondex value

Cardholder A

Merchant

Cardholder B

Mondex value

Merchant

Goods/Services

Note : There is no clearing system for the transfer to Mondex value (in the same way as transfer of bank notes).

VisaCash scheme

Cheques

Debit Customer A/C

(after cheque

is cleared)

VisaCash

Bank

Debit Customer A/C

(once value is uploaded)

Issue of

cheques

Uploading

value onto card

Cheque

Clearing

System

Bank

Customer

Payment by

cheque

Bank

Cardholder

Presentation of

cheque received

from customer

Goods/

Services

Payment

by card

Credit Merchant

Merchant

VisaCash

Clearing

System

A/C

Redemption

of value received

from cardholder

Goods/

Services

Credit Merchant

Merchant

Note : Transfer of VisaCash value would go through a clearing system in same way as clearing for cheques.

A/C

ISO 7816 Standards

7816/1

• Specifies the physical and dimensional

features of the plastic supports.

Additional characteristics specified are

Mechanical strength, Static electricity,

Electromagnetic fields and Bending

properties etc.

7816/2

Specifies the meaning and location of the

contacts.

This part defines eight contact referred to as

C1 to C8. The contacts are located as shown

in figure below.

Pin Assignment

Cont

Assignment

act

Contact

Assignment

No.

No.

C1

VCC (supply voltage)

C5

GND (ground)

C2

RST (reset signal)

C6

VPP

(Programming

voltage)

C3

CLK (clock signal)

C7

I/O (Data input/output

C4

Reserved to ISO/IEC JTC

C8

Reserved to ISO/IEC

1/SC 17 for future use

JTC 1/SC 17 for future

use

7816/3

Specifies

electronics

signals

and

transmission protocols that the DC electrical

characteristics, the character format and the

command protocol for the Smart Card.

This ISO standard describes two types of

data transfer between Smart Card and card

Reader/Writer:

asynchronous protocol with two data coding

conventions

synchronous protocol

Asynchronous protocol

Character format:

Each character (described in figure below)

is composed of:

one start bit

8 bits of data

one even parity bit

guardtime slot including two stop bits

The data speed transmission depends on

the clock signal frequency input into the

Smart Card on the CLK contact.

The nominal bit duration sent on the I/O

line is called the "elementary time unit"

"etu" by the ISO standard.

This bit duration is directly proportional to

the input clock during the "answer to reset",

but may be requested to be modified (by the

Smart Card) for the following data

exchange. The parameters of this

modification are given during the "answer

to reset".

I/O Line management:

The I/O line (Input/output line) is used to

exchange data in input mode (reception mode)

or in output mode (transmission mode). This

line must have two states:

stand-by state or high level state

working state or low level state:

Furthermore, the I/O line (as shown in figure

below) is used to generate or to detect data parity

errors in reception or transmission The transmitter

must sample the I/O line during the guardtime

duration.

The transmission is presumed valid if the I/O line stays

at a high level during the guardtime slot

The transmission is wrong if the I/O line is pulled down

during at least one etu (two etu max) during the

guardtime slot.

The receiver, in order to signal a reception error, must

pull down the I/O line.

Data coding

The ISO 7816 - 3 standard gives the

possibility of two kinds of data coding. The

direct convention or inverse convention.

The type of convention is fixed by the

Smart Card and is declared in the first

character of the "answer to reset'.

In direct convention, the logical "l " level is 5

Volt and the least significant bit (LSB) is

transmitted first.

In inverse convention, the logical "1" level is 0

Volt and the most significant bit (MSB) is

transmitted first.

Synchronous protocol

In synchronous protocol, successions of bits are

sent on the I/O line, synchronized with the

clock signal on CLK pin. In synchronous

protocol, the data frame format described

previously is not available.

7816/4

Specifies the inter-industry command for

interchange include:

The content of the message, commands and

responses, transmitted by the interface

device to the card and conversely.

The structure and content of the historical

bytes sent by the card during the answer to

reset.

The structure of files and data, as seen at the

interface when processing inter-industry

commands for interchange.

Access methods to files and data in the card.

A security architecture defining access

rights to files and data in the card.

Methods for secure messaging.

APDU (application protocol data unit)

message structure

A step in an application protocol consists of

sending a command, processing it in the

receiving entity and sending back the

response. Therefore a specific response

corresponds to a specific command, referred

to as a command-response pair.

An application protocol data unit (APDU)

contains either a command message or a

response message, sent from the interface

device to the card or conversely.

In a command-response pair, the command

message and the response message may

contain data, thus inducing four cases,

which are summarized by table below.

Command-response pair

Case

Command data

Expected response data

1

No data

No data

2

No data

Data

3

Data

No data

4

Data

Data

Command APDU structure

Header

CLA INS

CLA

INS

P1, P2

Lc field

Le field

P1

Body

P2

(Lc field)

(Data field)

(Le field)

- Class byte

- Instruction byte

- Parameter byte

- number of bytes present in the data

field

- maximum number of bytes expected in

the data field of the response APDU

Response APDU structure

The response APDU consists of

Conditional body of variable length.

Mandatory trailer of 2 byte.

Body

Data field

Trailer

SW1

SW2

Status Codes of response APDU trailer.

Part 2 Card Security

Simple security

Random Number Generator for dynamic

key generation

Cipher Engine for data protection:

Block

Stream

Choatic Function

Random Number Generator

For generation of session keys

Digital approach can only generate pseudo

random number based on

Xi =(a Xi-1 + b) mod c

Other use analogue approaches like VCO,

white noise generator etc.

Block Cipher

K1 : 16-bit

K2 : 16-bit

DataIn

DataOut

Block Cipher

8-bit

8-bit

Block Cipher Method –

Write to Memory

K1 : 16-bit

K2 : 16-bit

DataOut

8-bit

DataIn

Block Cipher

8-bit

Block Cipher Method – Read

from Memory

K1: Master Key of

length 16-bit

K2: Card ID of length

16-bit

K1 and K2 act as the key parameters to the block

cipher

The block cipher constructs a one-to-one mapping

For different combination of K1 and K2, different

mapping can be obtained

Exhaustive search through 28=256 combinations,

the mapping can be obtained without revealing

the key parameters

To reveal the key parameters, exhaustive search

of 2^16*2^16=2^32 combination is required

If the Card ID is known, a search of 2^16

combinations can reveal the Master Key

Stream Cipher

K1 : 16-bit

K2 : 16-bit

Stream Cipher

DataIn

8-bit

DataOut

8-bit

The Stream Cipher can be

viewed as a state machine

with K1K2 as the initial

state

It generates a

pseudorandom number

sequences which are XOR

with the Input Data to

form the Output Data

The data must be in

sequence in order to

encode and decode

correctly

Not suitable

Chaotic Function

K1 : 16-bit

K2 : 16-bit

Neural Network

8-bit

DataIn

8-bit

K1 : 16-bit

K2 : 16-bit

8-bit

8-bit

8-bit

8-bit

8-bit

NN

8-bit

NN

8-bit

NN

8-bit

NN

2-bit

2-bit

2-bit

2-bit

DataOut

8-bit

The neural network construct a mapping for 32-bit

input and 8-bit output

The 8-bit output for the Neural Network is XORed

with the Input Data to from the Output Data

For different K1 & K2, the same output of Neural

Network will be obtained, collision occurs

Knowing a pair of Data input and Data Output

will recover the output from the Neural Network

As collision occurs, knowing K1, exhaustive

search through K2, different K2 will result the

same output, hence increase difficulty in searching

K2

Using a 8-bit Artificial Neural Network

to generate Chaotic Function

8-bit

Layer1

8-bit

8-bit

NN

2-bit

8-bit

Layer2

8-bit

8-to-2 Table

2-bit

Advance Data Protection Encryption

Encryption

Encryption will modify data into irregular form

for security storage and transmission. The

reconstruction is achieved by using a set of

relevant Keys.

Two cryptosystems are currently being used, i.e.

symmetric (DES/FEAL) and asymmetric (RSA,

ECC). Symmetric cryptosystem requires only one

common key for encryption and decryption

whereas asymmetric system requires two keys, i.e.

private/user key and public/system key.

Common Encryption Techniques

Three algorithms will be introduced

DES (Data Encryption Standard)

RSA (Rivet, Shamir, Adleman)

ECC (Elliptic Curve Cryptography)

DES

DES

the most well-known symmetric system being

used by banking sector and computer security.

the technique was originated from IBM and

certified by National Bureau of Standards in

1977.

an official unclassified data encryption

method.

widely been used by Banking sectors

Encryption Process

DES System

Key Schedule

64 Bit Plaintext

64 Bit Key

Initial Permutation

32 Bit L0

+

32 Bit L1

32 Bit L15

+

32 Bit L16

32 Bit R0

Permutation Choice 1

Building

Block

F(R0,K1)

32 Bit R1

32 Bit R15

Final Permutation

64 Bit Ciphertext

28 Bit C0

28 Bit D0

Left Shift

Right Shift

C1

D1

C16

D16

K1(48 bits)

Permuted

Choice 2

F(R15,K16)

32 Bit R16

56 Bit Key

Permuted

Choice 2

Function f

Li-1

32 bits

Ri-1 32 bits

Expansion

Permutation 48 bits

S-Box

Substitution

choice 32 bits

P-box Permutation

Li

32 bits

Ri

32 bits

56 bits Key

Permuted Choice

48 bits

DES Substitution Boxes Operation

Operation Tables of DES (IP, IP-1, E and P)

RSA

RSA

developed by 3 researchers at MIT in 1977

based on two prime numbers (p & q) to generate

the keys

most popular is RSA 129 where p x q gives a

129 bit number

highly security and has once been proposed to

replace DES in banking application

report cipheranalysed by a group of 600

specialist in May 1994 through internet

RSA Steps

Select two large prime p& q

Generate n = pq

Generate f(n) = (p-1)(q-1)

Select e (encryption/public key) and d

(decryption/secret) as

ed = 1 (mod(f(n))

Encrption by C =(Me, mod n) where M is the

message

Decrypt by M =(Cd, mod n)

ECC

ECC

a new elliptic curve cryptosystem method for

public key applications

developed by Neil Koblitz (Washington

University) and Victor Miller (IBM, Yorktown

Heights) in 1985

using points in the elliptic curve as the elements

for encryption

will become IEEE standard in 1997/8 (99?)

Elliptic Curve Groups over

Real Numbers

An elliptic curve over real numbers may be

defined as the set of points (x,y) which satisfy an

elliptic curve equation of the form:

y2 = x3 + ax + b, where x, y, a and b are real

numbers.

Each choice of the numbers a and b yields a

different elliptic curve.

For example, a = -4 and b = 0.67 gives the elliptic

curve with equation y2 = x3 - 4x + 0.67; the graph

of this curve is shown below:

If x3 + ax + b contains no repeated factors, or

equivalently if 4a3 + 27b2 is not 0, then the elliptic

curve y2 = x3 + ax + b

Can be used to form a group. An elliptic curve

group over real numbers consists of the points on

the corresponding elliptic curve, together with a

special point O called the point at infinity.

P + Q = R is the additive property defined

geometrically.

Elliptic Curve Addition: A

Geometric Approach

Elliptic curve groups are additive groups; that is,

their basic function is addition. The addition of

two points in an elliptic curve is defined

geometrically.

The negative of a point P = (xP,yP) is its reflection

in the x-axis: the point -P is (xP,-yP). Notice that

for each point P on an elliptic curve, the point -P is

also on the curve.

Adding distinct points P and Q

Suppose that P and Q are two distinct points

on an elliptic curve, and the P is not -Q. To

add the points P and Q, a line is drawn

through the two points. This line will

intersect the elliptic curve in exactly one

more point, call -R. The point -R is reflected

in the x-axis to the point R. The law for

addition in an elliptic curve group is P + Q

= R. For example:

Adding the points P and -P

The line through P and -P is a vertical line which

does not intersect the elliptic curve at a third point;

thus the points P and -P cannot be added as

previously.

It is for this reason that the elliptic curve group

includes the point at infinity O.

By definition, P + (-P) = O. As a result of this

equation, P + O = P in the elliptic curve group . O

is called the additive identity of the elliptic curve

group; all elliptic curves have an additive identity.

Doubling the point P

To add a point P to itself, a tangent line to the

curve is drawn at the point P. If yP is not 0, then

the tangent line intersects the elliptic curve at

exactly one other point, -R. -R is reflected in the

x-axis to R. This operation is called doubling the

point P; the law for doubling a point on an elliptic

curve group is defined by:

P + P = 2P = R.

The tangent from P is always vertical if

yP = 0.

Doubling the point P if yP = 0

If a point P is such that yP = 0, then the tangent

line to the elliptic curve at P is vertical and does

not intersect the elliptic curve at any other point.

By definition, 2P = O for such a point P.

If one wanted to find 3P in this situation, one can

add 2P + P. This becomes P + O = P Thus 3P = P.

3P = P, 4P = O, 5P = P, 6P = O, 7P = P, etc.

Elliptic Curve Addition: An

Algebraic Approach

Geometrical approach is not practical

Adding distinct points P and Q

When P = (xP,yP) and Q = (xQ,yQ) are not negative of

each other,

P + Q = R where

s = (yP - yQ) / (xP - xQ)

xR = s2 - xP - xQ and yR = -yP + s(xP - xR)

Note that s is the slope of the line through P and Q

Doubling the point P

When yP is not 0,

2P = R where

s = (3xP2 + a) / (2yP )

xR = s2 - 2xP and yR = -yP + s(xP - xR)

Recall that a is one of the parameters chosen with

the elliptic curve and that s is the tangent on the

point P.

Elliptic Curve Groups over Fp

Calculations over the real numbers are slow and

inaccurate due to round-off error. Cryptographic

applications require fast and precise arithmetic;

thus elliptic curve groups over the finite fields of

Fp and F2m are used in practice.

Recall that the field Fp uses the numbers from 0 to

p - 1, and computations end by taking the

remainder on division by p. For example, in F23

the field is composed of integers from 0 to 22, and

any operation within this field will result in an

integer also between 0 and 22.

An elliptic curve with the underlying field of Fp can

formed by choosing the variables a and b within the

field of Fp. The elliptic curve includes all points

(x,y) which satisfy the elliptic curve equation

modulo p (where x and y are numbers in Fp).

For example: y2 mod p = x3 + ax + b mod p has an

underlying field of Fp if a and b are in Fp.

If x3 + ax + b contains no repeating factors (or,

equivalently, if 4a3 + 27b2 mod p is not 0), then the

elliptic curve can be used to form a group. An

elliptic curve group over Fp consists of the points on

the corresponding elliptic curve, together with a

special point O called the point at infinity. There are

finitely many points on such an elliptic curve.

Example of an Elliptic Curve

Group over Fp

As a very small example, consider an elliptic

curve over the field F23. With a = 1 and b = 0, the

elliptic curve equation is y2 = x3 + x. The point

(9,5) satisfies this equation since:

y2 mod p = x3 + x mod p

52 mod 23 = 93 + 9 mod 23

25 mod 23 = 738 mod 23

2=2

The 23 points which satisfy this equation are:

(0,0) (1,5) (1,18) (9,5) (9,18) (11,10) (11,13)

(13,5)

(13,18) (15,3) (15,20) (16,8) (16,15) (17,10)

(17,13) (18,10)

(18,13) (19,1) (19,22) (20,4) (20,19) (21,6)

(21,17)

These points may be graphed as below:

Arithmetic in an Elliptic Curve

Group over Fp

There are several major differences between

elliptic curve groups over Fp and over real

numbers.

Elliptic curve groups over Fp have a finite number

of points, which is a desirable property for

cryptographic purposes. Since these curves consist

of a few discrete points, it is not clear how to

"connect the dots" to make their graph look like a

curve. It is not clear how geometric relationships

can be applied.

As a result, the geometry used in elliptic

curve groups over real numbers cannot be

used for elliptic curve groups over Fp.

However, the algebraic rules for the

arithmetic can be adapted for elliptic curves

over Fp. Unlike elliptic curves over real

numbers, computations over the field of Fp

involve no round off error - an essential

property required for a cryptosystem.

Adding distinct points P and Q

The negative of the point P = (xP, yP) is the point -P

= (xP, -yP mod p). If P and Q are distinct points such

that P is not -Q, then

P + Q = R where

s = (yP - yQ) / (xP - xQ) mod p

xR = s2 - xP - xQ mod p and yR = -yP + s(xP - xR) mod

p

Note that s is the slope of the line through P and Q.

Doubling the point P

Provided that yP is not 0,

2P = R where

s = (3xP2 + a) / (2yP ) mod p

xR = s2 - 2xP mod p and yR = -yP + s(xP - xR) mod p

Recall that a is one of the parameters chosen with

the elliptic curve and that s is the slope of the line

through P and Q.

Elliptic Curve groups and the

Discrete Logarithm Problem

At the foundation of every cryptosystem is a hard

mathematical problem that is computationally

infeasible to solve. The discrete logarithm problem

is the basis for the security of many cryptosystems

including the Elliptic Curve Cryptosystem. More

specifically, the ECC relies upon the difficulty of

the Elliptic Curve Discrete Logarithm Problem

(ECDLP).

Recall that we examined two geometrically

defined operations over certain elliptic curve

groups. These two operations were point addition

and point doubling. By selecting a point in a

elliptic curve group, one can double it to obtain

the point 2P. After that, one can add the point P to

the point 2P to obtain the point 3P. The

determination of a point nP in this manner is

referred to as Scalar Multiplication of a point. The

ECDLP is based upon the intractability of scalar

multiplication products

The Elliptic Curve Discrete

Logarithm Problem

In the multiplicative group Zp*, the discrete

logarithm problem is: given elements r and q of

the group, and a prime p, find a number k such

that r = qk mod p. If the elliptic curve groups is

described using multiplicative notation, then the

elliptic curve discrete logarithm problem is: given

points P and Q in the group, find a number that Pk

= Q; k is called the discrete logarithm of Q to the

base P. When the elliptic curve group is described

using additive notation, the elliptic curve discrete

logarithm problem is: given points P and Q in the

group, find a number k such that Pk = Q

Example:

In the elliptic curve group defined by

y2 = x3 + 9x + 17 over F23,

What is the discrete logarithm k of Q =

(4,5) to the base P = (16,5)?

One way to find k is to compute multiples of P

until Q is found. The first few multiples of P are:

P = (16,5) 2P = (20,20) 3P = (14,14) 4P = (19,20)

5P = (13,10) 6P = (7,3) 7P = (8,7) 8P = (12,17) 9P

= (4,5)

Since 9P = (4,5) = Q, the discrete logarithm of Q

to the base P is k = 9.

In a real application, k would be large enough

such that it would be infeasible to determine k in

this manner.

ECC - key generation

Select an elliptic curve

Generate the coordinate pairs which satisfy the

conditions of modulo n and select starting point P

Key generation:

select a random integer d (secret key) in the interval [2,

n-2]

compute point Q = dP

make Q public

ECC Encryption

Encryption

select a random integer k in the interval [2, n-2]

compute (x ,y ) = kP and (x ,y ) = kQ

generate a mask Y from secret as f(x ) and

compute C = YM where M is the message

send the encrypted ciphertext EM as

concatenated [x , y , C]

1

1

2

2

2

1

1

ECC Decryption

Decryption

extract (x ,y ) from ciphertext EM

compute (x ,y ) from d(x ,y )

compute mask Y as f(x )

recover message by M = CY

1

1

2

2

1

2

1

Encryption and Decryption :

Actions perform by Party B

Actions perform by Party A

Encryption :

Decryption Process

1. Looks up A public

key : Q = 1.Ciphertext EM = (11001100001110)

(xQ,yQ)

received from B

= ( ,0)

2. Uses the first 8 bits of the string for

2. Select a random integer k = 2 in the one

- time public key : ((1100),(1100)).

interval [2, n -2 ] - the private key

The rest of EM will be stored in C

for

the one - time key pair

3. Computes the point (x2,y2) = d

( x1,y1) = 3 (1100,1100) = 3(, ) =

3. Computes the point (x1,y1) = kP =

2( , ) = ( , ) = ((1100),(1100))

( , )= ( (1010),(1110)). X2 is the

- the public key for one - time key

secret value.

5

11

5

11

4. Using the same mask generation

pair

4. Computes the point (x2,y2) = kQ =

function as B, A generate from x2 the

2( , ) = ( , ) = ((1010),(1110))

5

11

x2 is the secret value.

mask Y = 011010.

5. Recover the message M by XORing

5. Generates a mask Y of length 6 all

with the mask generation function

but the first 8 bits of EM with the

used, Y will vary. For the purposes

mask Y: M : C Y = (001110)

in this example, let Y = 011010.

(011010) = (010100)

6. Computes C = Y M = (011010)

(010100) = (001110)

7. Computes the encrypted message

by

concatenating (x1,y1) and C,

and transmit (11001100001110) to

A.

Security of Smart Card

Possible attacks

tracking: based on the protocol exchange

between the terminal and the card to track the

sequence of commands

EM analysis: use electron microscope to

inspect the internal structure of the mask

confusion: disturb the power supply during PIN

verification to confuse the accurate enter of PIN

and allow access to the protected memory

UV or X-ray inspection: use high efficiency

UV or X-ray to inspect the memory areas to

extract important information like PIN,

secret key and public key

Other possible attracts:

attract on DES like differentiate methods

attract on RSA using cyclic properties

Trusted System Evaluation

Criteria – USA(DoD)

D: Minimal protection

No protection

C1: Discretionary Security Protection

Use control acess

C2: Controlled Access Protection

Use accountability/auditing

B1: Labelled Security Protection

Use sensitivity (classification) labels

B2: Structured Protection

Use formal security policy more resistant to

penetrate

B3: Security domain

Highly resistant to penetration. Use security

administrator, auditing events and system

recovery process

A1: Verified protection

Highly assure of penetration. Use formal

specification and verification approaches.

Information Technology Security

Evaluation Criteria (ITSEC) - Europe

EAL1 – functional tested

EAL2 – structurally tested

EAL3 – methodologically tested and checked

EAL4 - methodologically designed, tested and

reviewed

EAL5 – semiformally designed and tested

EAL6 - semiformally verified designed and

tested

EAL7 -formally verified designed and tested

Security requirements

Cryptographic modules

module interface

role and services

finite state machine model

physical security

Environmental Failure Protection/Testing

(EFT/EFP)

Software security

Operation security

cryptographic key management

cryptographic algorithm

EMI/EMC

self tests

Security Assessment

USA Federal Information Processing

Standard Publications 140-2 (FIPS PUB

1401-2): Specifications for security

requirements for cryptographic modules

The specifications define 4 levels security:

SL 1 to SL 4 where SL 1 is the lowest

Type

SL1

1

Cryptographic

Modules

Define interfacing, H/W, S/W, Firmware & Module Security

Policy

2

Module

Interface

3

4

SL2

SL3

SL4

Define require and backup

Dta port is an important issue

interface, define path format and must be isolate from

for interface and internal

other information links

circuit

Role and

Logic

Must apply

Apply Identity based

services

separate the

role based

authentication

role and

authentication

services

Finite state

Define model, state and state transitional diagram and the

machine model state transitional conditions

5

Physical

security

Manufacturer Provide lock

classification and

layers

modification

evidents

6

EFP/EFT

Not required

Detection of Detection of

illegal

illegal

modifications modifications

and response and response

for covers

envelope for

and doors

access

Temperature and voltage

7

S/w security

S/W must be tested by

H/L language

finite state machine model

Formal model

8

O/S Security Execute

Read/write Indicate

Structural protection in B2

code,

protection in protection in B1 level

authenticatio C2 level

level with a

n and access

reliable

control for

communication

single

path

machine/user

9 Cryptographi Use FIPS endorsed creation Use encryption or split knowledge methods to

c Key

and distribution methods

input/output keys

management

10 Cryptographi Use FIPS endorsed non-classified document encryption algorithms

c algorithms

11 EMI/EMC

FCC Part 15 J class A or

equivalent

FCC Part 15 J class B or equivalent

12 Self test

Provide power up tests and conditional tests

*** END ***