Accounts Payable Bookkeeping

advertisement

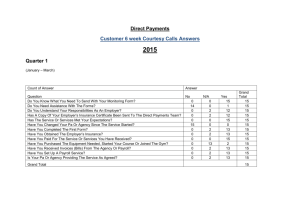

Accounts Payable Bookkeeping Jeff Steele, LDO, CPOT, ABOC Spokane Community College Objectives Describe accounts payable bookkeeping Describe steps involved for bill paying and maintaining expense documentation Differentiate between gross pay and net pay Identify payroll taxes which are deducted from an employee’s earnings and those which the employer must pay Demonstrate reconciling a bank statement Overview Accounts payable bookkeeping is the management, verification, and prompt payment of the practice expenses for supplies, payroll, rent and utilities These expenses represent overhead, or the cost of doing business Preparing Bills All bills awaiting payment should be stored in an accounts payable folder or file, including packing slips, invoices and statements Bills offering a discount for prompt payments should be paid at once, others should be set up for a predetermined time of the month (often the 10th and 25th) Preparing Bills, Cont. Remove all papers from the accounts payable folder and organize them by vendor If a statement covers several invoices received during the month, check each invoice against its listing on the statement When the invoices and their covering statement have been verified, staple the invoices to the back of the statement The doctor may want to review these bills before you write the checks Expense Documentation Once a bill or statement has been paid, it is marked with the date and check number, then re-filed by category Expenses are summarized by categories to provide important management data (utilities, venders, payroll, maintenance/cleaning, etc.) Depreciation Schedule Supplies and minor pieces of equipment which are used up fairly quickly are known as consumables, and are handled as practice expenses Major purchases, such as computers and testing equipment, must be written-off over a period of time. This process if called depreciation and it represents the value that is lost through wear and tear The practice accountant usually determines and maintains the depreciation schedule Annual Expense Summary After the accuracy of the entries have been verified, totals of earnings and costs are carried forth to the annual report Payroll Taxes and Records Federal regulations require than an employer make certain deductions from an employee’s pay, and that the employer also pay certain payroll taxes In many cases, state and/or local taxes must also be paid The person in charge of payroll must be familiar with all applicable taxes and follow the instructions carefully Government Reports Federal and state governments require an employer to deposit all taxes withheld on a regular basis All govt. forms must be filled out exactly and neatly and must be filed on time, as late penalties may apply A copy of the report should remain with the company records for a period of at least 5 years after payment has been made Payroll Records The government requires employers to keep records regarding the payroll, so it should be accurate and up-to-date at all times A separate payroll sheet should be maintained for each employee: Name Address Social Security Number Number of exemptions claimed Gross vs. Net Pay Gross pay= total amount earned Net pay= amount received after deductions and taxes have been taken out of the total amount earned Deductions + Net pay = Gross pay Payroll Deductions All employees must pay federal income tax and file a return A portion of this tax is deducted from each paycheck Income tax is strictly an employee tax (employer does not contribute) and the amount withheld depends upon the amount of exemptions claimed Each employee must complete a Withholding Exemption Certification (W-4) authorizing an employer to deduct tax and at which amount Wage and tax statements (W-2) show total earnings and taxes withheld for the calendar year and must be given to employees no later than January 31 of the following year Social Security Under the Federal Insurance Contributions Act (FICA), aka social security, the employer is required to deduct a certain percentage of the employee’s gross pay The employer is also required to make matching contributions To assure accuracy, any name changes must be reported to the Social Security Administration Federal and State Unemployment Tax The employer is required to make contributions to state and federal funds to cover the cost of unemployment benefits paid out within the state This is strictly an employer tax and may not be deducted form an employee’s pay Worker’s Compensation Under state law, the employer is also required to contribute to worker’s compensation to cover the medical expenses of employees who are injured on the job Also an employer tax Petty Cash Fund A small petty cash fund may be used to pay minor bills Any time petty cash is used, a receipt or voucher for the exact amount should be included, so all monies can be properly accounted for Usually replenished about once/month Check Writing 1. 2. 3. 4. 5. 6. 7. 8. 9. In order to make fraudulent alteration difficult, checks must be written properly: Entries accurate and complete Use ink or a check writer Date the check (pre-dating a check is illegal and post-dating should only be allowed with approval) Address the check properly State the amount clearly Fill in all spaces Authorized signatures only Void checks in which a mistake is made and start over Check the bank balance, to ensure accuracy Reconciling a Bank Statement 1. 2. 3. 4. It is important that the bank statement, and your check register records, be reconciled shortly after receipt of the statement You’ll need: The check register Deposit records for the period The bank statement Accompanying cancelled checks and debit memos (debits can include the banks service charge) Steps to Reconciling a Bank Statement 1. 2. 3. 4. 5. 6. Verify debits- compare each cancelled check or deduction with each charge Verify deposits Verify cancelled checks- be sure to exclude the outstanding checks (those which have not yet been cashed or included in the statement) Balance the register- through the last cancelled check or to the current date Perform calculations- repeat until all monies are accounted for Make necessary adjustments- enter all service charge and debits into the final tally, as well as account for any interest that may have been earned on the account Account Does Not Balance 1. 2. 3. 4. 5. 6. 7. Here are some areas to explore: Were all checks properly entered on the register? Was the amount of each check entered accurately? Are the amounts of your deposits the same as those on the bank statement? Are all outstanding checks accounted for? Have you added interest earned? Have you subtracted any debits/service charges? Are all calculations correct?