Chapter 9 - the School of Economics and Finance

advertisement

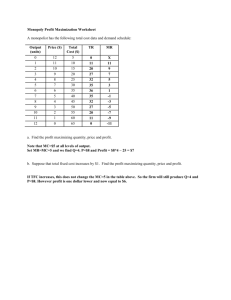

Monopoly and Other Forms of Imperfect Competition Introductory Microeconomics 1 The Perfectly Competitive Firm Is a Price Taker (Recap) The perfectly competitive firm has no influence over the market price. It can sell as many units as it wishes at that price. Typically, a “perfectly” competitive industry is one that consists of a large number of sellers, each of which makes a highly standardized product. 2 Profit-maximization for the perfectly competitive firm Profit = Total revenue - total cost Q. How much output should a perfectly competitive firm produce if its goal is to earn as much profit as possible? A. It should keep expanding output as long as the marginal benefit of doing so exceeds the marginal cost. The marginal benefit of expanding output by one unit is the market price. The marginal cost of expanding production by one unit is the firm's marginal cost at its current production level. 3 Example 10.1. If this grower can sell as many bushels of corn as he chooses to at a price of $5 per bushel, how many bushels should he sell in order to maximize profit? $/bushel The profit-maximizing quantity for the perfectly competitive firm is the one for which price = MC. Marginal cost of producing corn 6 5 4 Price 6 9 12 Thousands of bushels/year 4 Imperfect Competition Monopoly = "single seller" Oligopoly = "few sellers" Monopolistic competition: Many sellers, each with a differentiated product 5 Monopoly = “single seller” Towngas (The Hong Kong and China Gas Company Limited) supplies cooking fuel to households in Hong Kong An electronic payment system using a contactless smartcard. The sole supplier of electricity in Kowloon and New Territories. The sole supplier of electricity on Hong Kong Island. 6 Oligopoly = “few sellers” Six mobile service providers in Hong Kong 7 Monopolistic competition: Convenience stores 8 Five Sources of Monopoly 1. Exclusive control over important inputs Perrier’s mineral spring 9 Five Sources of Monopoly 2. Economies of Scale (Natural monopoly) The average cost of production declines as the number of unit s produced increases. Example: domestic cooking fuel 10 Five Sources of Monopoly 3. Patents Example: Prescription drugs 11 Five Sources of Monopoly 4. Government licenses or franchises Example: Postal services 12 Five Sources of Monopoly 5. Network Economies Example: Microsoft Windows 13 Five Sources of Monopoly 5. Network Economies Sony Playstation library: Over 1000 games that will not play on other formats 14 Five Sources of Monopoly 5. Network Economies Network economies may be thought of as a kind of economy of scale. Most enduring source of monopoly is economies of scale. With growth of research and development expenses, economies of scale are becoming more important. 15 The Old Economy Two widget producers, Acme and Ajax Each has fixed costs of $200,000, and variable costs of $0.80 per widget. Acme Annual production Ajax $1,000,000 $1,200,000 Fixed costs $200,000 $200,000 Variable cost $800,000 $960,000 Total cost Cost per widget $1,000,000 $1,160,000 $1.00 $0.97 Ajax, the high volume producer, has only a small cost advantage. Widget: 1. A small mechanical device or control. 2. An unnamed or hypothetical manufactured article. 16 The New Economy In the new economy, fixed costs are $800,000, reflecting the growing importance of the information and ideas in the product. Variable costs are only $0.20/widget. Acme Annual production Ajax $1,000,000 $1,200,000 Fixed costs $800,000 $800,000 Variable cost $200,000 $240,000 Total cost Cost per widget $1,000,000 $1,040,000 $1.00 $0.87 Ajax, the high volume producer, has a much larger cost advantage. Note: Capital can substitute for labor in production. Thus, higher fixed cost is likely associated with lower variable cost. 17 The New Economy This cost advantage becomes self reinforcing, as more and more of the market goes to Ajax: Acme Ajax Annual production $500,000 $1,700,000 Fixed costs $800,000 $800,000 Variable cost $100,000 $340,000 Total cost $900,000 $1,140,000 Cost per widget $1.80 $0.67 18 Demand curves facing Monopoly, oligopoly, and monopolistically competitive firms Monopoly, oligopoly, and monopolistically competitive firms have in common the fact that the demand curves for their goods are downward sloping. Price D Quantity For convenience, we will refer to any of these three types of imperfectly competitive firms as monopolists. 19 Demand curves facing perfectly a competitive firm The demand curve facing a perfectly competitive firm is a straight line at the market price. $/unit of output Market Price D Quantity 20 Marginal Revenue The marginal benefit to a competitive firm of selling an additional unit of output is the market price. By contrast, the marginal benefit to a monopolist of selling an additional unit of output is less than the market price. The reason MR < P for the monopolist is that it must cut its price in order to sell an extra unit of output. This means that is will earn less on the output it was selling thus far. 21 Example 10.2. If this monopolist is currently selling 3 units of output at a price of $7 per unit, what is its marginal benefit from selling an additional unit? Price TR from the sale of 3 units = $7x3 = $21 10 TR from the sale of 4 units = $6x4 = $24 So MR from the fourth unit = $24 - $21 = $3, which is less than both the original price and the new price. 7 6 3 4 10 Quantity 22 Example 10.3. If this monopolist is currently selling 4 units of output at a price of $6 per unit, what is its marginal benefit from selling an additional unit? Price TR from the sale of 4 units = $6x4 = $24 10 TR from the sale of 5 units = $5x5 = $25 So MR from the fifth unit = $25 - $24 = $1, which is less than both the original price and the new price. 6 5 4 5 10 Quantity 23 Example 10.4. If this monopolist is currently selling 5 units of output at a price of $5 per unit, what is its marginal benefit from selling an additional unit? Price TR from the sale of 5 units = $5x5 = $25 10 TR from the sale of 6 units = $4x6 = $24 So MR from the sixth unit = $24 - $25 = - $1, 5 4 5 6 10 Quantity 24 Marginal Revenue Curve The Marginal Revenue Curve for the monopolist in the preceding examples: Price 10 5 D 5 MR 10 Quantity 25 Marginal Revenue Curve More generally, MR for any monopolist with a straightline demand curve: Price For a straight-line demand curve: P = a - bQ a The corresponding MR curve: MR = a - 2bQ a/2 D Q0/2 MR Q0 Quantity 26 Marginal Revenue Curve More generally, MR for any monopolist with a straightline demand curve: Price For calculus-trained students: Demand: P = a - bQ MR = dTR/dQ TR = PQ = aQ-bQ2 so MR = a - 2bQ a a/2 D Q0/2 MR Q0 Quantity 27 Example 10.5 Find this monopolist’s marginal revenue curve. Price For calculus-trained students: 8 MR = dTR/dQ TR = PQ = 8Q-0.5Q2 so 4 MR = 8 - Q Demand: P=8-0.5Q 8 MR 16 Quantity 28 Profit-maximization for the monopolist Profit = total revenue - total cost Q. How much output should a monopolist produce if its goal is to earn as much profit as possible? It should keep expanding output as long as the marginal benefit of doing so exceeds the marginal cost. The marginal benefit of expanding output by one unit is the marginal revenue at the current output level. The marginal cost of expanding production by one unit is the firm's marginal cost at the current output level. So the monopolist should expand output until MR = MC. 29 Example 10.6. True or False: The profit-maximizing level of output for this monopolist is 9 units. Price MC 12 At Q=9, MC=6 > MR=0. There is net gain from producing one less unit at the proposed output. So the monopolist cannot be maximizing profit at Q=9. 6 Demand: P=12-0.67Q = 12 – (2/3)Q 9 MR 18 Quantity 30 Example 10.6. True or False: The profit-maximizing level of output for this monopolist is 9 units. The profit-maximizing quantity for the monopolist is the one for MC which MR = MC, in this case 6 units of output. At that level of output the monopolist will charge a price of $8/unit. Price 12 8 MR = 12 – (4/3)Q and MC = (2/3)Q Hence Q = 6, P=8. 6 4 Demand: P=12-0.67Q = 12 – (2/3)Q Quantity 18 6 9 MR 31 Example 10.7. Price Consider the profit-maximizing monopolist in Example 10.6. At Q=6, what is the benefit to society of an additional unit of output? What is the cost to society of an additional unit? Is this situation efficient from society's point of view? MC 12 8 6 4 D 6 9 MR 18 At Q=6, the marginal benefit to society of an additional unit of output is $8. The MC of an additional unit is only $4. That is, the society would gain a net benefit of $4 per unit of output if output were expanded by 1 unit from the profit-maximizing level. Quantity 32 Social efficiency: For social efficiency, production should expand as long as the marginal benefit to society exceeds the marginal cost. Marginal social benefit of an extra unit of output = the amount people are willing to pay for it = the amount given by the demand curve. Thus, social efficiency occurs where the demand curve intersects the marginal cost curve. 33 Social efficiency of monopoly Under monopoly: MC = MR < P, so output produced by monopoly is too low for social efficiency. Price MC P* Social efficient point MC, MR D Q* Quantity MR 34 Social efficiency of perfect competition Under perfect competition: MC = P, so output produced by perfectly competitive industry is socially efficient. MC i Price Price ATC i D S P P Q Market Quantity Q i* Firm i’s Quantity 35 Social efficiency of monopoly Note that the monopolist would gladly expand output if it could do so without having to sell the current output at a lower price. Price MC P* MC, MR D Q* Quantity MR 36 Example 10.8 If this monopolist maximizes profit, by how much will total economic surplus be smaller than the maximum possible economic surplus? Price MC 12 8 6 4 D 6 9 MR 18 Quantity 37 Example 10.8 The maximum possible economic surplus = CS + PS Price 12 Consumer surplus MC 6 D Producer surplus 9 18 Quantity 38 Example 10.8 Loss in economic surplus from Monopoly Price Consumer surplus 12 8 MC Loss in surplus =0.5*(9-6)*(8-4)=6 6 4 D Producer surplus 6 9 MR 18 Quantity 39 Example (loss in economic surplus) Rebecca is a single-price, profit-maximizing monopolist in the sale of singing lessons. If her demand and marginal cost curves are as shown, by how much does total economic surplus fall short of the maximum achievable surplus in this market if Rebecca charges the profit-maximizing price? $/lesson 24 a. $8 per week. b. $16 per week. c. $32 per week d. $56 per week. e. None of the above. MC 18 16 12 8 6 D 6 8 12 MR Lessons per week 24 40 Should we outlaw monopoly? Does the fact that perfect competition is socially efficient and monopoly is not mean that we should outlaw monopoly? Suppose the monopoly in question is the result of a patent that prevents all but one firm from manufacturing a highly valued product. Would we be better off without patents? 41 Should we outlaw monopoly? Suppose the monopolist is a natural monopolist. For the natural monopolist, MC < AC Price ($/minute) AC MC Minutes (millions/day) 42 Should we outlaw monopoly? Efficiency requires P=MC But if MC<AC, setting P=MC means losing money Price ($/minute) Economic loss = -$400,000/day AC = 0.06 P = 0.05 MR 40 AC MC D Minutes (millions/day) 43 Should we outlaw monopoly? What do you prefer? 1. A natural monopolist to maximize profit and stay in business 2. Force the monopolist to charge MC and go out of business. Price ($/minute) 0.15 Consumer surplus = $500,000/day Economic profit = $400,000/day 0.10 0.08 AC MC 0.05 D 20 MR Minutes (millions/day) 44 Source of efficiency loss from a monopoly The efficiency loss from single-price natural monopoly stems from the fact that the profit-maximizing price is above marginal cost, thereby excluding many buyers who "should" be in the market (because they are willing to pay a price greater than or equal to marginal cost). Price ($/minute) Output shortfall 0.10 AC MC 0.05 D 20 40 MR Minutes (millions/day) 45 Should we outlaw monopoly? Recall that the monopolist would gladly expand output if it could do so without having to sell the current output at a lower price. Price MC P* MC, MR D Q* Quantity MR 46 Price discrimination Can the monopolist find ways of lowering prices to some buyers while keeping price high for others? Price discrimination: charging different buyers different prices for the same good or service. 47 Example 10.9. Ram is a monopolist in the market for carved sisalwood bowls in his village, a minor tourist stop in Northern India. 48 Example 10.9. Each day 8 tourists visit his shop, and each has a different reservation price for Ram's standard bowl. If these reservation prices are as listed in the table below, draw the demand curve Ram faces each day. Visitor Reservation price A $16 B $14 C $12 D $10 E $8 F $6 G $4 H $2 49 Example 10.9. $/bowl Visitor Res. price A $16 B $14 C $12 D $10 10 E $8 8 F $6 6 G $4 H $2 4 2 16 14 12 0 1 D 2 3 4 5 6 7 8 Quantity 50 Example 10.10 Ram has to charge the same price to all buyers. He can produce as many bowls as he chooses at a cost of $3 each (and bowls can be sold only in integer amounts). How many bowls should he sell each day if his goal is to maximize profit? Expand if MR > MC = 3 MR from 1st bowl = 16; $/bowl MR from 2nd bowl = 12; T R=28 MR from 3rd bowl = 8; 16 14 T R=36 MR from 4th bowl = 4; T R=40 MR from 5th bowl = 0; T R=40 12 10 So keep expanding until Q = 4. 8 6 4 2 0 1 D 2 3 4 5 6 7 8 Quantity 51 Example 10.11. In the preceding example, how much profit does Ram make? Total revenue = 10x4 = $40/day Total cost = 3x4 = $12/day Profit = $40 - $12 = $28/day 52 Example 10.12. In the preceding example, is 4 bowls per day a socially efficient level of output? No, because buyers are willing to pay more for additional bowls than their $3 marginal cost. 53 Example 10.12. Visitor Reservation price A $16 B $14 C $12 D $10 E $8 F $6 G $4 H $2 Visitors A-G are willing to pay more for a bowl than the cost of producing one, and thus it is efficient that they each should have one. Visitor H is not willing to pay the cost of producing a bowl and so should not have one. Thus the socially efficient number is 7 bowls/day. 54 Example 10.13. Now suppose that Ram is a shrewd judge of human nature. After a moment's conversation with a visitor, he is able to discover the visitor's reservation price for a bowl. If Ram then charges each visitor his respective reservation price, how many bowls will he sell and how much profit will he make? 55 Example 10.13. Visitor Reservation price A $16 B $14 C $12 D $10 E $8 F $6 G $4 H $2 Ram will sell bowls to visitors A-G and each will pay his reservation price. He will not sell to visitor H. Total rev = 16+14+12+10+8+6+4 = $70/day Total cost = 7x3 = $21/day Profit = 70-21 = $49/day 56 Efficiency of a perfectly discriminating monopolist A monopolist who is able to charge each buyer his or her reservation price is called a perfectly discriminating monopolist. For a perfectly discriminating monopolist, there is no efficiency loss. All buyers are served who are willing to pay a price high enough to cover marginal cost. In practice, however, there are virtually no sellers who know each buyer's reservation price. Price discrimination does occur, but it is imperfect price discrimination. 57 The Hurdle Method of Discrimination 58 The Hurdle Method of Discrimination Pay discount price Start Pay list price 59 Example 10.14. Ram's 8 visitors again have the same reservation prices for carved wooden bowls as before. Ram does not know each buyer's reservation price. But he knows that all buyers with a reservation price above $9/bowl never use discount coupons. Those with reservation prices below $9 use them whenever they are available. If Ram makes coupons available in the government tourist magazine, those buyers who clip and present them get to pay a discount price for bowls. Others pay the regular list price for bowls. To maximize profit, at what levels should Ram set the list price of a bowl? The discount price? 60 Example 10.14. In each submarket, the monopolist should expand output as long as MR>MC. List price submarket Visitor Res. price A $16 B C D $14 $12 $10 Discount price submarket Visitor E Res. price $8 F G H $6 $4 $2 61 Example 10.14. For the list price submarket, MR from sale of fourth bowl is 4 > MC =3. To sell 4 bowls in the list price submarket, Ram will choose a list price of $10. At that price, all non-coupon clippers buy a bowl. Visitor A B C D Res. price $16 $14 $12 $10 MR $16 $12 $6 $4 62 Example 10.14. For the discount price submarket, the MR from the sale of the 2nd bowl is 4; the MR from the 3rd bowl is 0. So Ram should choose a discount price of $6/bowl and sell 2 bowls in the discount market. Visitor E F G H Res. price $8 $6 $4 $2 MR $8 $4 $0 -$4 63 Example 10.14. $/bowl 16 14 12 10 8 6 T R=28 T R=36 T R=40 T R=8 T R=12 T R=12 T R=8 4 2 0 1 D 8 6 7 5 3 4 2 Discount price List price buyers buyers Quantity 64 Example 10.15. At a list price of $10/bowl and a discount price of $6/bowl in the preceding example, how many bowls does Ram sell and how much profit does he make? Is this outcome socially efficient? Total revenue = 10x4 + 6x2 = $52/day Total cost = 6x3 = $18/day Profit = 52-18 = $34/day The outcome is not socially efficient because visitor G is excluded even though he is willing to pay more than marginal cost. But it is more efficient than the single-price case. 65 Examples of the hurdle method of price discrimination: Rebate coupons: hurdle = having to mail the coupon to the manufacturer 66 Examples of the hurdle method of price discrimination: Temporary sales: hurdle = having to find out when & where the sale occurs 67 Examples of the hurdle method of price discrimination: Hardback books and paperbacks: hurdle = having to wait for the paperback It is the ongoing behavior of our peers which ultimately determines how much we spend and how we spend it. Hardback: $25.00 Paperback: $16.47 68 Examples of the hurdle method of price discrimination: BMW 330i and BMW 325i: Hurdle = less powerful engine and fewer standard features 330i: MSRP = $39,900 325i: MSRP= $29,900 MSRP: Manufacturer's suggested retail price 69 Examples of the hurdle method of price discrimination: Coach fares and Super-Saver fares: hurdle = having to stay over a Saturday night Los Angeles-Honolulu round trip: NW Flight 91 Depart Thu Jun 16 Return Thu Jun 23 $570 NW Flight 91 Depart Wed Mar 30 Return Fri Apr 1 $1467 70 The hurdle method of price discrimination: In general, the more finely the monopolist can partition his market using hurdle methods, the smaller the efficiency loss will be. It is common in most firms to see not one but a whole menu of different discount prices, each with a different set of restrictions (the deeper the discount, the more stringent the restriction). 71 The fairness problem: The monopolist may earn an economic profit. Price ($/minute) Economic profit = $400,000/day 0.10 0.08 AC MC 0.05 D 20 MR Minutes (millions/day) 72 Aside: The monopolist may not earn any economic profit. Price ($/minute) Economic loss = $400,000/day 0.12 0.10 AC 0.05 MC D Minutes (millions/day) 20 MR 73 The fairness problem: The monopolist may earn an economic profit. If the monopolist does earn economic profits, their source is the list price buyer, who could have bought at a discount had he been willing to jump a minor hurdle. How is each dollar of the monopolist's excess profits distributed? Corporate income tax 15 cents Dividend or capital gains to shareholders 85 cents 74 Two Concerns about Natural Monopoly with price discrimination: 1. Inefficient (output is restricted because MR<P) 2. Unfair (monopoly profit > 0 => P>AC) 75 Two Concerns about Natural Monopoly with price discrimination : 1. Inefficient (output is restricted because MR<P) The hurdle method of pricing enables monopolists to expand their markets beyond point at which MR=MC for single-price monopolist. This mitigates efficiency losses associated with natural monopoly. 76 Hurdle method of pricing mitigates efficiency losses Price Qs* = profit-maximizing quantity for single-price monopolist P s* Price QL* = profit maximizing quantity at list price PL* QD* = profit maximizing quantity at discount price PD* MC MC MC D D Q s* Q MR QL* Q MR QL*+QD* 77 Not too unfair…. On the fairness side, the source of excess profits is the list-price buyer. These profits are distributed to shareholders, many of whom are wealthy. And 15% of each dollar of excess profits goes to finance various government services, many of which are targeted at low-income families. So the fairness argument against natural monopoly may also be less compelling that it might first appear. 78 End 79