Financial Education Program - University of South Florida

advertisement

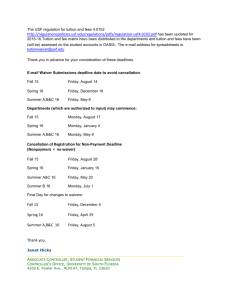

Pay-A-Bull Financial Literacy: Understanding How To Manage Your Money in College Presented by Financial Education @USF—Bull2Bull 1 • We are a one of a kind peer-based education program • Designed to help teach you: – Basic financial planning – Wise borrowing habits – How to develop short-term & long-term financial goals • All services are free and confidential for you! – One-on-one meetings – Group seminars • Located in SVC 2054 2 Agenda 1. 2. 3. 4. 5. 6. Money Management Cost Calculator: Forecast Your Costs Bright Futures OASIS: View Awards and Pay Your Bill Enrollment: How It Affects Your Aid Wrap-Up 3 Check Us Out ! www.usf.edu/fin-ed 4 Financial Education The knowledge of facts, concepts, principles and technological tools that are fundamental to being smart about money The key to personal financial success is simple: Earn more than you spend OR Spend less than you earn!! 5 Financial Planning The process of developing a plan to achieve financial success • Influenced by your: • Understanding of wants vs. needs • Lifestyle choices & behavior about spending money 6 Set Your Own Financial Plan Check Out Our Resources Get help if it’s not working (Visit us!) Understand Your Expenses Identify and Set Financial Goals(short-, midand long-term) Take Action and Review Your Progress Create a Budget to Meet Your Goals 7 Handy, Helpful Hints: • Limit entertainment expenses • Rent or buy used books • Walk, don’t drive • Use credit cards only for emergencies • Pay your credit cards off each month • Prepare meals at home • Live like a college student! 8 Budgeting A Budget is a written cash flow plan; that assigns every dollar to a specific category/expense at the beginning of each month • Helps you to live within your financial means and meet expenses • Helps you track spending versus saving to accomplish long- and short-term goals • Offers peace of mind. Worry is a waste of resources 9 Water Costs What!? Suppose you purchase a $2.00 bottle of water every day for an entire semester Over the course of four years the total cost is about $1,984 The interest rate on a federal student loan is at 3.86% • + + $248.00 x 8 $1,984.00 + 10 Saving • Cut down on dining out. Coffee ($4.00 a day) plus dining out ($9.00 a day) • $4.00 + $9.00 = $13.00 /day $13 X 7 = $91/week $91 X 52 = $4,732 /year If you graduate in 4 years, you spend $18,928 on going out to eat and coffee! The average graduation rate at USF is around six years. Stay an extra two years and that’s an additional $9,464 at $28,392! 11 Forecasting Your Costs & Planning Your Budget 12 Use Our Cost Calculator to Help Budget Your Costs! • What is the Cost Calculator? • Estimates your bill before payments are due • Why should I use the Cost Calculator? • The Cashier’s Office does not send bills • How much will my bill be? • Online version: Go to www.usf.edu/financial-aid • Under ‘Get Started’, click on the ‘Cost Calculators’ link • Review the paper version in your program • Do I have to do all the math? • Nope! Just enter all of your costs and let the calculator do the rest! 13 Use OASIS to Monitor Your Financial Aid Status Each Semester! • Check for unsatisfied requirements • Check for deferments • Check Satisfactory Academic Progress (SAP) • View your financial aid awards 14 Financial Aid Main Menu 15 Understand the Terms and Conditions • What are they? • Requirements you must meet in order to remain eligible for financial aid • Why do I need to know this? • Before you can be paid (grant, loan or work study funds), you are required to READ and ACCEPT the Terms & Conditions in OASIS every year. • Does this apply to my scholarship(s)? • Certain scholarship awards have separate terms and conditions which must also be accepted before these funds can be paid. 16 How Do I Accept the Terms & Conditions in OASIS? • Go to ‘My Award & Loan Information’ • Click the ‘Terms & Conditions’ tab 17 Florida Bright Futures • Go to www.floridastudentfinancialaid.org & make sure USF is listed as your postsecondary institution (in the Demographic Information section) so the scholarship can be paid • Click the ‘Scholarship’ tab on the USFAS webpage for step by step directions 18 Florida Bright Futures (cont’d) Bright Futures pays a flat amount per credit hour: • Florida Academic Scholars- $103 per credit hour • Florida Medallion Scholars- $77 per credit hour • The State of Florida requires students to repay the university any Bright Futures funds that were paid for courses that student drops or withdraws from…or the scholarship cannot be renewed for the next year. • Ex: One dropped course for an Academic Scholars student must repay $309 • Ex: One dropped course for a Medallion Scholars student must repay $231 19 Review Your Bill in OASIS 20 View Your Bill 21 Tuition & Fee Deferments 22 What Is A Tuition Deferment? A tuition deferment prevents cancellation of registration for non-payment of fees, and temporarily prevents assessment of late payment fees Term Tuition Payment Date Deferment Payment Date Summer A/C May 15th July 17th Summer B July 6th July 17th Fall August 28th October 23rd Tuition not paid by the deferment payment date will be assessed a late payment fee and have a cash collection hold placed on the student account by the University Controller’s Office 23 How Do I Receive a Tuition Deferment? • Automatically posted on OASIS if you: • Have scholarships (including Bright Futures) listed on your OASIS account OR: • Have a FAFSA on file at USF 10 business days before classes begin; and • Are enrolled in at least 6 undergraduate USF credit hours; and • Are meeting Satisfactory Academic Progress (SAP) requirements Check OASIS before classes begin each semester! 24 Housing Deferments 25 Housing Deferments Allows students to move into on campus housing without paying the first month’s rent Residency Status Amount of Aid Needed to Qualify* Florida Resident $5,800 in accepted aid Non-Florida Resident $11,200 in accepted aid *Student Direct Loan Borrowers must also complete the Federal Direct Loan Entrance Counseling and Master Promissory Note in order to qualify at www.studentloans.gov *Direct PLUS Loan Borrowers must apply and complete the PLUS Master Promissory Note in order to qualify at www.studentloans.gov 26 Bookstore Advance Purchase Program (BAPP) 27 The Basics of BAPP • What is the BAPP? • Allows you to purchase textbooks & supplies (at a USF campus bookstore) prior to the first day of classes using financial aid before it is paid • The amount you spend appears as a charge on your USF student account. After your financial aid has been paid, it will be applied to the charge • How do I qualify for the BAPP? • Be enrolled at least half-time (6 credits) in USF hours; and • Have financial aid that is at least $100 (maximum $600 for fall and spring, $300 for summer) more than your bill • Where do I find out if I qualify? • Check ‘My Requirements, Bookstore Authorizations and Deferments’ in OASIS • We will also email you • What if I don’t use my BAPP? • Any unused BAPP is refunded to you as a part of your financial aid refund 28 How Enrollment Decisions Affect Your Financial Aid Take 15!..credit hours each semester 29 Impact of Enrollment Decisions • Dropping courses: • Repaying Bright Futures for dropped courses • Increases the number of attempted credit hours • Excess credit hours: • Paying excess hours charges for credit hours attempted over 132 • Reaching the 120 credit hour limit on Bright Futures • Repeated courses: • Repeat course surcharges if the same course is taken for a third time • Some financial aid programs will not fund courses that are repeated! You must pay attention to the Terms & Conditions you accepted in OASIS to keep each type of aid program! 30 If You Don’t Graduate On Time… • Every semester you stay in school and extend your enrollment you will be adding about $10,500 to the cost of your degree! • Putting off starting your career will lose you estimated wages of $48,707 per year • One extra year in college: ($10,500x2)+$48,000=$69,000! Make sure you understand the financial implications before dropping a class! 31 Financial Literacy 101 • Required one hour online course for all first time in college students before classes begin • Access via CANVAS-`Life Skills: Financial Literacy 101’ • You must score 80% or higher to pass the course • Designed to give students basic financial management information • Credit card use • Financial aid (including student loans) • Budgeting 32 Things To Remember… • Read all emails sent by USFAS- all emails are sent to your USF email address • FAFSA: Complete the 2014-2015 FAFSA for summer & 2015-2016 FAFSA for fall • OASIS: Complete any unsatisfied financial aid requirements in OASIS • Terms & Conditions: Read and accept in OASIS; also accept awards • Accept Award Offers: Loans and Work Study require acceptance 33 Things To Remember… • Loans: Complete the online Master Promissory Note & online Entrance Counseling if loans are accepted at www.studentloans.gov • Review: This presentation is on the USFAS website (www.usf.edu/financial-aid) and • Pay: Pay the bill on time! 34 And…! • Attend our seminars/workshops & you may win a $500 scholarship! • Follow us on Twitter: @Bull2BullUSF • We reveal all our scholarship/loan repayment winners via Twitter! • We’re also constantly searching for good deals, free entertainment, free food, & ways to save $ #freefoodalertUSF • Visit us in SVC 2054! • Contact University Scholarships & Financial Aid Services if you have financial aid questions: 813.974.4700 35 Thank Questions? You! 36