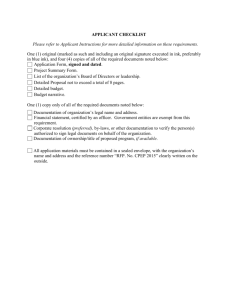

Save

advertisement