Opener

Sit in your NEW TEAMS, delegate a note taker

NAME, Email, phone #, cell phone #

Slide

2-1

Get your outlines for Chapter 1 out—turn in to me as a group

One person, send me and your teammates an email BEFORE

next class with the above info. Confirm receipt of email.

Assign homework chapter 1 (give me their names)

Give transparency to these people

Dim Sum activity

Finish Statements from Ch 1

Finish Ch 1

Begin Ch 2

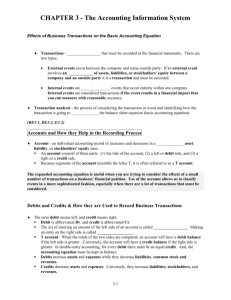

Chapter

2

The Recording

Process

Accounting 201, Instructor: Judith Paquette

Financial Accounting, Seventh Edition

Slide

2-2

So now we go into the land of

Slide

2-3

DEBITS

&

CREDITS

Study Objectives

Slide

2-4

1.

Explain what an account is and how it helps in the

recording process.

2.

Define debits and credits and explain their use in

recording business transactions.

3.

Identify the basic steps in the recording process.

4.

Explain what a journal is and how it helps in the

recording process.

5.

Explain what a ledger is and how it helps in the recording

process.

6.

Explain what posting is and how it helps in the recording

process.

7.

Prepare a trial balance and explain its purposes.

The Recording Process

The Account

Debits and

credits

Debit and credit

procedure

Stockholders’

equity

relationships

Summary of

debit/credit

rules

Slide

2-5

Steps in the

Recording

Process

Journal

Ledger

Posting

The Recording

Process

Illustrated

Summary

illustration of

journalizing and

posting

The Trial Balance

Limitations of a

trial balance

Locating errors

Use of dollar

signs

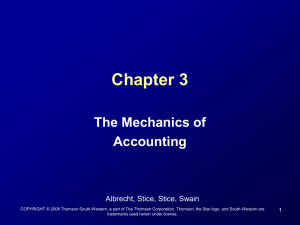

The Account

Account

Record of increases and decreases

in a specific asset, liability, equity,

revenue, or expense item.

Debit = “Left”

Credit = “Right”

An Account can

be illustrated in a

T-Account form.

Slide

2-6

Account Name

Debit / Dr.

Credit / Cr.

SO 1 Explain what an account is and how it helps in the recording process.

Debits and Credits

Double-entry accounting system

Each transaction must affect two or more

accounts to keep the basic accounting equation

in balance.

Recording done by debiting at least one account

and crediting another.

DEBITS must equal CREDITS.

Slide

2-7

SO 2 Define debits and credits and explain their

use in recording business transactions.

Debits and Credits

If Debits are greater than Credits, the account

will have a debit balance.

Cash

Debit / Dr.

Credit / Cr.

Transaction #1

$10,000

$3,000

Transaction #3

8,000

Balance

Slide

2-8

Transaction #2

$15,000

SO 2 Define debits and credits and explain their

use in recording business transactions.

Debits and Credits

If Credits are greater than Debits, the account

will have a credit balance.

Accounts Payable

Transaction #1

Balance

Slide

2-9

Debit / Dr.

Credit / Cr.

$10,000

$3,000

Transaction #2

8,000

Transaction #3

$1,000

SO 2 Define debits and credits and explain their

use in recording business transactions.

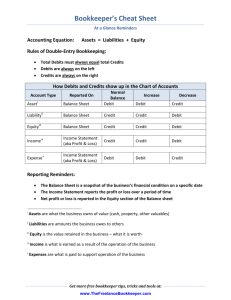

Debits and Credits Summary

Liabilities

Normal

Balance

Debit

Normal

Balance

Credit

Assets

Credit / Cr.

Normal Balance

Chapter

3-24

Equity

Credit / Cr.

Debit / Dr.

Debit / Dr.

Debit / Dr.

Credit / Cr.

Normal Balance

Normal Balance

Chapter

3-23

Expense

Debit / Dr.

Revenue

Chapter

3-25

Credit / Cr.

Debit / Dr.

Normal Balance

Chapter

3-27

Slide

2-10

Credit / Cr.

Normal Balance

Chapter

3-26

SO 2

Debits and Credits Summary

Balance Sheet

Asset = Liability + Equity

Income Statement

Revenue - Expense

Debit

Credit

Slide

2-11

SO 2 Define debits and credits and explain their

use in recording business transactions.

Debits and Credits Summary

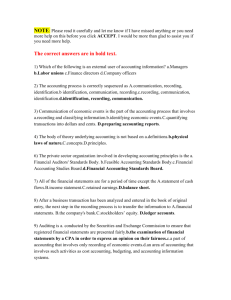

Review Question

Debits:

a. increase both assets and liabilities.

b. decrease both assets and liabilities.

c. increase assets and decrease liabilities.

d. decrease assets and increase liabilities.

Slide

2-12

Solution

notes page

SO 2 Define debits and credits and explain their

use in recording business transactions.

Assets and Liabilities

Assets

Debit / Dr.

Credit / Cr.

Normal Balance

Liabilities – Credits

should exceed debits.

Chapter

3-23

Liabilities

Debit / Dr.

Assets - Debits should

exceed credits.

Credit / Cr.

The normal balance is on

the increase side.

Normal Balance

Chapter

3-24

Slide

2-13

SO 2 Define debits and credits and explain their

use in recording business transactions.

Stockholders’ Equity

Issuance of stock and

revenues increase equity

(credit).

Equity

Debit / Dr.

Credit / Cr.

Dividends and expenses

decrease equity (debit).

Normal Balance

Chapter

3-25

Common Stock

Debit / Dr.

Retained Earnings

Credit / Cr.

Debit / Dr.

Normal Balance

Chapter

3-25

Slide

2-14

Chapter

3-25

Dividends

Credit / Cr.

Debit / Dr.

Normal Balance

Normal Balance

Credit / Cr.

Chapter

3-23

SO 2 Define debits and credits and explain their

use in recording business transactions.

Revenue and Expense

Revenue

Debit / Dr.

Credit / Cr.

Normal Balance

Chapter

3-26

Expense

Debit / Dr.

Normal Balance

The purpose of earning

revenues is to benefit the

owner(s).

The effect of debits and

credits on revenue accounts is

the same as their effect on

Owner’s Capital.

Credit / Cr.

Expenses have the opposite

effect: expenses decrease

owner’s equity.

Chapter

3-27

Slide

2-15

SO 2 Define debits and credits and explain their

use in recording business transactions.

ASSETS

LIABILITIES

Debit to Increase

STOCKHOLDERS'

EQUITY

Revenue

Expense

Credit to Increase Credit to Increase

Credit to Increase

Debit to Increase

Cash

Notes Payable

Service Revenue

Salaries Expense

Accounts

Receivable

Accounts Payable Additional Paid in Capital

Sales Revenue

Advertising Expense

Prepaid Rent

Current Portion of

Long term debt

Consulting Fees

Earned

Utilities Expense

Common Stock

Preferred Stock

Unearned

Prepaid Insurance Revenue

Commissions Earned Rent Expense

Retained Earnings

Land

Building

Equipment

Slide

2-16

Long Term Debt

Ticket Sales

Supplies Expense

Interest Income

Travel Expense

Interest Expense

Debits and Credits Summary

Review Question

Accounts that normally have debit balances are:

a. assets, expenses, and revenues.

b. assets, expenses, and retained earnings.

c. assets, liabilities, and dividends declared.

d. assets, dividends declared, and expenses.

Slide

2-17

Solution

notes page

SO 2 Define debits and credits and explain their

use in recording business transactions.

Debits & Credits

This is called: DOUBLE ENTRY accounting

system.

For every transaction, there is at least one

debit and one credit or the accounting

equation won’t balance.

DEBITS must equal CREDITS

Slide

2-18

Summary of Debit/Credit Rules

Relationship among the assets, liabilities and

stockholders’ equity of a business:

The equation must be in balance after every transaction.

For every Debit there must be a Credit.

Slide

2-19

SO 2 Define debits and credits and explain their

use in recording business transactions.

Steps in the Recording Process

Illustration 2-13

Analyze each transaction

Enter transaction in a journal

Transfer journal information

to ledger accounts

Business documents, such as a sales

slip, a check, a bill, or a cash register

tape, provide evidence of the

transaction.

Slide

2-20

SO 3 Identify the basic steps in the recording process.

The Journal – see your coursepack journal

Book of original entry.

Transactions recorded in chronological order.

Contributions to the recording process:

1. Discloses the complete effects of a transaction.

2. Provides a chronological record of transactions.

3. Helps to prevent or locate errors because the debit

and credit amounts can be easily compared.

Slide

2-21

SO 4 Explain what a journal is and how it helps in the recording process.

Journalizing

Journalizing - Entering transaction data in the journal.

Illustration: On September 1, stockholders invested

$15,000 cash in exchange for shares of stock, and Softbyte

purchased computer equipment for $7,000 cash.

Illustration 2-14

General Journal

Date

Sept. 1

Account Title

Cash

Ref.

Debit

15,000

Common stock

Computer equipment

Cash

Slide

2-22

Solution on

notes page

Credit

15,000

7,000

7,000

SO 4

Journalizing

Simple and Compound Entries

Illustration: Assume that on July 1, Butler Company

purchases a delivery truck costing $14,000. It pays $8,000

cash now and agrees to pay the remaining $6,000 on account.

Illustration 2-15

General Journal

Date

Sept. 1

Slide

2-23

Solution on

notes page

Account Title

Delivery equipment

Ref.

Debit

Credit

14,000

Cash

8,000

Accounts payable

6,000

SO 4

The Ledger – see coursepack – T accts

A General Ledger contains the entire group of accounts

maintained by a company.

The General Ledger includes all the asset, liability,

stockholders’ equity, revenue and expense accounts.

Illustration 2-16

Slide

2-24

SO 5 Explain what a ledger is and how it helps in the recording process.

Standard Form of Account

T-account form used in accounting textbooks.

In practice, the account forms used in ledgers are

much more structured.

Illustration 2-17

Slide

2-25

SO 5 Explain what a ledger is and how it helps in the recording process.

Chart of Accounts

Accounts and account numbers arranged in sequence in

which they are presented in the financial statements.

Illustration 2-18

Slide

2-26

SO 5 Explain what a ledger is and how it helps in the recording process.

Posting

Posting – the

process of

transferring

amounts from

the journal to

the ledger

accounts.

Illustration 2-19

Slide

2-27

SO 6 Explain what posting is and how it helps in the recording process.

Coursepack - The Recording Process Illustrated

Follow these steps:

#1: On October 1, CR Byrd invests

$10,000 cash in an advertising

company to be known as Pioneer

Advertising Agency, Inc.

1. Determine what

type of account

is involved.

2. Determine what

items increased

or decreased

and by how

much.

#

DATE

Account Titles AND Description

Debit

1

10/1

Cash

10,000

3. Translate the

increases and

decreases into

debits and

credits.

Common Stock

Credit

10,000

To record owner’s investment.

Illustration 2-20

Slide

2-28

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#2: On October 1, Pioneer purchases office

equipment costing $5,000 by signing a 3-month,

12% note payable.

2

10/1

Office Equipment

Notes Payable

5,000

5,000

To record purchase of equipments, 3 month note, 12%

Slide

2-29

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#3: On October 2, Pioneer receives a $1,200

cash advance from R. Knox, a client, for

advertising services that are expected to be

completed by December 31.

3

10/2

Cash

Unearned Revenue

1,200

1,200

To record cash advance

Slide

2-30

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#4: On October 3, Pioneer pays $900 office

rent for October in cash.

4

10/3

Rent Expense

Cash

900

900

To record paying rent.

Slide

2-31

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#5: On October 3, Pioneer pays $600 for a oneyear insurance policy that will expire next year

on September 30.

5

10/4

Prepaid Insurance

Cash

600

600

To record purchase of one year insurance policy

Slide

2-32

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#6: On October 5, Pioneer purchases an

estimated 3-month supply of advertising

materials on account from Aero Supply for

$2,500.

6

10/5

Advertising Supplies

Accounts Payable

2,500

2,500

Purchased supplies on account.

Slide

2-33

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#7: On October 9, Pioneer hires four employees

to begin work on October 15. Each employee is

to receive a weekly salary of $500 for a 5-day

work week, payable every 2 weeks—first

payment made on October 26.

7

Slide

2-34

10/9

No entry

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#8: On October 20, Pioneer’s board of

directors declares and pays a $500 cash

dividend to stockholders.

8

10/20

Dividends

Cash

500

500

To pay dividend.

Slide

2-35

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#9: On October 26, Pioneer owes employee

salaries of $4,000 and pays them in cash.

9

10/26

Salaries Expense

Cash

4,000

4,000

Paid salaries to employees.

Slide

2-36

SO 6 Explain what posting is and how it helps in the recording process.

Use coursepack: The Recording Process Illustrated

Illustration 2-21

#10: On October 31, Pioneer receives $10,000

in cash from Copa Company for advertising

services provided in October.

10

10/31

Cash

Service Revenue

10,000

10,000

To record payment for advertising services.

Slide

2-37

SO 6 Explain what posting is and how it helps in the recording process.

Use Course pack -Next steps – T Accounts

Post to your T Accounts

Total your T Accounts – remember which

side to put the total

Slide

2-38

Assets, Expenses – Debit side

Liabilities, Stockholders’ Equity, Revenues –

Credit Side

Dividends – Debit Side

Use Coursepack - Next steps – Trial Balance

Slide

2-39

List Accounts and their balances

Posting

Review Question

Posting:

a. normally occurs before journalizing.

b. transfers ledger transaction data to the journal.

c. is an optional step in the recording process.

d. transfers journal entries to ledger accounts.

Solution on

notes page

Slide

2-40

SO 6 Explain what posting is and how it helps in the recording process.

The Trial Balance

Illustration 2-32

A list of accounts

and their

balances at a

given time.

Purpose is to

prove that debits

equal credits.

Slide

2-41

SO 7 Prepare a trial balance and explain its purposes.

The Trial Balance

Limitations of a Trial Balance

The trial balance may balance even when

1.

a transaction is not journalized,

2. a correct journal entry is not posted,

3. a journal entry is posted twice,

4. incorrect accounts are used in journalizing or

posting, or

5. offsetting errors are made in recording the amount

of a transaction.

Slide

2-42

SO 7 Prepare a trial balance and explain its purposes.

The Trial Balance

Review Question

A trial balance will not balance if:

a. a correct journal entry is posted twice.

b. the purchase of supplies on account is debited to

Supplies and credited to Cash.

c. a $100 cash drawing by the owner is debited to

Owner’s Drawing for $1,000 and credited to Cash

for $100.

d. a $450 payment on account is debited to Accounts

Payable for $45 and credited to Cash for $45.

Slide

2-43

Solution on

notes page

SO 7 Prepare a trial balance and explain its purposes.

Use coursepack: Statements

Income Statement

Retained Earnings

Balance Sheet

DO IT!

Slide

2-44

End of Chapter 2

Slide

2-45

The Trial Balance

The accounts

come from the

ledger of

Christel

Corporation at

December 31,

2011.

Slide

2-46

Solution on

notes page

SO 7

Your Personal Annual Report

David Edmondson, the president and CEO of well-known

electronics retailer Radio Shack, overstated his

accomplishments by claiming that he had earned a bachelor’s

of science degree, when in fact he had not. Apparently his

employer had not done a background check to ensure the

accuracy of his résumé.

A chief financial officer of Veritas Software lied about having

an M.B.A. from Stanford University.

Slide

2-47

A former president of the U.S. Olympic Committee lied

about having a Ph.D. from Arizona State University. When

the truth was discovered, she resigned.

The University of Notre Dame discovered that its football

coach, George O’Leary, lied about his education and football

history. He was forced to resign after only five days.

Slide

2-48

A survey by Automatic Data Processing reported that 40% of

applicants misrepresented their education or employment

history.

A survey by the

Society for Human

Resource Management

of human resource

professionals

reported the following

responses to the

following question.

Slide

2-49

Using Radio Shack as an example, what should the company have

done when it learned of the falsehoods on Mr. Edmondson’s

résumé? Should Radio Shack have fired him?

NO: Mr. Edmondson had been a Radio Shack employee for 11 years.

He had served the company in a wide variety of positions, and had

earned the position of CEO through exceptional performance. While

the fact that he lied 11 years earlier on his résumé was unfortunate,

his service since then made this past transgression irrelevant. In

addition, the company was in the midst of a massive restructuring,

which included closing 700 of its 7,000 stores. It could not afford

additional upheaval at this time.

YES: Radio Shack is a publicly traded company. Investors,

creditors, employees, and others doing business with the company

will not trust it if its leader is known to have poor integrity. The

Slide “tone at the top” is vital to creating an ethical organization.

2-50

Copyright

Copyright © 2010 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

in Section 117 of the 1976 United States Copyright Act without

the express written permission of the copyright owner is

unlawful. Request for further information should be addressed

to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.

Slide

2-51

Summary of Debit/Credit Rules

Kathy Browne, president of Hair It Is, Inc., has

just rented space in a shopping mall in which she

will open and operate a beauty salon. A friend has advised Kathy to

set up a double-entry set of accounting records in which to record

all of her business transactions. Following are the balance sheet

accounts that Hair It Is, Inc., will likely need to record the

transactions. Indicate whether the normal balance of each account

is a debit or a credit.

Slide

2-52

Cash

Debit

Equipment

Debit

Supplies

Debit

Accounts payable

Credit

Notes payable

Credit

Common stock

Credit

Solution on

notes page

SO 2 Define debits and credits and explain their

use in recording business transactions.

Slide

2-53

SO 5 Explain what a ledger is and how it helps in the recording process.

The Recording Process Illustrated

Kate Turner recorded the following transactions

in a general journal during the month of March.

Post these entries to the Cash account.

Slide

2-54

Solution on

notes page

SO 6

Slide

2-55

SO 7 Prepare a trial balance and explain its purposes.