Document

advertisement

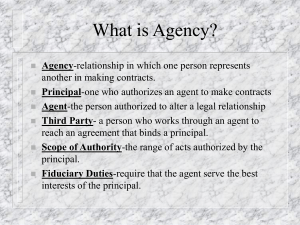

Chapter 17 Employment Relationships Chapter Objectives 1. Distinguish between employees and independent contractors. 2. Outline the ways in which an agency relationship can arise. 3. Specify the duties that agents and principals owe to each other and describe the liability of the principal and the agent with respect to third parties. 4. Describe the major laws relating to health and safety in the workplace. 5. Summarize the laws governing the rights of employees with respect to pension plans, family and medical leave, and privacy. 2 Agency Relationships In a principal-agent relationship, an agent acts on behalf of and instead of the principal, using a certain degree of his or her own discretion. An employee who deals with third parties is normally an agent. 3 Independent Contractors An independent contractor is not an employee, and the employer has no control over the details of physical performance. The independent contractor is not usually an agent. 4 Case 17.1 Graham v. James Richard Graham marketed CD-ROM disks containing compilations of shareware, freeware, and public domain software. Larry James agreed to create a program for him in exchange for credit on the final product. James built into the program a notice attributing authorship and copyright to himself. Graham removed the notice, claiming that the program was a work for hire and the copyright was his. James sold the program to another CD-ROM publisher. Graham filed a suit against James, alleging copyright infringement. The court ruled in favor of James. What are some other advantages of being an independent contractor? What might be some disadvantages? 5 Agency Formation There are four ways in which an agency relationship can arise: By Agreement By Ratification By Estoppel By Operation of Law 6 Agency by Agreement Through express consent (oral or written) or implied by conduct. 7 Agency by Ratification The principal, either by act or agreement, ratifies the conduct of an agent who acted outside the scope of authority or the conduct of a person who is in fact not an agent. 8 Agency by Estoppel When the principal causes a third person to believe that another person is his or her agent, and the third person deals with the supposed agent, the principal is “estopped to deny” the agency relationship. 9 Agency by Operation of Law Based on a social duty (such as the need to support family members) or created in emergency situations when the agent is unable to contact the principal. 10 Case 17.2 Williams v. Inverness Corp. Inverness manufactured an ear-piercing system which they claimed was “The Only Completely Safe, Sterile Ear Piercing Method.” Barrera bought the system, took a course, and set up shop. When Williams, a customer, had her ear pierced, which then became infected and led to complications, her mother filed suit against Inverness claiming, in part, that Inverness was liable on a theory of agency by estoppel. What are the policy reasons for holding a firm liable on a theory of agency by estoppel? 11 Duties of Agents and Principals Once the principal-agent relationship has been created, both parties have duties that govern their conduct. 12 Agent’s Duties to the Principal Performance - The agent must use reasonable diligence and skill in performing his or her duties. Notification - The agent is required to notify the principal of all matters that come to his or her attention concerning the subject matter of the agency. Loyalty - The agent has a duty to act solely for the benefit of his or her principal and not in the interest of the agent or a third party. Obedience - The agent must follow all lawful and clearly stated instructions of the principal. Accounting - The agent has a duty to make available to the principal records of all property and money received and paid out on behalf of the principal.. 13 The Duty of Loyalty The duty of loyalty to one’s employer/ principal is fundamentally an ethical duty that has been written into law. What about when the ethical duty of loyalty conflicts with another duty? Agency law does not impose on the principal a duty of loyalty to the agent. Why is this? What would result if the law did not impose a duty of loyalty on agents? 14 Principal’s Duties to the Agent Compensation - Except in a gratuitous agency relationship, the principal must pay the agreed-on value for an agent’s services. Reimbursement and indemnification - This principal must reimburse the agent for all sums of money disbursed at the request of the principal and for all sums of money the agent disburses for necessary expenses in the course of reasonable performance of his or her agency duties. Cooperation - A principal must cooperate with and assist an agent in performing his or her duties. Safe working conditions - A principal must provide safe working conditions for the agent-employee. 15 Liability for Agent’s Torts Under the doctrine of respondeat superior, the principal is liable for any harm caused to another through the agent’s torts if the agent was acting within the scope of his or her employment at the time the harmful act occurred. The principal is also liable for an agent’s misrepresentation, whether made knowingly or by mistake. 16 The Doctrine of Respondeat Superior A master (employer) must respond to third persons for losses negligently caused by the master’s servant (employee). The vicarious liability of the master for acts of the servant has been supported by theories of control and fault. How does the doctrine of respondeat superior relate to the doctrine of strict product liability? 17 Liability for Independent Contractor’s Torts A principal is not liable for harm caused by an independent contractor’s negligence unless hazardous activities are involved (in which situation the principal is strictly liable for any resulting harm). 18 Wage-Hour Laws Davis-Bacon Act (1931) Requires the payment of “prevailing wages” to employees of contractors and subcontractors working on government construction projects. Walsh-Healey Act (1936) Requires that a minimum wage and overtime pay be paid to employees of firms that contract with federal agencies. Fair Labor Standards Act (1938) Extended wage-hour requirements to cover all employers whose activities affect interstate commerce. The act has specific requirements in regard to child labor, maximum hours, and minimum wages. 19 Torts by Independent Contractors As a general rule, an employer is not liable for the torts committed by the independent contractor. This rule is riddled with many exceptions, and these exceptions come in many forms. Have the exceptions become the rule? What policy interest is furthered by imposing liability on employers for the torts of their independent contractors? 20 Worker Health and Safety The Occupational Safety and Health Act of 1970 requires employers to meet specific safety and health standards that are established and enforced by the Occupational Safety and Health Administration (OSHA). State workers’ compensation laws establish an administrative procedure for compensating workers who are injured in accidents that occur on the job, regardless of fault. 21 Case 17.3 Valdak Corp. v. OSHA The Valdak Corp. operates a car wash that uses an industrial dryer to spin-dry towels. The lock that was supposed to keep it closed during spinning usually did not work. An employee’s arm was cut off as a result. OSHA cited Valdak for a willful violation of a machine-guarding regulation and assessed a penalty. For what policy reasons might an employer set up a formal safety program or issue a written safety manual? 22 Income Security Federal and state governments participate in insurance programs designed to protect employees and their families by covering the financial impact of retirement, disability, death, hospitalization, and unemployment. 23 Social Security and Medicare The Social Security Act of 1935 provides for old age, survivors, and disability insurance. Both employers and employees must make contributions under the Federal Insurance Contributions Act (FICA) to help pay for the employees’ loss of income on retirement. The Social Security Administration administers Medicare, a health-insurance program for older or disabled persons. 24 Private Pension Plans The federal Employee Retirement Income Security Act (ERISA) of 1974 establishes standards for the management of employerprovided pension plans. 25 Unemployment Insurance The Federal Unemployment Tax Act of 1935 created a system that provides unemployment compensation to eligible individuals. Covered employers are taxed to help cover the costs of unemployment compensation. 26 COBRA The Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 requires employers to give employees, on termination of employment, the option of continuing their medical, optical, or dental insurance coverage for a certain period. 27 Family and Medical Leave Act The Family and Medical Leave Act (FMLA) of 1993 requires employers with fifty or more employees to provide their employees (except for key employees) with up to twelve weeks of unpaid family or medical leave during any twelve-month period. 28 For Review 1. How do agency relationships arise? What duties does the agent owe to the principal? What duties does the principal owe to the agent? 2. What criteria are generally used in determining whether a worker is an employee or an independent contractor? 3. In what circumstances will principals not be liable to third parties under contracts formed by an agent? Is the principal liable for an agent’s torts? 4. What federal statute governs wages and worker health and safety in the workplace? What is the purpose of workers’ compensation laws? 5. How does the government provide for workers’ income security? What are some issues relating to employees’ privacy rights? 29