Online Revenue

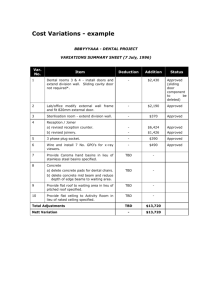

advertisement

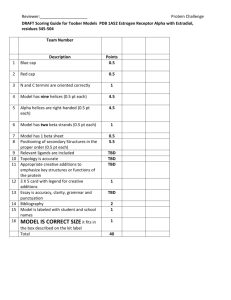

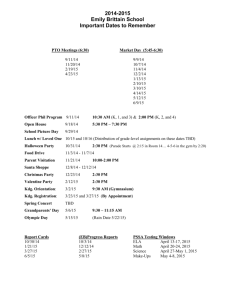

2015 BUP V1 planning... 2015 Planning 1st Draft Presentations October 9th, 2014 2015 BUPV1 Overview Planning Sheet Steve Johnson 2015 Planning Bottoms Up V1 2015 Planning Bottoms Up V1 Objectives What it IS ● Alignment on vision, mission, strategy ● Each BU outlines strategies, vision, mission, KPI’s, business as usual, additional plans, revenue and dependencies ● Summary draft of BUP revenue targets for all groups ● Time to assess if we can hire the needed team in time ● Stop/Start - what is going to be different? What it ISN’T ● Debate the strategies, ideas, numbers ● Time to work on your plan, work on other projects, email… ● Final numbers or approved. BUPV2 then Finance TDP, then exec, then board approval before this is locked down ● P&L 2015 Planning Process Bottoms up Planning Kick off Sept 16 Draft 1 GTM Preso Oct 9 Final GTM Preso Oct 28 Top Down Planning Kick off Sept 21 Draft 1 Top Down Nov 1 Merge of the Top/Bottom Plans Final Exec sign-off Nov 10 Final to the board by Nov 21 2015 Level Setting Planning Sheet Steve Johnson Copyright © 2010 Constant Contact, Inc. VISION - GTM To empower social businesses globally 90% Growth GOAL - All Revenue..Not Final! ● Revenue: $135M ARR, GAAP $100M, MRR $6M ● User: 13M Basic, 137 Pro, 4000 Enterprise, 900k WAU ● Corporate KPI’s: ARR $135M, NPS 50, Employee Attrition less than 50% Hootsuite’s Framework Vision/Mission 5-10 years V: Revolutionize communication via social M: We empower customers to transform messages into meaningful relationships Corporate Strategy 3- Where we will play: With individual social media power users, small businesses, across all departments, companies and org’s both small and large How we will win: By having these companies and org’s be wildly successful with HootSuite Core values: Lead with humility, Respect the individual, Passion in all we do, find a better way 5 years Financial Goals: 3- $2 Billion+ valuation and $250m+ Annual Revenue 5 years Strategic Themes: 3-5 years Corporate Objectives: 2-3 years Key Initiatives for Growth (big bets): 12-18 months Annual Budget: Every 12 months 1) Build the next generation of social apps 2) Own the social brand that appeals to all segments globally 3) Establish HootSuite as a platform for the enterprise & empower the social business Financial: To become a top 3 provider in the Ent. market & extend top SMB offering within 18 months Operational: Accelerate product innovation to eliminate functionality gaps Big bets: LATAM, Social Advertising, Customer Experience • Operating plans: Key metrics for acquisition, engagement, conversion, retention, COA, ARPU, NPS, WAU, revenue growth, market share, Av seat size, # of departments using Bottoms up by department Top down modeled Merging both plans Hootsuite’s GTM Revenue Structure Online Revenue Enterprise Revenue Traci Mercer - VP Global Online Revenue Darren Suomi, Global VP, Enterprise Revenue Sr Dir NA DIR EMEA Dir APAC Dir LATAM GM NA GM EMEA GM APAC GM LATAM GM** Analy New Product Growth* New Product Growth* - Campaign, Advertising, Advocacy etc. Greg Gunn - Campaign, Advertising, Advocacy etc. Greg Gunn ED* Corporate Foundation: Product, Engineering, Partners, Marketing, Alliances, Support, Community, Customer Success, BD, Platform Partners, Revenue Operations, Website *Growth – Sub $1M products **Post Growth - $1m-$5m products 2015 GTM Vision & Strategy Hootsuite Vision & Mission GTM Vision I n n o v a t i o n Target Markets / Segments One Voice…. Focused on communicating and delivering the customer value… FOCUSED on FIVE GROWTH Levers…. Acquisition Conversion Retention Engagement ARPU Through 9 Channels Online Revenue Enterprise Revenue Partner Revenue BD/Platform Revenue Customer Success Support Campaigns Revenue Social Ads Revenue Enabled by Insights, Strategy, PR, Marketing, Great Talent Analytics Revenue E x p e r i m e n t a t i o n 2015 GTM Vision, Strategy & Goals GTM Vision: To empower social businesses globally 2015 USER GOALS: 13M Basic, 197K Pro, 3000 Enterprise, 900k WAU 2015 REVENUE GOALS: ARR $135M, MRR $11M, GAAP Revenue $100M 2015 CORPORATE KPI’s: ARR $135M, NPS 50, Employee Attrition less than 15% Optimize Coverage Model. Focus on Intl., Size, Geo. Targeted Mkt Who We Serve Customer Benefits Optimize Conversion. Convert to the next level (Visitors-Free-Pro-Ent ) Strategic Partnerships to leverage reach Delight Customers..thru Education, Support, CSM teams ↑ LTV, ↑ARPU Individuals, Influencers, Consultants (Free Product) SMB’s, Sm Agencies, Brands, Consultants (Pro Product) Business Units, Lg Agencies, Enterprise Brands (Enterprise Product) Powerful entry level for social media users (manage multiple SN users in one place) Advanced SM Tools (Unltd SN, Team collaboration, Reporting, Advanced Sched) Unified Collaboration, Analytics, Unlimited Social Networks, Security & Governance 2015 Big Bets Planning Sheet Steve Johnson 2015 Strategic Themes ** updated/changed December #1 Customer Experience #2 Social Ads #3 LATAM 2015 Plan Components (8 Items) 1) Vision, Goals & Strategies for your business unit 2) Business As Usual - baseline target revenue goals by quarter with dependencies 3) Business As Usual - key action plans/activities 4) Proposed Organizational structure 5) Key Performance Indicators (KPI's) 6) Geographical/Market Plan 7) New Initiatives 8) Summary of all of the above items ** Costs to be added later by finance team Copyright © 2010 Constant Contact, Inc. Online Revenue Planning Sheet CRAIG RYOMOTO VISION - Online Revenue To be the global leader in social media management for small businesses and professionals GOALS - Online Revenue ● ● ● ● ● 14M Free Users 200K Pro Customers $3.1M MRR by Dec $37.5M in ARR (+42% YoY growth) $40M in ARR (+ 52% YoY growth) STRATEGIES Summary - Online Revenue 1. Expand global customer acquisitions through paid & organic channels 2. Continuous optimization of conversion paths (web, mobile, email, indashboard) 3. Enrich user experience, product knowledge & improve engagement rates 4. Diversify and improve monetization channels & upsells 5. Optimize for globalization/localization 6. Leverage insights to drive customer & revenue growth opportunities REVENUE GOALS - Online Revenue EST Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015 ARR NA $3,890,000 $4,210,000 $4,590,000 $5,000,000 $5,370,000 $21,910,000 EMEA $1,660,000 $1,790,000 $1,990,000 $2,220,000 $2,410,000 $9,930,000 APAC $450,000 $510,000 $570,000 $650,000 $710,000 $2,940,000 LATAM $390,000 $450,000 $520,000 $610,000 $670,000 $2,770,000 TOTAL $6,350,000 $6,960,000 $7,670,000 $8,480,000 $9,160,000 $37,550,000 +9.58% Q/Q +10.27% Q/Q +10.41% Q/Q +8.17% Q/Q +42.69% DEPENDENCIES - Online Revenue Marketing: ● ● Pro/SMB Marketing manager in region o localization of personas, positioning, content, resources Blog to support regional content Product: ● ● ● Receiving accurate usage event triggers for targeted and timely nurtures Improving onboarding & billing process (including Sendgrid emails) Capturing demographic profiles of new and active users Finance ● ● $750K/month PUA budget Approved headcount FACTS - Online Revenue 1. Brand search declining in core countries (CA, US, UK, AU) 5. Under resourced in Marketing for EMEA & APAC 2. Low brand awareness outside core countries 6. Users need help getting started / on-boarded 3. Gaps in international Online Revenue leadership 7. Lots of billing confusion, leading to abandons & refunds 4. Email upgrade campaigns have been extremely successful 8. Mobile is an untapped opportunity THEMES - Online Revenue 1. REGIONALIZATION 2. DEMAND CREATION 3. ONBOARDING ORG STRUCTURE - Online Revenue VP Dir NA (50) Current: 30 Dir EMEA (18) 7 Dir APAC (11) 5 Dir LATAM (0) HSU BD ? REGIONAL STRUCTURE - Online Revenue Dir NA (Craig) 50 Dir EMEA 18 Dir APAC Dir 11 CUSTOMER ACQUISITION CUSTOMER ACQUISITION CUSTOMER ACQUISITION CONVERSION OPTIMIZATION CONVERSION OPTIMIZATION CONVERSION OPTIMIZATION COACHING COACHING COACHING MONETIZATION TBD TBD DATA & ANALYTICS DATA & ANALYTICS DATA & ANALYTICS LATAM INCUBATED IN NORTH AMERICA FUNCTIONAL STRUCTURE - Online Revenue Vancouver Example: Global KPI’s - Online Revenue Q1 2015 Q2 2015 Q3 2015 Q4 2015 1,375,000 1,572,000 1,568,000 1,547,000 V:F 17.04% 16.97% 16.63% 16.88% New Monthly Free Signups 234,000 267,000 261,000 261,000 V:T 1.03% 1.03% 1.02% 1.02% Monthly New Trials 14,100 16,200 15,983 15,783 69.07% 69.75% 70.29% 70.14% 9,300 10,800 11,300 11,700 4.13% 4.13% 4.22% 4.23% 6,500 6,900 7,600 8,000 $14.27 $14.77 $15.24 $15.60 11,290,000 12,070,000 12,830,000 13,590,000 163,000 175,000 186,000 197,000 Acquisition New Monthly Visitors Conversion T:P Monthly New Pro Customers Retention Churn Monthly Lost Pro Users Monetization Pro ARPU User Growth Total Free Users Total Pro Users NEW INITIATIVES - Online Revenue 1. Restructuring operating model to regional ownership 2. Activating demand creation initiatives (Youtube, radio ads, RTB) 3. Localizing email nurtures and conversion (AB test) optimizations in region 4. Elevating our web analytics insights (Google Analytics Premium, Adometry) 5. Resourcing to increase user engagement o more active users = bigger pool to upgrade = bigger pool to upsell 6. Introducing Paid Coaching services 7. Testing Pro sales coaches NEW INITIATIVES - Online Revenue ***PRODUCT DEPENDENT*** 1. Activating mobile customer acquisition campaigns o mobile upgrade flow needs to be resolved to be cost effective 2. Building gated 60 day free trial workflow for targeted campaigns o remove coupon flow; significant & proven revenue lift 3. Testing (and implementing) no credit card free trials o potential MASSIVE upside 4. Launching 2 year plans (so monthly, annual, 2 year plans) o reduce churn and increase cash collections 5. Introducing new currencies & expand payment options KEYS TO SUCCESS - Online Revenue 1. Dedicated regional OR focus, leader and structure 5. Building regional brand awareness 2. Hiring local/regional SMB/Pro marketing individual 6. Accessing more and timely data 3. Dedicating resources to improve onboarding (emails and product) and billing flow 7. Continuously testing, optimizing, and operationalizing 4. Mobile growth & monetization strategy 8. And….. COMPANY-WIDE TEAMWORK! EMEA Enterprise Planning Sheet JOE SMITH VISION - EMEA The most widely adopted social media enterprise software solution in EMEA GOALS - EMEA ● Acquisition ○ $17 M Net New Bookings ○ 600 + Net New Clients Adds ● Retention ○ $ 6.5 M Renewals @ 85% Renewal Rate ○ Exit 2015 with 1000 + Enterprise Clients ● Monetisation ○ $ 2 Million Upsell ○ Multi Product Adoption STRATEGIES Summary - EMEA ● Geo Strategy o Launch German and France Office to drive faster market penetration @ Strat / LAE ● Build Core SME Sales Organisation in London ● Focus on Finance and Regulated industry ● Expand Channel for better coverage outside core territories ● Deploy Upsell program / focus to drive ARPA and Multi Product Adoption REVENUE GOALS - EMEA Projected DIRECT Bookings By Quarter Q1 Q2 Q3 Q4 Totals CORP EMEA New/Upsell $2,120,000 $3,180,000 $3,282,500 $4,300,000 $12,882,500 STRAT EMEA New/Upsell $585,000 $1,500,000 $1,335,000 $2,875,000 $6,295,000 TOTAL NEW $2,705,000 $4,680,000 $4,617,500 $7,175,000 $19,177,500 Renewals $1,317,520 $1,277,874 $1,395,977 $2,993,785 $6,985,156 $0 Other DIRECT Revenue $4,022,520 $5,957,874 $6,013,477 $10,168,785 $26,162,656 Projected DIRECT MRR $917,661 $1,307,641 $1,692,414 $2,290,290 $2,290,290 Projected ATTRIBUTED Bookings By Quarter Q1 Q2 Q3 Q4 Totals ANALYTICS $216,400 $374,400 $369,400 $574,000 $1,534,200 CAMPAIGNS $108,200 $187,200 $184,700 $287,000 $767,100 ASMS $0 $0 $0 $0 $0 CUSTOM EDUCATION $0 $0 $0 $0 $0 Other $135,250 $234,000 $230,875 $358,750 $958,875 ATTRIBUTED Revenue $459,850 $795,600 $784,975 $1,219,750 $3,260,175 Dependencies - EMEA ● Sales Capacity ○ Hiring AEs on time ○ Onboarding ● Onboarding for new staff (45 staff increase Q4 to Q1FY15) ○ EDR ○ Pre Sales ○ Sales ● Operational Management ○ new mgt team to onboard ● Office Space ○ London Expansion ○ Paris Office ○ DACH Office ● Top of the Funnel Activity to drive leads for 39 AEs ● Get LAE / Strat ready ○ Customer Success ○ Professional Services ● Channel Enablement / Effectiveness ● Field Marketing local to Revenue ORG STRUCTURE - EMEA KPI’s - EMEA / by Region ● ● Bookings KPIs ○ Bookings by Q ○ Average Deal Size ○ Average Contract Length ○ ARPA for new Clients ○ ARPA across Install Base Churn KPIs ○ Total # of Customers ○ # New Customers ○ # Churned Customers ○ # Net New Customers ○ % churn as revenue ○ Net Promoter Score ● ARR KPIs ○ New ARR ○ Churned ARR ○ Upsell ARR ○ Net New ARR ● Funnel Metrics ○ MQL / SQL / Opp ○ Opp to Close ● Sales Metrics (by month) ○ # FTE Account Execs ○ Quota per AE ○ Productivity by AE NEW INITIATIVES - EMEA ● CSM focus on Retention, Commercial Renewal team & Upsell Focus ● Expand Channel more aggressively APAC Enterprise Planning Sheet KEN MANDEL CONTEXTUAL INTELLIGENCE CONTEXTUAL INTELLIGENCE VISION - APAC The most Asian centric & widely adopted social media enterprise software solution in Asia Pacific or...Sell More Shit* GOALS - APAC ● Build high performing sales org with increased productivity & increased deal sizes ● Double Enterprise Revenues to USD 4.2M+ ● Launch Channel Partnerships Program and build strong partner revenue pipeline ● Increase awareness of Hootsuite in key APAC markets (ANZ, ASEAN, N. Asia) to drive monetization STRATEGIES Summary - APAC ● Increase multi-product sales by creating APAC relevant/priced bundles increasing avg deal size ● Open Satellite Office in Australia by Q2 to increase monetization from ANZ market ● Establish & launch Regional GAPP & Boutique Agency program driving incremental revenues from this key APAC influencer channel ● Hire local remote Channel Account Managers to expand coverage & revs in N. Asia, IN & ID and increase coverage in ANZ ● Increase EDR & Sales Productivity via in-market training REVENUE GOALS - SUMMARY ● Acquisition ○ $3M Net New Bookings + Upsell ○ 225 + Net New Clients Adds ● Retention ○ $ 1.3 M Renewals @ 80% Renewal Rate ○ Exit 2015 with 325+ Enterprise Clients ● Monetisation ○ 20% Upsell ○ ARPA Increase of 50% REVENUE GOALS - APAC Insert high-level quarterly revenue goals & List main dependencies ORG STRUCTURE - APAC Insert high-level Org structure as planned for 2015 KPI’s - APAC Insert high-level KPI summary for your business unit Key Dependencies - APAC 1. Time to Fill o o o APAC Hiring Dead Zone Mid Nov - March also known as the CNY effect Talent HC added ASAP to clear Q4 backlog HC Approval by end October (sooner for some key roles) 2. Sales & EDR Training o Need approval to hire dedicated Sales Trainer ASAP #hard-to-find 3. SalesOp / BI o Improve utilization & productivity of sales org through detailed reporting & analysis 4. Local Marketing o o Driving Marketing ROI from HQ 2 way knowledge bridge “HQ to Region & Region to HQ” 5. Space to Grow & Build Culture NEW INITIATIVES - APAC Q4 2015 Insert list of potential new initiatives OUTSIDE your business-as-usual plan NA Enterprise Planning Sheet DARREN SUOMI VISION - NA Enterprise The most widely adopted social media enterprise software solution in NA GOALS - NA Enterprise ● 100% increase in Enterprise ARR ● Seed, Harvest, Lock - Increase Upsell Revenue 200% YOY ● Exit 2015 with 2000 Active clients ● 225 new SME clients STRATEGIES Summary - NA Enterprise ● Expand vertical focus in Corp ● New focus in lower SME segment (sub 100M) ● Leverage & replicate success in FINSERV to: ○ Insurance > Wealth Management, Retail Banking ● Expand US/Canada Gov’t Business coverage ● Expand Tech B2B Customer Base ● Double up the Strategic sales team to allow focus REVENUE GOALS - NA Enterprise ORG STRUCTURE - NA Enterprise KPI’s - Enterprise (NA) ● Acquisition KPIs ○ ○ ○ ○ ○ ● ● ○ New ARR ○ Upsell ARR ARPA for new Clients ARPA across Install Base Bookings by Product Average Deal Size # of Net New Customers Total # of Customers New Pipeline created ● Conversion ○ MQL / SQL / Opp ○ Opp to Close ● Other Retention ○ ○ ○ # Churned Customers % churn as revenue Net Promoter Score APRA/ARR KPIs ○ ○ Employee NPS Employee turnover NEW INITIATIVES - NA Enterprise ● ● ● ● ● Add focus on 5 additional Corp verticals Create new tier of AEs focused on <$100M accounts Focused Canadian Gov’t AE in Ottawa Tech B2B Social Selling Offering Inside sales reps to support Strat AEs (1-2 Ratio) Insert list of potential new initiatives OUTSIDE your business-as-usual plan Key Dependencies ● ● ● ● Clean data Support on building territories Recruiting Product enhancements: customer service, content library, automation, limited-use seats, etc. LATAM Enterprise Planning Sheet DARREN SUOMI VISION - LATAM Enterprise The most widely adopted social media enterprise software solution in LATAM GOALS - LATAM Enterprise ● Launch office in Brazil ● Grow revenue by 100+% ● Recruit 5-10 key Partners in Region STRATEGIES Summary - LATAM Enterprise ● Dedicated resources in region with office (Brazil) ● Sales resource in region (Mexico) ● Deploy Partners in Key Markets REVENUE GOALS - LATAM Enterprise ORG STRUCTURE - LATAM Enterprise KPI’s - Enterprise (LATAM) ● Acquisition KPIs ○ ○ ○ ○ ○ ● ● ○ New ARR ○ Upsell ARR ARPA for new Clients ARPA across Install Base Bookings by Product Average Deal Size # of Net New Customers Total # of Customers New Pipeline created ● Conversion ○ MQL / SQL / Opp ○ Opp to Close ● Other Retention ○ ○ ○ # Churned Customers % churn as revenue Net Promoter Score APRA/ARR KPIs ○ ○ Employee NPS Employee turnover NEW INITIATIVES - LATAM Enterprise ● Launch Office ● Partner Recruitment Insert list of potential new initiatives OUTSIDE your business-as-usual plan Global Enterprise Planning Sheet DARREN SUOMI VISION - Enterprise (Global) The most widely adopted social media enterprise software solution Globally GOALS - Enterprise (Global) ● ● ● ● ● Grow Enterprise Revenues 90% YOY Grow Upsell Revenue by 200% YOY Exit 2015 with 4,000 Active Ent clients Close first 8 figure deal 90% renewal rate with Tier 1-3 clients STRATEGIES Summary - Enterprise (Global) ● ● ● ● ● ● Vertical focused selling Deploy Upsell program to top 300 clients Launch LATAM Office Regional Field marketing resources Expand Partner Network to implement Operational Excellence (Account/Opp Plan) STRATEGIES Summary - BD Enterprise ● Continue to train and educate our team on the value of the ecosystem and how to position it. ● Develop co-marketing strategies with partners to drive revenue. ● Leverage our partners to increase reach globally (partners, resellers, SIs) ● Integrate with Partners to increase capabilities and reach. ● Develop a set of APIs that enable the platform to become extensible. ● Continue development and expansion of existing implementations. REVENUE GOALS - Enterprise (Global) ORG STRUCTURE - Enterprise (Global) KPI’s - Enterprise (Global) ● Acquisition KPIs ○ ○ ○ ○ ○ ● ● ○ New ARR ○ Upsell ARR ARPA for new Clients ARPA across Install Base Bookings by Product Average Deal Size # of Net New Customers Total # of Customers New Pipeline created ● Conversion ○ MQL / SQL / Opp ○ Opp to Close ● Other Retention ○ ○ ○ # Churned Customers % churn as revenue Net Promoter Score APRA/ARR KPIs ○ ○ Employee NPS Employee turnover NEW INITIATIVES - Enterprise (Global) ● Inside Sales with Strategic Accounts ● Expansion Offices (LATAM, Dach, France) ● Leveraging Channel more Key Dependencies ● Ability to hire and train new staff in timely manner ● Data Access ○ Insight into customer usage ● Product enhancements: customer service, content library, automation, limited-use seats, etc. API’s ● Key role hiring (GM’s, Field Marketing) Hootsuite Analytics Planning Sheet MARK PASCARELLA VISION - HS Analytics - 3E BBD Empower the entire enterprise to make better business decisions using social insights. GOALS - HS Analytics ● ● ● ● ● Grow Analytics Revenue +90% to $10.5M Grow Direct Revenue + 40% to $3.5M Grow Direct MRR +92% to $377 / $4.5ARR Expand Avg. New Deal Size +50% to $20K 75% renewal rate with current customers STRATEGIES Summary - HS Analytics ● We become a single brand, fast. ○ Simplicity. ○ Speed, Clarity, Ease of Use. ● Fire up and trickle down. We power Enterprise to win w Analytics in every deal and every renewal. ● We grow 1st in North America. REVENUE GOALS - HS Analytics Direct New: Q1 2015 Q2 $357 $750 $500 Direct Renewals: Q1 Q2 2015 $357 $219 $143 ENT Attributed: Q1 Q2 $900 $281 Q3 Q4 $2.5M +260% Y/Y Q3 Q4 $1M Q3 Total Total -36% Y/Y Q4 Total ORG STRUCTURE - HS Analytics KPI’s - HS Analytics ● New Customer Acquisition ○ 125 new customers ○ AOV $20K ● 30% ENT attach rate ● 5% ENT “Renew w uberVU” ● 2 six-figure deals ● 2 new “Info” deals ● $377 MRR NEW INITIATIVES - HS Analytics ● Affinity Index ● We sell subscriptions to insights & information. We sell Boards & Reports. ● Renew with uberVU ● Vertical alignment Marketing Planning Sheet DeeAnna McPherson VISION - Marketing Position Hootsuite to be the category and thought leaders in our markets GOALS - Marketing ● Drive qualified leads through the pipeline ● Raise awareness and credibility of Hootsuite in the markets we serve ● Build customer advocacy ● Operate effectively as a global team ● Increase free users by XX% STRATEGIES Summary - Marketing ● Deepen customer relationships and put customers at the center of marketing efforts ● Leverage data + the freemium pipeline to drive revenue ● Empower the sales organization for efficient outbound marketing and account expansion ● Shift resources into the regions NEW INITIATIVES - Marketing ● LatAm marketing ● User conference in early 2016 with planning and expenses in 2015 Insert list of potential new initiatives OUTSIDE your business-as-usual plan Customer Success Planning Sheet ROGER ORDE VISION - Customer Success Be our customers trusted advisors as we revolutionize communications via Social GOALS - Customer Success ● Lead customers to a social strategy that ensures they meet or exceed their Social Enterprise goals … Launch, Success, Education/training ● Automation to increase user adoption, retention, control ● Increase client TLV ● Become the ‘trusted advisor’ to our clients STRATEGIES Summary - Customer Success ● 2015 is about getting the fundamentals right - standardize and gain operational efficiency globally - automate, best practices, methodology ● Segment and prioritize client base (global) ● Go deep with clients - on-sites, training ● Educate - Training Packages ● ProServ - Services Packages REVENUE GOALS - Customer Success Customer Success: Q1 Q2 Total 2015 $5M $5.1M Professional Services: Q1 Q2 Total 2015 $952k $1.5M $1.5M Q3 $5M Q4 $11M Q3 $1.9M $26.8M Q4 $5.7M (Allocated) Training: Q1 Q2 Q3 Q4 Total 2015 Insert high-level quarterly revenue goals & List main dependencies $42k $50k $61k $72k $225k (Average 20% QTQ Growth) ORG STRUCTURE - Customer Success KPI’s - Customer Success Acquisition: Add reference clients in all tiers Conversion: Trial conversion increase + agency and partner program conversions Retention: Customer churn reduction - all tiers ARPA - Renewal Rates, Education / training, Upsell #’s Insert high-level KPI summary for your business unit KPI’s - Customer Success Other: QBR’s (Tiers 2,3,4) - Client visits (tiers 2 and 3), QBR/Client visits (CSE’s and tier 1) Insert high-level KPI summary for your business unit NEW INITIATIVES - Customer Success ● Automation tools - Gainsight, BI, Tableau Insert list of potential new initiatives OUTSIDE your business-as-usual plan Partners Planning Sheet KEVIN O’BRIEN VISION - Partners Empower Social Business Transformation Globally GOALS - Partners ● ● ● ● ● 150% ARR Growth with Partners Activate 300 New Partners into Program Globally Achieve $1MM Partner (ARR) Sign Agency Holding Company Partnership Launch Certified Partner Services Program/Directory STRATEGIES Summary - Partners ● Continued Top down/Bottoms Up Gapp Progam ● Empowered global solution partner channel to deliver regional onboarding and training (EMEA, APAC) ● Boutique Agency as a Channel for Social Business ● Accelerate Online Revenue with ISV Partners via Bundle programs. ● Programmatize/ Scale for Reseller Networks (IBM, MSFT, WSI) STRATEGIES Summary - Hootsuite Platform ● Strategies - Hootsuite Platform REVENUE GOALS - Partners Projected DIRECT Bookings By Quarter Q1 Q2 Q3 Q4 Totals Boutique Agency NA $240,000 $240,000 $240,000 $240,000 $960,000 Booked $ARR --- $10,000/pm Boutique Agency EMEA $38,000 $132,000 $132,000 $132,000 $434,000 $9,600k /pm Boutique Agency APAC $38,000 $132,000 $132,000 $132,000 $434,000 $9,600k /pm $0 $0 $0 $0 $0 Pro Serv Revenue (All Regions) $36,000 $48,000 $48,000 $48,000 $180,000 DIRECT Revenue $352,000 $552,000 $552,000 $552,000 $2,008,000 Projected DIRECT MRR $26,333 $42,000 $42,000 $42,000 $42,000 Projected ATTRIBUTED Bookings By Quarter Q1 Q2 Q3 Q4 Totals Enterprise New/Upsell $675,500 $785,000 $890,000 $1,000,000 $3,350,500 Enterprise Renewals $530,000 $613,000 $710,000 $822,000 $2,675,000 Online $40,000 $40,000 $40,000 $40,000 $160,000 Affiliate $150,000 $150,000 $150,000 $150,000 $600,000 Boutique Agency LATAM Insert high-level quarterly revenue goals & List main dependencies Comments 4 agencies / pm / month MRR at end of quarter Comments ORG STRUCTURE - Partners KPI’s - Partners Acquisition Conversion Productivity Pro/Boutique Leads 900 GAPP Leads 100 Solution Partner Leads 100 Pro/Boutique Partners Launched 250 GAPP Partners Launched 40 Solution Partners/Resellers Launched 60 Agency Seats 3,000 GAPP Opps 100 Solution Partner Opps 100 Boutique ARR Sol Partner ARR Insert high-level KPI summary for your business unit NEW INITIATIVES - Partners ● Geographic Reseller Programs EMEA/APAC ● LATAM - Partner Coverage ● ISV Bundles - Dependent on billing system support 1:many Insert list of potential new initiatives OUTSIDE your business-as-usual plan Support Planning Sheet KIRSTY TRAILL VISION - Support Through positivity, empowerment and ownership, we connect with our customers to build awesome experiences. #WeWow GOALS - Support ● ● ● ● ● NPS = 50 CSAT > 92% First Response time <1 hour #BSU on chat (>50% of mix) 70% FCRR (one touch tickets) STRATEGIES Summary - Support ● Re-launch NPS with closed loop reporting ● Develop and launch segmented customer support by plan type ● Scale cost effectively ● Drive customer engagement ● Become a top tier player in social customer support ORG STRUCTURE - Support KPI’s - Support ● ● ● ● ● ● ● ● ● Deliver NPS >50 CSAT >92% First Response Time < 1 hour First Resolution Rate (% One touch tickets) Ticket touches to resolution Contact Rate Refund Rate Contact channel mix (email vs. chat) Cost per contact NEW INITIATIVES - Support ● ● ● ● ● ● ● #BSU on chat Alternate location strategy Tiered support by plan type Advocate specialization Gamification for Advocates Training repository Closed loop NPS and NPS task force Community JEANETTE GIBSON VISION - Community Build lasting relationships with our communities around the world and inspire future Hootsuite fans and users GOALS - Community ● Make our brand personal and accessible to increase engagement ● Open markets and grow our free user base ● Increase engagement with Ambassadors ● Gain the support of influencers ● Strengthen relationships with Enterprise customers STRATEGIES Summary - Community ● Connect our community online and offline through unique, grassroots experiences that nurture long-term relationships ● Be master storytellers to increase thought leadership ● Create action-based campaigns that surprise and delight #sexybrand ● Scale our Hootup and Ambassador programs to support regional business goals ● Provide a rich community experience for HSE customers ● Build a robust influencer network ● Serve as HS brand champions and infuse our culture in all we do #hootsuitelife ORG STRUCTURE - Community Jeanette Gibson VP, Community & Customer Experience Justine Velcich Mgr, Events/Ops Elaiza Datar Marianne B. Jenny Huynh Tot Diana Luong TBH Dir, NA Online Community Elizabeth Houston, Dir, NA Enterprise Community Dan Spicer Mgr, EMEA Community TBH Mgr, APAC Community Connor Meakin David Kyle Lotta Ygartua Stephanie W. Ileana Rossello Tom D. Paul Sackman Crystal Jiang TBH: Community Coordinator TBH: Community Coordinator TBH: Community Coordinator, FR TBH: Community Coordinator PT Contractor: 1 Ambassador (Philippines) TBH Mgr, LATAM Community Marina Tostes (currently on leave) PT Contractors: 2 Ambassadors (Brazil, Puerto Rico) KPI’s - Community ● ● ● ● ● ● ● ● ● ● Increase social reach by 50% (# followers to HS handles, FB, etc.) Social engagement (shares, likes, RT, comments) Competitive SOV by region # Enterprise Community participants and forum engagement Ambassadors: # per region, social reach, participation in challenges Influencers: # per region, social reach, positive sentiment, shares Conversation volume: # mentions, # mentions per campaign HootUps: 5 new cities/qtr, # attendees, CSAT, coupon redemption Brand sentiment (for influencers, ambassadors, general) Alignment with Online and Enterprise strategy NEW INITIATIVES - Community ● #Sexybrand campaign activation ● Top user engagement plan ● SMB-specific HootUps to test/learn paid workshop opportunity ● Ambassador Summit (test mini summit at SXSW) ● Social Media Unconference ● eStore for #Hootswag Insert list of potential new initiatives OUTSIDE your business-as-usual plan Campaigns GREG GUNN VISION - Campaigns [Draft] Connect Social Engagement to Business Objectives GOALS - Campaigns ● Achieve $5M in direct & indirect Enterprise Sales ● Launch and optimize Freemium Campaigns ● Develop unified experience for Hootsuite users STRATEGIES Summary - Campaigns Vision: Connect Social Engagement to Business Objectives. Build & launch Free Tool Build & Launch Pro Tool Grow Enterprise Business REVENUE GOALS - Campaigns Revenue Direct Enterprise Sales Revenue Attributed Enterprise Sales Revenue Online Revenue Total Q1 Q2 Q3 Q4 2015 Total $250,000 $430,000 $620,000 $740,000 $2.04M $320,000 $560,000 $855,000 $1,060,000 $2.80M $0 $105,000 $560,000 $1,296,000 $1.96M $570,000 $1,095,000 $2,035,000 $3,096,000 $6.80M Dependencies: ● Hires: Enterprise Sales Team, Marketing Manager, ● Engineering Support (headcount) ● Freemium online revenue team ORG STRUCTURE - Campaigns Greg Gunn VP New Product Growth TBD, Sales Director Account Executive Team Stefan K, GTM Enterprise Sales Michelle Reid, EDR Manager TBD Senior Product Marketer, Online Revenue Senior Digital Marketer, Online Revenue Simon Stanlake VP Tech Director of Product, Rich Hungerford Senior Product Designer Alanna Fiedler, Customer Success Manager Chris, McGuire Senior Engineering Manager Enterprise Engineering Team KEY TBD Senior Product Marketer, Enterprise Freemium Engineering Team Current Employee Open Headcount KPI’s - Campaigns Free Pro Enterprise Metric Unit Q1 Q2 Q3 Q4 Free Users # of Users 22K 49K 98K 160K Trial Users # of Users 0 910 1.8K 2.2K Q1 Q2 Q3 Q4 Metric Unit Pro Users # of Users 0 1.5K 5.1K 10.6K Pro Revenue $ of Realized Revenue $0 $105K $560K $1.3M Metric Unit Q1 Q2 Q3 Q4 New Clients Net New Clients (combined) 28 48 71 87 Enterprise Revenue $ of Realized Revenue (combined) $570k $1M $1.45M $1.8M NEW INITIATIVES - Campaigns ● Test Bundling to increase enterprise deal size ○ Explore an ‘e-commerce’ feature set to bundle onto Enterprise Campaigns ○ New integrations (i.e. data marketing automation software) Advertising GREG GUNN VISION - Advertising [Draft] Option 1 - Make paid social more accessible to SMBs & SMMs VISION - Advertising [Draft] Option 2 - Decentralize Paid Social Media VISION - Advertising [Draft] Option 3 - Demystify Paid Social GOALS - Advertising ● Acquire 45k repeat users driving $14M in Ad Spend ● Allow clients to launch & manage Facebook and Twitter Ads for free ● Deepen relationships with API partners at Facebook and Twitter STRATEGIES Summary - Advertising Vision: Make paid social more accessible to SMMs [draft] Launch a Free Ads Management Tool Test and launch a paid Pro-Level Ads Tool Explore Enterprise Strategy REVENUE GOALS - tbd Revenue goals will be determined in Q1, 2015 once we have a strong user base and better understanding of our clients business needs. Insert high-level quarterly revenue goals & List main dependencies ORG STRUCTURE - Advertising Greg Gunn VP New Product Growth Simon Stanlake VP Tech TBD, Product Manager Phil G, Senior Engineering Manager Engineering team KEY QA Engineer Current Employee Open Headcount KPI’s - Advertising For Ad Purchases via Hootsuite Active Users Purchasing Ads Average Annual Ad Spend / User Total Annual Ad Spend Facebook 45K $211 $9.47M Twitter 23K $211 $4.74M Total 67K $211 $14.21M Enterprise Education Products GREG GUNN VISION - Education Accelerate the social organization via education GOALS - Education ● Incubate and grow education products to $3M Total Revenue ● Scale through transition -OR- establish independent business group ● Scope and launch new products (1-3 annually) STRATEGIES Summary - Education Direct Online ● ● ● Create awareness, recognition ● & credibility Educate on value & benefits Drive revenue through optimized website, with low● touch sales rep ● Enterprise Attributed Provide ongoing sales enablement w/ focused training to new Regions/Sales Reps Help identify bulk purchases Drive revenue by attaching to 15% of Net New HSE wins PREMIUM CERTIFICATIONS Outbound Bulk Purchases ● ● ● Ensure alignment to target audience (w/ global footprint) Activate & sustain through co-marketing / co-training Drive Revenue through discounting on high volume CUSTOM EDUCATION STRATEGIES Summary - Education Key Funnel Metrics Direct + Ent. Att ● Provide consistent sales outreach and active enablement during discovery ● Drive revenue by attaching to tbd% to Net New HSE wins ● ● Deliver outstanding customer/product experience Earn visibility across executives ● ● Inbound + Outbound to 1,200 businesses Discover to SAL at 15% ● Convert to SQL at 20% (on direct channel) ● ● Close WIN at 20% 90% renewal + expand Education Revenue goals = $3.047M ASMS Direct Online ASMS Ent. Att. ASMS Bulk Outbound Custom Edu Ent. Att. Custom Edu Direct Q1 $94K $107K $20K $180K $120K $521K Q2 $112K $131K $31K $225K $150K $649K Q3 $135K $160K $50K $315K $180K $840K Q4 $162K $195K $80 $360K $240K $1.037M Totals $503K $593K $181K $1.08M $690K $3.047M 2015 ASMS Rev = $1.277M 2015 C.E. Rev = $1.770M ORG STRUCTURE - for biz case review VP New Product Growth Education Michael Blondé, New Product Growth,Ent Edu Stefan Person Premium Cert’s Sales Mgr tbd, Prod. Marketing Manager. New Product Growth, Ent Edu ASMS Sales Rep / Course Advisor tbd, Marketing Coord.. New Product Growth, Ent Edu tbd, Program Manager, Custom Education KEY tbd, AE Custom Education tbd, EDR, Custom Education Current Employee Requested Headcount KPI’s - Education Prem. Certs Custom Education Metric Unit Q1 Q2 Q3 Q4 Fortune 1,000 Exposure Sell into 20 new in 2015 5 5 5 5 Global Footprint Sell into 10 new countries in 2015 2 2 3 3 Q1 Q2 Q3 Q4 Metric Unit Executive Visibility New relationships built with 10 in 2015 2 2 3 3 Average Seat Size 250+ tbd tbd tbd tbd NEW INITIATIVES - Education ● Assess, scope and then build 1 new Premium Certification ● Globalize Content + Language for ASMS ● Light-weight Custom Education version HSU GREG GUNN VISION - HSU Be the go-to destination for best-in-class social media education GOALS - HSU ● 8,500 Currently Enrolled Students ● $1.7M Total ; $177K MRR ● 50 NPS STRATEGIES Summary - HSU Vision: Be the global go-to-destination for online social media education Build & expand acquisition programs Enhance educational experience to decrease churn Expand certification program to increase ARPU International expansion to increase global reach REVENUE GOALS - HSU Revenue Revenue HSU Online Revenue Enterprise Attr. Q1 Q2 Q3 Q4 2015 Total $372K $403K $449K $508K $1,732,645 TBD $1,732,645 Dependencies: ● Q1 Hires: Digital Growth Strategist ● Dedicated Engineering Support (headcount) ● Dedicated OR Support (Acquisition, conversion headcount) HSU Org Breakdown - 2015 - 6 New Hires VP, Online Revenue Director, HSU Existing - 9 Higher Ed Manager Digital Growth Strategist Content Lead Higher Ed Coodinator Online Growth Coordinator Courseware Producer Regional LeadEMEA Copywriter Regional Lead APAC Video Editor Regional Lead LATAM Video Editor Q1 - 2 Q2 - 2 Q3 - 1 Q4 - 1 Prod. mktg Manager Business Analyst TBD Strategic Initiative - Q2 Product Manager KPI’s - tbd Free Lever Metric Q1 Q2 Q3 Q4 ACQ HSUF:HSF TBD TBD TBD TBD CONV HSUFT:HSUPa TBD TBD TBD TBD RET Churn (Free) TBD TBD TBD TBD Metric Q1 Q2 Q3 Q4 HSUT:HST TBD TBD TBD TBD HSUP:HSP TBD TBD TBD TBD CONV HSUPrT:HSUPrPa TBD TBD TBD TBD RET Churn (Free) TBD TBD TBD TBD Pro Lever ACQ NEW INITIATIVES - HSU ● Launch student loyalty program under student loyalty strategist to decrease churn Insert list of potential new initiatives OUTSIDE your business-as-usual plan Alliances Greg Gunn VISION - Alliances Build & grow strategic relationships that drive a sustainable competitive advantage. GOALS - Alliances Maintain required levels of elevated access & engineering support for our core product Secure access & engineering support for APIs that enable new features + products. Develop co-marketing initiatives to drive new business & deepen our partnerships STRATEGIES Summary - Advertising Build & grow strategic relationships that drive a sustainable competitive advantage. Scale product alignment programs Scale comarketing programs Scale partner education programs International expansion to build global relationships ORG STRUCTURE - Alliances Greg Gunn > tbd VP Strategic Director Global Alliances Alanna Kostiw Manager Global Alliances Partner Manager NA Partner Manager EMEA Partner Manager APAC tbd, Product Support Associate tbd, Alliance Education Associate Current Employee Open Headcount Requested Headcount KPI’s - update in progress Alliances Interfaced With • # of Alliance Companies • # of Teams Within Alliances Internal Teams Interfaced With • # of Product Marketing Managers • # of Product Managers # of API Issues Resolved & New Features Requested • Ticket volume reduction • # of New Feature Requests Handled; # Implemented Partner Referrals • # of MQLs, SALs, SQLs, Pipeline (opps), Revenue (closed won opps) Performance of Alliance-Influenced Marketing • Enterprise -- # of MQLs, SALs, SQLs, Pipeline (opps), Revenue (closed won opps) attr. to Alliance-Influence Marketing • Free / Pro -- # of new users, trials & conversions attr. to Alliance-Influence Marketing • Content -- # of page views & downloads attr. to Alliance-Influence Marketing NEW INITIATIVES - Alliances 1. Scale Alliance team internationally to deepen global relationship development 1. Identify & share joint success metrics with Alliances 1. Identify & grow relationships with non-native networks (ex. regional + emerging) Insert list of potential new initiatives OUTSIDE your business-as-usual plan OR BD Greg Gunn VISION - OR BD Grow partner ecosystem to drive customer value, global awareness, and distribution Mission, Goals, Programs Mission Goals Core Programs To drive value for HS Pro via strategic partnerships 1. Best in Breed SMB Social Relationship Platform 2. Increase reach and visibility of HS Pro in New Markets 3. Push local engagement through Private/Public Partnerships 4. Identify and develop distribution channels Technology Partner Program Attributable Revenue / Reach Strategic Partnerships Public / Gov Partnerships Distribution Market Value/Reach Awareness Acquisition GOALS - OR BD Develop the Best in Breed SMB and Mobile SRP ecosystem Increase reach and visibility of HS Pro in New Markets Push local engagement through Private/Public Partnerships Identify and develop distribution channels STRATEGIES SUMMARY - OR Technology Partner Program New Apps and Mobile Extensions Strategic Partnerships Executive Alignment Public / Gov Partnerships Federal relationship development Mobile App Store Promotions Local Engagement (Municipal/Regional) Strategic Partner CoMarketing Professional Association Relationships Mobile Carrier Channel Development Live / Virtual Events SMB Website Builders Co-Marketing New App GTMs New Social Networks Ongoing Ecosystem Marketing International Reach Mobile: OEMs, MNOs, OS Providers Distribution Triangulation with Ambassadors for events ORG STRUCTURE - OR BD Director Pro BD Director Mobile BD Partner Management Data Partner Marketing BD Manager Technology Partnerships OR BD Analyst (Shared between Mobile + Pro) (tbd) BD Manager Public/Trade Orgs Partners (Q2 2015) Current BD Resource Requested Resource ORG STRUCTURE - OR BD Director Pro BD Director Mobile BD Partner Management Data Partner Marketing BD Manager Technology Partnerships OR BD Analyst (Shared between Mobile + Pro) (tbd) BD Manager Public/Trade Orgs Partners (Q2 2015) Current BD Resource Requested Resource KPI’s - HS Pro BD Partner External Reach (Demand Creation) Partner Social Following / Amplification Partner Email Recipients Partner Webinar Attendees Partner Live Event Registration / Attendance Partner Blog Views and Content Technology Partners Attribution Acquisition New App Directory Apps App Directory App Installs App Directory App Usage Pro App Attributable Revenue Loyalty Program Churn Reduction* Government Partners Vertical Assoc Partners Expert Ecosystem* Pro Coupons Claimed Bundles Claimed User Acquisition via External APIs* *Programs TBD KPI’s - HS Mobile Awareness Activity & Engagement Revenue # of in-App Store promotions # of Days as featured application App Downloads New User Sign Ups Daily Active Users Monthly Active Users Distribution Channel Success In App Purchases Pro Upgrades KPI GOALS - OR KPI Q1 Q2 Q3 Q4 2015 New App Directory Partners 3 3 3 3 12 App Directory Case Studies 1 1 2 2 6 Tier 1 & 2 AD Installs 50K 75K 100K 125K 250K Apps Attributable Revenue $556K $613K $675K $729K $2.75M Email Reach 500K 750K 1.5M 2M 4.75M Partner Aggregate Social Reach 500K 750K 1M 1M 3.2M Live Events (or LE Attendees) 4 10 20 40 80 KPI GOALS - OR KPI Q1 Q2 Q3 Q4 2015 Mobile Application Downloads 660k 660k 660k 660k 2.64mm Mobile Attributable Revenue $605k $670k $734k $800k $2,800,000 NEW INITIATIVES - will be leaned out New Initiative Dependencies Comments 1. App Performance Attribution Analysis Data availability from Data team If we know which Apps are performing w/ Attributable rev we can go long on marketing those 2. Expert Ecosystem Program Testing Analysis Internal Alignment Somewhere in between HSU Certification and Agencies -- how do we provide services for SMBs? Surface these in Pro buying lifecycle, discoverable on web , etc. Local search, etc. 3. Small Biz Web Experience Resources SMB Strategy Webpage for Small Business Resources Mostly a marketing effort, but plug in partners/experts/events 4. Live events Testing/Anlaysis Ambassador Program Local presence Leverage Ambassadors / local small biz relationships to drive events 5. External APIs API Development Engagement / Data APIs for third party tools Unclear when these will be delivered. Scale then. 6. Loyalty Program Coupon Inventory (Partners) Risk Analysis (worth the hassle/risk?) Reduce churn by giving our Pro customers perks from partners. NEW INITIATIVES - Mobile BD New Initiative Dependencies Comments 1. Publish APIs API Development Allow users to post to Hootsuite from 3rd party mobile applications 2. In-App Purchase Analysis Data availability & Product team input We need to understand why so few mobile users upgrade to Pro via in-app purchase 3. Mobile User Base usage analysis Product & Marketing team availability We need to understand why people use our apps and whether they are consumers or Pro customers Revenue Operations Planning Sheet JULIAN HANNABUSS VISION - Revenue Ops The framework for sustained GoToMarket success GOALS - Revenue Ops ● Revenue Team has the skills to deliver on our NSP and hit Revenue Goals ● GTM Leaders have the reporting, analytics and KPI’s to drive their business units ● Instill best practices to deliver long-term sales success and customer satisfaction ● Processes needed for sustained success are supported via our systems and tools STRATEGIES Summary - Revenue Ops ● A Sales Training Team to onboard new employees and run skills development programs ● An Analyst Team to deliver reports, analysis and strategic guidance to GTM leaders ● A Systems Team to build, operate and extend our sales/customer - related systems & tools ● An Operations Team to ensure we establish and follow good business practices ● A Global Team; extend Training, Operations, Reporting / Analysis into EMEA & APAC ORG STRUCTURE - Revenue Ops NEW INITIATIVES - Revenue Ops ● Support for LATAM training, operations and reporting/analysis ● Extend on-boarding & training into wider GTM roles (ProServ, Support, Partner Enablement, Community, Marketing) ● Comp Plan & Commissions ownership ? Insert list of potential new initiatives OUTSIDE your business-as-usual plan WAKE UP, WE’VE FINISHED !