Strategy - It works!

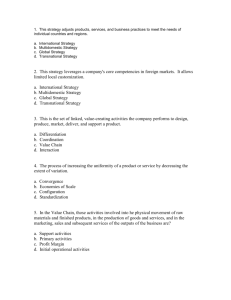

advertisement

The Strategy and Organization of International Business Strategy and the Firm Value Creation Firm as Value Chain Role of Strategy Strategy Actions taken by managers to attain firm’s goals. Profit () The difference between total revenue (TR) and total costs (TC): =TR-TC Maximize Long-term profitability Profitability Rate of return concept; i.e. return on sales (ROS). ROS= /TR 2 Value Creation V-P P-C V P C C V = Consumer Value P = Market Price C = Cost of Production V-P = Consumer Surplus P-C = Profit Margin V-C = Value Added 3 The Firm as a Value Chain Support Activities Materials Management Human Resources Information Systems Company Infrastructure R&D Production Marketing & Sales Service Primary Activities 4 The Role of Strategy Identifying and taking actions that will lower costs of value creation and/or differentiate the firm’s product offering through superior design, quality service, functionality, etc. 5 Profiting from Global Expansion Firms operating internationally are able to: Realize location economies. Realize greater cost economies. Earn a greater return from the firm’s distinctive skills or core competencies. Earn a greater return by leveraging valuable skills developed in foreign operations and transferring them to the firm’s other operations. Profitability is constrained by product 6 customization and the “imperative of localization”. Location Economies Assembly Creating a Global Web Parts Sales Advertising Design Pontiac LeMans Parts Parts 7 Needs for consideration Transportation costs. Trade barriers. Political risks. Economic risks. 8 Experience Curve Learning effects: Cost savings that come from “learning by doing.” More significant in complex tasks. Economies of Scale: Reduction in unit cost achieved through volume production. Sources: Spread fixed costs over volume. Employing specialized equipment or personnel. 9 The Experience Curve Unit Costs Strategic Significance Moving down the curve reduces the cost of creating value. B A Accumulated Output 10 Leveraging Core Competencies Firm skills that competitors can not easily match or imitate. 1. Value greatest when: Skills and products are most unique. 2. Value placed by consumers is great. 3. Few capable competitors with skills or products. 11 Leveraging Subsidiary Skills Skills can be created anywhere in a multinational’s global operations network. New Challenges 1. Humility to recognize valuable skills can come from anywhere. 2. Establish incentives to encourage local employees to acquire new skills. 3. Need a process to identify new skill development. 4. Need to facilitate transfer of new skills within the firm. 12 Pressures for Cost Reduction and Local Responsiveness High Company C Generally reflects the position of most companies Company B Cost pressures Low Low High Pressures for local responsiveness 13 Cost Reduction Mass producing a standardized product at an optimal location. Intense: in commodity industries. Where competitors are in low cost locations. Where there is persistent excess capacity. Where there are low switching costs. Because of greater international competition. Local responsiveness Arise from: Differences in consumer taste and preferences. Differences in infrastructure and traditional practices. Differences in distribution channels. Host government demands. 14 Local Responsiveness Taste and preference Distribution channels Infrastructure And Delegate production practice and marketing to national subsidiaries Host government Delegate marketing to national subsidiaries. Delegate manufacturing and production to foreign subsidiaries. Manufacture locally. 15 Four Basic Strategies High Global Strategy Transnational Strategy International Strategy Multi domestic Strategy Cost pressures Low Low High Pressures for local responsiveness 16 Strategic Choices International create value by transferring skills to local markets where skills are not present. Multidomestic oriented toward achieving maximum local responsiveness. Global increase profitability through cost reductions from experience curve effects and location economies. Transnational Exploit experienced based cost and location economies, transfer core competencies within the firm, and pay attention to local responsiveness needs. 17 The Advantages and Disadvantages of the Four Strategies Strategy Global International Advantages Exploit experience curve effects Exploit location economies Transfer distinctive competencies to Foreign Markets Disadvantages Lack of local responsiveness Lack of local responsiveness Inability to realize location economies Failure to exploit experience curve effects Table 12.1a 18 The Advantages and Disadvantages of the Four Strategies Strategy Advantages Disadvantages Multi-domesticCustomize product offerings Inability to realize location and marketing in accordance economies with local responsiveness Failure to exploit experience curve effects Failure to transfer distinctive competencies to foreign markets Transnational Exploit experience curve Difficult to implement effects due to organizational Exploit location economies problems Customize product offerings and marketing in accordance with local responsiveness Reap benefits of global learning 19 The Organization of International Business Organization Architecture and Profitability Organization architecture is the totality of a firm’s organization, including structure, control systems and incentives, processes, culture and people. Superior enterprise profitability requires three conditions; An organization’s architecture must be internally consistent. Strategy and architecture must be consistent. Strategy, architecture and competitive environments must be consistent. 21 Organization Architecture Structure Controls & Incentives People Culture Processes Figure 13.1 22 Organization Architecture Control Systems: Processes: Metrics used to measure Manner in which subunit performance. decisions are made. Make judgments about Manner in which work managers’ abilities to is performed. run units. Conceptually distinct Incentives are devices from location of to reward appropriate decision-making managerial behavior. responsibility. 23 Organization Architecture Culture: Norms and value systems shared by the employees. People: Not just employees, but the strategy to recruit, compensate, and retain individuals with necessary skills, values and orientation. If a firm is going to maximize its profitability, it must pay close attention to achieving internal consistency among the various components of its architecture. 24 Vertical Differentiation Concerned with where decisions are made. Centralization: Facilitates coordination. Ensure decisions consistent with organization’s objectives. Top-level managers have means to bring about organizational change. Avoids duplication of activities. Decentralization: Overburdened top management. Motivational research favors decentralization. Permits greater flexibility. Can result in better decisions. Can increase control. 25 Strategy and Centralization Global Multi-domestic Centralize International Centralize for core competencies Decentralize for operating decisions Decentralize Transnational Both Centralize And Decentralize 26 Horizontal Differentiation How a firm divides itself into subunits function type of business International must reconcile conflict between product and location. geographical area 27 A Typical Functional Structure Top Management Purchasing Buying units Manufacturing Plants Marketing Branch sales units Finance Accounting units 28 The Functional Structure Typically, the structure that evolves in a company’s early stages. Coordination and control rests with top management. 29 A Typical Product Division Structure Headquarters Division product line A Department Purchasing Buying units Division product line B Department Manufacturing Plants Division product line C Department Marketing Branch sales units Department Finance Accounting units 30 Product Division Structure Probable next stage of development. Reflects company growth into new products. Each unit responsible for a product. Semiautonomous and accountable for its performance. Eases coordination and control problems. 31 One Company’s International Division Structure Headquarters Domestic Division General Manager Product line A Domestic Division General Manager Product line B Domestic Division General Manager Product line C Functional units Functional units Country 1 General Manager (product A, B, and / or C) International Division General Manager area line Country 2 General Manager (product A, B, and / or C) 32 International Division Widely used. 1. Can create conflict between domestic and foreign operations. 2. Implied lack of coordination between domestic and foreign operations. Growth can lead to worldwide structure. 33 The International Structural Stages Model Foreign Product Diversity Worldwide Product Division Alternate Paths of Development International Division Global Matrix (“Grid”) Area Division Foreign Sales as a Percentage of Total Sales 34 Worldwide Area Structure Headquarters North American area European area Latin American area Middle East / Africa area Far East area 35 Worldwide Area Structure Favored by firms with low degree of diversification. Area is usually a country. Largely autonomous. Encourages fragmentation. Facilitates local responsiveness. Consistent with multi-domestic strategy 36 A Worldwide Product Division Structure Headquarters Worldwide product group or division A Worldwide product group or division B Worldwide product group or division C Area 1 Area 2 (domestic) (international) Functional units 37 Product Division Consistent with global or international strategy Reasonably diversified firms. Attempts to overcome international division and worldwide area structure problems. Weak local responsiveness. Believe that product value creation activities should be coordinated worldwide. 38 A Global Matrix Structure Headquarters Area 1 Area 2 Area 3 Product division A Product division B Product division C Manager here belongs to division B and area 2 Figure 13.7 39 Matrix Structure Attempts to meet needs of transnational strategy. Doesn’t work as well as theory predicts. Conflict and power struggles. “Flexible” matrix structures. Consistent with transnational strategy 40 Integrating Mechanisms Need for coordination: Transnational High Global International Multidomestic Low Impediments; Different managerial orientations. Differing goals. Time zones, distance, nationality. 41 Formal Integrating Mechanisms Direct contact Liaison roles Teams Matrix structures Increasing complexity of integrating mechanism Figure 13.8 42 A Simple Management Network G B C A E D Informal contacts between managers within an enterprise. F 43 Control Systems and Incentives Types of controls: Personal. Bureaucratic Output. Cultural. Incentives: Depends on employee and his/her tasks. Can be used to improve manager coordination between units. Need to account for national differences in institutions and culture. Caveat: beware of the rule of unintended consequences. 44 Performance Ambiguity A function of the interdependence among subunits. Control Systems Multinational Output/Bureaucratic Global/Transnational Cultural 45 Interdependence, Performance Ambiguity, and the Costs of Control for the Four International Business Strategies Strategy Multi-domestic International Global Transnational Interdependence Performance Ambiguity Costs of Control Low Low Low Moderate Moderate Moderate High High High Very high Very high Very high 46 Processes The manner in which decisions are made and work is performed within an organization.” Cut across national boundaries as well as organizational boundaries. Can be developed anywhere within the firms global operations network. 47 Organization Culture Values and norms shared among people. Sources: Founders and important leaders. National social culture. History of the enterprise. Decisions that result in high performance. Cultural maintenance: Hiring and promotional practices. Reward strategies. Socialization processes. Communication strategy. 48 Organization Culture and Performance A “Strong” Culture: Culture must match an organization’s architecture. Not always good. Culture does not necessarily Sometimes beneficial, translate across borders. sometimes not. Context is important. Transnational Culture Adaptive cultures. Strong Weak Global International Multidomestic 49 A Synthesis of Strategy, Structure and Control Systems Structure and control Multi-domestic International Global Transnational Vertical differentiation Decentralized Core competency; rest decentralized Some centralized Worldwide area structure Worldwide product division Worldwide product division Mixed centralized and decentralized Informal matrix Need for coordination Low Moderate High Very high Integrating mechanisms None Few Many Very many Performance Low Moderate High Very high Low Moderate Horizontal differentiation ambiguity Need for cultural controls High Very high 50