INTERNATIONAL STRATEGIC MANAGEMENT - E

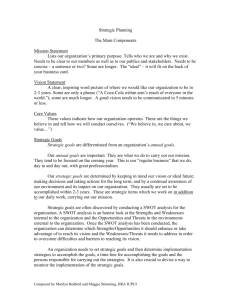

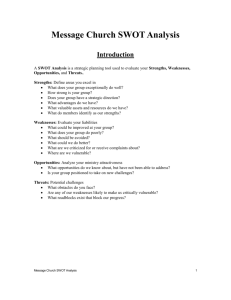

advertisement