Ethics What Every Tax Preparer Needs to Engrave in Their Thoughts

advertisement

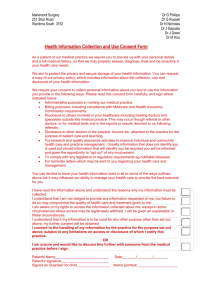

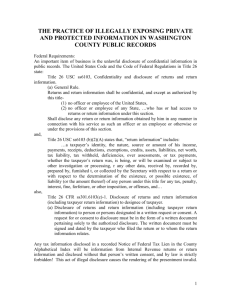

ETHICS What Every Tax Preparer Needs to Engrave in Their Thoughts 1 Presented By: Marcia L. Miller, MBA, EA Financial Horizons, Inc. Weston, Florida ProactiveTax@aol.com 2 Ethics has always been a requirement, but will our clients agree not to control us by swaying our ethical requirements? Frivolous tax arguments and tax scams will always be a dilemma to be reckoned with, but now – more than ever – it is imperative that we not trust the client too much. 3 Imagine a Pyramid At the bottom appears the Code of Professional Conduct’s six principles are the cornerstone of ethical behavior. They include: 1 - Responsibilities 2 - The Public Interest 3 - Integrity 4 - Objectivity and Independence 5 - Due Care 6 - Scope and Nature of Services 4 Principles These are positive statements of responsibility in the Code of Professional Conduct that provide the framework for the rules, which govern performance. 5 Next are the rules by which we are governed whether we are in the practice of accounting or merely providing professional services. Independence Integrity and objectivity General Standards Compliance with Standards Accounting Principles Confidential Client Information Contingent Fees Acts Discreditable Commissions and Referral Fees Advertising and Other Forms of Solicitation Form of Organization and Name 6 RULES Broad but specific descriptions of conduct that would violate the responsibilities stated in the principles in the Code of Professional Conduct. 7 Now as the Pyramid narrows, you as the professional, must make your own interpretations of these specific rules, some of which may require rulings for certain circumstances. 8 INTERPRETATIONS This refers to those pronouncements issued by organizations such as the AICPA’s Division of Professional Ethics to provide guidelines concerning the scope and application of the rules of conduct. 9 ETHICS RULINGS Rulings summarize the application of rules and interpretations to a particular set of factual circumstances. 10 “YOUR BEHAVIOR” Lastly, at the top of your pyramid is the Behavior for which your peers are judging your actions. Your Behavior needs to be impacted by the Code, Interpretations and Rulings. 11 CIRCULAR 230 In order to protect citizens from incompetent and unethical practitioners, governments have passed laws and regulations regarding the professional conduct of certain professionals who provide accounting and tax services. In particular, Certified Public Accountants (CPAs) and Public Accountants (PAs) are regulated by State Boards of Accountancy; and professionals who are authorized to practice before the Internal Revenue Service (IRS) are regulated by Treasury Department Circular 230 and the IRS Office of Professional Responsibility. The body of law which is intended to protect citizens from unethical behavior is sometimes referred to as regulatory ethics. Those who are regulated and fail to uphold the required standards of ethical and professional conduct are guilty of committing 12 acts which are not only unethical, but also illegal. CIRCULAR 230 Many accounting and tax practitioners are not directly regulated by State Boards of Accountancy or the Internal Revenue Service. However, the standards of ethical and professional conduct established by those authorities represent the high expectations of the citizens who are served by the accounting profession. Because these standards are widely published and well known, they may also be used in a court of law when a citizen sues to obtain damages from a practitioner. Therefore, it is important for all accounting and tax professionals, whether regulated or not, to understand the high level of ethical and professional conduct that is expected because of the trust that is conveyed to them by the individuals and businesses they serve. 13 CIRCULAR 230 Liability for Fraud Actual fraud and constructive fraud present two different circumstances under which an accountant may be found liable. An accountant may be held liable for actual fraud when he or she intentionally misstates a “material fact” to mislead his or her client, and the client detrimentally relies on the misstated fact. A material fact is one that a reasonable person would consider important in deciding whether to act. Constructive fraud, on the other hand, will be found when an accountant is grossly negligent in the performance of his or her duties. The intentional failure to perform a duty in reckless disregard of the consequences of such a failure would constitute gross negligence on the part of an accountant. Both actual and constructive frauds are potential sources of legal liability under which a client may bring an action against an accountant. When a client is dissatisfied with the performance of an accounting firm, he or she will often sue on all three common law theories in the alternative. The Federal Rules of Civil Procedure permit a pleader, in a claim or defense, to make two or more statements which are not necessarily consistent with each other. A plaintiff may sue on several theories. 14 CIRCULAR 230 Treasury Department Circular 230 Circular 230 provides regulations governing the practice of Attorneys, Certified Public Accountants, Enrolled Agents, Enrolled Actuaries, Enrolled Retirement Plan Agents, and Appraisers before the Internal Revenue Service. As part of an ongoing effort to improve ethical standards for tax professionals and to curb abusive tax avoidance transactions, the Treasury Department and the Internal Revenue Service have issued final regulations amending Circular 230 to achieve the strategic goal of ensuring that attorneys, accountants, enrolled agents, and other tax practitioners adhere to professional standards and follow the law. Subpart B of Circular 230 describes the duties and restrictions relating to practice before the Internal Revenue Service, the best practices for tax advisors, and standards with respect to tax returns, financial documents, and workpapers. Subpart C describes the sanctions for violation of the regulations, and defines incompetence and disreputable conduct for which a practitioner may be sanctioned. The most recent revision of Circular 230 is available on the Internal Revenue Service website. 15 CIRCULAR 230 Tax professionals who are authorized to practice before the Internal Revenue Service (that is, to represent clients) are regulated by the Office of Professional Responsibility (OPR) and are legally obligated to follow Circular 230 requirements. Tax professionals who are not authorized to practice before the Internal Revenue Service are not directly regulated by OPR. However, all tax professionals should be familiar with Circular 230 as many of the standards and best practices discussed are universally applicable. Some of the most important requirements regarding professional conduct are summarized below. Furnishing Information: A practitioner must furnish records or other information to the IRS or OPR upon a proper and lawful request unless the practitioner believes in good faith and on reasonable grounds that the records or information are privileged. If the practitioner does not possess the requested records, he/she must promptly notify the requesting IRS officer or employee. The practitioner must ask the client where the requested records are located, and provide any information regarding the identity of any person who the practitioner believes may have possession of the requested records to the IRS officer or employee. Knowledge of Client’s Omission: If a practitioner knows that a client has not complied with the revenue laws or has made an error in or omission from any return or other document submitted to the U.S. government, the practitioner is obligated to advise the client promptly of the facts of such noncompliance, error, or omission. The practitioner must also advise the client of the consequences of such noncompliance, error, or omission as provided under the Internal Revenue Code and regulations. 16 CIRCULAR 230 Diligence as to Accuracy: A practitioner must exercise due diligence as to the accuracy of all returns, documents, other papers, and oral or written representations which relate to IRS matters. If the practitioner relies on the work product of another person, he/she will be presumed to exercise due diligence if the practitioner has used reasonable care in engaging, supervising, training, and evaluating the person, taking into account the nature of the relationship between the practitioner and the person. Prompt Disposition of Pending Matters: A practitioner may not unreasonably delay the prompt disposition of any matter before the Internal Revenue Service. Assistance from Disbarred or Suspended Persons: A practitioner may not knowingly accept assistance regarding IRS matters, either directly or indirectly, from any person who is under suspension or disbarment from practice before the Internal Revenue Service. 17 CIRCULAR 230 Notaries: A practitioner may not act as a notary public with respect to any matter administered by the IRS if the practitioner is also employed by the client regarding IRS matters or is in any way interested in the matter pending before IRS. Fees: A practitioner may not charge unconscionable fees. Generally, a practitioner is not allowed to charge a contingent fee for tax return preparation or other matters before the IRS. A contingent fee is a fee that is based on a percentage of the refund reported on a return, or is otherwise dependent on the result obtained. However, contingent fees are allowed in the following situations: Services rendered in connection with an examination or other challenge to a taxpayer’s original return. Services rendered in the preparation of an amended return or claim for refund or credit which is filed within 120 days of the taxpayer receiving a notice of examination or a written challenge to the return. Services rendered in connection with a claim for refund or credit regarding the determination of interest and penalties assessed by the IRS. Services rendered in connection with any judicial proceeding arising under the Internal Revenue Code. 18 CIRCULAR 230 Return of Client’s Records: A practitioner is obligated to promptly return, upon request, any and all records that belong to the client, or that the client needs to comply with his/her federal tax obligations. The practitioner may retain copies of the records returned to the client. A dispute over fees does not relieve the practitioner of this responsibility. (There is an exception, where allowed by state law, whereby the practitioner may retain the records subject to the fee dispute, but must provide the client with reasonable access to review and copy the records.) The practitioner is not required to release returns or other documents which have been prepared by the practitioner or the practitioner’s firm if the return or document is being withheld due to the client’s nonpayment of fees with respect to that return or document. 19 CIRCULAR 230 Conflicting Interests: A practitioner shall not represent a client before the IRS if the representation involves a conflict of interest. A conflict of interest exists if the representation of one client will be directly adverse to another client. There is also a conflict of interest if there is a significant risk that the representation of a client will be materially limited by the practitioner’s responsibilities to another client, a former client or a third person, or by the practitioner’s own personal interests. A practitioner may reasonably believe that he/she will be able to provide competent and diligent representation to clients where a potential conflict of interest exists. The clients may consent to such representation if it is not prohibited by law. Each affected client must waive the conflict of interest and give informed consent in writing within 30 days after being informed of the conflict. The practitioner must retain copies of the written consents for at least 36 months after the conclusion of the representation of the affected clients, and must provide those consents upon request to any officer or employee of the IRS. 20 CIRCULAR 230 Solicitations: A practitioner may not advertise or solicit clients, either publicly or privately, in any manner that could be considered false, fraudulent, misleading, deceptive, or coercive. Any uninvited solicitation must clearly identify the solicitation as such, and also identify the source of information used in choosing the recipient. If a practitioner publishes a fee schedule, he/she may not charge more than the published fees for at least 30 days after the last date of publication. The practitioner must retain a copy of any communication containing fee information, along with a list or description of persons to whom the communication was distributed. The practitioner must retain these copies for at least 36 months after they were last used. This applies to all methods of communication – mailings, e-mails, radio, television, flyers, telephone directories, and all others. 21 CIRCULAR 230 Clients’ Refund Checks: A practitioner who prepares tax returns may not endorse or otherwise negotiate any check issued to a client by the government with respect to a federal tax liability. Best Practices: Tax professionals should adhere to best practices when preparing tax returns or other documents or providing advice regarding federal tax matters. In addition to compliance with standards, best practices include the following: Communicating clearly with clients and having a clear understanding with clients as to the scope of advice and assistance being given. Establishing the facts, determining which facts are relevant, evaluating the reasonableness of any assumptions, relating the facts to the applicable law, and arriving at conclusions that are supported by the law and the facts. Advising clients regarding the importance and potential consequences of the conclusions reached, including the avoidance of penalties if the taxpayer relies on the advice. Acting fairly and with integrity in the conduct of your business. 22 CIRCULAR 230 Standards with Respect to Tax Returns: Circular 230 establishes certain standards with respect to tax returns and other submissions to the Internal Revenue Service. A tax professional may NOT: Advise a client to take a position on a return or document submitted to the IRS unless the position is not frivolous. Advise a client to submit a document to the IRS for the purpose of impeding or delaying 23 CIRCULAR 230 Advise a client to submit a document to the IRS for the purpose of impeding or delaying administration of federal tax laws. Advise a client to submit a return or document that is frivolous. Advise a client to submit a return or document that contains or omits information in a manner that demonstrates an intentional disregard of a rule or regulation (unless the client is also advised to submit documents that evidence a good faith challenge to the rule or regulation). In order to comply with standards, a tax professional must: Inform a client of any penalties that may reasonably apply to a position taken on a tax return, if the practitioner gave advice regarding the position or prepared or signed the tax return. Inform a client of any opportunity to avoid penalties by disclosure, and of the requirements of adequate disclosure. 24 CIRCULAR 230 A tax professional may generally rely in good faith without verification upon information furnished by the client. However, a practitioner may not ignore the implications of information furnished by the client or otherwise known by the practitioner. If the information provided by the client appears to be incorrect, inconsistent, or incomplete, the professional must make reasonable inquiries to obtain reliable information. Giving Written Advice: When giving written advice to a client, a tax professional may NOT: Base the advice on unreasonable factual or legal assumptions; Unreasonably rely on the representations or statements of the taxpayer or any other person; Ignore or fail to consider all relevant facts that the professional knows or should know; or Take into account the risk of being audited or having the advice challenged by the IRS. 25 CIRCULAR 230 Incompetence and Disreputable Conduct: Incompetence and/or disreputable conduct may subject a tax professional who is authorized to practice before the IRS to sanctions for violation of the regulations. Incompetent and/or disreputable acts include the following: Conviction of any criminal offense under the federal tax laws. Conviction of any criminal offense involving dishonesty or breach of trust. Conviction of any felony under federal or state law which would render a practitioner unfit to practice. Knowingly giving false or misleading information to the Department of the Treasury or its officers or employees. Soliciting employment or attempting to deceive a client or prospective client using false or misleading representations, or intimating that the practitioner is able to obtain special consideration or action from the IRS or its officer or employee. Willfully failing to file a federal tax return, or participating in evading or attempting to evade any assessment or payment of any federal tax. Willfully assisting, counseling, or encouraging a client or prospective client to violate any federal tax law, or knowingly counseling or suggesting to a client or prospective client an illegal plan to evade federal taxes. 26 CIRCULAR 230 Misappropriation or failure to remit funds received from a client for the purpose of paying taxes or other government obligations. Directly or indirectly trying to influence the official action of any IRS officer or employee by the use of threats, false accusations, duress or coercion, or by offering or promising gifts, favors, or anything of value. Disbarment or suspension from practice as an attorney, certified public accountant, public accountant, or actuary by any state or other U.S. jurisdiction. Knowingly aiding and abetting another person to practice before the IRS during a period of suspension, disbarment, or other period of ineligibility. Contemptuous conduct in connection with practice before the IRS, including the use of abusive language or malicious or libelous communications. Knowingly, recklessly, or through gross incompetence giving a false opinion on questions arising under Federal tax laws. Willfully failing to sign a tax return prepared by the practitioner. Willfully disclosing or otherwise using a tax return or tax information in a manner not authorized by the Internal Revenue Code. 27 CIRCULAR 230 Confidentiality, Privacy, and Disclosure of Financial or Tax Information Citizens have a right to expect professionals who assist them with private financial matters to be trustworthy. The accounting and tax professional has an obligation to maintain and respect the confidentiality of information obtained in the performance of all professional activities. The Gramm-Leach-Bliley Act of 1999 requires each financial institution and tax preparer to disclose its privacy policy to those who trust them with nonpublic personal information. In general, the tax preparer’s privacy policy should state that nonpublic personal information is not disclosed without the client’s consent. Any exceptions should be explained in the privacy policy. The following are some common exceptions that a tax preparation firm should explain in its privacy policy: Disclosure to employees, technical advisors, software consultants, or electronic filing providers. Disclosures required to comply with federal, state, or local laws, or with licensing requirements. Disclosures required to comply with legal subpoenas or other legal actions. The Internal Revenue Service also has requirements regarding the disclosure of tax information. These requirements are found in Revenue Procedure 2008-35, published in the Internal Revenue Bulletin on July 21, 2008. Section 7216(a) of the Internal Revenue Code imposes criminal penalties on tax return preparers who knowingly or recklessly make unauthorized disclosures or uses of information furnished in connection with the preparation of a tax return. Any disclosure or use of tax information requires the informed consent of the taxpayer. 28 Due Diligence It probably doesn’t mean that practitioners must use all measures possible to verify all information that client provides but the scope of our investigations has broadened. It would be likely that facts and circumstances would be considered. 29 Letter to Client Due to the tighter standards imposed by the new rules, the cost of providing written tax opinions will likely be higher unless the disclaimer approach is taken. 30 Firm Responsibilities Effective for all members, associates and employees there must be a conformity with Circular 230. 31 Tax Return Preparation Tax return should not be signed as preparer if it contains a position that does not have a realistic possibility of being sustained on its merits. Audit roulette does not count. Does it have a one in three chance (or greater) of being sustained on its merits. If position is improper it is frivolous. Preparers must make taxpayers aware of the penalties involved. 32 Penalties Reckless violation or incompetence is grounds for censure, suspension or disbarment from practice. All information, hearings, pleadings, evidence, reports decisions will be made available to the public. 33 Changing Face of Return Prep SBWOTA changes Substantial or Gross valuation misstatement >$5,000 penalties to 20% or 40%, respectively unless: Substantial authority or Adequately disclosed and reasonable basis. 34 Understatement of Tax Liability by Return Preparers Prior 1st Tier penalty $250 for Income Tax preparer if: Not disclosed; Not ‘realistic possibility’ (1/3) 2nd Tier penalty if willful neglect; $1,000 preparer penalty 35 Tax return preparer penalties Old Law: An income tax return preparer is liable for penalties for failing to have a reasonable factual or legal basis for a position taken on a return. Evolved into a "realistic possibility of success" standard, as a one-in-three chance of prevailing on the merits of an issue. 36 Tax return preparer penalties If the position did not meet the realistic possibility of success an income tax preparer could avoid the penalty for non-frivolous positions through adequate disclosure. Only subject to the penalty if an understatement arose as the result of : (1) a nondisclosed position that failed to meet the "realistic possibility of success" standard, or (2) a disclosed position that was frivolous. 37 Understatement of Tax Liability by Return Preparers Now: ANY return prepared > 5/27/07 More Likely Than Not sustained (51%+) 1st Tier is greater of $1,000 or 50% of fees 2nd Tier is greater of $5,000 or 50% of fees Change effectively applies penalties, due to understatement of taxpayer liability, to preparers of ALL returns (Gift, Estate, 941, Excise, 990-T, W-2’s, 1099’s) 38 New Preparer Penalty Legislation Undisclosed Positions: Preparer may be subject to penalties even though the taxpayer would not as a result of an understatement. Standard for Taxpayers: Substantial Authority Standard for Practitioners: Higher level, was a realistic possibility of success, MORE LIKELY THAN NOT, (more than 50% likely to succeed) now is 39 New Preparer Penalty Legislation New Law: Return preparer is subject to a penalty of up to 50% of the fees for the assignment if: - the position was not disclosed and the return preparer did not have a reasonable belief that the position was more likely than not correct, or - the position was disclosed but did not have a reasonable basis. 40 New Preparer Penalty Legislation Accounting firms may be forced to change the Engagement letters, Organizer Letters and even the Circular 230 disclaimer on e-mails and memoranda advising clients to disclose any position that does not meet the "more likely than not" standard. Notice 2007-54 delayed application for all returns filed before 2008. 41 New Preparer Penalty Legislation Tax professionals should react with caution to this change in the law. It has been suggested that some practitioners in order to protect themselves may disclose every position taken on a return on Form 8275 rather than risk the penalty. Line-by-line basis, that there is no certainty that each number reflected on the return is more likely than not correct……….. AICPA Urged Congress to Reconsider….see article in Sept Journal Of Accountancy, page 25. 42 Are YOU willing to GAMBLE $1,000 or 50% of professional fees for………. 1099 issued to individual in lieu of Form W-2? Asset is held for investment versus sale? Expense capitalized versus deducted? Form W-2 issued to self-employed member (partner) of LLC (partnership)? Value of non-cash charitable contributions? Basis of asset sold? Worthlessness of a Stock or Debt? Claiming Real Estate Pro when not? Unreasonably LOW compensation of S shareholder? Business Miles driven by taxpayer? 43 Getting the records and proof from clients: don’t trust your client too much Suggested solutions for consideration Document, document, document!!! Form 8275 - Disclosure Statement – Disclose a position contrary to a rule such as a statutory position or IRS revenue ruling. 44 IRS advice: avoid the ‘Dirty Dozen’ tax scams of 2009 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Phishing Economic Stimulus Payments Frivolous Tax Arguments- taxes are illegal Fuel Tax Credit Scams Hiding Income Offshore Abusive Roth IRAs Zero Wages False claims for refunds and abatements Return Preparer Fraud Disguised Corporate Ownership Trust Misuse Use of Charitable Organizations to shield income 45 Update on Circular 230 1. In general, Treasury Department proposed changes to Circular 230 on March 6, 2006 2. What is a contingent fee? Fee based in whole or part on a position taken on a tax return; includes refund or reimbursement of fees Cannot charge contingent fee on Original Can charge contingent free on: Amended return, exam of original return, or judicial proceeding 46 Tax Return Preparation 230 regs forbid practitioners from signing a return that contains a position that does not have ‘realistic possibility’ of being sustained. Generally 1-in-3 or better chance of being sustained. ‘Risk of audit’ cannot be considered. Disclosure to client of potential penalties Disclosure of position on return? IRS sanctions include censure, suspension, or disbarment from practice before IRS. 47 New Preparer Penalties Update Standard is now “MLTN” or >50% Applies to all tax returns IRS Notice 2008-13 May rely on good faith upon information furnished by T/P or 3rd party You don’t have to audit your clients Make reasonable inquiries Do not ignore other information you may have 48 Pension Protection Act Penalties 1. Thresholds for accuracy related penalties reduced - From 200% to 150% for Substantial valuation misstatement (20% penalty) - From 400% to 200% for Gross valuation misstatement (40% penalty) 2. Appraisal penalties increased - $1,000 or 10% of tax understatement - Max = 125% x appraisal fee unless ‘more likely than not’ correct appraisal 49 Accuracy Related Penalty NOTE: Per the IRS general instructions: The portion of the accuracy-related penalty attributable to the following types of misconduct cannot be avoided by disclosure on Form 8275: Negligence Disregard of rules or regulations Any substantial understatement of income tax Any substantial valuation misstatement Any substantial overstatement of pension liabilities Any substantial estate or gift tax valuation understatements 50 FIVE MINUTE MANAGEMENT COURSE 51 Lesson 1: A man is getting into the shower just as his wife is finishing up her shower, when the doorbell rings. The wife quickly wraps herself in a towel and runs downstairs. When she opens the door, there stands Bob, the next-door neighbor. Before she says a word, Bob says, "I'll give you $800 to drop that towel" After thinking for a moment, the woman drops her towel and stands naked in front of Bob, after a few seconds, Bob hands her $800 and leaves. 52 The woman wraps back up in the towel and goes back upstairs. When she gets to the bathroom, her husband asks, "Who was that?" "It was Bob, the next door neighbor," she replies. "Great," the husband says, "did he say anything about the $800 he owes me?" 53 Moral of the story If you share critical information pertaining to credit and risk with your shareholders in time, you may be in a position to prevent avoidable exposure. 54 Lesson 2 A priest offered a nun a lift. She got in and crossed her legs, forcing her gown to reveal a leg. The priest nearly had an accident. After controlling the car, he stealthily slid his hand up her leg. The nun said, "Father, remember Psalm 129?" The priest removed his hand. But, changing gears, he let his hand slide up her leg again. The nun once again said, "Father, remember Psalm 129?" The priest apologized "Sorry sister but the flesh is weak." Arriving at the convent, the nun sighed heavily and went on her way. On his arrival at the church, the priest rushed to look up Psalm 129. It said, "Go forth and seek, further up, you will find glory." 55 Moral of the story: If you are not well informed in your job, you might miss a great opportunity. 56 Lesson 3: A sales rep, an administration clerk, and the manager are walking to lunch when they find an antique oil lamp. They rub it and a genie comes out. The genie says, "I'll give each of you just one wish." "Me first! Me first!" says the admin clerk. "I want to be in the Bahamas, driving a speedboat, without a care in the world.“ Puff! She's gone. "Me next! Me next!" says the sales rep. "I want to be in Hawaii , relaxing on the beach with my personal masseuse, an endless supply of Pina Coladas and the love of my life." Puff! He's gone. "OK, you're up," the Genie says to the manager. The manager says, "I want those two back in the office after lunch." 57 Moral of the story: Always let your boss. have the first say. 58 Lesson 4 An eagle was sitting on a tree resting, doing nothing. A small rabbit saw the eagle and asked him, "Can I also sit like you and do nothing?" The eagle answered: "Sure, why not." So, the rabbit sat on the ground below the eagle and rested. All of a sudden, a fox appeared, jumped on the rabbit and ate it. 59 Moral of the story: To be sitting and doing nothing, you must be sitting very, very high up. 60 Lesson 5 A turkey was chatting with a bull. "I would love to be able to get to the top of that tree" sighed the turkey, "but I haven't got the energy." "Well, why don't you nibble on some of my droppings?" replied the bull. They're packed with nutrients.“ The turkey pecked at a lump of dung, and found it actually gave him enough strength to reach the lowest branch of the tree. The next day, after eating some more dung, he reached the second branch. Finally after a fourth night, the turkey was proudly perched at the top of the tree. He was promptly spotted by a farmer, who shot him out of the tree. 61 Moral of the story: Bull s**t might get you to the top, but it won't keep you there.. 62 Lesson 6 A little bird was flying south for the winter. It was so cold the bird froze and fell to the ground into a large field. While he was lying there, a cow came by and dropped some dung on him. As the frozen bird lay there in the pile of cow dung, he began to realize how warm he was. The dung was actually thawing him out! He lay there all warm and happy, and soon began to sing for joy. A passing cat heard the bird singing and came to investigate. Following the sound, the cat discovered the bird under the pile of cow dung, and promptly dug him out and ate him. 63 Morals of the story: (1) Not everyone who sh*ts on you is your enemy. (2) Not everyone who gets you out of sh*t is your friend. (3) And when you're in deep sh*t, it's best to keep your mouth shut! 64 THUS ENDS THE FIVE MINUTE MANAGEMENT COURSE Send this to at least five bright, funny people you know and make their day! 65 Sec 7216 Discussion Points ■ General Overview of Sec. 7216 ■ Criminal Penalties Apply ■ Tax Return Preparation & Auxiliary Services ■ Definition of Tax Return Information ■ Use and Disclosure ■ Permitted Disclosures without Consent ■ How do we protect ourselves? 66 IRS REGULATION 7216 Use and Disclosure of Tax Information As of this filing Season 2009, IRS Regulation 7216 provides guidance to tax preparers regarding the use and disclosure of their clients' tax information. This regulation strengthens taxpayers' ability to control their tax information and to make informed decisions regarding the preparer's use of that information. Tax preparers who fail to comply with this regulation face a $1,000 fine and one year in jail for each violation. The Consent to Use of Tax Return Information requires the client’s permission to use his or her tax information for purposes other than preparing and filing the tax return (such as determining whether bank or other financial products may be available to the client). The Consent to Use of Tax Return Information explains this requirement and must be signed before the return is prepared. The Consent to Disclosure of Tax Return Information requires all tax preparers, to obtain the client’s permission to disclose his or her tax return information to third parties (such as to banks for bank products, or to service bureaus or franchisors). The Consent to Disclosure of Tax Return Information must be signed before sending the return to the designated third party. 67 Section 7216 Overview New regulations under Internal Revenue Code Section 7216, became effective January 1, 2009. The new regulations update regulations that have been substantially unchanged since the 1970s, and give taxpayers greater control over their personal tax return information. The statute limits tax return preparers’ use and disclosure of information obtained during the return preparation process to activities directly related to the preparation of the return. Rev. Proc. 2008-35 provides guidance to tax return preparers regarding the format and content of consents to disclose and consents to use tax return information with respect to taxpayers filing a return in the Form 1040 series. This revenue procedure also provides specific requirements for electronic signatures when a taxpayer executes an electronic consent to the disclosure or use of the taxpayer’s tax return information. 68 Sec 7216 overview continued Unless section 7216 or §301.7216-2 specifically permits the disclosure or use of tax return information, a tax return preparer may not disclose or use a taxpayer’s tax return information prior to obtaining a consent from the taxpayer. Consent must be knowing and voluntary. There is form and content requirements that all consents to disclose or use must include, as well as timing requirements and other limitations upon consents to disclose or use tax return information. There is a limitation upon consents to disclose a taxpayer’s social security number to a tax return preparer located outside of the United States. 69 Sec 7216 overview continued The Secretary may, by publication in the Internal Revenue Bulletin, prescribe additional requirements for tax return preparers regarding the format and content of consents to disclose and consents to use tax return information with respect to taxpayers filing a return in the Form 1040 series, as well as the requirements for a valid signature on an electronic consent under section 7216. The Secretary may, by publication in the Internal Revenue Bulletin, describe the requirements of an “adequate data protection safeguard” for purposes of removing the limitation upon consents to disclose a taxpayer’s social security number to a tax return preparer located outside of the United States. This revenue procedure provides additional consent format and content requirements and defines an “adequate data protection safeguard.” 70 Form and Content of a Consent to Disclose or a Consent to Use Form 1040 Tax Return Information Separate Written Document. A taxpayer’s consent to each separate disclosure or use of tax return information must be contained on a separate written document, which can be furnished on paper or electronically. For example, the separate written document may be provided as an attachment to an engagement letter furnished to the taxpayer. Special rule for multiple disclosures or uses within a single consent form. Multiple disclosures and uses can be authorized within a single forms, only if the document provides the taxpayer with the opportunity to affirmatively select each disclosure or use, and must be provided any information required for each specific disclosure or use. A consent furnished to the taxpayer on paper must be provided on one or more sheets of 81/2 inch by 11 inch or larger paper. All of the text on each sheet of paper must pertain solely to the disclosure or use the consent authorizes, and the sheet or sheets, together, must contain all the elements described in section 4.04 and, if applicable, comply with section 4.06. All of the text on each sheet of paper must also be in at least 12-point type (no more than 12 characters per inch). 71 Form and Content continued An electronic consent must be provided on one or more computer screens. All of the text placed by the preparer on each screen must pertain solely to the disclosure or use of tax return information authorized by the consent, except for computer navigation tools. The text of the consent must meet the following specifications: the size of the text must be at least the same size as, or larger than, the normal or standard body text used by the website or software package for direction, communications or instructions and there must be sufficient contrast between the text and background colors. In addition, each screen or, together, the screens must: - contain all the elements described in section 4.04 and, if applicable, comply with section 4.06, - be able to be signed as required by section 5 and dated by the taxpayer, and - be able to be formatted in a readable and printer-friendly manner. 72 Form and Content continued Consents Must: Identify the intended purpose of the disclosure or use; Identify the recipient(s) and describe the particular authorized information to be disclosed or used; Include the name of the tax return preparer and the name of the taxpayer; Include the applicable mandatory language set forth in section 4.04(a)-(c) of Revenue Procedure 2008-35 that informs the taxpayer that he is not required to sign the consent and if he signs the consent, he can set a time period for the duration of that consent; Include the mandatory language set forth in section 4.04(d) of Revenue Procedure 2008-35 that refers the taxpayer to the Treasury Inspector General for Tax Administration if he believes that his tax return information has been disclosed or used improperly. 73 Form and Content continued Consents Must: Where applicable, include the appropriate mandatory statement set forth in section 4.04(e) of Revenue Procedure 2008-35 that informs the taxpayer that his tax return information may be disclosed to a tax return preparer located outside the U.S; Be in 12-point type on 8 1/2 by 11 inch paper. Electronic consents must be in the same type as the web site’s standard text; and Contain the taxpayer’s affirmative consent (as opposed to an “opt-out” clause); and Be signed and dated by the taxpayer. 74 Form and Content continued 4 Types of Consents: Consent to disclose tax return information in context other than tax preparation or auxiliary services. Consent to disclose tax return information in tax preparation or auxiliary services context. Consents for disclosure of tax return information to a tax return preparer outside of the United States if the tax return information to be disclosed does not include the taxpayer’s social security number, or if the social security number is fully masked or otherwise redacted. Consents for disclosure of the taxpayer’s tax return information including a social security number to a tax return preparer outside of the United States. 75 Form and Content continued Adequate data protection safeguard A tax return preparer located within the United States, including any territory or possession of the United States, may disclose a taxpayer’s SSN to a tax return preparer located outside of the United States or any territory or possession of the United States with the taxpayer’s consent only when both the tax return preparer located within the United States and the tax return preparer located outside of the United States maintain an adequate data protection safeguard at the time the taxpayer’s consent is obtained and when making the disclosure. An “adequate data protection safeguard” is a security program, policy and practice that has been approved by management and implemented that includes administrative, technical and physical safeguards to protect tax return information from misuse or unauthorized access or disclosure and that meets or conforms to one of the privacy or data security frameworks listed in Rev. Proc. 2008-35. 76 Form and Content continued ELECTRONIC SIGNATURES If a taxpayer furnishes consent to disclose or use tax return information electronically, the taxpayer must furnish the tax return preparer with an electronic signature that will verify that the taxpayer consented to the disclosure or use. The regulations under §301.7216-3(a) require that the consent be knowing and voluntary. Therefore, for an electronic consent to be valid, it must be furnished in a manner that ensures affirmative, knowing consent to each disclosure or use. 77 Electronic signatures continued A tax return preparer seeking to obtain a taxpayer’s consent to the disclosure or use of tax return information electronically must obtain the taxpayer’s signature on the consent in one of the following manners: (a) Assign a personal identification number (PIN) that is at least 5 characters long to the taxpayer. To consent to the disclosure or use of the taxpayer’s tax return information, the taxpayer may type in the pre-assigned PIN as the taxpayer’s signature authorizing the disclosure or use. A PIN may not be automatically furnished by the software so that the taxpayer only has to click a button for consent to be furnished. The taxpayer must affirmatively enter the PIN for the electronic signature to be valid; (b) Have the taxpayer type in the taxpayer’s name and then hit “enter” to authorize the consent. The software must not automatically furnish the taxpayer’s name so that the taxpayer only has to click a button to consent. The taxpayer must affirmatively type the taxpayer’s name for the electronic consent to be valid; or (c) Any other manner in which the taxpayer affirmatively enters 5 or more characters that are unique to that taxpayer that are used by the tax return preparer to verify the taxpayer’s identity. For example, entry of a response to a question regarding a shared secret could be the type of information by which the taxpayer authorizes disclosure or use of tax return information. 78 Criminal Penalties A violation of section 7216 is a misdemeanor, with a maximum penalty of up to one year imprisonment or a fine of not more than $1,000, or both, together with the costs of prosecution. Section 7216(b) establishes exceptions to the general rule in section 7216(a) and also authorizes the Secretary to promulgate regulations prescribing additional permitted disclosures and uses. Section 6713(a) prescribes a related civil penalty for unauthorized disclosures or uses of information furnished in connection with the preparation of an income tax return. The penalty for violating section 6713 is $250 for each disclosure or use, not to exceed a total of $10,000 for a calendar year. Section 6713(b) provides that the exceptions in section 7216(b) also apply to section 6713. 79 Tax Return Preparation & Auxiliary Services A “tax return preparer” is anyone who is engaged in the business of preparing tax returns or providing auxiliary services in connection with the preparation of income tax returns. That is true even if the preparation of tax returns or provision of auxiliary services is not the principal business of the organization, as well as if no fee is charged specifically for the preparation of income tax returns. It also includes those that do such returns “on the side” outside the course of business, if done for compensation. 80 Tax Return Information Tax return information includes any and all information provided to a tax return preparer in connection with the preparation of a taxpayer’s tax return. It also includes information received from third parties in connection with the preparation of the taxpayer’s tax return, including items received from the IRS. Statistical compilations of tax return information also constitutes tax return information, even if the information is maintained in a form that cannot be associated with the taxpayer, unless it is for internal management and support of the taxpayer’s business. 81 Use & Disclosure Use of tax return information is defined as any circumstance where the preparer refers to or relies upon tax return information as to the basis to take or permit an action. IRS Example: Tax preparer inquires of taxpayers about whether they wish to make an IRA contribution after determining if the taxpayer is eligible to make an IRA contribution. Only those taxpayers that are eligible to make an IRA contribution receive the inquiry. This is a use of tax return information potentially subject to the consent rules. Disclosure of tax return information includes the act of making tax return information known to any person in any manner whatever. An extremely broad definition. 82 Permitted Disclosures without Consent Regulation 301.7216-2 provides a list of cases where tax return information may be used for disclosed without taxpayer consent. CPAs need to review their state’s regulations. The following are permitted: 1) Disclosures pursuant to other provisions of the Internal Revenue Code or Regulations. 2) Disclosures to Officers or Employees of the IRS. 3) Disclosures or Uses for the Preparation of a Taxpayer’s Tax Return. 4) Disclosure to Other Preparers. 5) Related Taxpayers 83 Permitted Disclosures without Consent 6) Courts & Regulatory bodies. 7) Attorney for purposes of securing legal advice. 8) Officer of the Court. 9) Certain disclosures by Attorneys & Accountants. 10) Corporate Fiduciaries. 11) Taxpayer’s Fiduciary. 12) Employee of the Treasury Dept. for use in investigation of the tax return preparer. 84 Permitted Disclosures without Consent 13) Other Tax Returns/Tax Obligations. 14) Payment for Tax Preparation Services. 15) Retention of Taxpayer records. 16) Lists for solicitation of Tax Return Business. 17) Production of Statistical information for return preparation business. 18) Quality or Peer Reviews. 19) Disclosure to Report the Commission of a Crime. 20) Due to Tax Return Preparer’s Incapacity or Death. 85 How Do We Protect Ourselves? Know the Rules. Use disclosure letters. When in doubt, use disclosure letters. Inform your staff and all return preparers. Have a company written policy and procedures document that all employees must sign. Inform your clients as you meet with them during tax season. Use NSA’s Tax Talk forum. It’s a free member benefit. 86 Thank you for attending today. Today’s Course has been presented by: Marcia L. Miller, MBA, EA Financial Horizons, Inc. Weston, Florida ProactiveTax@aol.com 87