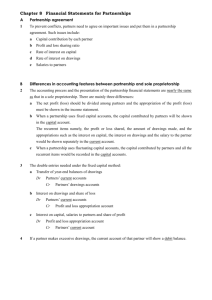

Partnership: final accounts

advertisement

Introduction of Partnership Accounts 1 Characteristics of Partnership 2 – 20 owners Governed by the Partnership Ordinance A partnership agreement can be drawn up to define the rights and obligations of the partners. If no agreement, the Partnership Ordinance applies A partnership has no separate legal identity except for the limited partners A limited partnership may also be formed, which means that at least one unlimited partner 2 Partnership Agreement Not all partnership have agreements. However, a written partnership agreement will help prevent problems and solve dispute between the partners 3 Terms of agreement Amount of capital to be contributed by each partners Ratio in which profits and loss to be shared between partners Rate of interest, if any to be allowed on partners’ capital Rate of interest, if any, to be charged on partners’ drawings Rate of interest, if any, to be allowed on partners’ loans to firm Salaries to be paid to the partners 4 1. 2. 3. 4. 5. 6. In the absence of partnership agreement, the Partnership Ordinance applies which states: All partners may contribute capital equally Profits and losses are to be share by partners equally No interest is to be paid on capital No interest is to be charged on partners’ drawings Partners are entitled to interest of 5% per annum on loans to the firm No salaries are allowed to partners 5 Features of Partnership Accounts Profit and Loss Appropriation Account It is drawn under the trading and profit and loss account It shows the distribution of profits among the partners Capital Accounts These accounts record the amount of capital by each partners 6 Current Accounts As the partnership makes profit/loss, and the partners take the firm’s resources for private uses, there will be fluctuation in the partners’ capital balances. A current account is set up to maintain constant capital balances of the partners as stated in the agreement. Current account is to record: Share of profit /loss Interest on capital Interest on drawings Interest on loans Drawings Partners’ salaries 7 Accounting Treatment Items Accounting Entries Capital contributed in cash Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Share of profits Share of losses Interest on capital Partners’ salaries Cash Partners’ Capital Accounts Profit and Loss Appropriation Partners’ Current Accounts Partners’ Current Accounts Profit and Loss Appropriation Profit and Loss Appropriation Partners’ Current Accounts Profit and Loss Appropriation Partners’ Current Account 8 Items Accounting entries Interest on partners’ loan Dr Profit and loss appropriation Cr Partners’ current Partners’ drawings Dr Partners’ current Cr Partners Drawings Interest on drawings Dr Partners’ current Cr Profit and loss appropriation 9 Profit and Loss Appropriation 10 T- Form Peter and John Profit and Loss Appropriation Account for the year ended 31 December 1997 Partners’ Salaries Net Profit b/f X Peter X Interest on Drawings John X X Peter X Interest on Capital John X X Peter X John X X Share of Profit Peter X John X X X X 11 Peter and John Trading and Profit and Loss Account for the year ended 31 December 1997 Sales X Less: Cost of goods sold Opening stock X Add: Purchases X Less: Closing stock X X Gross profit X Less: Expenses Rent X Lighting X X Net Profit X Add: Interest on Drawings Peter X John (%*drawings) X X Less: Partners’ Salaries Peter X John X X Interest on Capital Peter X John (%* capital) X X Share of Profit Peter (1/2) X John (1/2) X X 12 Peter Capital account John Bal b/f Debit balance Current account Peter John Bal b/f Interest on drawings X Drawings X Bal c/f X X X X X X Peter X Peter Bal b/f Share of profit Interest on capital Partners’ salaries Bal c/f X X X X X John X John X X X X X 13 Fixed assets Buildings Furniture Current assets Stock Debtors Bank Peter and John Balance Sheet as at 31 Dec 1997 Cost Dep. X X X X X X Less: Current liabilities Creditors Working capital Financed by: Capital – Peter - John Net X X X X X X X X X X X X X 14 Current account Opening balance add: Share of profit Partners’ salaries Interest on capital Peter X X X X X Less: Drawings X Interest on drawings X X Long term liabilities 15% Loan John (X) X X X X X X X Total Debit balance X X X X 15 Example 1 16 Tom and David are in partnership, sharing profits and losses equally. The Following is their trial balance as at 31 December 1997. Dr Cr Fixed assets 400000 Provision for depreciation 40000 Stock as at 1 Jan 1997 10000 Sales 290000 Purchases 150000 Expenses 30000 Capital – Tom 197000 - David 197000 Current – Tom 8000 - David 2000 Drawings – Tom 5000 - David 5000 Debtors 70000 Bank 80000 10% Loan from Tom 20000 752000 752000 17 1. 2. 3. 4. Additional information: Stock in hand as at 31 December has been valued at cost at $30000 Depreciation is to be provided at 10% per annum on the straight line bases Pat interest on capital at 1% and charge interest on drawings at 5% Partners’ salaries are $10000 to Tom and $5000 to David 18 Example 1 Tom and David Trading and Profit and Loss Account for the year ended 31 December 1997 Opening Stock Purchases 10,000 150,000 160,000 Less: Closing Stock Cost of Goods Sold Gross Profit 30,000 130,000 160,000 290,000 Expenses Depreciation Interest on Loan (20,000 X 10%) Net Profit 30,000 40,000 2,000 88,000 160,000 Sales 290,000 290,000 Gross Profit 160,000 160,000 19 Tom and David Trading and Profit and Loss Account for the year ended 31 December 1997 Partners’ Salaries Tom 10,000 David 5,000 15,000 Interest on Capital Tom 1,970 David 1,970 3,940 Share of Profit Tom (1/2) 34,780 David (1/2) 34,780 69,560 88,500 Net Profit Interest on Drawings Tom David 88,000 250 250 500 88,500 20 1997 Jan 1 Bal. b/f Tom Tom and David Current Account 1997 David 2,000 Dec31 P&L Appropriation -Int. on Drawings 250 250 31 Drawings 5,000 5,000 31 Bal. c/f 51,500 34,500 Tom Jan 1 Bal. b/f 8,000 Dec 31 Profit and Loss Appropriation - Int. on Capital 1,970 1,970 - Profits 34,780 34,780 - Salaries 10,000 5,000 31 Profit and Loss - Int. on Loan 56,750 41,750 David 2,000 56,750 41,750 21 Tom and David Balance Sheet as at 31 December 1997 400,000 Capital Accounts Tom 197,000 80,000 David 197,000 320,000 Current Accounts Tom 51,500 30,000 David 34,500 Long-term Liabilities 70,000 80,000 180,000 Loan from Tom 500,000 Fixed Assets Less: Provision for Dep. Current Assets Stock Debtors Bank 394,000 86,000 20,000 500,000 22 Net profit 88,000 Interest on Drawings 500 88,500 Partners’ salary Tom 10,000 David 5,000 Interest on capital Tom 1,970 David 1,970 18,940 69,560 Share of profit Tom 34,780 David 34,780 69,560 23 Minimum Share of Profits Sometime, one of the partners is guaranteed a minimum profit. If the amount of profits shared according to the normal profit-sharing ratio is smaller than the minimum share, that partner will get his/her minimum share first, while the balance of the profits is to be shared between the other partners 24 Example 2 25 Paul, Betty and Rose are in partnership sharing profits in the ratio of 5:3:2. Rose is guaranteed a minimum share of profits of $10000. Profits for the years ended 31 Dec 1996 $200000 31 Dec 1997 $42000 Required Calculate the share of profits to each partner for 1996 and 1997 are: 26 Paul, Betty and Rose Profit and Loss Appropriation Account for the year ended 31 December 1997 Share of Profit: Paul (5/10) Betty (3/10) Rose (2/10) Net Profit 100,000 60,000 40,000 200,000 200,000 200,000 200,000 Paul, Betty and Rose Profit and Loss Appropriation Account for the year ended 31 December 1997 Share of Profit: Paul (5/10 X 32,000) 20,000 Betty (3/10 X 32,000) 12,000 Rose (guaranteed) 10,000 Net Profit 42,000 42,000 42,000 42,000 27