Chapter 15

Partnerships:

Formation,

Operation, and

Changes in

Membership

McGraw-Hill/Irwin

Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved.

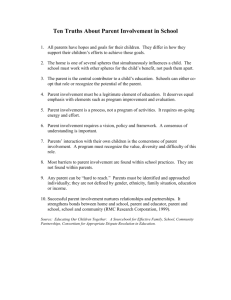

Partnerships

• This chapter focuses on the formation

and operation of partnerships, including

accounting for the addition of new partners

and the retirement of a present partner.

• Chapter 16 presents the accounting for

termination and liquidation of partnerships.

15-2

Partnerships

• The number of partnership in the United

States has been estimated to be between

1.5 and 2.0 million, second only to sold

proprietorships, which number in excess

of 15 million businesses.

• In contrast, there are about 1 million

corporations in the United States.

15-3

Partnerships

• Partnerships are a popular form of business

because they are easy to form and because

they allow several individuals to combine

their talents and skills in a particular business

venture.

• In addition, partnerships provide a means of

obtaining more equity capital than a single

individual can obtain and allow the sharing of

risks for rapidly growing businesses.

15-4

Partnerships

• Accounting for partnerships requires

recognition of several important factors.

• First, from an accounting viewpoint, the

partnership is a separate business entity.

• From a legal viewpoint, however, a

partnership, like a sole proprietorship, is

not separate from the owners.

15-5

Partnerships

• Second, although many partnerships account

for their operations using accrual accounting,

some partnerships use the cash basis or

modified cash basis of accounting.

• These alternatives are allowed because the

partnership records are maintained for the

partners and must reflect their information

needs.

15-6

Partnerships

• The partnership’s financial statements are

usually prepared only for the partners, but

occasionally for the partnership’s creditors.

• Unlike publicly traded corporations, most

partnerships are not required to have annual

audits of their financial statements.

15-7

Partnerships

• Although many partnerships adhere to generally

accepted accounting principles (GAAP),

deviations from GAAP are found in practice.

• The specific needs of the partners should be the

primary criteria for determining the accounting

policies to be used for a specific partnership.

15-8

Definition of a Partnership

• The Uniform Partnership Act of 1914 (UPA) has

been the general governing authority for

partnerships since its adoption by almost all

the states.

• Section 6 of the UPA defines a partnership

as an “association of two or more persons to

carry on as co-owners a business for profit.”

15-9

Formation of a Partnership

• The agreement to form a partnership may be as

informal as a handshake or as formal as a many

paged agreement typically termed the articles of

copartnership.

• Each partner must agree to the formation

agreement, and partners are strongly advised

to have a formal written agreement in order to

avoid potential problems that may arise during

the operation of the business.

15-10

Limited Life

• A partnership legally terminates as a

business entity each time there is a

change in membership.

• This legal termination is called a

“dissolution of partnership.”

• Most partnerships include provisions

in their articles of copartnership for

changes in membership so that the

business is not interrupted.

15-11

Agency Relationship

• Each partner is a co-owner of the

partnership assets and liabilities.

• Creditors view each partner as an

agent of the partnership capable of

transacting business in the name

of the partnership.

• Consequently, any partner can bind

the partnership when acting within

the scope of the partnership activities.

15-12

Unlimited Liability

• Because partnerships are not incorporated, all

partners in a general partnership have unlimited

liability.

• In the event the partnership fails and its assets

are not sufficient to pay its liabilities, partnership

creditors may take recourse by obtaining liens

or attachments against the personal assets of

any or all the partners.

• Generally, creditors will take action against the

partner with the most liquid assets.

15-13

Limited Partnership

• Many persons view unlimited liability as the

major disadvantage of partnership form of

business.

• For this reason, sometimes people become

limited partners in a limited partnership.

• The liability of limited partners is limited to

the amount of their investment, but they are

restricted as to the types of management

acts they may perform.

15-14

Limited Liability Partnership

• Many public accounting and other professional

service partnerships now have letters LLP after

the name of their partnership.

• The LLP means that the partnership is limited

liability partnership, registered as such under

appropriate state laws.

• This designation has not changed the nature of

accounting services provided to clients and has

been generally accepted in the business place.

15-15

Limited Liability Partnership

• The limited liability partnership is a recent

change in the partnership law or most states and

provides that the partners are not personally

liable for any debt, obligation, or liability that is

chargeable to the partnership.

• The partners are still liable up to the amount of

their capital accounts, but their personal assets

are protected from the partnership’s creditors.

15-16

Partnership Formation

• At the formation of a partnership, it is necessary

to assign a proper value to the non-cash assets

and liabilities contributed by partners.

• An item contributed by a partner becomes

partnership property co-owned by all partners.

15-17

Partnership Formation

• The partnership must clearly distinguish

between capital contributions and loans

made to the partnership by individual

partners.

• Loan arrangements should be evidenced by

promissory notes or other legal documents

necessary to show that a loan arrangement

exists between the partnership and an

individual partner.

15-18

Partnership Formation

• The contributed assets should be valued at

their fair values, which may require appraisals

or other valuation techniques.

• Liabilities assumed by the partnership should

be valued at the present value of the remaining

cash flows.

15-19

Partnership Formation

• The individual partners must agree to the

percentage of equity that each will have in the

net assets of the partnership.

• Generally, the capital balance is determined by

the proportionate share of each partner’s capital

contribution.

• For example, if A contributes 70 percent of the

net assets in a partnership with B, then A will

have a 70 percent capital share and B will have

a 30 percent capital share.

15-20

Partnership Formation

• In recognition of intangible factors, such as a

partner’s special expertise or necessary

business connections, however, partners may

agree to any proportional division of capital.

• Therefore, before recording the initial capital

contribution, all partners must agree on the

valuation of the net assets and on each

partner’s capital share.

15-21

Key Observations

• Note that the partnership is an accounting entity

separate from each of the partners and that the

assets and liabilities are recorded at their market

values at the time of contribution.

• No accumulated depreciation is carried forward

from the sole proprietorship to the partnership.

• All liabilities are recognized and recorded.

15-22

Key Observations

• The key point is that the partners may allocate

the capital contributions in any manner they

desire.

• The accountant must be sure that all partners

agree to the allocation and must then record it

accordingly.

15-23

Partner’s Accounts

• The partnership may maintain several accounts

for each partner in its accounting records.

• These partner’s accounts are as follows:

• Capital Accounts.

• Drawing Accounts.

• Loan Accounts.

15-24

Capital Accounts

• The initial investment of a partner, any

subsequent capital contributions, profit or

loss distributions, and any withdrawals of

capital by the partner are ultimately recorded

in the partner’s capital account.

• The balance in the capital account represents

the partner’s share of the net assets of the

partnership.

15-25

Capital Accounts

• Each partner has one capital account, which

usually has a credit balance.

• On occasion, a partner’s capital account may

have a debit balance, called a deficiency or

sometimes termed a deficit, which occurs

because the partner’s share of losses and

withdrawals exceeds his or her capital

contribution and share of profits.

• A deficiency is usually eliminated by additional

capital contributions.

15-26

Drawing Accounts

• Partners generally make withdrawals of

assets from the partnership during the

year in anticipation of profits.

• A separate drawing account often is used to

record the periodic withdrawals and is then

closed to the partner’s capital account at

the end of the period. For example:

Blue, Drawing

Cash

$$$

$$$

15-27

Drawing Accounts

• Noncash drawing should be valued at their fair

market values (FMV)—not book value (BV)—at

the date of the withdrawal. For example:

Blue, Drawing

Auto

Gain

FMV

BV

Difference*

*That is, FMV less BV

15-28

Drawing Accounts

• A few partnerships make an exception to the rule

of market value for withdrawals of inventory by

the partners.

• They record withdrawal of inventory at cost,

thereby not recording a gain or loss on these

drawings.

15-29

Loan Accounts

• The partnership may look to its present partners

for additional financing.

• Any loans between a partner and the

partnership should always be accompanied by

proper loan documentation such as promissory

note.

• A loan from a partner is shown as a payable on

the partnership’s books, the same as any other

loan.

15-30

Loan Accounts

• Unless all partners agree otherwise, the

partnership is obligated to pay interest on the

loan to the individual partner.

• Note that interest is not required to be paid on

capital investments unless the partnership

agreement states that capital interest is to be

paid.

• Interest on loans is recorded as an operating

expense by the partnership.

15-31

Loan Accounts

• Alternatively, the partnership may lend money

to a partner, in which case it records a loan

receivable from the partner.

• Again, unless it is otherwise agreed by all

partners, these loans should bear interest and

the interest income is recognized on the

partnership’s income statement.

15-32

Loan Accounts

• A loan to/from a partner is a related-party

transaction for which separate footnote

disclosure is required, and it must be

reported as a separate balance sheet

item, not included with other liabilities.

15-33

Allocating Profit or Loss

• Profit or loss is allocated to the partners at

the end of each period in accordance with

the partnership agreement.

• If no partnership agreement exists, section

18 of the UPA declares that profits and

losses are to be shared equally by all

partners.

15-34

Allocating Profit or Loss

• A wide range of profit distribution plans is found

in the business world.

• Some partnerships have straightforward

distribution plans, while others have extremely

complex ones.

• It is the accountant’s responsibility to distribute

the profit or loss according to the partnership

agreement regardless of how simple or complex

that agreement is.

15-35

Allocating Profit or Loss

• Profit distributions are similar to dividends

for a corporation: these distributions should

not be included in the income statement,

regardless of how profit is distributed.

• Stated otherwise, profit distributions are

recorded directly into the partner’s capital

accounts, not as expense items.

15-36

Allocating Profit or Loss

• Most partnerships use one or more

of the following distribution methods:

• Preselected ratio.

• Interest on capital balances.

• Salaries to partners.

• Bonuses to partners.

15-37

Preselected Ratio

• Preselected ratios are usually the result of

negotiations between the partners.

• Ratios for profit distributions may be based

on the percentage of total partnership capital,

time and effort invested in the partnership, or

a variety of other factors.

• Some partnerships have different ratios if the

firm suffers a loss versus earns a profit.

15-38

Interest on Capital Balances

• Distributing partnership income based on

interest on capital balances recognizes the

contribution of the partners’ capital investments

to the profit-generating capacity of the

partnership.

• This interest on capital is not an expense of the

partnership; it is a distribution of profits.

15-39

Salaries to Partners

• If one or more of the partners’ services are

important to the partnership, the profit

distribution agreement may provide for salaries

or bonuses.

• Again, these salaries paid to partners are a form

of profit distribution and are not an expense of

the partnership.

15-40

Bonuses to Partners

• Occasionally, the distribution process may

depend on the size of the profit or may differ

if the partnership has a loss for the period.

• For example, salaries to partners might be

paid only if revenue exceeds expenses by a

certain amount.

• The accountant must carefully read the articles

of copartnership to determine the precise profit

distribution plan for the specific circumstances

at the time.

15-41

Allocating Profit or Loss

• The profit or loss distribution is recorded with a

closing entry at the end of each period.

• The revenue and expenses are closed into an

income summary account or directly into the

partners’ capital accounts.

• In addition, the drawing accounts are closed to

the capital accounts at the end of the period.

• An example is provided on the next two slides.

15-42

Example: Allocating Profit or Loss

• NOTE: All amounts assumed.

• Blue, Capital

$4,000

Blue, Drawing

$4,000

Close Blue’s drawing account.

• Revenue

$45,000

Expenses

$35,000

Income Summary

$10,000

Close revenue and expenses (assuming

revenue > expenses).

15-43

Example: Allocating Profit or Loss

• Income Summary

Alt, Capital

Blue, Capital

$10,000

$6,000

$4,000

Distribute profit in accordance with

partnership agreement (assuming

6:4 P/L ratio).

15-44

Partnership Financial Statements

• A partnership is a separate reporting entity

for

accounting purposes, and the three financial

statements - income statement, balance sheet,

and statement of cash flows– typically are

prepared for the partnership at the end of

each reporting period.

• In addition to the three basic financial

statements, a statement of partners’ capital

is usually prepared to present the changes on

the partners’ capital accounts for the period.

15-45

Changes in Membership

• Changes in the membership of a partnership

occur with the addition of new partners or

retirement of present partners.

• New partners are often a primary source of

additional capital or needed business expertise.

• The legal structure of a partnership requires the

admission of a new partner to be subject to the

unanimous approval of the present partners.

15-46

Changes in Membership

• Public announcements are typically made

about new partner additions so that third

parties transacting business with the

partnership are aware of the change

in the partnership.

• A new partner is liable for all obligations of

the partnership incurred before the new

partner’s admission date, but the extent of

liability for preexisting debts is limited to the

new partner’s capital investment.

15-47

Changes in Membership

• The retirement or withdrawal of a partner from a

partnership results in the legal dissolution of the

partnership.

• A dissolution does not require termination of the

business.

• A dissolution means that the partnership’s books

are brought up to date through any necessary

adjusting entries and the withdrawing partner’s

capital account is determined as of the date of

withdrawal.

15-48

Changes in Membership

• The admission of a new partner or retirement of

a present partner results in a new partnership,

although daily operations of the business

generally are not affected.

• Because a new partnership is formed, many

partnerships use the transactions surrounding

the change as evidence for revaluing the

existing assets of the partnership or for

recording previously unrecognized goodwill.

15-49

Changes in Membership

• This practice of asset revaluation and goodwill

recognition constitutes a marked difference from

corporation practice.

• The justification given to revaluing assets at the

time of the change in the membership of the

partnership is to state fully the true economic

condition of the partnership at the time of the

change in membership and to assign the

changes in asset values and goodwill to the

partners who have been managing the business

during the time the changes in values occurred.

15-50

Changes in Membership

• A new partner may be admitted by:

• Acquiring part of an existing partner’s

interest directly in a private transaction

with a selling partner.

• Investing additional capital in the

partnership.

15-51

New Partner Purchases an Interest

• An individual may acquire a partnership

interest directly from one or more of the

present partners.

• In this type of transaction, cash or other

assets are exchanged outside the partnership, and the only entry necessary on the

partnership’s books is a reclassification of

the total capital of the partnership.

15-52

New Partner Purchases an Interest

• A partnership has wide latitude in recognizing

goodwill or revaluing assets.

• The partnership’s accountant should ensure that

sufficient evidence exists for any revaluation in

order to prevent valuation abuses.

• Corroborating evidence such as appraisals or an

extended period of excess earnings help support

asset valuations.

15-53

New Partner Invests in Partnership

• Generally, an excess of investment over the

respective book value of the partnership interest

indicates that the partnership’s prior net assets

are undervalued or that the partnership has

some unrecorded goodwill. Three alternative

accounting treatments exist in this case:

• Revalue assets upward.

• Record unrecognized goodwill.

• Use bonus method.

15-54

New Partner Invests in Partnership

• With respect to the three alternatives indicated in

the prior slide, the decision is usually a result of

negotiations between the prior partners and the

prospective partner.

15-55

New Partner Invests in Partnership

• The accountant’s function is to ensure that

any estimates used in the valuation process

are based on the best evidence available.

• Subjective valuations that could impair the

fairness of the presentations made in the

partnership’s financial statements should

be avoided or minimized

15-56

Retirement of a Partner

• When a partner retires or withdraws from a

partnership, the partnership is dissolved but

the remaining partners may with to continue

operating the business.

• The primary accounting issue is the proper

measurement of the retiring partner’s capital

account.

15-57

Retirement of a Partner

• Most partnership have covenants in their

partnership agreements to guide the process of

accounting for retirement of a partner.

• For example, some retiring partners receive only

the book value of their capital accounts, not the

fair value.

• Other partnerships may require that the

partnership’s net assets be appraised and that

the retiring partner receive the proportionate

share of the fair value of the business.

15-58

Retirement of a Partner

• The retiring partner is still personally liable for

any partnership debts accumulated before the

withdrawal date, but is not responsible for any

partnership debts incurred after the retirement

date.

• Therefore, it is especially important to determine

all liabilities that exist on the retirement date.

15-59

Retirement of a Partner

• Generally, the existing partners buy out the

retiring partner either by making a direct

acquisition or by having the partnership

acquire the retiring partner’s interest.

• If the present partners directly acquire the

retiring partner’s interest, then the only entry

on the partnership’s books is to record the

reclassification of capital among the partners.

15-60

Retirement of a Partner

• If the partnership acquires the retiring partner’s

interest, then the partnership must record the

reduction of total partnership capital and the

corresponding reduction of assets paid to the

retiring partner.

15-61

Retirement of a Partner

• For example, assume that Alt retires from the

ABC Partnership when his capital account has

a balance of $55,000. The entry made by the

ABC Partnership is:

Alt, Capital

$55,000

Cash

$55,000

Retirement of Alt.

15-62

Retirement of a Partner

• Often, a partnership pays a “retirement

premium” for a retiring partner.

• The premium is usually treated as a bonus from

the other partners, allocated in the remaining

profit and loss ratio.

• Note: The bonus reduces the capital accounts

of the remaining partners.

15-63

Retirement of a Partner

• Occasionally, a partnership uses the retirement

of a partner and dissolution of the old

partnership to record unrecognized goodwill.

• In this case, the partnership may record the

retiring partner’s share only, or it may impute the

entire amount of goodwill based on the retiring

partner’s profit percentage.

• If total goodwill is imputed, the remaining

partners also receive their respective shares of

the total goodwill recognized.

15-64

Tax Aspects of a Partnership

• The Internal Revenue Service views the

partnership form of organization as a temporary

aggregation of some of the individual partners’

rights.

• The partnership is not a separate taxable entity.

• Therefore, the individual partners must report

their share of the partnership income or loss on

their personal tax returns, whether withdrawn or

not.

15-65

Partnership Joint Venture

• A partnership joint venture is accounted

for as any other partnership.

• Typically, the joint venture has its own

accounting records, and all facets of

partnership accounting presented in

this chapter apply to these partnerships.

15-66

Partnership Joint Venture

• Some joint ventures are accounted for on the

books of one of the venturers; however, this

combined accounting does not fully reflect the

fact that the joint venture is a separate reporting

entity.

15-67

Syndicate

• Another form of business association is the

syndicate. Syndicates are usually short term

and have a defined single purpose such as

developing a financing proposal for a

corporation.

• Syndicates are typically very informal;

nevertheless, the legal relationships between

the parties should be clearly specified before

beginning the project.

15-68

You Will Survive This Chapter !!!

• The Uniform Partnership Act of 1914, and the

specific terms of the articles of copartnership,

dictate partnership accounting procedures.

15-69

Chapter 15

End of Chapter

McGraw-Hill/Irwin

Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved.